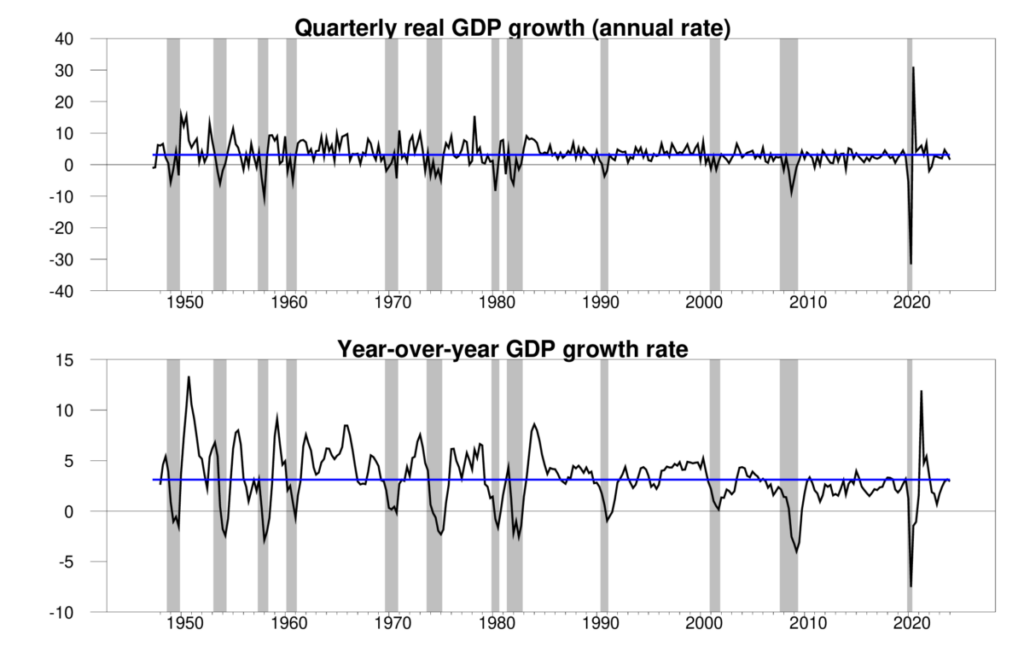

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.6% annual rate in the first quarter. That’s a little lower than many analysts expected. But the year-over-year growth is still on track.

Top panel: quarterly real GDP growth at an annual rate, 1947:Q2-2024:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter. Bottom panel: year-over-year growth rate. Calculated as 100 times the difference in the natural log of real GDP from the same quarter of the previous year.

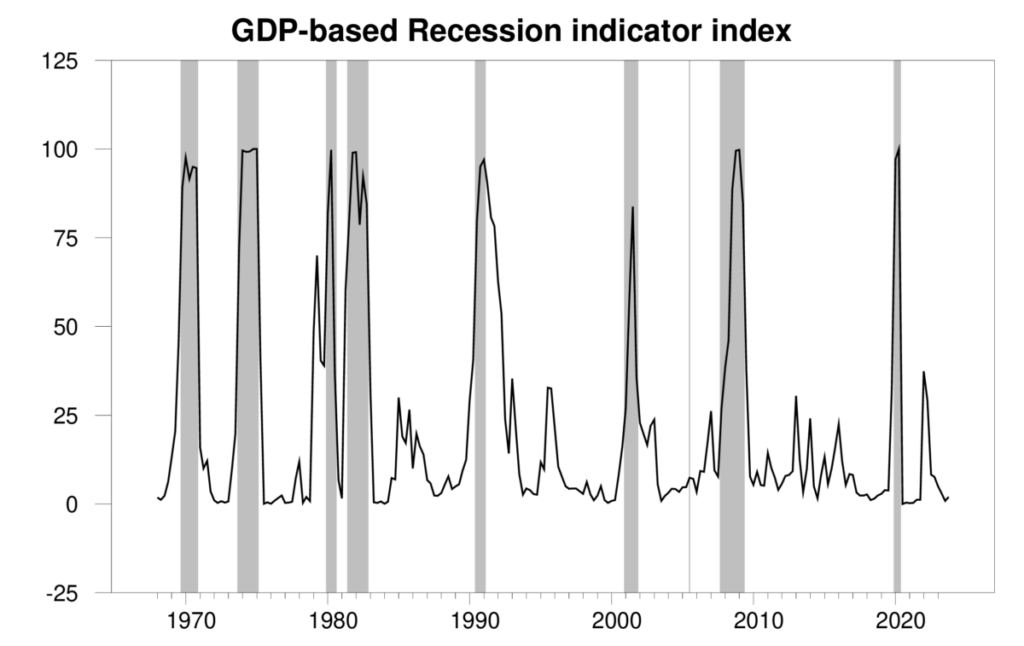

The new numbers put the Econbrowser recession indicator index at 2.0%, a very low level, indicating unambiguous continuation of the economic expansion that began in 2020:Q3.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2023:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

