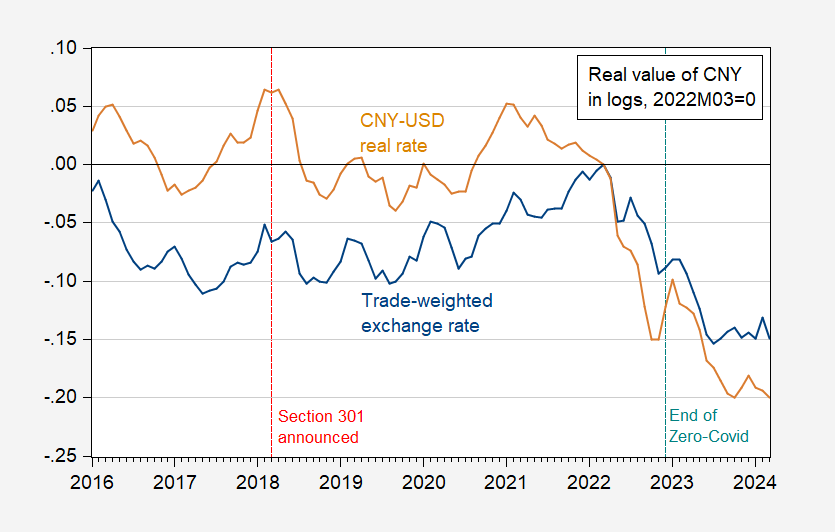

There’s been a lot of discussion of overcapacity in Chinese production, and the resulting pressures in US and other markets. Here’s a picture of the Chinese real exchange rates.

Figure 1: China trade weighted CPI deflated real exchange rate (blue), and US-China bilateral CPI deflated real exchange rate (tan), in logs. Up denotes increase in value of Chinese currency. Chinese CPI adjusted by author using X-13. Source: BIS, FRB, BLS via FRED.

In principle, I’d prefer to use PPI deflated real rates, or even unit labor cost deflated (see this paper), but those are harder to come by. The Chinese trade weighted value of the CNY is down 15% in log terms since its recent peak at 2022M03. In contrast, the decline in the bilateral real exchange rate is 20%. From 2021M02, it’s 25%. Interestingly, Imports of goods from China (as reported in the trade statistics) are not far different from 2022M03:

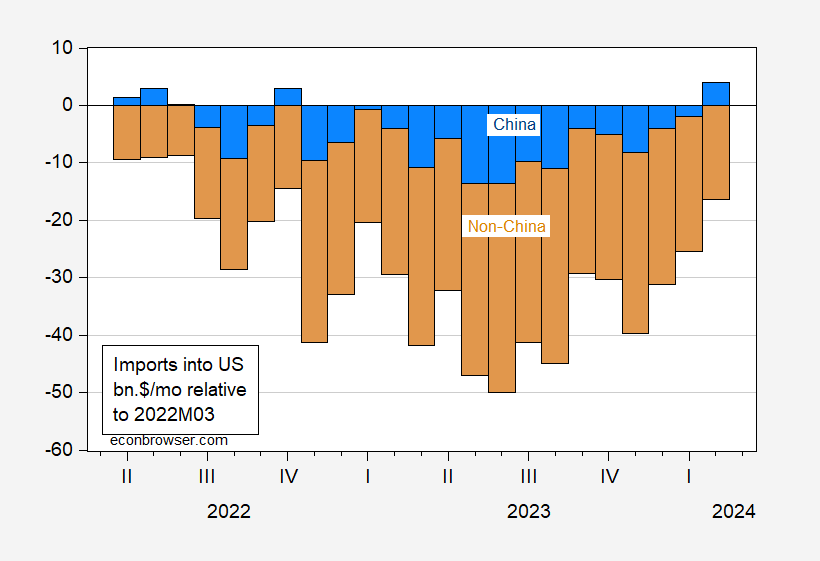

Figure 2: Change in imports from China relative to 2022M03 (blue bar), from non-China (tan bar), in bn.$/month. Imports from China are goods, Customs basis; total imports of goods and services, Balance of Payments basis. China goods imports seasonally adjusted by author using X-13. Source: Census, BEA via FRED.

That being said, it’s clear that a lot of Chinese goods are getting to the US via third countries (trans-shipped, or production shifted). Really, what we’d like to see more is value added imported from China; to my knowledge, up-to-date data of this sort is not readily available.

Even then, the bilateral value added flow would not show the total pressure on tradables prices, since Chinese imports could be depressing traded prices globally, thereby increasing imports into the US.

Is the Chinese currency undervalued? More on that later (older recap of approaches, see here). The latest Treasury report is from November. The BigMac index, using December data, indicates 26.3% undervaluation using the Penn Effect.

Brad Setser has some thoughts, here.

Wow. That’s incredible devaluation.

Seriously dude? Try how much the dollar appreciated in the early 1980’s. Come on Stevie – we get you are incompetent when it comes to economics but DAMN!

https://fred.stlouisfed.org/series/EXJPUS/

From late 1978 to late 1982, the Japanese yen devaluation by almost 50% relative to the US dollar. Maybe one could say that was an incredible devaluation but 15% devaluation is not. Of course the world’s worst consultant proves he is as clueless as it gets.

Now if Stevie wants to do his usual I hate China nonsense, let’s check out the devaluation just over 30 years ago:

https://fred.stlouisfed.org/series/DEXCHUS

Chinese Yuan Renminbi to U.S. Dollar Spot Exchange Rate

Over 50% but I guess would say this is not incredible as it was before Xi.

