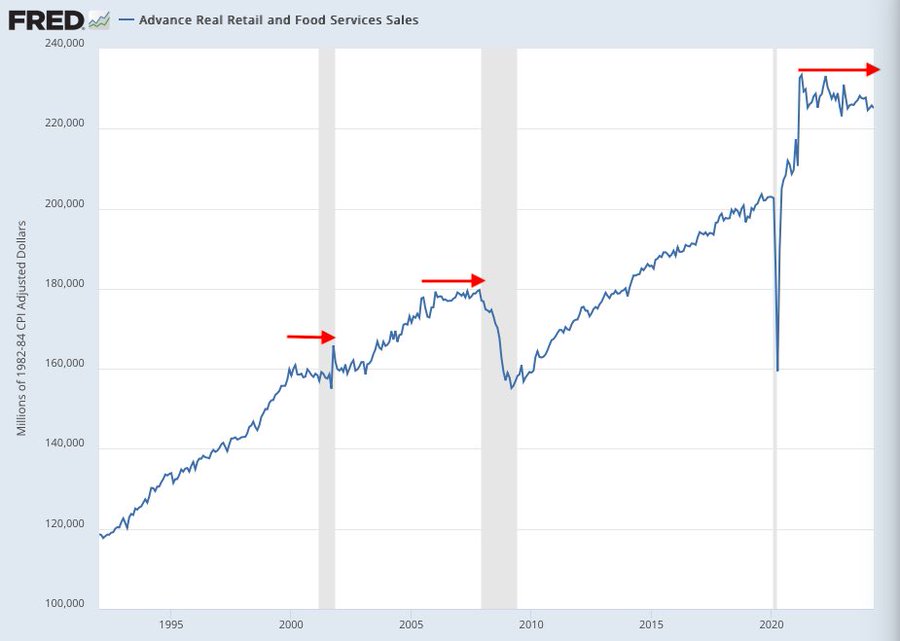

Out of curiosity, I peruse the web to see who is still saying a recession is coming (with an open mind). This tweet suggests retail sales are the indicator de jour:

Source: Alex Joosten (2024).

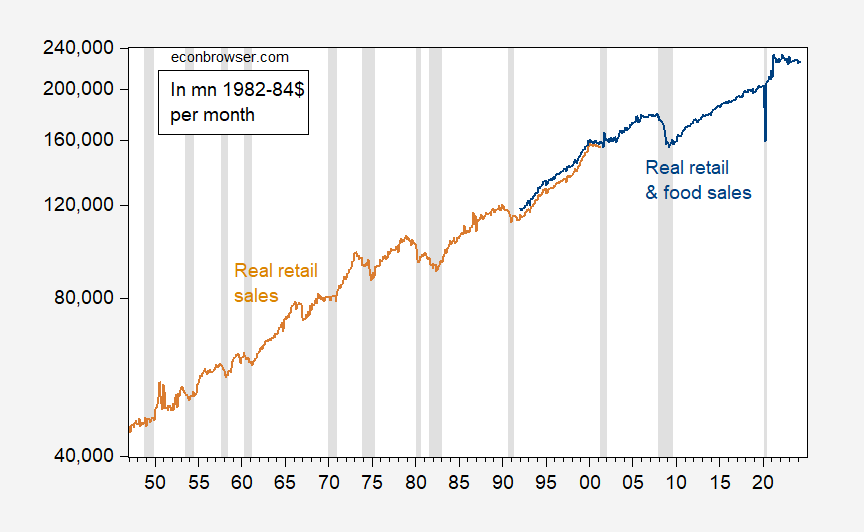

Pretty convincing, for the past 3 recessions. However, the post-pandemic boom in consumption and retail spending is quite remarkable, so I thought it might be useful to consider a longer span of data, using inflation adjusted retail sales. This is the picture I got, for 1947-2024M04.

Figure 1: Real retail sales (FRED series RSALES) (tan), and real retail and food service sales (FRED series RSAFS) (blue), in mn.1982-84$, deflated using FRED series CPIAUCSL. NBER defined peak-to-trough recession dates shaded gray. Source: FRED, NBER.