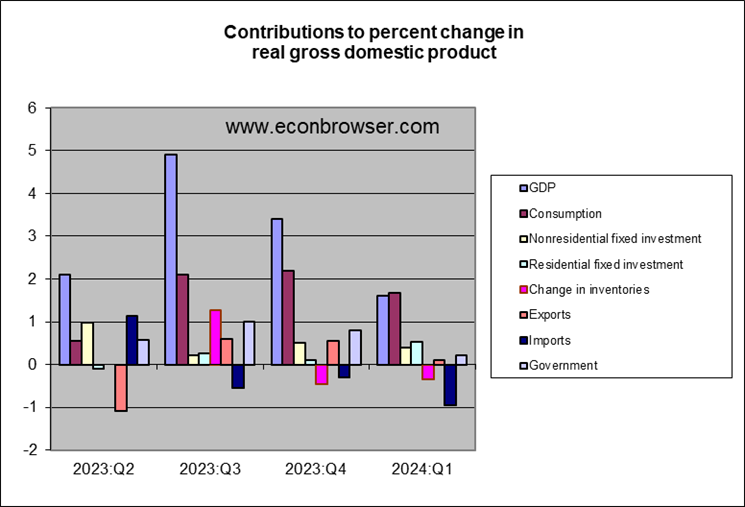

A key factor in the weaker GDP growth was a surge in imports, which are subtracted in calculating GDP. The import estimates are volatile and can be subject to revision.

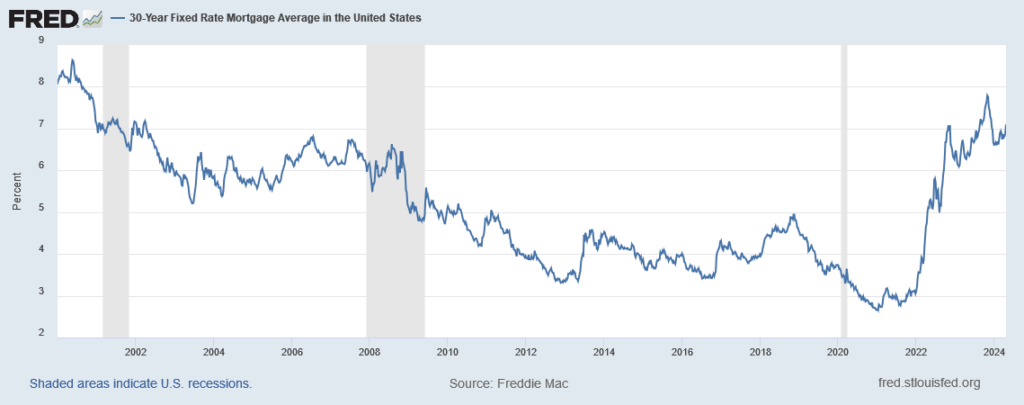

Residential fixed investment made a nice contribution to Q1 GDP growth, despite high interest rates. Mortgage rates had come down between November and February but have moved partly back up since then.

