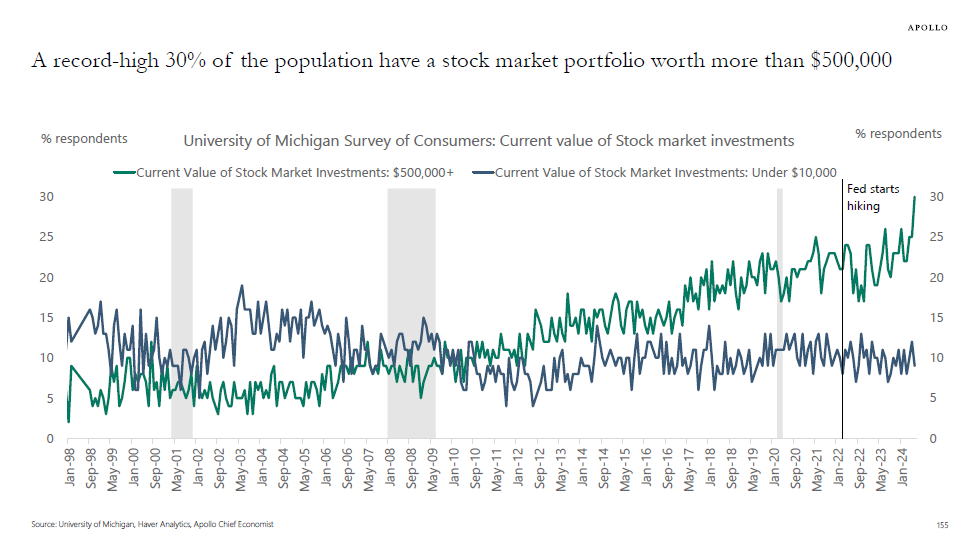

Torsten Slok presents this graph, and writes “The bottom line is that the tailwind to consumer spending for homeowners and equity owners is significant, in particular when combined with record-high cash flows from fixed income.”

Source: Torsten Slok/Apollo, 19 July 2024.

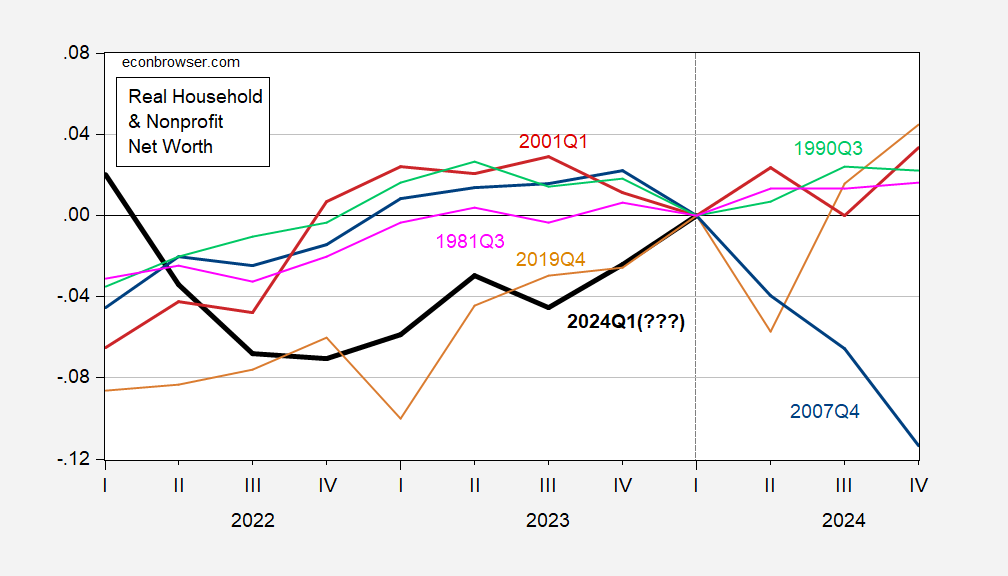

This made me wonder whether we’ve seen NBER peaks at quarters where household net worth has been rising. The household net worth series is relatively short, so I use household and nonprofit net worth, deflated by the consumption deflator.

Figure 1: Real household and nonprofit net worth, in logs normalized to NBER business cycle peak. Latest cycle (bold black) assumes peak at 2024Q1. Source: Fed Flow of Funds, BEA via FRED, NBER, and author’s calculations.

Of the previous five recessions, real household net worth has been decreasing into the NBER peak four times. The sole exception was the recession associated with the 2020 pandemic. By way of contrast, in 2024Q1, real net worth increased by 10% (q/q AR).

