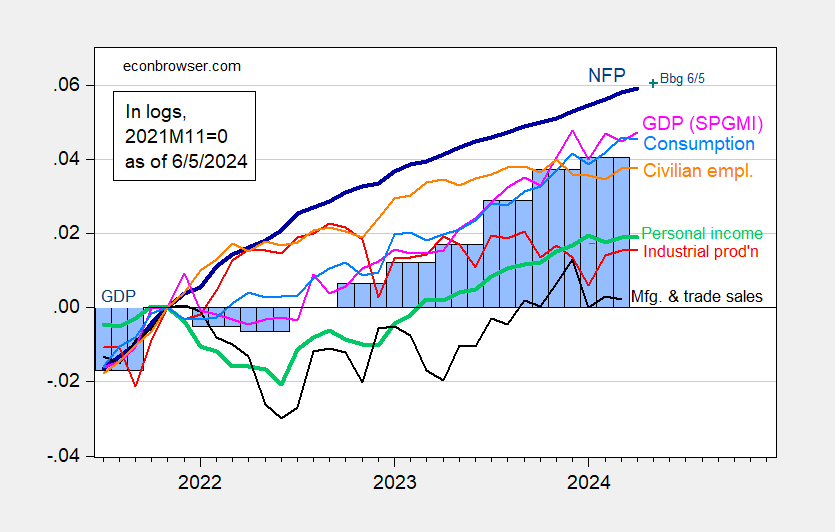

Monthly GDP recovers.

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 second release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 release), and author’s calculations.

Byron Donalds expresses nostalgia for the Jim Crow era, when ‘the Black family was together’

The Trump surrogate’s comments, made during a Black voter outreach event in Philadelphia, sparked outrage from Democrats.

https://www.politico.com/news/2024/06/05/byron-donalds-nostalgia-jim-crow-00161786

PHILADELPHIA — Rep. Byron Donalds (R-Fla.) was on the defensive on Wednesday as Democrats attacked him for comments he’d made the night before praising Black families under the era of racial segregation in America. “During Jim Crow the Black family was together,” Donalds said during a Black GOP outreach event in a gentrifying part of Philadelphia on Tuesday, and criticized decades-old policies from former Presidents Dwight Eisenhower and Lyndon Johnson for promoting a culture of dependence. “During Jim Crow, more Black people were — not just conservative, because Black people always have always been conservative-minded — but more Black people voted conservatively.”

Well the Senate has Uncle Tim (South Carolina) so I guess the House has to have Uncle Byron. MAGA!

Yes they were together – huddling together in the basement hoping those KKK terrorists would bypass their house and take out someone else. But at least they were together.

Kevin Drum in his own way is noting why consumption/GDP comparisons across nations are not as meaningful as consumption/GNP comparisons:

https://jabberwocking.com/consumption-around-the-world/

‘Ireland, by contrast, has a fairly modest consumption of $30,000 per person but has a huge GDP. Consumption is a tiny fraction of GDP….there are countries that use financial jiggery pokery to artificially juice their GDP figures. This includes countries like Ireland and Luxembourg.’

His graph notes he could have also noted Singapore which too is known for its transfer pricing games. I checked with FRED which provides GNP/GDP by nation and all three had low GNP/GDP ratios.

Hezbollah may be handing Netanyahu a lifeline:

https://www.timesofisrael.com/netanyahu-warns-were-ready-with-extremely-powerful-response-to-hezbollah-attacks/

Gazah is Israel’s fault. Hezbollah isn’t, at least not entirely. Giving Israel another war to fight is what Hezbollah exists to do, but now? Can’t we let Netanyahu implode first?

I wanted to say something semi-intelligent, for Menzie’s post here. I feel strongly one should stay quiet if you can’t “contribute” or make the dialogue better, so here goes……

Our family will buy a “new” car soon (6 months to a year from now) “New” car means, “new” to our family, but maybe a used car. My favorite car expert “Scotty Kilmer” of YT fame, and some credentialed Economists are saying cars will get cheaper soon. I am so happy two parties I like are telling me good news about our car buying dreams. Do any of our “sharper” commenters or hosts have thoughts about this??? Where are car prices going the next 6 months?? or 2-3 years?? Really, anyone’s thoughts are welcome. I promise to unveil our choice , of car model and brand, when we have made it, to ensure blog commenter interest or laughs,

—Uncle Moses.

Fine, I’ll attempt a substantive contribution as well.

My one criticism of these graphs is that the starting point of January 2021 is obsolete. It was originally chosen to highlight that no recession in early 2022 had occurred. It’s not particularly helpful as to 2024 (imho).

So here is the same data, except for monthly GDP, normed to each series’ respective peak:

https://fred.stlouisfed.org/graph/?g=1oB22

In a recession, we would expect to see all of these off peak. And as of now, 3 are: civilian employment, industrial production, and real manufacturing and trade sales. The others: nonfarm payrolls, real consumption, and real income, are either at new peaks or down -0.1% from the last prior month. And by the way, if we decomposed real consumption into goods and services, we would see that real spending on goods is down -0.9% from its December 2023 peak. And services spending tends to rise right through most recessions.

To generalize greatly, production, sales, and consumption of goods have stalled this year. It is aggregate real income and its spending on services which have kept the economy in expansion.

