Who thinks it’s 4% or above?

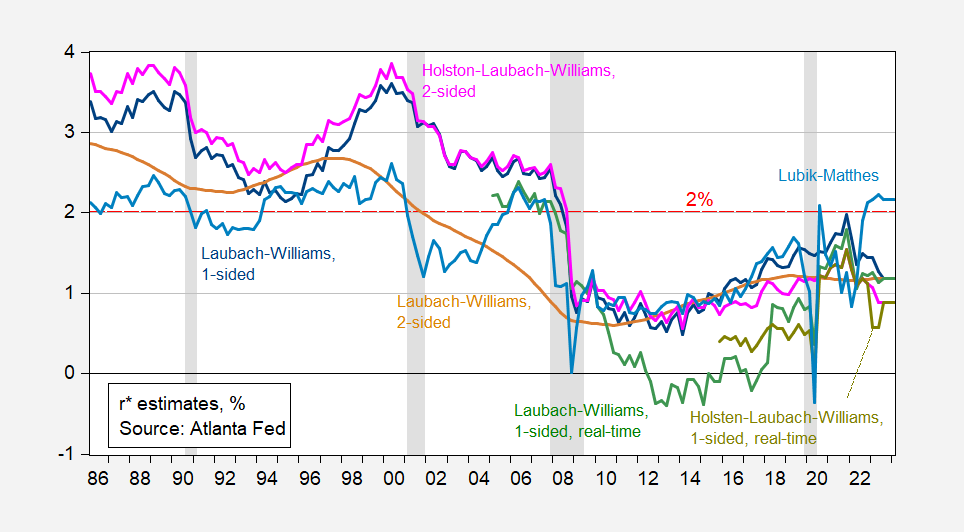

Figure 1: Estimates of r*, %. See description here. Source: Atlanta Fed.

Addendum:

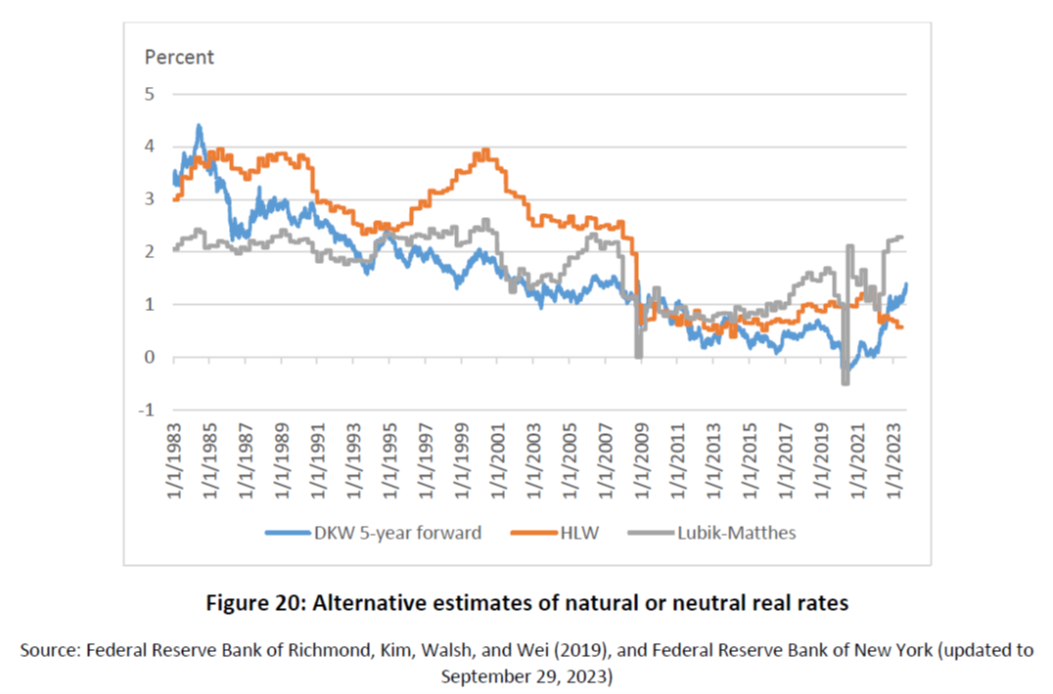

The Lubik-Matthes r* estimate is just 5 year average of TVPVAR estimate of future real fed funds. As Obstfeld (2023) shows, using the DKW premia adjusted five year, one obtains a lower estimate.

