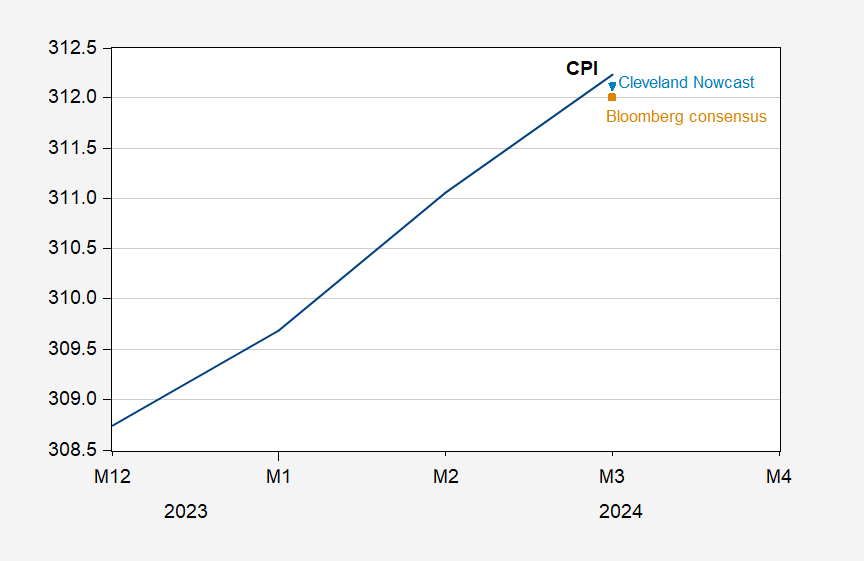

Here’s a graphic depiction of the extent of the surprise, in levels, relative to Bloomberg Consensus and Cleveland Fed nowcasts.

Figure 1: CPI (black), Bloomberg consensus (tan square), Cleveland Fed nowcast (sky blue inverted triangle), all on log scale. Source: BLS via FRED, Bloomberg, Cleveland Fed, and author’s calculations.

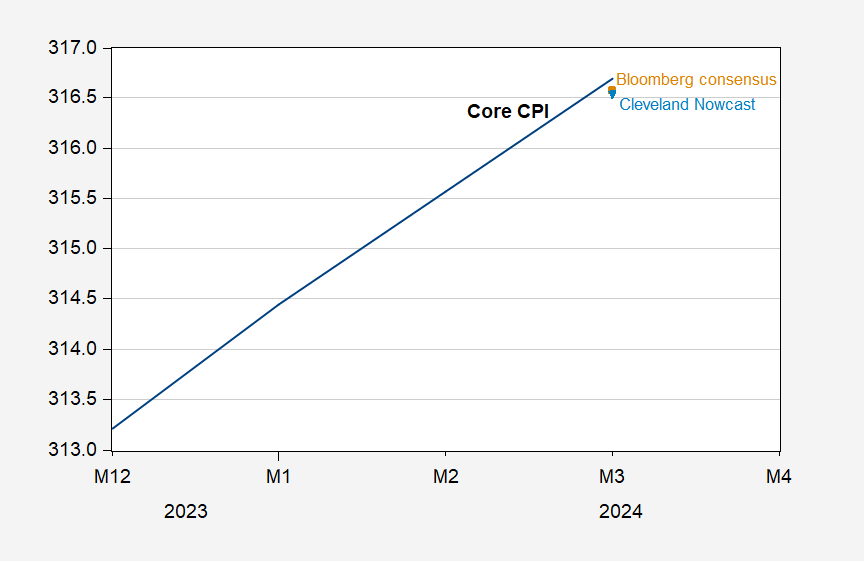

Figure 2: Core CPI (black), Bloomberg consensus (tan square), Cleveland Fed nowcast (sky blue inverted triangle), all on log scale. Source: BLS via FRED, Bloomberg, Cleveland Fed, and author’s calculations.

