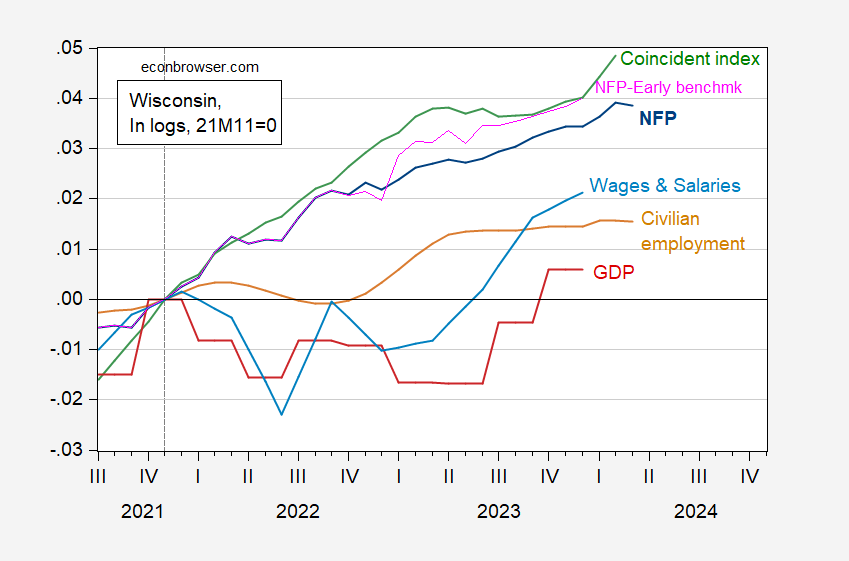

Latest employment, coincident indices:

Figure 1: Wisconsin Nonfarm Payroll Employment (dark blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), real wages and salaries linearly interpolated, deflated by national chained CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed [1], [2], and author’s calculations.

While Thursday’s employment release indicated a small m/m decline in nonfarm payroll, but the 3 month change was 12,600 (or an annualized 1.7% growth).

Note that the coincident index for Wisconsin continues its acceleration into February. The trajectory of the coincident index (as well as other indicators) diverges from that of Wisconsin real GDP. Note that state level GDP is not calculated directly as one would at the national level, via the expenditure approach. Rather the estimate is based on factor payments, combined with national level industrial data on value added (see BEA (2017)).

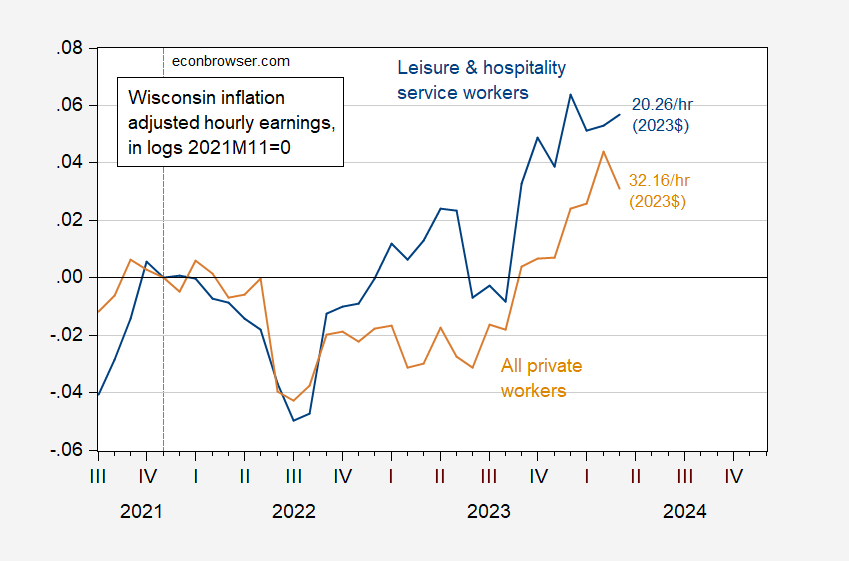

Real wages have risen since November 2021 (previous peak in US GDP). Since average wages don’t take into account the skew in wages, in the absence of median wages (see COWS/High Road Strategy for discussion of median 2022 wage growth), I add in real wages for leisure and hospitality workers.

Figure 2: Average hourly earnings for Wisconsin leisure and hospitality workers (blue), and for all private workers (tan), in 2023$, in logs 2021M11=0. Wages deflated by CPI for East North Central subregion, seasonally adjusted by author using Census X-13. Source: BLS, and author’s calculations.

BLS does not report inflation by state. For the states in the BLS Midwest subregion encompassing Illinois, Indiana, Michigan, Ohio, and Wisconsin, the cumulative price level change is comparable to that for the US overall.