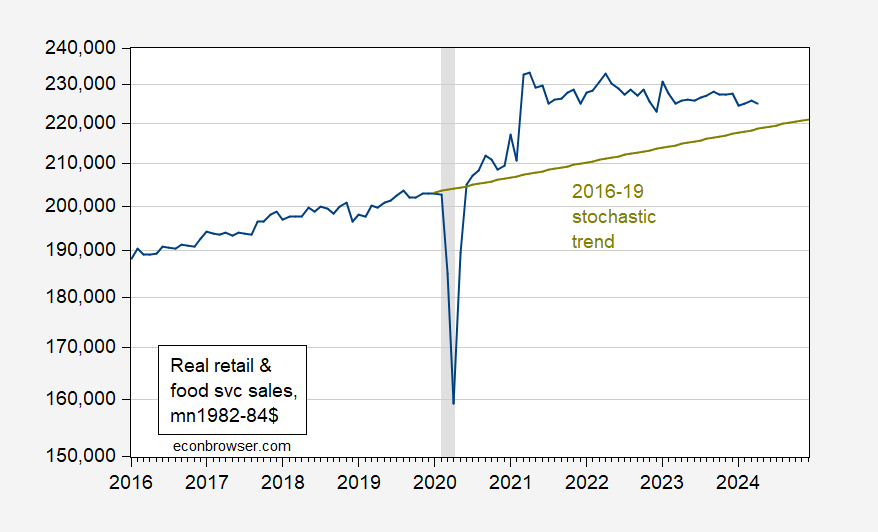

It’s certainly true that retail sales flatten and even decline in some cases before a recession (as defined by the NBER). On the other hand, each of the previous cases, retail sales was deviating from a pre-recession trend. Is this true in this case? Without knowing if an incipient recession is just upon us, I can’t answer that. However, I can evaluate whether retail and food sales, deflated by the CPI, was deviating from the 2016-19 (stochastic) trend.

Figure 2: Real retail and food service sales (FRED series RSAFS) (blue), in mn.1982-84$, deflated using FRED series CPIAUCSL. NBER defined peak-to-trough recession dates shaded gray. Source: FRED, NBER.

So, by one metric, we should be worried. By another (deviation from trend), maybe not.

This person’s Twitter describes himself as “Chief Investment Officer at Diamond Hands Capital”. Now that’s some impressive credentials – not.

How Republicans used misleading videos to attack Biden in a 24-hour period

Such deceptively edited videos, known as “cheap fakes,” have become staples of Republican attacks against the president.

https://www.washingtonpost.com/politics/2024/06/11/biden-videos-republicans-cheap-fake-d-day/

Hey – MAGA Republicans do this with economics data. Why not videos of Biden honoring those who served us during WWII?

A good part of what is different this time is the huge stimulus checks and a shift in spending, from purchasing entertainment to purchasing stuff – and the slow reversal of that. Might be interesting to compare with graphs of other types of consumer spending.

Excellent point. Here’s one picture:

https://fred.stlouisfed.org/graph/?g=1oSk3

Note that about a year, real services spending accelerated as goods spending slowed. Total real PCE is running along at a reasonable pace. That’s the answer to “are we in recession?” to the extent that currwnt consumer spending data can answer it.

As to anticipating recession, we need to think about the inventory cycle and the leading nature of the goods sector. It isn’t encouraging to see goods demand below the cyclical peak, no matter that goods demand had been on a ridiculous trajectory. This is what Menzie has been tracking in his regular posts on the NBER series – not new, but worth thinking about.

Informative graph – again thanks for the useful information that never makes it to Faux Business or tweets from the Heritage Foundation.

That real goods spending had soared before it flat lined would have been evident even in the tweet graph. But did anyone notice? Oh yea – you did as did our host who brilliantly wrote:

‘It’s certainly true that retail sales flatten and even decline in some cases before a recession (as defined by the NBER). On the other hand, each of the previous cases, retail sales was deviating from a pre-recession trend. Is this true in this case? Without knowing if an incipient recession is just upon us, I can’t answer that. However, I can evaluate whether retail and food sales, deflated by the CPI, was deviating from the 2016-19 (stochastic) trend.’

Taken an honest view of economic data is just not done on the Twitter by the MAGA crowd.

Another part of this may be a shift from buying stuff at the mall versus buying stuff online. OK I’m assuming retail sales includes the former not the latter so correct me if I’m mistaken.

“Are e-commerce sales included in current monthly retail sales estimates?

“Yes. In addition, we are separately estimating e-commerce sales.”

https://www.census.gov/retail/marts_general_faqs.html#:~:text=Are%20e%2Dcommerce%20sales%20included,Yes.

E-commerce as percentage of total retail sales in the United States from 2019 to 2027

https://www.statista.com/statistics/379112/e-commerce-share-of-retail-sales-in-us/

Well I’m right about internet sales rising but no – they are part of retail sales. So scratch my previous comment.

