An extensive Board article released on Friday:

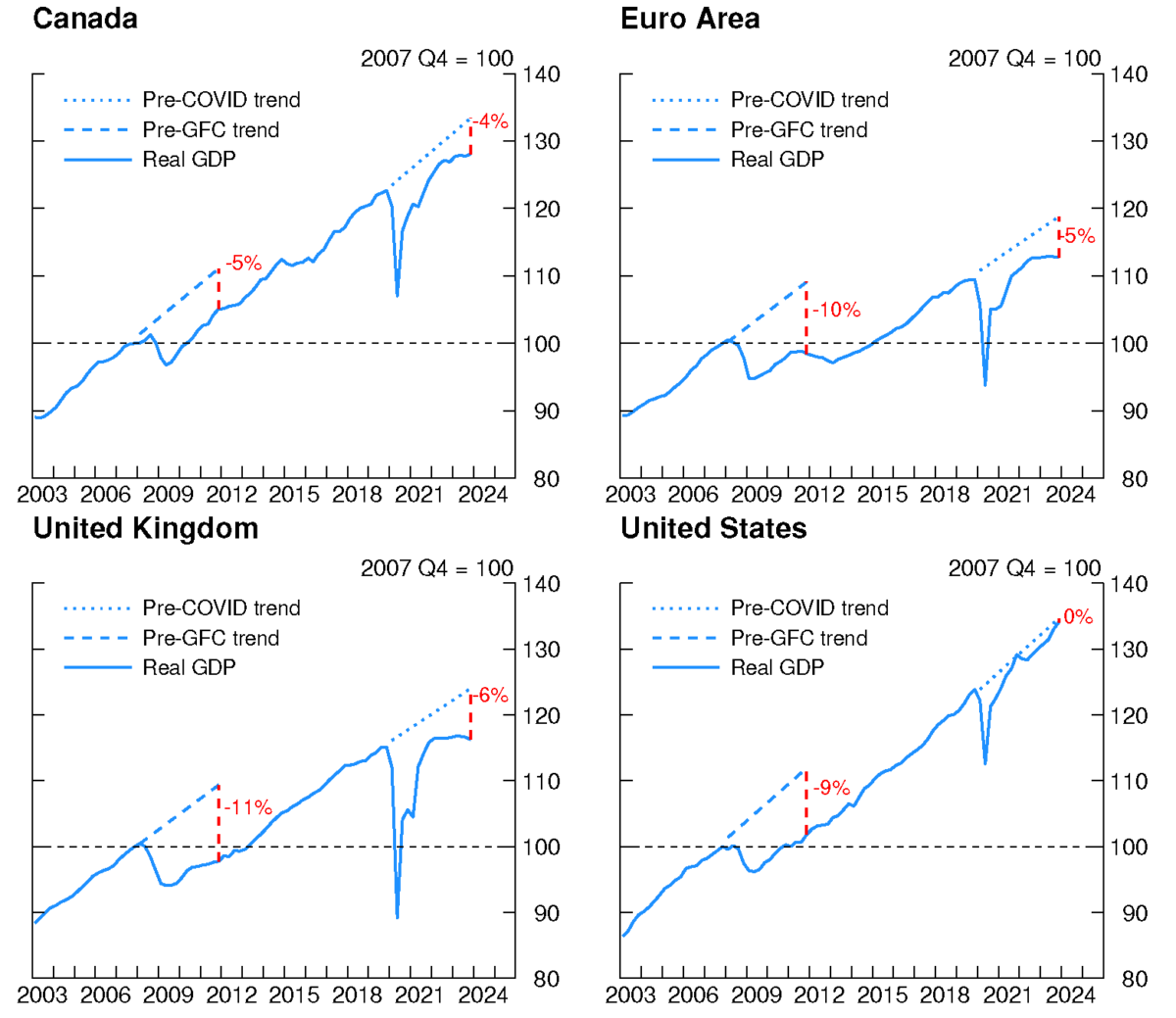

Figure 1 displays the fact that the US has reverted to pre-Covid trend, while other economies have not (pity poor UK, buffeted by Covid and Brexit).