According to my experience in recession studies [and monetary economics in general]. It can be said that a recession does not last more than two consecutive periods. It is separated from prosperity and recovery by a state of uncertainty.

What do you define as a “period”?? One quarter??

Are you better off than you were 4 years ago? Seems so!

I don’t think the pandemic lockdown recession contradicts Slok’s point (and I doubt Prof. Chinn does either).

I have two separate similar models that make the same fundamental point.

The first is real aggregate nonsupervisory payrolls which, going back 60 years, have (again with the exception of the pandemic lockdown) *always* decelerated sharply and turned down before a recession has begun:

https://fred.stlouisfed.org/graph/?g=1qqiI

The second fundamentals-based model is that a recession will not begin if either an important household asset class that can be cashed in (stocks, home equity) is rising in value, or real wages are increasing, or debt can be refinanced at lower interest rates, thus freeing up more cash for spending. Only when all sources of increased spending are shut off, and the saving rate starts to increase, does a recession begin.

Needless to say, neither of those models indicates a recession is close at hand.

Agreed. There is a worry that housing wealth can be cashed in, but won’t be due to high mortgage rates. Turns out, households are increasing their use of home equity loans in the past two years, reversing the post-2008 trend. The KC Fed notes some of the new HELOC debt is used to pay off credit card debt – a decision to increase risk in order to reduce payments:

https://www.kansascityfed.org/denver/rocky-mountain-economist/more-households-are-tapping-into-their-home-equity-after-rapid-home-value-appreciation/

Apparently the bulk of HELOC debt goes to uses other than debt consolidation, so to some form of spending.

Black Knight tracks potential mortgage refinancing, and find a few million recent-vintage mortgages able to cut payments if rates drop as forecast, but for now, refinancing is just a trickle:

https://m.investing.com/economic-calendar/mortgage-refinance-index-1428/?catPage=history

As a result, mortgage equity withdrawal is also a trickle:

https://www.calculatedriskblog.com/2024/06/the-home-atm-mostly-closed-in-q1.html?m=1

The preference for HELOCs over refinancing with mortgage equity withdrawal is obvious – only the cash-out is paid off at today’s high rates.

Lower rates could help solidify the connection between household wealth and continued economic expansion.

Deeply sceptical about the idea that 100M Americans have a portfolio worth more than 500k, when the median retirement savings balance account is below 100k:

https://www.federalreserve.gov/econres/scf/dataviz/scf/table/#series:Retirement_Accounts;demographic:all;population:all;units:median

I thought so too, but then I looked up the household net wealth percentiles, and it appears that 50% of households have a net wealth of > $585K… that was a real surprise to me. It seems a lot more plausible to me now.

Where did that number come from? According to the Fed, the median net worth was $193k in 2022 (mean was $1 million).

The more I look the more crazy that $500k number looks. According to the 2021 Census, only 27% of households owned any stocks and mutual funds and their median value was just $32k. If you include “retirement accounts”, you still only get to 57% of households and a median value of $110k.

https://www.kiplinger.com/personal-finance/605075/are-you-rich …

Maybe it’s a bad number? Maybe I’m misunderstanding it?

I’d expect a lot of that $585K median net worth to be residential real estate. US residential real estate assets are about as large as the total market cap of publicly US companies (about $40T for both).

https://www.corelogic.com/intelligence/why-the-uss-largest-asset-class-residential-real-estate-does-not-substantially-contribute-to-the-economic-output/

Also most residential real estate is owned directly by households, while only 1/3 of stocks are held in retirement accounts (foreigners own about ~40%, and non-profit another ~5%).

https://www.taxpolicycenter.org/taxvox/who-owns-us-stock-foreigners-and-rich-americans

This US Census Bureau document from 2021 seems to agree:

https://www.census.gov/content/dam/Census/library/publications/2023/demo/p70br-183.pdf

I’ll join you in that skepticism. Your FRED link is very useful. Comparing the mean and median values shows one helluva a lot of skew in the data, and the skew is most pronounced in the older and upper income demographics. I’d be leery of using any parametric analyses with that data.

Ithaqua, net worth is assets minus liabilities. For most households, their largest net worth asset is the equity in their homes. That is quite different from “market portfolio,” meaning stocks and bonds.

Thank you. Some folks here must not understand the accounting. You do.