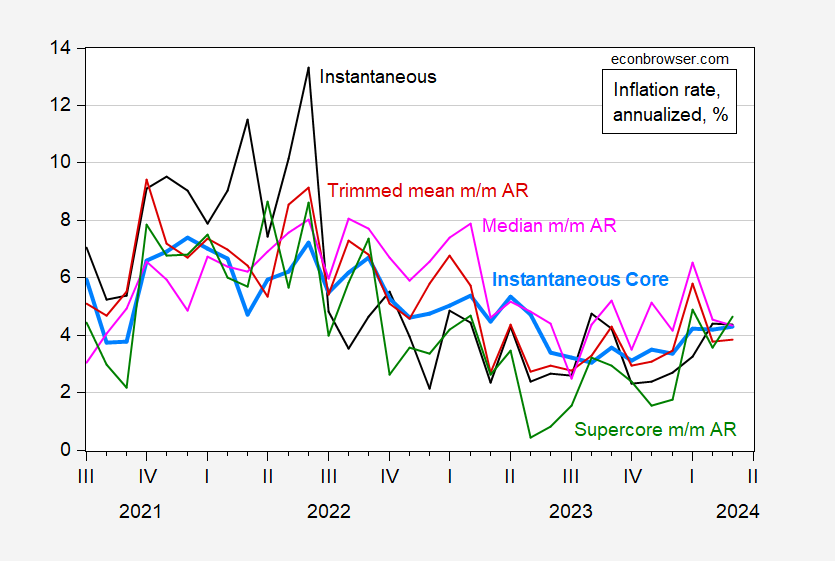

Here’s what “trend” inflation measures look like, in particular instantaneous inflation (T=12, a=4) per Eeckhout (2023).

Figure 3: Instantaneous CPI inflation (bold black), instantaneous core CPI inflation (sky blue), trimmed mean inflation m/m annualized (red), median inflation m/m annualized (pink), and CPI supercore m/m annualized (green). Instantaneous inflation calculated per Eeckhout (2023), for T=12, a=4. Source: BLS, Dallas Fed via FRED, BLS, and author’s calculations.

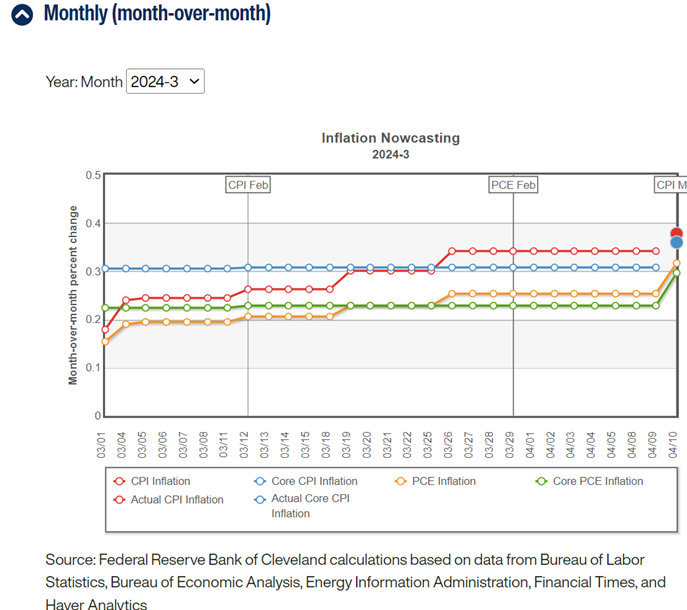

Recall, the Fed doesn’t target the CPI explicitly, but the PCE deflator (headline, according to text, but in practice it seems everybody uses core). But clearly information from the CPI is relevant to the PCE deflator. The Cleveland Fed nowcast utility shows how the PCE deflator nowcasts are affected.

Source: Cleveland Fed, accessed 4/10/2024.