From the Conclusion:

Our analysis points to growth divergence between the U.S. and AFEs being the result of a variety of factors, including differences in monetary and fiscal policies, variations in labor and capital market institutions, and different region-specific shocks. It is currently challenging to judge how much exactly of the divergent performance is explained by each individual element. Overall, our analysis suggests that structural factors play a role in the way different economies responded to cyclical policies, and caution against interpreting recent productivity developments as only reflecting permanent shifts across economies.

Everybody else went kind of flat in the past two years but not US. I guess they didn’t have a President like Biden who passed an inflation reduction act.

Competence matters. We would probably be flat, at best, if trump were running the show these days. Trump relied on the obama economy in his last term. He will destroy the biden economy if reelected. It wont be pretty.

The Board’s conclusion is mostly that growth differences are due to policy differences. The U.S. has more expansive fiscal and monetary policy during and for a while after the recession. Lower barriers to new-firm entry allowed rapid new business formation.* The authors also note structural differences, but when they write “structural”, they appear to mostly mean “policy”.

I don’t have a beef with any of this. I would say, however, that policymakers tend to look for – and so to find – policy causes. The rapid pace of immigration to the U.S. has been identified as a major source of growth in this expansion. Some of that immigration is allowed under U.S. policy, some isn’t. Geography, demographics and economics are big factors in both legal and illegal immigration. Policy has a facilitating role (or impeding) immigration, but isn’t the cause. Other examples of non-policy causes of U.S. growth surely exist. Russia’s war in Ukraine, for instance.

* There is a good bit of anecdotal evidence to suggest that transfers, in the form of elevated and prolonged jobless benefits among other things, funded the creation of new businesses. So it was probably both low barriers to entry and fiscal largesse which spurred rapid business creation.

Menzie has recently promised more on tariffs, infant industries and such:

https://econbrowser.com/archives/2024/05/infant-industries-subsidies-strategic-trade-policy

We have also had some discussion in comments of the weak trend in productivity in recent years. These two issues can overlap, and we should hope that, in reality, they will overlap.

So here’s a picture that I find interesting:

https://fred.stlouisfed.org/graph/?g=1o3Q5

This is total factor productivity for a handful of industries, and one industry stands out. Computer and electronic products have driven nearly all the gain in U.S. productivity since around 1990. I’ve left out a bunch of industries, but adding them wouldn’t change the picture. Notice that the pace of growth in productivity in the computer and electronics sector slowed starting in 2011 and has recently reversed.

Two things –

The CHIPS Act aims to add capacity in the sector which has enjoyed the fastest productivity gains over the last 35 years. It aims to boost productivity in that industry. That makes economic sense.

Productivity in the rest of the economy hasn’t been growing all that well since 1990, a fact that is obscured if you only look at broad aggregates. That’s bad. Worse is that productivity in some sectors has been falling.

If we are going to have an industrial policy, then let’s not only pay attention to computers. And by the way, we’re going to have an industrial policy. We always have an industrial policy, even if by default. Might as well have a good one, one which aims to support societal goals and not just whatever the luckiest lobbyists ask for.

“Why direct US China goods fell, goods passing from China to Indochina surged, negating the tariff. We can see this by viewing products made in China but shipped to Indochina.”

I seem to recall our host discussing this possibility on the eve of the Trump tariffs. Sure there was some of this going on which was documented, but the tariffs still had a tremendous if not unfortunate effect,

“The so called Trump tariffs were much less relevant than you may think.”

You have mistaken me for someone else.

So there’s this thing that social-media monetizers do to grab eyeballs which involves making a denigrating assumption about the owners of those eyeballs. You’ve all seen it:

“You’re eating/cleaning/exercising/bathing wrong.”

“You think/believe/understand wrong.”

“Nobody knows that…”

“‘They’ don’t want you to know…”

Not aimed at Mr. Redding in particular, but this is a form of argumentation which is to be avoided. Presuming to know what’s in other people’s heads, presuming that you know more than others, is a sloppy way to think. Easy and unchallenging. At least begin with the facts, begin by recognizing that the other guy may know stuff. That’s the way to tone up one’s own thinking.

Getting into aggregate heads is part of economics. Pretending to see into the minds of individuals is quite another.

Regarding your Republican/Democratic economy dichotomy, you don’t seem to give much credit to private sector decisions, to innovation, to demographics, to the rest of the world. Government activity as part of the environment, certainly, but not as much o the story as politicians would like us to believe.