Well, sure, but it’s a question of plausibility… if 50% of the households have a net worth of $585K or above, and 90% are at $971K and above, there’s plenty of room there for 30% to have portfolios of $500K or more. https://www.kiplinger.com/personal-finance/605075/are-you-rich .

joseph I could buy the claim that 30% of households have a net worth of at least $500k, but the chart in Menzie’s post specifically says stock market portfolio, and that doesn’t pass the smell test. Looking at Ithaqua’s link it shows that the mean family holding in stock portfolios is $489.49k, but the median is only $52.0k. And when you break it down by income percentiles, the top 10% have a mean of $2,085.32k and a median of $601.60k. The next lowest percentile has a mean stock market portfolio or $393.56k and a median value of $127.85. And the 60th to 80th percentile has a mean portfolio value of $155.11k and a median value of $43.74. Bottom line is that the data is so skewed that you cannot do any parametric analysis.

“retirement savings balance account” is a subset of net worth.

This could be a case of poor labeling in the chart – “the population” vs “households”. As Ithaqua points out, the claim about 30% holding $500,000 in equity looks right for households.

Typically, wealth increases with age. If we leave out most single-person and newly-formed two-person households, you can see how the average starts to skew higher. In a four-and-a-half person household, $500k amounts to $111k each.

No, this still makes no sense, even for households.

You can look at the Federal Reserve’s Survey of Consumer Finances. Here are some highlights:

https://www.federalreserve.gov/releases/z1/dataviz/dfa/compare/chart/

This chart shows that the lower 50% of households have essentially zero stock market wealth. It is absurd to believe that the upper 30% have $500,000. You can look at just the upper 50% to 90%. They have a cumulative $10 trillion of combined stocks and defined contribution benefits (401k and IRA) for 52 million households which equates to $190,000 per household — average — for that whole group.

Or you can look at this chart:

https://www.federalreserve.gov/releases/z1/dataviz/dfa/compare/chart/

It shows that even for the 75% to 99% group, 62% of their wealth is real estate (their homes) and only 30% is stocks. So unless you argue that 30% is $500,000 which means their total wealth is $1.67 million — for that entire group[, which is also contradicted by the data.

There is simply no way that you could conclude that 30% of households have at least $500,000 in stock market or mutual fund portfolios.

The Michigan survey is only 500 households. While you can get a rough margin of error calculation for simple yes/no questions, you have a much larger margin of error when sampling household wealth that varies from zero to millions.

I simply do not believe that 30% of households have stock market portfolios over $500,000.

Title says “population”, Y-axis label says “respondents”. Both would have to be defined more specifically. Maybe it is behind the paywall but that doesn’t help us here. However the idea that 30% of our 330 million population has a stock portfolio in excess of $500K is just absurd.

The larger point that increased home values, stock values and interest incomes are holding its hand under the consumers – is indisputable. Increases in earned income are also helping people.

To get a recession you need some kind of shock/scare that will get consumers to curtain consumption (70% of GDP). But this is America, we live to consume – so forget about it.

But the Fed’s data is for families (which is pretty similar to households, if not identical), and it says the median (i.e. 50th percentile) is $193k in 2022. According to the Fed, there are 131 million families (for 330 million population, or an average family size of 2.5).

Also, as a double check, Fed Flow of Funds says net worth of households is $150 million, which also comes out to a mean net worth per household of just over $1 million. And the Fed says the total net worth of the bottom half of the distribution is just $3.8 million.

UBS agrees that no country on earth has a median net worth of $500k, and says the value for individual adults in the US is $100k, which again makes sense as there are usually 2 wealth holders per family.

It seems the conflicting data for Ithaqua’s link comes from some company called Wealthx?

https://dnyuz.com/2024/07/20/laura-loomer-cheers-rep-sheila-jackson-lees-death-in-racist-rant/

Sad to hear that the great Sheila Jackson Lee died. Disgusted at how I learned. Laura Loomer is your stand racist piece of trash that worships Donald Trump as the Orange Jesus. Laura Loomer, a white nationalist and Donald Trump’s one-time favored pick for a campaign role, sparked outrage on social media by metaphorically dancing on a Black Congresswoman’s grave. Rep. Sheila Jackson Lee (D-TX), a progressive voice in Congress who fought for civil and women’s rights, died Friday evening at 74, shortly after she announced she was battling pancreatic cancer. “Even on her death bed, this ghetto bitch couldn’t keep President Trump’s name out of her disgusting mouth,” the conservative TV host wrote in a series of posts on X. Loomer initially reposted one of Jackson’s last posts; a July 20 comment criticizing the former president. “Sheila Jackson Lee will be remembered as a destructive force in America and one of the most low IQ members of Congress in the history of our nation.”