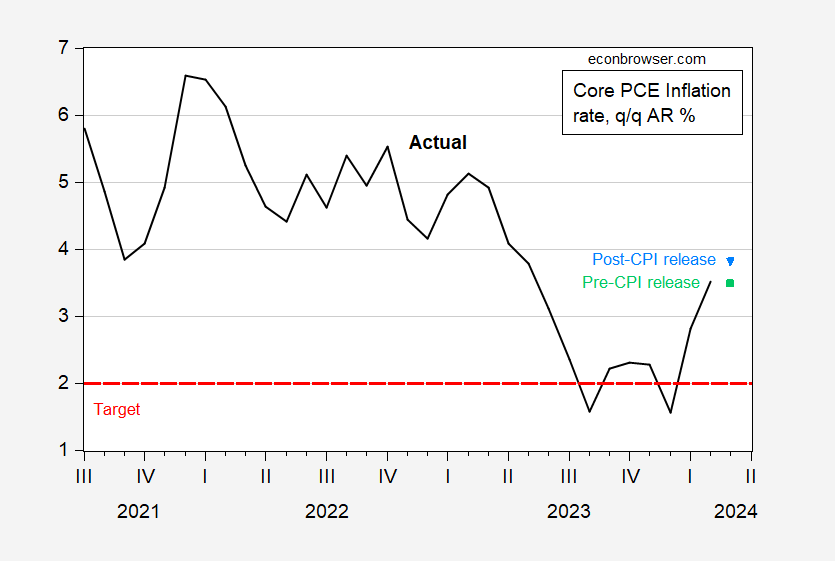

While y/y core PCE inflation would be decreasing with the pre- and post-CPI release nowcasts, the q/q core PCE inflation would now be rising instead of stabilizing.

Figure 4: Core PCE quarter-on-quarter annualized inflation (bold black), and nowcast as of 3/10 (sky blue inverted triangle), and as of 3/9 (light green square), all in %. Source: BEA, Cleveland Fed, and author’s calculations.

Modal forecast from the CME for the June 12th meeting was for a drop by 25 bps (56%); post-CPI release, it’s a no-change (81%). The expected value was 5.23% pre-release, and 5.33% post-release.

CEA’s take, here.

CEA is right – a a tick above market expectations. Expectations were 3.4% but prices grew by 3.5%. Of course the morons in the press declared this to be hyperinflation

What concerns me is that looking at the Core instantaneous graph line, there looks like there could have been an inflection around October or November 2023.

Fortune loves to mislead:

A $90 trillion Great Wealth Transfer will make millennials the ‘richest generation in history,’ blockbuster report says

https://fortune.com/2024/02/29/america-wealthest-one-percent-minimum-millennials-richest-generation/

Read the story but know it is missing something:

Not all millennials can bank on the $90 trillion Great Wealth Transfer—a third say they expect nothing, and are already caring for Boomer parents plus their own kids

https://www.msn.com/en-us/money/personalfinance/not-all-millennials-can-bank-on-the-90-trillion-great-wealth-transfer-a-third-say-they-expect-nothing-and-are-already-caring-for-boomer-parents-plus-their-own-kids/ar-BB1lo0tu

Many millennials can eagerly anticipate becoming the “richest generation in history” over the next 20 years as they are set to inherit their baby boomer parents’ wealth. However, a large portion of millennials are not expecting a windfall of cash when their parents pass away. The estate planning company Trust & Will analyzed proprietary data from 52,505 people and found that only a select few can kick up their feet and bank on the $90 trillion “Great Wealth Transfer”.

From the Saint Louis Fed’s “The State of U.S. Wealth Unequality”:

• The top 10% of households by wealth had $6.5 million on average. As a group, they held 66.6% of total household wealth.

• The bottom 50% of households by wealth had $50,000 on average. As a group, they held only 2.6% of total household wealth.

https://www.stlouisfed.org/institute-for-economic-equity/the-state-of-us-wealth-inequality#:~:text=In%20the%20third%20quarter%20of%202023%2C%20households%20headed%20by%20a,based%20on%20their%20household%20representation.

Here’s a visualization of wealth distribution, telling the same story:

https://www.visualcapitalist.com/wealth-distribution-in-america/#google_vignette

The bottom 50% will transfer 2.6% of all that wealth “Fortune” is whooping about. The 50th to 90th percentiles will transfer 31%. That’s if everything goes well for them, which mostly means as long as nothing bad happens in the housing market.

I imagine “Fortune” sees its audience as tpp 10%, and overweighted with people who work in finance. This intergenerational transfer is a revenue opportunity.