Here’s Cny, Jpy and Eur vs the dollar, indexed to the beginning of 2022:

https://fred.stlouisfed.org/graph/?g=1kD8d

Since the beginning of 2022, the Yen has weakened more than the Yuan. If I were to toss in the Trl or a few other currencies, you’ll find much greater devaluation than for the Cny.

Note that the period since the Covid recession has been volilatile relative to the 2015-2019 period, but not relativr to earlier periods.

For an interesting view of the interaction of politics and currencies, consider the UK Pound (Gbp) vs Cny:

https://fred.stlouisfed.org/graph/?g=1kDc5

Keep in mind that for Gbp, a decline is read as depreciation, while for Cny, a rise is read as depreciation.

“Since the beginning of 2022, the Yen has weakened more than the Yuan.”

Nice use of FRED. The yen devaluation was twice that of the Yuan. Yea – Stevie never learned a damn thing about exchange rates even if this troll had currency changes as his magic policy tool for “depressions” (or did he say “suppression”).

Off topic – Hakeem Jeffries, Shadow Speaker:

https://www.axios.com/2024/04/21/hakeem-jeffries-speaker-mike-johnson-israel-ukraine

Axios reports on Jeffiries’ role in recent bipartisan budget and foreign aid legislation. Unlike Obama’s compromises in an effortto win Republican support for legislation, even when he didn’t need it, Jeffries has held Speaker Johnson’s feet to the fire. He has gotten the deal his caucus wanted as the price for passing legislation the majority of Republicans want.

Jeffries is obviously on his way to holding the Speaker’s gavel. To be a great Speaker, one must handle good times and bad to best advantage – as Biden has mostly done as President. We haven’t seen Jeffries with institutional power yet, but he handles the power he does have extremely well. Looks promising.

“Former House Speaker Nancy Pelosi (D-Calif.), a master legislative tactician, heaped praise on her successor: “He is fabulous. We’re so proud of him.”

One senior House Democrat told Axios: “It easily could have fallen apart … He played the cards the way you’d want to play them.”

“I would not want to play blackjack against him,” the lawmaker added.

A lot of old timers like me taught Pelosi was the best Speaker ever. She stepped down to make room for Jeffries who will in time eclipse her reign.

How when was the last time we had a competent GOP speaker? Not in my life time and I’m getting old.

“A lot of old timers like me thought Pelosi was the best Speaker ever.”

“How when was the last time we had a competent GOP speaker? Not in my life time and I’m getting old.”

I guess “bipolar” might be too harsh a term, but……

OK – Joseph William Martin Jr. was Speaker during Ike’s first term. He supported a little bit of the New Deal and a little bit of LBJ’s War on Poverty. Other than that – he was generally despised by Democrats for good reason. And of course he served as Speaker before I was born. So yea – GOP speakers have sucked for a long time.

It’s really neither here nor there, just my own pet biases, but I always thought Carl Albert ranked pretty high on House Speakers. But other than a few elementary schools named after him nobody knows who the hell he is/was anymore. I’m trying to remember now but I think my Dad got to shake his hand once when he a a group of teachers visited the nation’s capital. There were strong rumors he had drinking problems but he did a good job overall and had a decent amount of collegial respect:

https://ghostsofdc.org/2012/12/06/drunk-speaker-carl-albert/

I can’t get that link to work. if anyone knows how to get it up in the internet archives I’d love to see it and read it. He should have been punished if he got behind a steering wheel after drinking, but it was a different era.

Income distribution comes up fairly often here, so it may be of interest that Branko Milanovic is out with a new article tackling Keynes’ neglect of income distribution:

https://branko2f7.substack.com/p/why-not-keynes

Parts of the review aren’t flatteringto Keynes. For instance, Milanovic observes that Keynes identified 14 factors which affect aggregate propensity to consume in the “General Theory”, but doesn’t include income distribution among them. There is little chance Keynes some hadn’t realized the impact of income distribution on consumer demand. Here’s Milanovic, discussing the effect of income distribution, using one equation from the “Keynesian cross”:

“Even a very cursory look at the fundamental equation which is A (aggregate supply) = C + I + G shows that if C (aggregate consumption) is a function of income distribution an obvious way to rebalance supply and demand is to “improve” income distribution, that is to transfer purchasing power from the rich to the poor. If $1 is transferred from a rich person who normally consumes only 50 cents, to a poor person who would consume 95 cents, aggregate consumption will increase. One can then fine-tune it until it closes the gap between the aggregate supply and the effective/aggregate demand. There is no need to introduce government spending, G.”

Milanovic concludes that Keynes avoided mentioning income distribution because he thought it would be bad politics; something had to be done to manage aggregate demand, and selling government spending as a policy was more likely to succeed than selling a redistribution of income. Milanovic cites a review by a contemporary of Keynes who noted the oversight and thought Keynes must have been aware.

In fact, nowadays automatic stabilizers do include income redistribution. Unemployment insurance takes money from the employed and gives it to the unemployment. Food assistance is paid partly through taxes. Reduced tax revenues are a boon to those who earn less in bad times, no matter how much or little they earn.

The thing Keynes was willing to recommend – counter-cyclical fiscal policy – seems a stupid target for the right-wing attacks compared to what Keynes chose not to recommend. Income redistribution has ended up part of the counter-cyclical toolkit even without Keynes explicit support.

Interesting topic.