Low IQ Laura? You are one dumb piece of garbage.

Sheila Jackson Lee graduated from Yale and University of Virginia law school. Laura Loomer got a degree in “broadcast journalism” from Barry University (??) (Average SAT score of 940 out of 1600)

Thank you. I was going to check her creds but you already have!

“In an effort to contain misinformation and extremism that have spread across the platforms, Instagram and its parent company, Facebook, have banned Alex Jones, Infowars, Milo Yiannopoulos, Paul Joseph Watson, Laura Loomer, and Paul Nehlen under their policies against dangerous individuals and organizations.”

https://www.theatlantic.com/technology/archive/2019/05/instagram-and-facebook-ban-far-right-extremists/588607/

She is in the best of company!

I don’t know where I got the idea but I think rational financial planners subtract real estate equity from calculations about investing or buying modern scams around life insurance.

The trend of my net worth has more impact on the aspirin/rollaids supply than my spending plans.

Biden drops out of the race endorsing Harris. Kamala Harris will be our President in 6 months. You heard it here first.

That’s two steps toward ending the circular firing squad. What we don’t yet know is whether the work has been done to avoid a fight against Harris. That would keep the firing squad going.

If my understanding is correct – and it may well not be – this has to be settled at the convention. There are no longer any committed delegates unless, buried in convention rules, delegates are somehow committed to the ticket, not just the candidate. I’m not aware of any such rule, but I’m not an expert.

Not since Carter had there been a hint of a convention fight, and that was just a hint. Rules have changed since then, and haven’t been tested. Any pundit who claims to know what’s what is pretending.

Do we have a VP choice? Drawing attention from Trump by making the choice a drama might be useful. Picking someone who can go toe-to-toe with Vance may be the most important issue.

Anyone know how Harris polls in swing states?

It seems no of the usual candidates plan to challenge her. The Clintons have already endorsed her and the other big dogs are lining up to do the same. The firing squad is now aiming directly at the MAGA crowd.

‘Do we have a VP choice?’

Not yet but people are already lining up to serve with her. I’m sort of partial to the governor of Kentucky but we’ll see.

There is chatter about Beshear. Don’t know how he’d be replaced; he is really important in his present job, but winning the presidential race is more important.

There is also chatter that the choice needs to bring a swing state, and we don’t know much about that. I hope there has been some effort beyond idiot-professionals’ personal opinions. Sadly, polling isn’t all that useful either – not extensive enough in swing states and not highly accurate. Even name recognition is limited among low-engagement swing voters.

Trump and that racist twit son of his are on a rampage. Let’s see. Trump calls Biden the worst President ever. Don Jr. calls Harris incompetent. That’s pretty funny since Jr. hasn’t done anything in his life except spend grandpa’s money and Trump is clearly the worst President eve.

This all the MAGA crowd – lies and juvenile insults.

UAW saying nice things about Harris. I bet they endorse her this week. Of course we know Trump is all about insulting the UAW. I guess his buddy Elon Musk is worried he might have to pay his workers a decent wage.

Harris has my full support. Biden stepped in when we needed him 4 years ago. Now he acts selflessly again in the best interest of the country. I wish harris nothing but success as she challenges the immoral and corrupt felon trump on the fall ballot.

With Biden endorsing Harris right away, he has terminated the discussion. Nobody else has a chance, so nobody will risk their reputation. Her vice-president will likely be a white male, and there are lots to chose from. Political best choice would be from a swing state where there is an uphill battle. But being on the same page and comfortable with each other is also critical for an intense next 100 days.

No doubt that the stock market contributes to the “tail winds”, but here’s the rest of the story.

https://www.fool.com/research/how-many-americans-own-stock/

So, the question is how prevalent is the withdrawal of stock gains for consumer spending? If the gain is in a 401k, it’s probably not affecting spending habits too much. On the other hand, if you are retired and pulling money out of your investments, it may not be going for new housing or college educations. For the 1% that own 49% of the stocks, they may be re-investing the money (which is good for the economy) or just happy to watch the market plug along (which doesn’t necessarily contribute to other growth) For the roughly 40% of Americans who don’t own stocks, there is no head wind for them there.

Those who are homeowners may be enjoying an increasing in the value of that asset, but one might question if that is contributing to consumer spending. After all, their property taxes are probably reflecting that increase in valuation and with HELOC rates where they are, the homeowners may not be inclined to take out a loan to finance their trip around the world.

