Industrial production at +0.6% m/m vs. +0.3% consensus (manufacturing production +0.4 vs. +0.2% consensus).

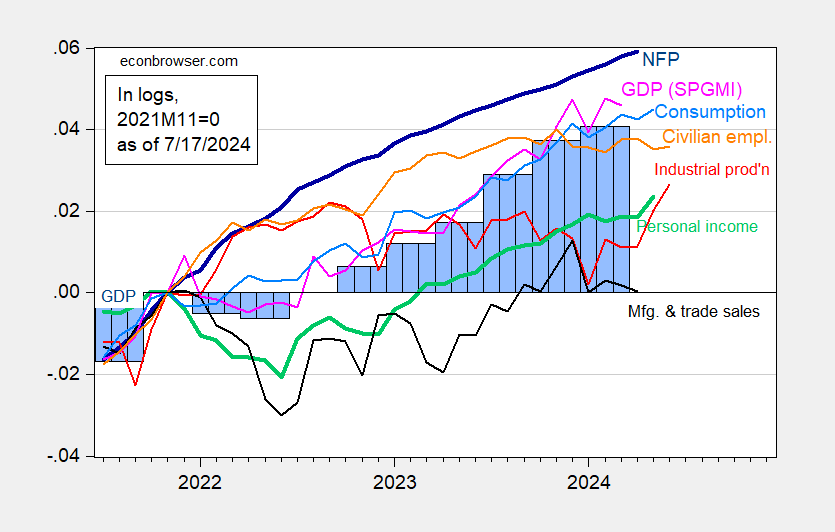

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2024 release), and author’s calculations.

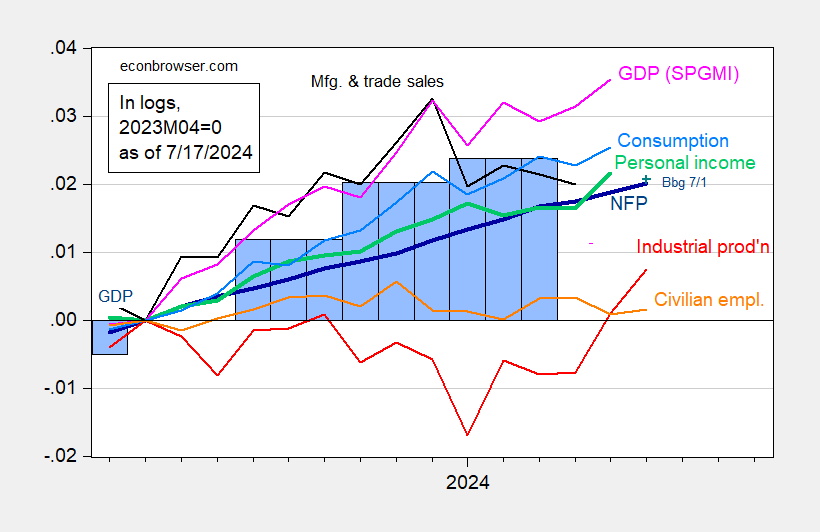

Normalized to April 2023:

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2024 release), and author’s calculations.

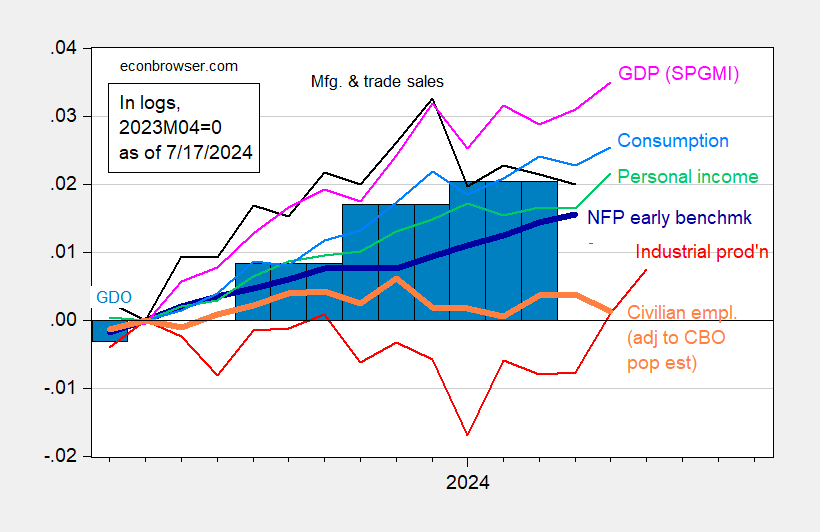

Alternative indicators for output, employment:

Figure 3: Nonfarm Payroll (NFP) employment Philadelphia Fed early benchmark (bold dark blue), civilian employment adjusted to CBO immigration (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2024 release), and author’s calculations.