Source: Obstfeld (2023).

I dunno. Little Jonny boy maybe but he has no clue what r-star even is.

Now given the massive fiscal stimulus in Russia maybe their r-star is even higher. Of course little Stevie has no what r-star is either.

I will admit that I didn’t know what r* is. But I just looked it up. It’s always good to learn something new.

I’ll snatch the low hanging fruit and say Larry Summers thinks it’s near to 4%.

Larry Summers, who I quoted on a previous thread, thinks that the neutral rate is around 4%.

Any way that you test whose formulas and assumption are right? If so, how did their past determinations of the neutral rate fare over time?

Laubach and Williams have answered your question:

“This essay assesses the empirical evidence regarding the natural rate of interest in the United States using the Laubach-Williams model. Since the start of the Great Recession, the estimated natural rate of interest fell sharply and shows no sign of recovering. These results are robust to alternative model specifications.”

https://www.federalreserve.gov/econres/feds/measuring-the-natural-rate-of-interest-redux.htm

“Robust to alternative model specifications” is science speak for “our estimates have been good.”

The Fed’s Taylor Rule utility with its pre-set alternatives shows that using Laubach-Williams r* estimates as inputs to the Taylor Rule produce very similar results to other standard inputs to the Rule. In other words, the Laubach-Williams estimate of r* stands up to scrutiny.

If you’d like to propose some other test, feel free.

Love it! “Of course, this evidence does not prove that the recent decline in the natural rate is permanent, but it does dispel arguments that it can’t be so”

Now there is a definitive endorsement for you! It suggests that neutral rate determinations can be fit to historical data but have zero predictive power.

Moreover, while the paper does include a forecast, the forecast time frame is concluded before the paper is issued! “If we plug in the median forecast from the Survey of Professional Forecasters (SPF) into the LW model and run in through the third quarter of 2016Q3, the estimates of the natural rate of interest barely budge, rising to about zero. The reason for this prediction is that the SPF respondents expect only moderate growth in GDP and a gradual increase in inflation over the next year, while the forecast for the short-term real interest rate remains below zero.”

SPF forecasts? Aren’t they the same folks that grossly underestimated inflation precisely because the current status quo dominates their thinking? And if there is such a thing as a neutral rate forecast, shouldn’t it be valid at least until the FOMC meeting after the one at which the Fed changed its rate? Preferably, shouldn’t the impact of the Fed’s neutral rate determination be made explicit in a forecast that could be tracked over time? Of course, here we run into the problem of the Fed’s policy biased forecasts that were regularly over optimistic.

The real question here is whether the neutral rate has real world, practical application…or whether it is really just a concept, an unknowable abstraction based upon lots of historical data, formulas and assumptions that help explain what happened in the past but offers little insight into the future.

Here’s the Atlanta Fed’s Taylor Rule utility:

https://www.atlantafed.org/cqer/research/taylor-rule#Tab1

Lubik and Matthes, apparently. According to the linked Atlanta Fed page, “… r* is the five-year-ahead forecast of the real federal funds rate..” and is just above 2 per cent in your chart. Add 2 per cent for expected inflation and you get a nominal r* of >4 per cent.

H Brown: But that’s not r*. Summers is saying r*+pi* (where pi* = target PCE inflation) is closer to 5-6% (i.e., 5 handle).

Sorry to be argumentative, but I’m baffled. You say “…that’s nor r*.” I don’t understand what “that” refers to. The neutral rate in nominal terms? Lots of papers define r* in nominal terms.

You say “Summers is saying …”, but I didn’t (and wouldn’t) quote Larry Summers as an authority on this or anything else. Perhaps your reply was intended to refer to another comment – but then why bring my name into it?

H Brown: Apologies. The post is response to this. That being said, it seems to me that most of the time, r pertains to real rates.

JP Morgan is not “God”of lexicon but they do make their living in the private market economy. Here they seem to define it as a real rate:

https://am.jpmorgan.com/it/en/asset-management/liq/insights/portfolio-insights/fixed-income/fixed-income-perspectives/what-is-r-star-and-is-it-rising/

I agrees that r* is very likely well below 4%, but there may be some smart people who disagree. Last August, Katie Baker, Logan Casey, Marco Del Negro, Aidan Gleich, and Ramya Nallamotu raised the possibility that short-run r* was or at least had been above 4%, but expected it to drop to near 4% this year. That estimate was based on data from March of last year:

https://libertystreeteconomics.newyorkfed.org/2023/08/the-evolution-of-short-run-r-after-the-pandemic/

The high level of r* in that estimate relative to earlier estimates resulted mostly from easier than expected financial conditions, as seen in relatively narrow credit spreads. Credit spreads have narrowed further since March of last year:

https://fred.stlouisfed.org/series/BAMLC0A4CBBB

Inflation has also come down and the jobless rate has risen, which may offset some of the narrowing of credit spreads.