Banks sometimes add a margin to the prime rate to determine their HELOC interest rates. Currently, it’s at 8.5%, the highest the prime rate has been in 23 years.

https://www.businessinsider.com/personal-finance/mortgages/average-heloc-interest-rate?op=1

Still, for those with stock ownership and home ownership, the increased valuations certainly take anxiety out of spending and running up those bills.

How Many Americans Own Stock? About 158 Million — But the Wealthiest 1% Own More Than Half

Careful there Brucie. We know the Trump agenda is to take from the poor and give to the rich. Highlighting this is not going to get you that hot date with Kelly Anne Conway.

“Those who are homeowners may be enjoying an increasing in the value of that asset, but one might question if that is contributing to consumer spending.”

My God – could you try to read other comments. This issue has been answered already and the right answer does not fit your MAGA stupidity.

BTW – I mentioned YOU specifically when I mocked what Trump said about mortgage rates and you did not notice. At least you forgot to claim that rates were above 11% so maybe you are marginally less stupid than Trump. But neither of you get that a weak economy from the mishandling of COVID leads to low rates as in late 2000 whereas Biden’s boom raises interest rates. Yea – macroeconomics not your forte.

You know – most variable rates are tied to something like LIBOR. Very few people in finance even bother with something as arcane as the prime rate. But our MAGA moron has to dig deep into the barrel of the sewage tank to try to make one of his usual worthless rants.

LIBOR is no more. LIBOR went officially extinct a year ago and its use started phasing out 5 years ago. All new contracts were forbidden to use LIBOR after 2021 and legacy contracts ended use of LIBOR in 2023.

LIBOR has been replaced by SOFR (Secured Overnight Financing Rate). SOFR is calculated by the Federal Reserve based on the prices of actual transactions in the overnight repo market. It is much more transparent and less subject to illegal price fixing than LIBOR.

Yea I have seen that. One thing all the yada, yada, yads misses is that the LIBOR encompassed more than 1-day interbank loans as there were 1-month, 3-month, 6-month, and even 12-month LIBORs. Term structure people – come on. Of course we have all sorts of domestic interbank rates so LIBOR was really not needed.

This is not a “probably” this, “probably” that issue. This thing called the wealth effect has long studied by economists. So let’s consider some of the findings of actual economics.

First, that business of the top 1% holding 49% of equities and the “may” do this or that, well may always carries a “may not” right along with it. Any analysis relying on “may” needs to attach an empirically established probably, or it means nothing. Most of the rest of equity holdings are among the top two income quintiles, which accounts for over half of consumer spending. See? Real numbers!!!

Now, on to real estimates o the wealth effect.

Here’s something from 1999:

https://www.newyorkfed.org/medialibrary/media/research/epr/99v05n2/9907ludv.pdf

Something like 5 cents of consumption arose in the 1990s from of each dollar of increase in equity value.

A study fro 2021 finds an all-in effect, including spending multipliers, funds a 32 cent wealth effect from each dollar of equity-value increase:

https://www.aeaweb.org/articles?id=10.1257/aer.20200208

That’s high relative to most estimates, but it’s the kind of number that real analysis can come up with.

Here’s what some real economists conclude about the wealth effect this year:

“…BNP Paribas economists predicted that higher stock and house prices will lift consumer spending by $246 billion this year…”

https://www.reuters.com/markets/us/far-credit-crunched-us-household-wealth-is-soaring-mcgeever-2024-06-21/

So let’s not have any of this “probably not”, “may not”, “may be” silliness. Economics can do lots better than that.

Here is a classic paper your links and a lot of others cite:

Ando, Albert, and Franco Modigliani. 1963. “The Life Cycle Hypothesis of Saving: Aggregate Implications and Tests.” AMERICAN ECONOMIC

REVIEW

Modigliani got a Nobel Prize for his work on this issue. But has little Brucie boy read anything Modigliani has written on this? Of course not.

Bruce Hall The biggest threat to median household wealth would be a Trump win that brings along a MAGA Congress. Pretty much all of the respectable macroeconomic models predict disaster if MAGA wins and makes good on its promises. Ten percent tariffs? Mass deportations? Executive control of the Fed? Tax cuts? Yikes. I know those things have a kind of instinctive, gut level appeal for the economically illiterate MAGA crowd, but anyone who knows anything about macroeconomics should be tearing their hair out. Even very conservative Nobel economists are alarmed at the idiocy of his proposals.