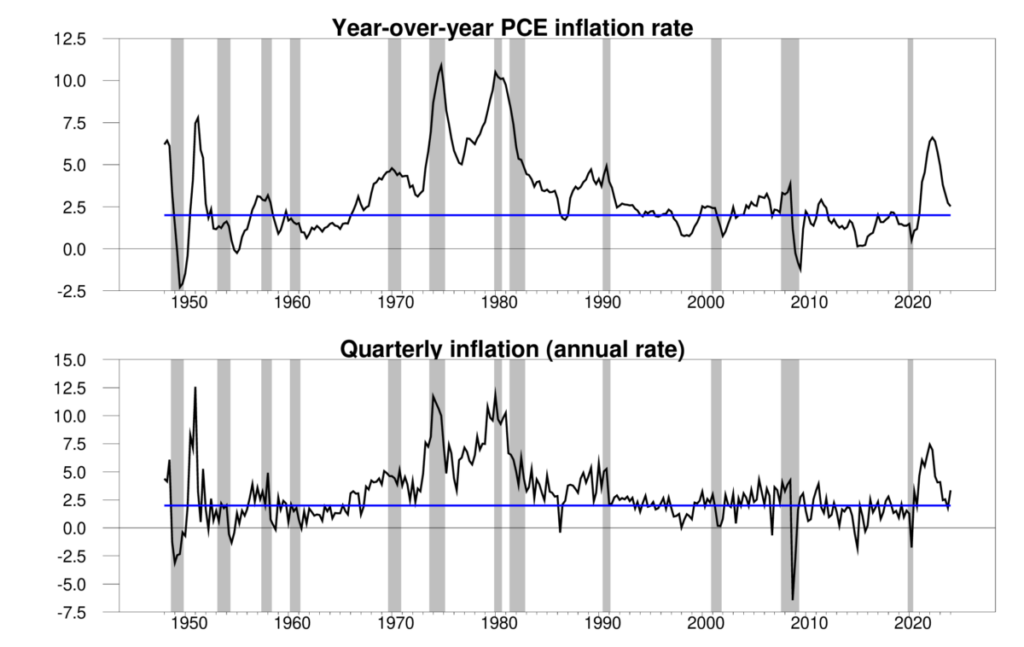

The explanation for the recent uptick in mortgage rates is that the Fed has not made as much progress at bringing inflation down as many had hoped. The new GDP report is a little disappointing there as well. The implicit PCE deflator increased at a 3.3% annual rate in the first quarter. The year-over-year rate was 2.5% — a little better than the quarterly increase, but still above the Fed’s 2% target.

Top panel: 100 times the difference in the natural log of the implicit price deflator on personal consumption expenditures from the same quarter of the previous year. Bottom panel: 400 times the difference in the natural log of the PCE deflator from the value the previous quarter.

The absence of further progress on inflation has resulted in a big shift in market expectations about the Fed’s next moves. At the start of December 2023, the futures contract for the December 2024 fed funds rate was 4.3%, consistent with four 25-basis-point cuts in the fed funds rate this year. Right now the contract implies a 5% rate in December. Traders are now anticipating only one cut, and that not coming until later in the year.

Several supply-side factors also have the potential to bump up the inflation rate. The two presidentical candidates seem to be competing to see who will increase the prices of imported goods the most. Geopolitical riks could bring higher energy prices. And measures like California’s $20 minimum wage for fast-food workers cannot help.

It continues to appear that the Federal Reserve has carried off the coveted “soft landing,” bringing inflation down without a recession. But I have to admit that the plane is not quite on the ground just yet.

Nice details. Only additions. Inventories lowered measure GDP growth which could quickly turn around. And defense spending fell which will also likely turn around.

Real fiinal sales to private domestic purchasers up 3.1% (SAAR), roughly on par with the prior two quarters. That’s faster than trend, so quite healthy.

Real disposable income up 1.1%. With real personal consumption rising faster, at a 2.5% rate, the personal saving rate slowed to 3.6% from 4.0% in Q4. That’s sustainable for a while, but low enough that it’s eventually going to be a drag on spending.

Menzie notes the drag from inventories, and that revisions are coming. The drag from inventories was pretty much inevitable after the large lift in Q4, but (as so far reported) is small enough that there is no guarantee inventories will add to Q2 GDP. Inventories were a drag even though goods consumption fell and imports rose – ya don’t see that every day.

The drag from trade is a reflection of strong domestic demand relative to the rest of the world. As long as U.S. growth holds up, we can expect more of the same.

Crud. I did it again, confusing Hamilton with Chinn. Apologies to both.

Off topic – presidential immunity:

Based on the questions asked by Justices in today’s hearing, it seems likely that the Supreme Court will reject Trump’s claim of blanket presidential immunity from prosecution. If so, then the next question is whether the Justices will decide to rule narrowly on this claim of immunity or attempt to establish a broad set of rules regarding presidential immunity in general.

In the case of a narrow ruling, Trump’s January 6 and stolen documents trial(s?) could begin later this year. Establishing a set of rules, on the other hand, would very likely mean sending the case back down to the lower court as a first step. That would likely preventing any further action till after the election.

It was mostly Republican Justices who repeatedly said ‘I’m not asking about this case. I’m asking about the future’, suggesting an interest in a broad ruling – to Trump’s advantage. It was Justice Brown who asked ‘Can we rule on just the case in front of us?’ So we seem to have Republicans pushing for delay and Democrats looking for “speedy justice”. Anyone surprised?