By the way, remember those tariffs on metals? If those tariffs worked in an “infant industries” sort of way, shouldn’t we see productivity rising as infants learn to walk and then to run? See if you can pick out when the latest round of tariffs was implemented in this picture of primary metals manufacturing:

https://fred.stlouisfed.org/series/IPUEN331W000000000

“remember those tariffs on metals?”

There is no infant industry argument for this stupid Trump tariff. No – these tariffs protect companies with low productivity which you graph shows. But I recall a Bruce Hall “rebuttal” that had something to do with robots. Only problem – these robots probably got in the way as Brucie boy programmed them.

Don’t give the Trump administration too much credit for thinking and logic rationales. Clearly nobody with even rudimentary economics and thinking abilities would have arrived at the idea that protecting an old faltering raw materials industry like metals, was a good idea for anybody except the owners of that dying industry. You are making a good point that they became less efficient rather than more – as expected if the industry owners just wanted to harvest more short term profits, rather than investing in more efficient production for long term competitiveness.

I still believe that if someone digs deep enough they will find a classic Trump/mobster deal where money flowed to Trump in exchange for him paying back with desired policies. Sad thing is that it was probably not that much worse than classic New Gingrich K-street project corruption.

I always suspected that Navarro and gold old WILBUR Ross were profited a lot from milking these tariffs. When trade policy is run by the mob, this stuff happens.

” While real GDP in the U.S. has already returned to its pre-pandemic trend, advanced foreign economies (AFEs) experienced a much weaker recovery, both relative to the U.S. and to their own pre-pandemic trend.”

Huh — Bruce Hall tried to tell us that the US was “comparable” to China and here this document compares the US to other advanced economies. Oh wait – Bruce Hall is under the illusion that the US should have long-term growth nearer to 4%.

OK, OK, Brucie is not stupid enough (yet) to use “suppression” to describe 2020. That would be Steve Kopits who on the one hand claims US fiscal and monetary policy have been too expansionary and on the other hand claimed there was some 2022 recession.

I guess neither one of these Know Nothings will actually read this informative document.

pgl, it would appear government spending and debt might be a big part of the great performance.

Federal Net Outlays as Percent of Gross Domestic Product (FYONGDA188S)

https://fred.stlouisfed.org/series/FYONGDA188S

War helps

Federal Government: National Defense Consumption Expenditures and Gross Investment (FDEFX)

https://fred.stlouisfed.org/series/FDEFX

All for free!!!

Federal Debt: Total Public Debt as Percent of Gross Domestic Product (GFDEGDQ188S)

https://fred.stlouisfed.org/series/gfdegdq188S

Happy days are here again….

Funny how you showed government debt and spending as shares of GDP, but military spending in nominal dollars. It’s almost as if you know showing military spending as a share of GDP would undercut the story you want to tell.

Here, again, is U.S. military spending as a share of GDP:

https://fred.stlouisfed.org/graph/?g=1o55l

Really, Brucie, this is the wrong place to try to play tricks with numbers.

Thanks for the comment as I have grown very bored dealing with Brucie’s incessant dishonesty and incompetence.

Thanks Macroduck. I didn’t run across that and the one in dollars only reflected Bidenomics inflation.

The other two charts still hold, so if military spending has remained steady as a percentage of GDP, we’ll have to assume that the big increase in government spending and debt is a result of the Inflation Reduction Act (oooo, the irony).

How effing stupid are you?

“we’ll have to assume that the big increase in government spending and debt is a result of the Inflation Reduction Act”

As I have already noted – your Federal Net Outlays as Percent of Gross Domestic Product spiked in 2020 and has been declining since.

And you don’t know how to do defense spending as a share of GDP even after all the previous comments on this talked about this?

Seriously Brucie boy – why do you even bother to comment. We know you lie 24/7. We know your IQ is in the single digits already. So what’s the point? To prove you are nothing more than a worthless little twit? We got that too.

pgl: In answer to your question: Very! It’s as if he’s never taken a class in economics, or any class in analyzing data.

“the one in dollars only reflected Bidenomics inflation”

WTF? The increase in defense spending under Trump is being blamed in Faux News circles on inflation that temporarily went up in 2021/22 and is now rather low? Damn Brucie – I now have to apologize to those retarded dogs as they are way smarter than you will ever be.