GDPNow revised up to 2.7% in Q2.

Off topic – a look at financial market expectations regarding a second Trump administration from the Banca d’Italia:

https://cepr.org/voxeu/columns/us-election-risks-and-impact-trumps-re-election-odds-financial-markets

From the introduction:

“A higher likelihood of Trump’s election (1) increases the volatility in the US bond market, (2) decreases equity market volatility and boosts stock prices, and (3) reduces the oil price. Thus, financial markets expect a Trump administration to be relatively more market-oriented than Biden’s, less focused on environmental concerns and on the sustainability of public debt.”

One little quibble – “market friendly” is a conventional but misleading characterization. Trump’s policies are viewed as “equity-market friendly”. For the far larger and arguably more important fixed income market, Trump’s policies are decidedly unfriendly.

This research is based mostly on market responses to voter-preference polling and on forward measures of market volatility. No attention is given to measures of the structure of market pricing. That’s not a fault on the authors’ part – they’ve avoided crystal-ball gazing. We are free to practice the arcane arts, and I will do so.

Here’s an evaluation of the S&P500 price/earnings ratio as of May 1, 2024:

https://www.currentmarketvaluation.com/models/price-earnings.php

The Shiller version of the ratio (ten-year average) was 1.7 standard deviations above the historic average. Even for the post 1995 period, when the average has been higher, the ratio is well above average. By the way, P/Es have risen since May, as equity indices have risen to new highs:

https://www.multpl.com/s-p-500-pe-ratio

Point being, whatever market participants may think about the relative advantages to share prices of Trump’s likely policies, in absolute terms, stock pricing already looks rich. Rate cuts may offer some help, but are already priced in to a considerable extent, which is one reason P/Es are where they are.

“Point being, whatever market participants may think about the relative advantages to share prices of Trump’s likely policies, in absolute terms, stock pricing already looks rich. Rate cuts may offer some help, but are already priced in to a considerable extent, which is one reason P/Es are where they are.”

Rumor has it Kevin Hassett wants to update his 1999 book with a slightly edited title: Dow 72,000: The New Strategy for Profiting From the Second Trump Administration.

One source of strength in today’s industrial production data was utility output, a reflection of record-high temperatures in much of the country:

https://fred.stlouisfed.org/graph/?g=1qjuC

We are like to see more of that, as there is a steady increase in heating and cooling degree days in the U.S. due to climate change:

https://www.epa.gov/climate-indicators/climate-change-indicators-heating-and-cooling-degree-days

Seasonal adjustment mechanisms, being backward looking, are likely to routinely introduce an upward bias to industrial production in January, February, June, July, August and December, as long as heating and cooling demand is trending upward.

Utility output is also likely to become more volatile, as it already has.

Utility swings aside, manufacturing output was up nicely in June, and in all of Q1 and Q2. That’s not the result of the heat wave:

https://fred.stlouisfed.org/graph/?g=1qjug

Can’t tell just from these data if that’s the factory construction boom showing up in factory output, but it seems a plausible explanation.

Off topic – perhaps the usual “I know stuff” punditry, but it seems to fit:

https://www.politico.com/news/2024/07/17/rnc-republican-party-transformation-maga-00168933

An less corporate-friendly, more populist GOP, with declining interest in movement-conservative issues. Movement-conservative issues are often unpopular with voters.

“And that’s exactly what’s unfolding in Milwaukee. It wasn’t just Trump’s selection of Vance, the opponent of Ukraine aid who once said “I don’t really care what happens to Ukraine one way or another.” It was also the party’s adoption of a slimmed down abortion platform and the criticisms of corporations it heard on the RNC floor.”

All head fakes. Vance is in the pockets of billionaires who want more tax cuts for rich people and fewer protections for worker’s rights. And Trump is as pro-life as it gets. But a week of lying is what Republican conventions excel at.

https://www.msn.com/en-us/news/politics/union-twitter-account-goes-rogue-after-president-speaks-at-rnc/ar-BB1qa3Qn?ocid=msedgdhp&pc=U531&cvid=ae7877391d80405f9094b001d2f8fbb6&ei=14

It seems the rank and file Teamsters did not appreciate that wet kiss their President gave to Trump. Check out the Twitter reactions.