If Trump is voted back into office and he pardons himself, the Court will have to rule on whether he has the power to do so. Ruling that he doesn’t have blanket immunity, only to then rule that he can pardon himself, seems little embarrassing.

“Ruling that he doesn’t have blanket immunity, only to then rule that he can pardon himself, seems a little embarrassing.”

You’re mistaking the majority of this SCOTUS for having the ability to feel shame. It probably means you are optimistic about human character, which is a positive personal trait to have (no sarcasm), but still makes you wrong in this particular case.

Didn’t one of them declare “I like beer”? Bring him a case and he will rule however you want.

I have mixed feelings about this proposition. I like sharing beer with people, but the thought of sitting near Kavanaugh and drinking beer kind of makes me nauseated. Other thoughts here I will keep to myself for the moment. I guess if there was a time limit set ahead of time for sharing the beers and it would mean that Presidents could/would be held responsible for criminal actions, I guess I could take Dramamine and “suck it up”.

The question of whether he was trying to protect the country (against terrible voter fraud) or his own ass (against the will of the voters) really should be left for the jury to decide. The idea that the President should be shielded from a jury making that decision is just crazy and not based on anything in the constitution.

He can only pardon himself from Federal crimes, making state-level prosecutions still a viable option in that bizarro world.

Fed Res soft landing or not, I think the guys spreading musical cheer to senior citizens are “the real MVP”.

Related to my comment just above, If any said person/ kind gentleman is taking song requests, I like Syd Barrett’s “Terrapin”

Now THAT is obscure. Not a bad tune, though.

The lyrics are vague enough to fit together and fit a common theme people might feel, but the melody is what I like, It hooks into you but doesn’t look like it would be technically hard with an acoustic guitar. I went through this phase when I lived in China and I liked listening to the soundtrack “More” alot and then I got turned on to Syd Barrett, which is ironic because not a single tune on that album is written by Barrett.

I hate to be picky but year on year is at an annual rate.

Could you qualify please.

It is those damned annualised rates again.

You get 1/2 credit for consistency of message.

On substantive grounds you get……..

“…with dementia, you have trouble retaining new information…one starts to ask the same question over and over…”

https://www.prevention.com/health/memory/a36399678/early-warning-signs-of-dementia/

Professor Hamilton,

I looked at the various elements of real GDP as a percentage of GDP and seem to see that real government consumption and gross investment, FRED series (GCEC1) has declined from 35% of GDP as of 1955Q1 to 17% of GDP as of 2024Q1. Given our growing national debt and deficit spending, I was surprised.

AS:

Government transfer payments such as Social Security and Medicare are part of the government deficit but are not counted in GDP. Transfer payments account for all the growth in government spending as a percent of GDP.

Thanks.

You have noted the fall in defense spending/GDP but as Dr. Hamilton notes, government transfer payments (not purchases and not part of GDP) have risen a lot.

Looking at real dollars, US’ war spending is as much as during Reagan splurge, with a 30% reduction in forces.

Units of military largesse keep rising in demand for dollars.

You could follow Hoover institute for how USA is weak unless it spends 7% of GDP for big ticket things like F 35

David Bobo Brooks pens an oped on the deficit:

https://www.nytimes.com/2024/04/25/opinion/us-federal-debt.html

Nowhere in this little screed does Bobo talk about raising tax rates. One has to wonder why the NYTimes ran this screed given the fact BoBo only ranted his usual eeeek.

More demonstration of ignorance:

Is there an easy way to compare the inflow of funds which are transferred, in order to see the net transfer payments?

Off topic – Looks like Kristi Noem is warming up for a presidential run:

https://www.theguardian.com/books/2024/apr/26/trump-kristi-noem-shot-dog-and-goat-book

Hide your pets.

Looking at BEA data from FRED, I see the month of March 2024 personal transfer receipts at $4,243.9 billion, FRED series, PCTR.

I see contributions to government social insurance, domestic at $1,888.4 billion. FRED series, a061rc1.

If I have done the VAR correctly, it looks like we reject the null hypothesis that increases in the national debt do not cause changes in net benefits. It looks like we borrow first and then increase benefits. Corrections to my interpretation are welcome.

Dependent variable: DLOG_BENEF_CONTR

Excluded Chi-sq df Prob.

DLOG_GFDEBTN_BILLIONS 32.36296 6 0.0000

All 32.36296 6 0.0000

Dependent variable: DLOG_GFDEBTN_BILLIONS

Excluded Chi-sq df Prob.

DLOG_BENEF_CONTR 8.083287 6 0.2321

All 8.083287 6 0.2321