I decided to consult with those appendices in the Economic Report of the President 2024 to check on a couple of things:

(1) Since you were too dishonest to present defense spending/GDP, the ERP’s numbers show this ratio ROSE under Trump from 3.1% to 3.4%. It fell under Biden to 3.0%. But then Macroduck already exposed your lie here.

(2) OK – you did present outlays/GDP but I guess you played Mr. Magoo again as this ratio was over 30% in 2000 but has declined to 22.7% in 2023.

So your point again little Brucie boy? Oh yea – your ability to analyze even the simplest data issues SUCKS.

Hey Brucie – is there some reason you direct your usual stupid lies at me. Macroduck already chimed in on your biggest misdirection.

But take a real look at your other two links old blind one. Outlays/GDP up under Trump and down under Biden. And a similar story on your little debt/GDP ratio.

Come on Brucie – I got a long time ago that you lie 24/7 and you are dumber than a retarded rock. Direct your trash somewhere else as you are boring the eff out of me.

Dr. Chinn’s post treated us to an excellent discussion by Francois de Soyres, Joaquin Garcia-Cabo Herrero, Nils Goernemann, Sharon Jeon, Grace Lofstrom, and Dylan Moore but MAGA MORON Bruce Hall once again decides not to read it before launching into another stupid worthless comment.

Come on Brucie – the authors covered a lot of material into an excellent cross county comparison of fiscal policy which bothered to distinguish between fiscal impact versus changes in the deficit from output movements. I guess real economics is WAY OVER your little pea brain given that your comment and links does none of that. Yea once again Bruce Hall cannot make a decent point beyond the obvious fact that he may be the dumbest of all those MAGA MORONS.

So Brucie – before you direct a comment to me at least have the effing dignity to grasp what the post is about. Assuming you can.

It seems the last 2 sentence summarizes most of the social “sciences” quite well.

Let’s see if this post gets a shadow ban.

You have a problem with modest claims on behalf of economics? Sounds like a personal issue, stalker.

You are right but I was hoping everyone would just ignore this worthless little troll.

Teehee. I’m so naughty. Punish me, Menzie!

Yay!

Bolololo

Macroduck: “The Board’s conclusion is mostly that growth differences are due to policy differences. The U.S. has more expansive fiscal and monetary policy during and for a while after the recession.”

Not only that, but we have the counterfactual as well. We had an inadequate fiscal policy after the 2008 recession and it took more than a decade to fully recover. I don’t think the evidence from these two cases is particularly ambiguous.

Have you considered the possibility that it is large military spending which distinguishes the US economy from others? Military Keynesianism is the key.

GDP (Keynesianism) growth is about increases, not the absolute level of spending. If anything Europe is increasing their military spending more than US.

https://en.wikipedia.org/wiki/List_of_countries_with_highest_military_expenditures

Defense spending/GDP by nation. Ukraine leads the list (of course) with Russia, Israel, and certain oil rich nation ranking above the US.

Well if defense spending increased under Biden. It actually went down.

Wrong, mostly. Military spending is a subset of government spending. Government spending serves as an automatic stabilizer, so military spending is an automatic stabilizer. Governments in other countries often spend larger shares of GDP than does the U.S. government, even if not on defense, so their “Keynesian” automatic stabilizers are stronger than in the U.S.

Here’s U.S. military spending as a share of GDP:

https://fred.stlouisfed.org/graph/?g=1o55l

Mutary spending has been a declining share of output, on trend, since the early 1950s. It is currently at the lowest share on record. The counter-cyclical swing during the Covid episode was 0.4% of GDP at the maximum – historically rather small – and lasted only 4 quarters. Military spending is now 1.0 % lower that the recessionary peak, so a drag on growth.

If you’re looking for cases of “military Keynesianism”, consider Russia and China. I’m not sure you can find the data, but it’s worth a look.

Nice graph. Under spend and spend and borrow and borrow Trump, defense spending/GDP was 4.1%. Under Biden, 3.6%.

Speaking of things mitary, the FT has sketched out some of the larger military issues involved in the China/Taiwan confrontation:

https://ig.ft.com/taiwan-battlegrounds/

Very useful stuff, focused on geography, alliances and missile technology as elements of strategy.

Most analysis of this issue shows that both sides would suffer disastrously in a shooting war. The FT analysis is more focused on the difficulties for the U.S. and, almost incidentally, Taiwan.