By the way, your second link and both of my links are figments of our imaginations. They cannot possibly exist, since Johnny is the only person in existence who cares about wealth distribution. Well, outside of the Kremlin, that is.

It’s time to think about budget redistribution since, obviously, the Fed hasn’t gotten the message.

The fed does not do its mandate very well.

It should stay away from any other issues

stooopid comment. you think your statement is cute. it just shows ignorance.

Interesting to me that next to an article about this Wealth Transfer – you find numerous articles about how people are not saving enough for retirement. Also – I thought we had already had a Great Wealth Transfer when we had more than a million excess deaths during the pandemic?

Speaking of aging Boomers – I like how these dingbat MAGA-GOP types don’t think the elderly should vote because you will be dead in 5 or 6 months. https://www.msn.com/en-us/news/politics/republican-suggests-thousands-of-seniors-shouldnt-be-voting/ar-BB1lkDPr

Instead of running his campaign via right wing radio/media outlets from his office in California – I would like Hovde to visit the Wisconsin Veterans Home in King WI and let them know they should not be voting or have any assistance to vote – which is hard to do when you don’t have control of your limbs from a service related injury.

And since I am a fan of Senator Baldwin – I would mention that she introduced and got passed the Commitment to Veteran Support and Outreach Act to support veterans – among many other accomplishments for the people of Wisconsin https://www.baldwin.senate.gov/news/press-releases/in-2023-senator-baldwin-delivered-for-wisconsin

Trump tanked Speaker Johnson’s 3rd effort to reauthorization sections of FISA today. What happened next? Johnson announced he’ll be holding a press conference with Trump on “election integrity”.

Johnson has been an election denier from the beginning, but had piped down about it as speaker. Now, he’s kissing the ring, just like McCarthy did before he kissed his job goodbye.

Johnson also explained to reporters today the Ukraine funding requires “consensus, as you know”. Anytime someone leans on “as you know” or “as we all know”, it’s a safe bet they’re making stuff up.

Legislation requires a simple majority of both chambers and the president’s signature. Not consensus. ‘Cause democracy. What Johnson meant was “It’s up to a guy who doesn’t hold any elective office (though I say he does because I’m afraid of him and so I can be Speaker), has no role under the Constitution and disagrees with a majority of the public, a majority of both chambers and a majority in his own party.”

That’s what “consensus, as you all know” really means.

Kind of like a child eating raw meat on the living room floor and then he discovers it wasn’t beef it was a hacksawed immediate relative. James Lankford is so damned dumb he still doesn’t know what happened to the time he spent on his immigration bill.

What I wonder is how deflationary AI will be in services – https://www.reuters.com/breakingviews/ais-deflationary-winds-will-blow-away-profits-2023-06-27/ My personal experience at a small financial services firm – so far – has made me a little dubious. So far – Microsoft Co-Pilot has been about as helpful as Microsoft Clippy. (and yeah – that makes me sound old and jaded about the wonders of software applications.)

I have used chatgpt to replace some computer programming efforts by other folks. AI can be used to complete well defined tasks that simply take time and careful effort to complete on your own. but it takes a dedication to learning how to use it that I have not invested in, yet. but I bet It could be used to complete nearly a quarter of my efforts, to some degree. it will definitely increase productivity, the question is to what degree.

This article in Yahoo News gives a nice graphic where inflation is affecting consumers most.

https://finance.yahoo.com/news/why-auto-insurance-costs-are-rising-at-the-fastest-rate-in-47-years-130004238.html

Auto insurance and shelter are the biggest hits. Energy, groceries, and health care are moderate although there is a likelihood that beef prices will increase considerably this year. That could affect consumer perception of inflation.

https://thehill.com/homenews/nexstar_media_wire/4465781-beef-prices-could-hit-record-highs-in-2024-experts-warn-heres-why/

And then there is oil and gasoline:

https://www.cnn.com/2024/04/08/business/oil-price-surge-threat-us-economy/index.html

Brucie boy wants us to believe inflation is back to his 13% BS. Of course Brucie boy never figured out the difference between relative price changes v. general inflation. Then again little Brucie boy found a way to kiss up to Kelly Anne Conway.