The point of the tweet is not a bad one. Historically, real retail sales has actually been a very good – but not perfect! – short leading indicator of recession. Here’s the historical look going all the way back to 1948, compared with real personal consumption of goods, a very similar metric:

https://fred.stlouisfed.org/graph/?g=1oSF9

Real retail sales measured YoY quarterly had no false negatives and only had 3 false positives (1951, 1966, and 2002) before the pandemic. Obviously it had a fourth false positive in 2022-23. Meanwhile real personal spending on goods had no false positives, but one false negative (2001) and two very late signals (1960 and 1970). It also briefly turned negative in 2022.

The huge pandemic stimulus did distort spending patterns (Menzie’s second interpretation), and the 10% broad based commodity price decline also provided a huge countervailing force, particularly on services spending.

As I have pointed out in response to several other postings here, the production, real sales, and real spending on goods have all been generally flat or even negative over much of the past two years. It has been building construction and strong spending on services that has fueled the expansion.

Typically in the past 60+ years there has had to be a simultaneous downturn in both manufacturing and construction – or a very large decline in one with flatness in the other – to lead to a recession:

https://fred.stlouisfed.org/graph/fredgraph.png?g=1oSGs

So it is of some concern that both are now slightly negative. Although services spending provision is still going very well, as noted in Macroduck’s graph in the comment above.

The surge in factory construction strongly suggests a future rise in factory employment. Historically, factory employment has tended to lead factory construction:

https://fred.stlouisfed.org/graph/?g=1oTaV

No mystery in that. This time, factory construction is driven by policy, as well as by the desire to shorten supply lines – leads and lags are switched. My wee brain can’t ome up with an estimate of when hiring for these factories will show up in the data, or how much hiring is implied by the surge in construction.

The “when” and “how much” of factory hiring has implications for wages and for turn-over. Given the location of the factories, we’re going to see stories about relocation, housing shortages and stress on public facilities.

The giant chip facility (facilities?) outside of Phoenix have me concerned. Summer isn’t here yet, and the current temperature is 106 F.

Joey Chestnut banned from Nathan’s Hot Dog Eating Contest

https://www.msn.com/en-us/news/offbeat/joey-chestnut-banned-from-nathan-s-hot-dog-eating-contest/ar-BB1o2ssN?ocid=msedgdhp&pc=U531&cvid=6f782151fcaa4268a55c0b34e9c9789e&ei=6

‘Joey Chestnut has become the unquestioned face of the annual Nathan’s Hot Dog Eating Contest over the past several years, but he will not be permitted to take part in the event this year. Steve Cuozzo of the New York Post reported on Tuesday that Chestnut has been banned from participating in the 2024 Nathan’s Hot Dog Eating Contest because of the 40-year-old’s recent decision to sign an endorsement deal with vegan brand Impossible Foods.’

WTF? Very unfair. Joey should sue.

Chestnut going vegan !!!!

Traitor.

The Black Widow retired from competition. Now Joey can’t compete in the top hotdog event? The Four Horsemen are in a sorry state.

The entire event is a promotional tool. If Joey Chestnut wants to make a buck on the side that’s his choice. The SMART thing for “Impossible Foods” to do would be to stage an event very near to the Nathan’s event, with the exact same time clock and same volume of hotdogs eaten with Joey Chestnut and some invited competitors. There’s no copyright on hotdog eating competitions that I am aware of, and Joey Chestnut is the one who will get people’s eyeballs~~not Mr XYZ 2nd best.

While I never liked the vegan version of hamburgers, maybe I’ll try one of their hot dogs. After all – in my 16 years of living in NYC I had only one hot dog and the damn thing made me sick. The bagels and pizza in NYC, however, we quite good.

Maybe certain events in the recent news cycle caught Mr. Chestnut’s attention. The hidden optimist inside me likes to think so.

https://www.npr.org/2024/05/24/nx-s1-4978739/morgan-spurlock-dead-super-size-me

Junk food junkies enjoy the fun and games…… until they don’t. And we don’t need to engorge ourselves to know that. Just like you don’t need to see what happens when you continue smoking cigarettes after a laryngectomy. Though I’m certain some PhD at UW-Madison or James Madison U has done research on that exact activity, just to enlighten us all.

OK, check the timeline on my comments, who struck gold first??

https://www.cnbc.com/2024/06/12/netflix-to-live-stream-hot-dog-eating-contest-with-rivals-chestnut-kobayashi.html

Mark Redding: Wouldn’t we be overcounting, if BLS weren’t take into account elderly deaths? Seems to me most recent information suggests BLS population controls underestimates employment, at least as CBO is concerned.

Would you care to provide some documentation?

To date Mr. Redding has only chirped in an annoying way. Now if you can get him to make a real contribution, that would be nice.