I guess, I’m supposed to be angry?? Or not?? How do you feel about retail consumption between now and September??? up or down?? This is a serious question.

semi-drunk Guy Moses

There’s good reason to expect goods demand to remain sluggish, relative to recent periods. That is that goods demand isn’t at all sluggish, relative to trend:

https://fred.stlouisfed.org/graph/?g=1oC2h

We are still buying more goods and fewer services as a share of total consumption, than prior to the pandemic.

It’s the classic supply vs demand. My understanding is that supplies are getting back to normal. The reason car prices go down during recessions and severe economic downturns is that demand drops quickly and it takes time for car companies to reduce supply. So the sweet spot is when the economy starts dipping and everybody stop buying for fear of instability in their income, but the supply line of new cars is still running full speed.

My daughter is looking to buy a new (new) car within the next year or so. I have told her to start looking into what kind of car she wants (identifying about 2-4 different cars she could be happy with). Then wait until car dealers start advertising more on TV and factories begin offering factory rebates. The best time is usually 2-6 months after new models come out (and dealers want to clear last years model). The best deals comes to those who are flexible on models, trim lines and colors. But it is not worth it to save another $500 on a car that is not what you want. It’s always a balance between what you want/need, what deals you can get, and how important another $500 less is, in the short and long run (we buy new, and keep it until it dies – so the long run is indeed long).

Ivan, do you live in a relatively large city??? I recommend MAZDA on price Alone…. then Toyota and Honda…… Or some grandma who want to sell her car SUPER cheap, Your daughter’s “creepy uncle” Moses (although, yes, twisted in the head) would never steer Ivan’s daughter wrong. REVIEW: TOYOTA, HONDA, MAZDA (MAZDA IS YOUR BEST VALUE PRICE)

Trust me on this Ivan my friend. I’d “go to the wall” for you and your daughter,

ADP private jobs data for May came out yesterday. Employers added 152,000 jobs, the smallest gain since January. The usual suspects – leisure and hospitality, health care and education, other services – added jobs. So did construction, trade and transportation and finance. Mining, factories and business services all shed workers.

Not a bad month, but there is a pretty obvious softening underway.

By the way, compare the ADP data to New Deal Democrat’s comments on demand and you’ll see a reasonable match.

Econoday Forecasts are interesting since the consensus forecast range is shown.

https://us.econoday.com/byevent?fid=591578&year=2024&lid=0#top

For nonfarm payroll, the Econoday consensus forecasts a change of 188K.

The low range value forecasts a change of 151K.

The high range value forecasts a change of 225K.

My FWIW forecast is near the bottom of the Econoday forecast range. I continue to have difficulty forecasting state and local government employment. For the month of April 2024, the net change in state and local employment was 6K.

State Government Monthly Change

https://fred.stlouisfed.org/graph/?g=1ng63

Local Government Monthly Change

https://fred.stlouisfed.org/graph/?g=1oCcZ

Easy to see why forecasting these series is difficult. The pattern is quite different in recent quarters than over longer periods.

After shortening the time period for both state and local government, I finally came to a forecast.

Private: 158K change.

Fed: 0

Local and state: 32K

Total 190K.

Economist Mohamad El-Erian Says Fed ‘Traumatized’ By Big Mistake It Made In 2021, Calls For Rate Cut In July

https://www.msn.com/en-us/money/markets/economist-mohamad-el-erian-says-fed-traumatized-by-big-mistake-it-made-in-2021-calls-for-rate-cut-in-july/ar-BB1nK4sk?ocid=msedgdhp&pc=U531&cvid=a377b3c2fab04cd6a1c548ad9f6025f3&ei=11

With the Bank of Canada and the European Central Bank becoming the first two G7 central banks to go ahead with rate cuts, traders’ eyes are now firmly on the U.S. Federal Reserve. According to economist Mohmad El-Erian, it is only right that the U.S. central bank starts cutting rates sooner rather than later.

What Happened: The Fed should begin to lower interest rates at the July meeting, said El-Erian in an interview with Fox News. But he was not sure whether it would. “We have got a Fed that is so traumatized by the big mistake they made in 2021,” he said, referring to the large COVID-19 stimulus it handed out.“They only look at the past,” the economist said, adding that the central bank is reactionary and therefore a rate cut may not be announced in July but should be. Premising his view on evidence of slowing growth, El-Erian said manufacturing activity indices, retail sales, and job openings data were all weak. All these are saying the economy was slowing faster than most people expected, including the Fed, he added.

“Monetary policy acts with a lag. So you are really targeting the economy of tomorrow,” El-Erian said. “But if you do it based on yesterday’s data, you will likely get it wrong,” The economist said if they had 2021 so wrong when they decided inflation is transitory, much against warnings by economists, they will now be afraid of making a strategic call now. “We have to respect that,” he said. El-Erian added that there is a 50% chance of a soft landing — inflation comes down with some sacrificing of growth but not much — a 15% chance of new-age technologies such as generative AI leading to hotter growth without a spike in inflation and a 35% chance of a “hard landing.”

I am not a big fan of El-Erian, but since he agrees with my long-held view of the FOMC’s embarrassed “fighting the last war” mentality, I’m a bigger fan today.

Bannon has been ordered to begin his prison sentence:

https://www.nbcnews.com/news/amp/rcna155209

Nobody is above the law. Except corporations.

Alas – this loud mouth racist is still screaming. Maybe he needs a gag order too.

A friend of mine and I have a phone greeting: “Today is a good day. Peter Navarro is still in jail.” We are planning our update(s) to this small reminder of the good things in life.