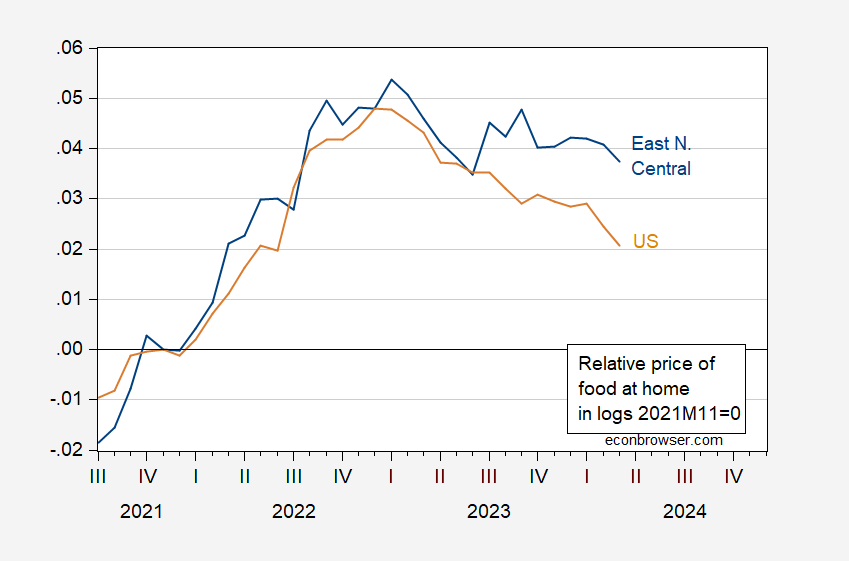

Food at home prices have risen relatively more in the Midwest subregion, as shown in Figure 3.

Figure 3: Relative price of food at home to overall CPI in East North Central subregion (blue), and nationwide (tan), both in logs, 2021M11=0. East North Central price indices seasonally adjusted by author using Census X-13. Source: BLS, and author’s calculations.

As noted in an earlier post, food-at-home prices (read, approximately groceries) have risen more, proportionately, in the East North Central subregion than nationwide.

It is with regret that I inform you that we have lost Claudia Sahm…

She has gotten a job at New Century Advisors. She plans to keep writing for the public, but you know ow how new jobs are.

If her firm wants her as a public face – which seems likely – we’ll hear from her at some point Otherwise, I have my doubts.

Why now for aid to Ukraine? Politico says it’s because new intelligence indicates Ukraine is at a breaking point:

https://www.politico.com/news/2024/04/18/biden-johnson-ukraine-aid-00153237?nname=playbook&nid=0000014f-1646-d88f-a1cf-5f46b7bd0000&nrid=0000014e-f117-dd93-ad7f-f91799170000&nlid=630318

Well, maybe. There is the Congressional calendar to consider. There is the fact that interrupting aid to Ukraine resulted in a lot of unnecessary Ukrainian deaths which could have been reduced by timely delivery of munitions. Even if Ukraine is saved from reaching a breaking point, the approach to that breaking point has been bad for Ukraine’s military prospects, apart from the loss of life.

But if all one cares about is one’s own political future, Ukraine only matters to the extent it matters to voters and to other members of Congress. It does matter to voters and members, and Johnson is now at the mercy of House Democrats. So perhaps Ukraine suffering sudden, major losses seemed to Johnson like a bad thing for Johnson. Not a good look for Johnson, but consistent with what we know of him. He allowed Ukrainians to die, allowed Ukraine’s military to suffer, fostered doubts about U.S. steadfastness, then it’s “Well, I guess we’ll get on with it before it becomes a problem for me.”

So should we give Moskow Marjorie credit for forcing Johnson to saddle up with Democrats yet again? I think maybe we should.

Speaker Mike Johnson’s sudden bid to deliver aid to Ukraine came days after fresh intelligence described the U.S. ally at a true make-or-break moment in its war with Russia. It was exactly the kind of dire assessment that President Joe Biden and the White House had spent months privately warning Johnson was inevitable.

There have been a lot of public discussions noting this for the last several months. Was the Speaker living in a cave for the last 6 months?

A major Ukraine loss because Johnson and GOP failed to support them would have been very bad for GOP in November. That is the only reason Johnson decided to let the vote happen. His one and only focus is on how to retain power. I am sure he already has a deal with the democrats to remain speaker until the election – regardless of what MTG and her idiot squad does.

The National Multifamily Housing Council quarterly market conditions survey is out:

https://www.nmhc.org/research-insight/quarterly-survey/2024/nmhc-quarterly-survey-of-apartment-conditions-april-2024/

The “market tightness” index came in below 50, as it has every quarter since Summer of 2022. The “sales volume” index came in above 50 for the first time since Winter, 2022. Both readings now suggest supply is improving in the multifamily housing sector. That should be good for controlling the rise in rents. Rents are a problem for the Fed right now, and are in large measure responsible for the swing from market participants expecting a bushel-basket full of Fed cuts this year to maybe one.

@ Macroduck Nice catch you sharpy you.

Reminds of when Torsten Slok went to Apollo Advisors. They gave Slok a “longer leash” than I thought they would, but he was neutered a little, no doubt. I have mixed feelings about Sahm, but it will be a loss if she can’t speak freely in a public setting.

Brad Setser stopped blogging when he worked for the Biden Administration but the good news is that he is back!