The index came in at +0.9% vs. +0.2% m/m.

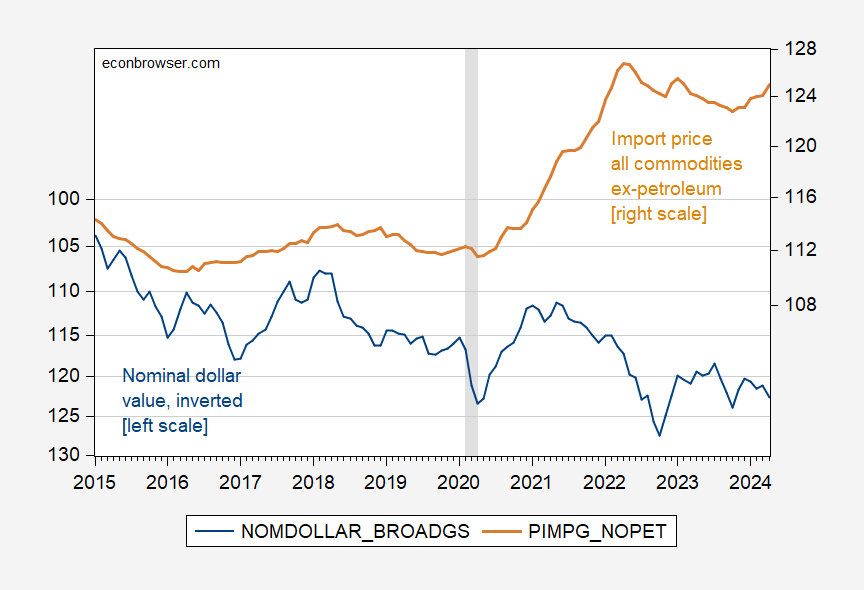

I’ve inverted the dollar index so that the exchange rate and import price should comove if there is exchange rate pass through.

Figure 1: Nominal dollar value inverted (blue, left scale), and price of all imported commodities excluding petroleum, n.s.a. (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BLS via FRED, NBER.

Note the uptick in import prices ex-petroleum (which shows up in commodity import prices as well). GS put up their estimate of the PCE deflator inflation by 1 bp (m/m) as a consequence.

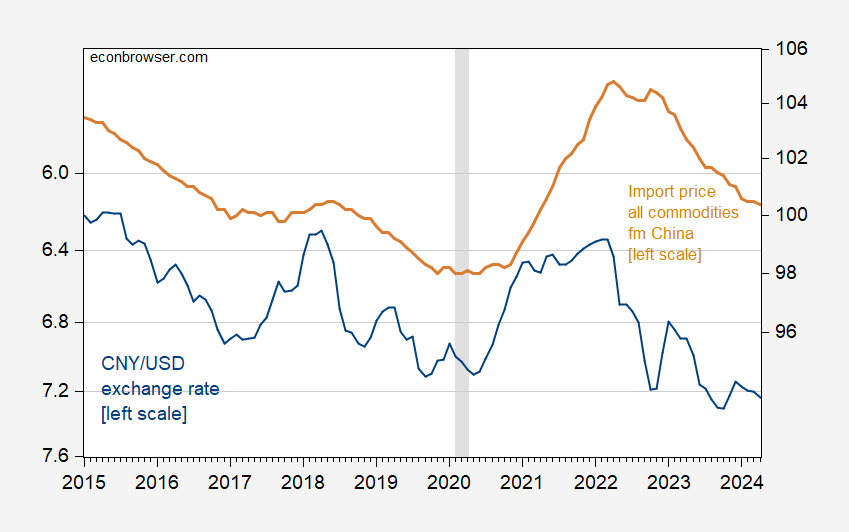

Interestingly, import prices from China have tracked the dollar/yuan.

Figure 2: Nominal CNY/USD inverted (blue, left scale), and price of all imported commodities from China, n.s.a. (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BLS via FRED, NBER.

Note that the import prices from China do not incorporate the tariff costs (see here).

While the series appear to comove, it’s interesting that in fact exchange rate pass through as much as can be measured is quite low in the most recent period, from 2017M01-2024M04, on the order of 0.05. Using the exchange rate pass through coefficient of 0.3 obtained from a regression 2010M04-2017M01 (lower than previous 0.5 for 2005-2010), the import price is about 5% higher than predicted (although the imprecision of the estimates places the actual within the plus/minus one standard error band). This seems to suggest that US tariffs did not, on net, push down the pre-tariff import price into the US (i.e., essentially full tariff pass through, as noted in U.S. ITC, 2023, page 145).

Caveat: Regression on gross aggregate magnitudes, so these are just back-of-the envelope estimates.

Professor Chinn,

I think there may be a typo on the scale for Import Prices. Seems like the scale is on the right, not the left.

I wonder how much of the import prices will flow through to the CPI.

AS: Thanks – fixed now.

https://www.bls.gov/opub/ted/2024/u-s-import-prices-up-0-4-percent-over-the-year-ended-march-2024.htm

I’m sure there’s other data out there for you AS but this is the best I can do for you as I’m pressed on time for late morning errands:

https://www.imf.org/-/media/Websites/IMF/imported-flagship-issues/external/pubs/ft/weo/2006/01/chp3pdf/_fig38pdf.ashx

Maybe I can add some more stuff later, sorry.