Core PPI under consensus (0% vs. +0.3% m/m).

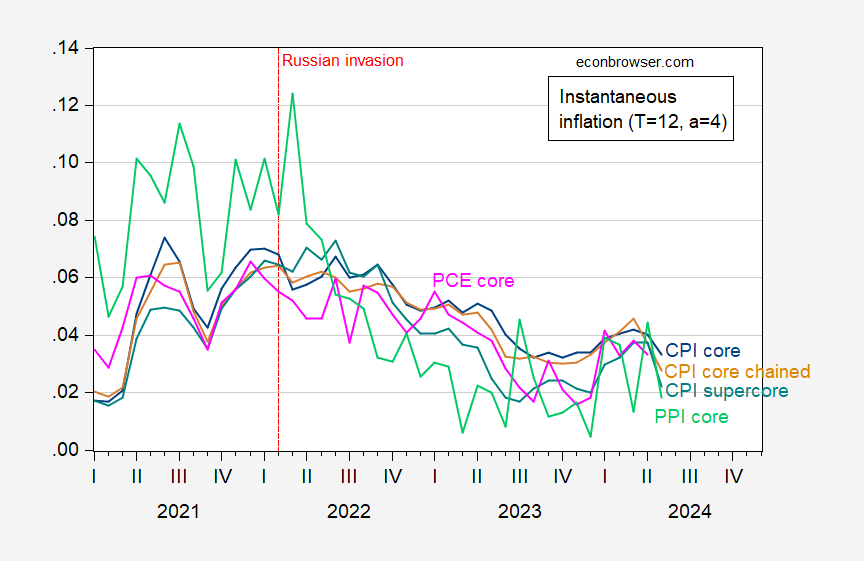

Figure 1: Instantaneous inflation (T=12, a=4) per Eeckhout (2023) for core CPI (blue), chained core CPI, seasonally adjusted by author using X-13 (tan), PCE deflator (pink), CPI supercore (teal), PPI core (light green). Source: BLS, BEA via FRED, BLS, and author’s calculations.

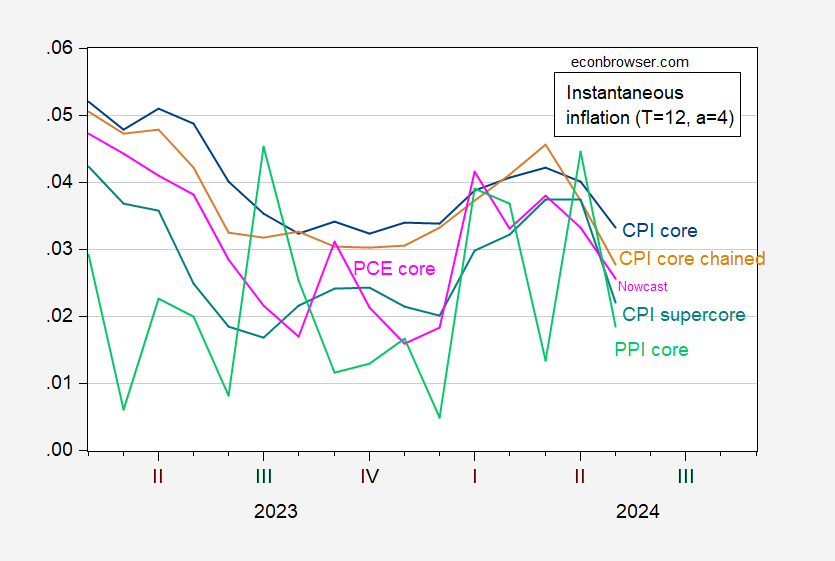

Here’s a detail.

Figure 2: Instantaneous inflation (T=12, a=4) per Eeckhout (2023) for core CPI (blue), chained core CPI, seasonally adjusted by author using X-13 (tan), PCE deflator (pink), CPI supercore (teal), PPI core (light green). May PCE core for May is Cleveland Fed nowcast as of 6/13. Source: BLS, BEA via FRED, BLS, Cleveland Fed, and author’s calculations.

Note that May observation for core PCE instantaneous inflation incorporates the Cleveland Fed nowcast.

Interesting post from Kevin Drum:

Raw data: Inflation in the US vs. Europe

https://jabberwocking.com/raw-data-inflation-in-the-us-vs-europe/

Europe measures inflation using something called HICP—the Harmonized Index of Consumer Prices. This is measured a bit differently than CPI in the United States, but luckily the BLS calculates an unofficial HICP index for the US every month. This allows an apples-to-apples comparison of inflation in the US and Europe.

[see his graph]

It should surprise no one that inflation is pretty closely matched. In particular, our recent inflationary surge happened almost identically in Europe with a lag of a few months. This is why you shouldn’t pay much attention to anyone who suggests there was some kind of unique American action that caused inflation. It was a worldwide phenomenon and that points in pretty much one direction: COVID.

It wasn’t Joe Biden’s stimulus. It wasn’t greedy American companies. And it wasn’t anything special about our response to COVID. It was supply constrictions caused by the pandemic combined with government actions to keep incomes stable. Reduced supply + stable demand = inflation. Simple.

Think the fed will notice?