That’s the song I was thinking about when I saw the headline in the WSJ, Trump Allies Draw Up Plans to Blunt Fed Independence:

Several people who have spoken with Trump about the Fed said he appears to want someone in charge of the institution who will, in effect, treat the president as an ex officio member of the central bank’s rate-setting committee. Under such an approach, the chair would regularly seek Trump’s views on interest-rate policy and then negotiate with the committee to steer policy on the president’s behalf. Some of the former president’s advisers have discussed requiring that candidates for Fed chair privately agree to consult informally with Trump on the central bank’s decisions, the people familiar with the matter said. Others have made the case that Trump himself could sit on the Fed’s board of governors on an acting basis, an option that several people close to the former president described as far-fetched.

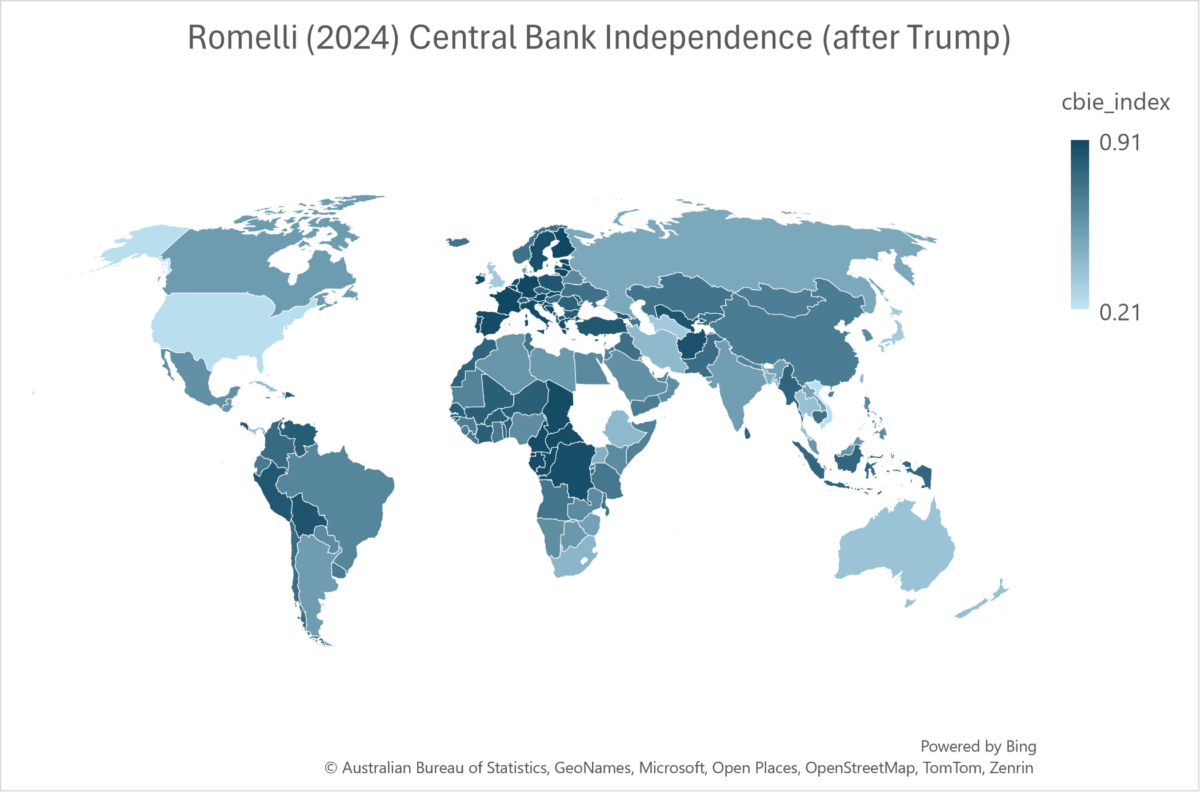

Then, we wouldn’t have to worry about r*, potential GDP, PCE vs. CPI, etc. Just push those interest rates to zero (if Trump is president; as high as possible if he’s not- simple algorithm!) No need for the Fed to hire expensive economists. We just need, say, Larry Kudlow or Steven Moore as Fed Governors. And, more importantly, we wouldn’t need to waste precious time trying to estimate the degree of Fed independence. For instance, here’s a map of central ban independence (CBPI) in 2024, according to Romelli (2024).

Source: Romelli (2024). Higher values (darker blue) indicate greater central bank independence.

But with Trump implemented reforms, we can be like…Vietnam!

Source: Romelli (2024), with US CBI set to Vietnam value. Higher values (darker blue) indicate greater central bank independence.

Carola Binder’s Central Bank Pressure Index (discussed in this post)indicates that there was pressure exerted on the Fed to loosen monetary policy in 2018Q4 (the data extends up to 2019Q1, so we don’t know what Mr. Trump did in 2019Q2-Q4). Mr. Trump in a second term, well, it’ll be easy for us to figure out what the Fed will be doing…

If Trumpian low interest rate policy were adopted early next year – inflation would assuredly go up and perhaps a lot. And we all know Bruce Hall would not utter a peep as he is a two faced MAGA hatter – just like Kudlow and Moore.

But nice song!

The public already gives presidents too much credit and too much blame for economic performance.

It’s a poor decision rule.

The Fed already has too many goals and too few tools. Let’s addanew goal (making the president happy) without new tools.

What happens to monetary policy, and to governance in general, if we overturn carefully designed systems meant to prevent meddling in good governance?

Remember when Article 1 of the Constitution was read as an actual limit on presidential war powers? Oh, yes, let’s expand presidential powers some more, please. 🙁

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html <<—-site deemed useless as of January 21, 2025. 100% probability target rate 001 bps.

Time to get in the grass skirt business? Might have a brilliant future.

With a MAGA labeled elastic band. Price point $59.99. Bruce Hall and Kopits want a bulk order.

After I read this – and thought – a serial business bankrupter Trump will be in charge of setting interest rates – I watched an interview with Bill Barr – who thinks the main problem with America is progressive Biden agenda (to pay off student debt, cap prescription drug prices, invest in renewable energy, let women make their own healthcare choices, and provide responsible governance) and the Anglosphere democracies, the Five Eyes (yeah – I had to look it up – it is the intelligence alliance between the United States, the United Kingdom, Canada, Australia, and New Zealand -Barr trying to push some Deep State nonsense.). So Barr is voting for Trump – who among other crimes – tried to overthrow our government and stole classified documents. https://digbysblog.net/2024/04/27/terminal-fox-news-brain-rot/

Interesting to see how many countries have recognized the need to set some kind of barrier between rate setting and what is good for politicians in the short term.

The incentives for a “President for life” may actually be higher – he would expect to preside when the bill comes due.

Unique to the US is that we are the world reserve currency. EU might be ready to switch away from the dollar if Trump is elected – the dollar would just not be stable enough to be used in mid-to-long term contracts. They would probably wait for Trump to do something stupid with NATO and/or Ukraine – but they would be jumping to dump the dollar from the day after the election.

Just starting to “get my drink on” and in a good mood. Listening to the old Sam Spence scored NFL films music. Other composers too. THere’s one in particular I like and I always forget the title when I’m hunting for it. I’ll find it if it take me 10 hours tonight. I like it so much. Envisioning the heroes of my teenage years listening to this great music.

Thanks for the PDF/paper links Menzie. The knowledge you share with us is so great and very much appreciated. I think your Madison-WU classroom students are so fortunate, and I hope they are aware of that. I wager they are aware of that.