I wouldn’t want to be a Chinese citizen during or after such a war. Any conflict short of a nuclear exchange would continue after the shooting stops, with efforts to contain and weaken China intensifying and persisting for a very long time. Yes, the U.S. would suffer, but we are designed for regime change; to China, the regime is the only thing, and the end of stability that war would bring could threaten Communist rule.

If Mr. George is going to join us, perhaps a bit of “getting to know you” is in order. I’m pretty sure Mr.George blogs on economics, with a strong monetarist bent. Here’s an example:

http://www.philipji.com/mitem/2016-03-07/higher-interest-rates-benefit-the-real-economy

In that post, Mr. George argues that higher rates boost economic activity, based on the observation that C&I loans appear to rise when the fed funds rate is high. We might ask Mr. George to consider the possibility of a missing variable in this picture – that variable being economic growth itself. When growth is strong, demand for credit is strong, and the Fed will often raise rates in an effort to prevent overheating.

That blog post, from 2016, misses a considerable period of near-zero fed funds rates. During that period, the observation that high rates and high demand for credit run together falls apart, as can be observed here:

https://fred.stlouisfed.org/graph/?g=1o5vq

Mr. George has written a handful of blog posts and an ebook (Free! on Kindle) in which he claims to have found glaring errors in the foundations of economics. He makes these claims without, if I read his LinkedIn bio correctly, having much formal education in economics.

Lack of an economics degree doesn’t mean Mr. George is wrong – far be it from me to rely on credentialism. But we know that he has made a rookie mistake on his blog regarding the direction of causation between Fed rates and credit demand. Here, he has repeated a mistake previously made on his blog regarding military spending – a mistake which requires ignorance of the basic data and perhaps of the meaning of “Keynesianism”.

Thought you should know.

“The graph below shows the YoY change in Commercial and Industrial Loans (for all commercial banks) v/s the Effective Federal Funds Rate. From 1973 onwards it shows that commercial and industrial loans respond positively to a rise in interest rates.”

Well the explanation is simple but it is not what he wrote. More what you wrote. Once again – a shift of the investment demand curve and a movement along the national savings curve is a far different even than a movement along the investment demand curve.

I guess Mr. George never took freshman economics.

Or you simply have a competent president leading the nation. Look folks, its really not that hard. The answer is right in front of you. Just because we had 4 years of dysfunction under trump does not mean that is the norm. Why would you want to return to that dysfunction?

Yep – Inflation Reduction Act and CHIPS and Science Act which also set up the U.S. for continued growth and invests in renewable energy saving our grandchildren from a hellish future .

Trump is promising to undo all this and appoint a loyal sycophant as Fed Chair – Navarro? Pillow Guy? Bannon?

Also where is the major NY Times reporting? Trump is promising to execute his political opponents and establish a 50 year Reich with MAGA judges https://digbysblog.net/2024/05/19/trump-says-if-biden-were-gop-hed-be-executed/

At least Reuters has a report on Trump taking over control of the DOJ and defunding the FBI https://www.reuters.com/world/us/donald-trump-wants-control-justice-department-fbi-his-allies-have-plan-2024-05-17/

The major story of this election is why do we have a large percentage of voters sleepwalking to the end of democracy?

While many of our elected officials continue efforts to distract us from real governance, the Powder River Basin is probably going to be off-limits to coal mining:

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/051624-us-moves-to-make-nations-largest-coal-region-unavailable-to-new-mining

Who’d have guessed you could campaign and govern at the same time.

Trump Media issued its 10-Q for the 3 months ended 3/31/2024:

Revenue fell to only $770 thousand dollars.

Expenses soared to almost $100 million.

Who on earth would want to own such a LOSER!

The SAD part is that a lot of individuals have purchased shares. So this scam is a little like the televangelist scams. Unsophisticated individuals think they have found a savior, when they have just found another con artist. Some get taken for all they have. Part of me says “you can’t be THAT stupid” but then another part realize that about 1/3 of the population can’t balance a checkbook.

Evidence? You’ve made several assertions here, but how “liquidity” (a term with a handful of meanings) helps U.S. growth and what Africa “going with” China, Southeast Asia with Europe, would look like is unclear.

Good to have a new voice. Give us a little more detail, please.