Another example of MAGA moron reading the headline about beef prices and failing to read the story:

It’s worth noting that beef prices have dipped marginally since December, coming down about 0.3%, according to the latest CPI. Data from the National Cattlemen’s Beef Association shows wholesale prices across various cuts of beef have come down slightly through the first weeks of February, but are higher than prices we saw during the same period of 2023.

Come on Brucie – we have noted this before. What’s your problem – is preK reading over your little brain or what?

Bruce Hall the ever steno Sue for Kelly Anne Conway blames Biden for the recent increase in auto insurance rates. Of course the adults here have already noted the reasons why insurance rates have risen but one more time for our MAGA moron:

https://www.forbes.com/advisor/car-insurance/car-insurance-rates-up-again/

Insurers cite several factors for rising car insurance rates. They include:

Higher costs. An increase in prices for car parts, repairs and new and used cars, along with higher medical costs, are making claims more expensive. In addition, many newer cars feature more sophisticated technology that’s pricier to fix.

“Sophisticated vehicle safety systems can reduce accidents but they haven’t held down rates because they are so expensive to repair,” notes Amy Danise, lead insurance analyst for Forbes Advisor. “A small crash can mean substantial repair bills when exterior cameras and sensors are damaged.”

An increase in accidents. The number of insurance claims related to car crashes has risen 14% since 2020, while claim severity jumped 36%, according to a July 2023 report from the American Property Casualty Insurance Association.

A spike in auto theft. Car theft rates went up sharply in 2023, increasing 29% in the 34 cities included in a year-end report by the Council on Criminal Justice. It found that motor vehicle theft has more than doubled since 2019, even as other crime rates fell. The National Insurance Crime Bureau reports that in 2023, vehicle thefts in the U.S. topped 1 million for the second consecutive year.

More severe weather. The number of catastrophic weather events has increased, causing more vehicles to be damaged by floods, hail, fire, hurricanes and tornadoes.

Doug Heller, director of insurance for the Consumer Federation of America, acknowledges that the industry had a tough year in 2022 as more drivers returned to the roads and supply chain disruptions drove up prices. But he contends that insurers responded with aggressive rate increases and stricter rules that have continued well after overall inflation came down.

I bet Brucie’s driving record is horrific and I would not put past Brucie to steal car parts. We do know Brucie is a climate change denier so that weather is on him for sure.

I decided to check with FRED on ground beef prices and the price of steak given the fact that Bruce Hall is either too lazy or too stupid to do so. No Brucie reads the headline of some press report but utterly failed to read the whole story.

FRED confirmed what the real story said. The price of steak and the price of ground beef in March 2024 was the same as it was in July 2023. Contrary to the lie Brucie was peddling that these prices exhibited high inflation latey.

Now had Brucie read his own link, he would have also seen that we have plenty of supply for any increase in demand over the next few months but it is possible that beef prices might rise in late 2024 or in 2025. That is AFTER President Biden wins reelection and Trump is sent off to jail.

Now maybe we should thank Brucie for once again making an utter fool out of himself!

pgl, you sure read a lot into my comments. I think you may have a comprehension problem. You don’t have to agree with the information in the links, but actual counterpoints would be useful. Otherwise, you are wasting everyone’s time.

btw, my driving record has been spotless and no claims (other than a windshield replacement for a rock hit) But I suppose you think everyone drives maniacally as you tootle along on your skateboard. Of course you know that I wasn’t “blaming” Biden, but highlighting a serious increase affecting perception of inflation.

As for your beef with the beef forecast (not mine), you should explain why you think it is wrong, not refer to the past. Enjoy your soy.

Regardless, I see from the constant references that Kelly Anne must be the woman of your dreams. Sweet dreams.

” I think you may have a comprehension problem. You don’t have to agree with the information in the links, but actual counterpoints would be useful. Otherwise, you are wasting everyone’s time.”

Comprehension problem? You are the dork you does not bother to read his own link. And I provided a rather thorough set of counterpoints – but I guess Brucie boy did not comprehend them. Speaking of wasting everyone’s time – that applies to EACH and EVERY one of your stupid comments.