Nice said but 2 things about “anyone who knows anything about macroeconomics should be tearing their hair out”.

Brucie has proven over and over again that his knowledge of economics is zero.

In spite of wasting his money on Hair Club for Men products (along with his bleach treatments for COVID) Brucie is as bald as an American eagle.

A question for the longer termm is whether housing or stock values will fall, dragging down spending. Here are household wealth and wealth relative to GDP:

https://fred.stlouisfed.org/graph/?g=1qrrM

I don’t know any good way to draw conclusions from jus this picture. But the median home price looks a little precarious:

https://fred.stlouisfed.org/series/MSPUS#0

Same for the Shiller P/E:

https://www.gurufocus.com/economic_indicators/56/shiller-pe-ratio-for-the-sp-500

So we may be building in a sizable drag on growth during the next recession through a negative wealth effect.

“So we may be building in a sizable drag on growth during the next recession through a negative wealth effect.”

In the bizarro stupid world of Steve Koptis, this balance sheet event would be a “depression”. But to prove how utterly stupid Stevie is – he now calls this a “suppression”.

Yea – his brain stopped functions years ago but his keyboard keeps typing!

“The sole exception was the recession associated with the 2020 pandemic.”

Recession v suppression.

Oh joy – our village moron has to get in his utterly worthless little word.

Stevie – get an effing clue. NO ONE gives a damn about the trash you write. So be a good boy and just disappear.

“Suppression” WTF does that even mean?? You don’t even know, do you?? In a perfect world you would have been declared senile upon upload of this comment, and not some pretty great guy, GREATLY contributing to America the last 4 years. searching for the correct words in his mind during some bullshit crock-of-shit debate.

A suppression is an exogenous force acting on the economy. A recession would ordinarily be an endogenous force, that is, something intrinsic to the economy.

So, if you’re a real business cycle theory guy, as I think I am in most cases, the economy looks something like this: During an expansion, the fixed asset stock cannot keep pace with growing demand, leading to a bubble in asset prices, and possibly in commodity prices (‘peak oil’ is an example of this). Thus, asset prices continue to climb. However, at some point, the supply chain starts to catch up with demand, as more houses, ships, buildings, etc. are constructed. Over time, supply outstrips demand, and prices start to fall, leading to layoffs and bankruptcies, etc. Thus, expansions and recessions are viewed as a function of lags in the delivery of fixed assets to meet rising demand. The business cycle, from this perspective, can be considered endogenous, that is, implicit in the nature of a free-market economy. That’s a recession.

Now, you can take a perfectly healthy economy, still in an expansion phase, and shut in down in a matter of weeks with an endogenous shock, in our case, a pandemic. This has nothing to do with inflation, interest or employment rates or asset prices. The economy is simply shut down in whatever state it was in when the panic started. That’s a suppression.

We would expect suppressions and recessions to have quite different dynamics, and the data pretty much says that they do, as Menzie points out above.

Steven Kopits: You have used the term “real business theory” in a way that no credentialed macroeconomist would understand. Real business cycle theory relies upon technology and preference shocks, along with some adjustment costs, to explain movements in aggregate output. New Keynesian models (to differentiate from paleo-Keynesian models) append price stickiness and/or credit market imperfections to real business cycle mechanics. Would it kill you to read a macro textbook, so you can stop confusing economists?

I have avoided using ChatGPT and the like so I do not know how this works. But could Steve Koptis be some ancient and corrupted version that even the original programmers forgot about? I mean he writes all sorts of disjointed rants proving over and over that he has no idea what the terms he chooses even mean.

If Finn E. Kydland and Edward C. Prescott read this discussion of the Real Business Cycle – they might come over to your house and burn your computers to the ground. This has the be the dumbest thing you have ever written and that is saying a lot.

Oh wait – you have no clue who Finn E. Kydland and Edward C. Prescott are – do you?

“the fixed asset stock cannot keep pace with growing demand”

My God – this is stupid even for you. Anyone who knows anything about the Real Business Cycle knows that anticipated changes in aggregate demand affects nominal prices but not real GDP. This is a core proposition of their theory, which is why they called it the REAL business cycle model.

Most morons even know this but not little Stevie boy as he is the most moronic clown God ever created.

“A suppression is an exogenous force acting on the economy. A recession would ordinarily be an endogenous force,”

No Stevie has no idea WTF he means by suppression. Two other words this arrogant moron does not understand. Exogenous and endogenous.