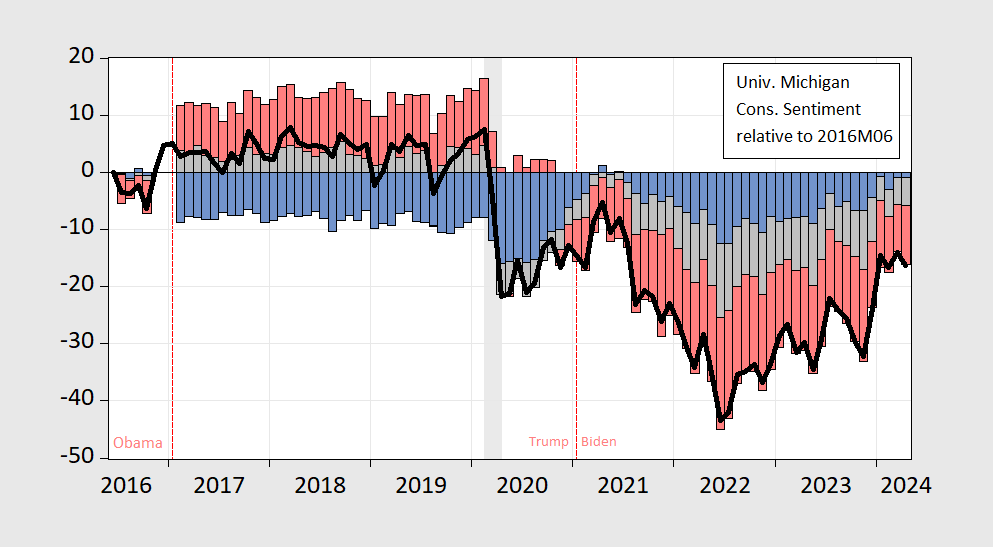

Republicans and lean Republican respondents really, really, really don’t like economic conditions right now, switching “bigly” upon Trump’s election, contributing an outsize impact on the overall University of Michigan consumer sentiment index. Democrats and lean Democratic respondents think things are about the same as mid-2016 (under Obama).

Figure 1: University of Michigan Consumer Sentiment relative to 2016M06 (bold black line), contribution from Democratic/lean Democratic (blue bar), from Independent (gray bar), and from Republican/lean Republican (red bar). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan, NBER, and author’s calculations.

I’ve assumed weights of 0.33 to Democrats and Republicans, and 0.34 to Independents (not too far off actual weights). Notice that in recent months, independent disaffection is decreasing, and so too is Republican — however, the latter is exhibiting a less pronounced decrease.

Also, as an interesting aside, Republicans/lean Republicans viewed the pandemic and immediate pandemic period as better than in the last half year of the Obama administration.

One take-away from the increased focus on politics in sentiment is that sentiment is now a less reliable indicator of economic behavior. When we focus on politics in reading sentiment data, we are looking at a measure increasingly tainted by political sentiment and assuming it tells us something we didn’t already know about politics. It’s circular.

One of the questions that has been asked repeatedly during this expansion is why consumption has been strong when sentiment is weak. The answer is pretty clear once you know that 33% of respondents not really telling us how they view the economy. Asked “How do you feel about the economy?”, they answer “I’m a Republican.”

So sentiment indices don’t tell us much that we don’t already know about the political environment, and don’t tell us much that’s useful about consumer behavior. A gift from faux news.

ADP reports 192,000 new private sector jobs in April, with gains in all sectors but telecommunications. Wage gains remain strong though slower than last year.

ADP isn’t always a good predictor of BLS private hiring on a month-to-month basis:

https://fred.stlouisfed.org/graph/?g=1lNqV

ADP has run higher than BLS for in each of the past 5 months by an average of 45,000 per month. In June of last year, BLS reported 358,000 more new private jobs than did ADP. Weigh them as you will.

Thanks for the info. BLS reports tomorrow at 8:30 Eastern.