Even so the funds rate, at 5.33%, would still be too high.

Jonny boy is now relying on Lawrence Summers on a topic that little Jonny boy does not understand:

Summers Says Fed Is ‘Wrong’ on Neutral, Warns on Rate-Cut Bets

Former Treasury chief says neutral rate more likely above 4%

Fed officials have projected policy rate at 2.5% long term

https://www.bloomberg.com/news/articles/2024-03-08/summers-says-fed-is-wrong-on-neutral-warns-on-rate-cut-bets

OK but we have known that Summers has been an uber inflation hawk for the last couple of years. But this question of Jonny boy about how the “neutral rate” has somehow “fared” has to be as dumb as anything gets. Unless Jonny boy thinks the neutral rate is the expected real interest rate. Yea – Jonny boy is one dumb turd.

pgl noted that “we have known that Summers has been an uber inflation hawk for the last couple of years.” So pgl suggests that someone’s personal bias is what determines the neutral rate? Since we can’t even definitively state whether the neutral rate is nominal or real, I’d have to conclude that the neutral rate is in the eye of the beholder…kind of like the Output Gap or the sanctity of 4% unemployment as a minimum.

Reminds me of my meeting with an econometrician who had just quit her job to become a stand-up comedian. When I asked her what next year’s GDP growth rate would be, she answered: “What do you want it to be?”

A Reconsideration of Fiscal Policy in the Era of Low Interest Rates

Jason Furman and Lawrence Summers, November 30, 2020

https://www.hks.harvard.edu/centers/mrcbg/programs/growthpolicy/reconsideration-fiscal-policy-era-low-interest-rates-jason

I originally noted this paper to mock the habit of Econned of saying gee I agree with Furman so Dr. Chinn is stupid (he does that a lot) without telling us which of many Furman’s papers he is referencing to. This one was written by Furman and that guy Summers back in late 2020. Oh how times have changed.

Now the only thing Econned got of this paper was that one should look at the interest expense to GDP ratio. OK – but the authors stressed it’s real interest rates not nominal – another point I tried to arithmetic challenged Princeton Stupid Steve.

But for our purposes, let’s see if our other Village Moron (JohnH) can tease out that these authors were saying about the neutral rate just a few years ago. This should be fun.

Another Summers paper little Jonny boy never read. Back in 2018 the neutral rate was quite negative so Summers et al. argued we need lower not higher interest rates. But not Jonny boy!!! No Jonny boy wanted higher interest rates even if tight money might lead to another recession.

https://www.nber.org/system/files/working_papers/w26198/w26198.pdf

ON SECULAR STAGNATION IN THE INDUSTRIALIZED WORLD

Łukasz Rachel, Lawrence H. Summers, August 2019

We argue that the economy of the industrialized world taken as a whole is currently – and for the foreseeable future will remain – highly prone to secular stagnation. But for extraordinary fiscal policies, real interest rates would have fallen much more and be far below their current slightly negative level, current and prospective inflation would be further short of the two percent target levels and past and future economic recoveries would be even more sluggish. We start by arguing that, contrary to current practice, neutral real interest rates are best estimated for the bloc of all

industrial economies given capital mobility between them and relatively limited fluctuations in their aggregated current account. We show, using standard econometric procedures and looking at direct market indicators of prospective real rates, that neutral real interest rates have declined by at least 300 basis points over the last generation. We argue that these secular movements are in larger part a reflection of changes in saving and investment propensities rather than the safety and liquidity properties of Treasury instruments. We highlight the observation that levels of government debt, the extent of pay-as-you-go old age pensions and the insurance value of government healthcare programs have all ceteris paribus operated to raise neutral real rates. Using estimates drawn from the literature, as well as two general equilibrium models emphasizing respectively life-cycle heterogeneity and individual uncertainty, we suggest that the “private sector neutral real rate” may have declined by as much as 700 basis points since the 1970s.