More articles on dollar dominance, e.g. in Foreign Policy, Wells Fargo, vs. BitcoinNews. But most of the discussion centers on dollar use in terms medium of exchange etc. (SWIFT use, invoicing). Here, some recent trends for the reserve dimension.

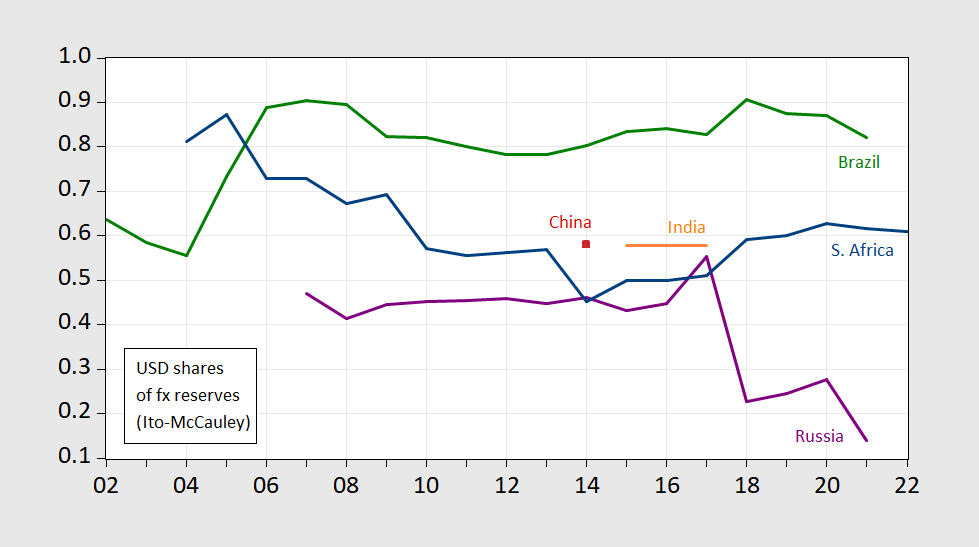

Here are some pictures of key reserve currencies held by the BRICS.

Figure 1: Share of foreign exchange holdings in USD, by central bank. Source: Ito-McCauley database,.

Next, EUR holdings shares; note the change in scale.

Figure 2: Share of foreign exchange holdings in EUR, by central bank. Source: Ito-McCauley database,.

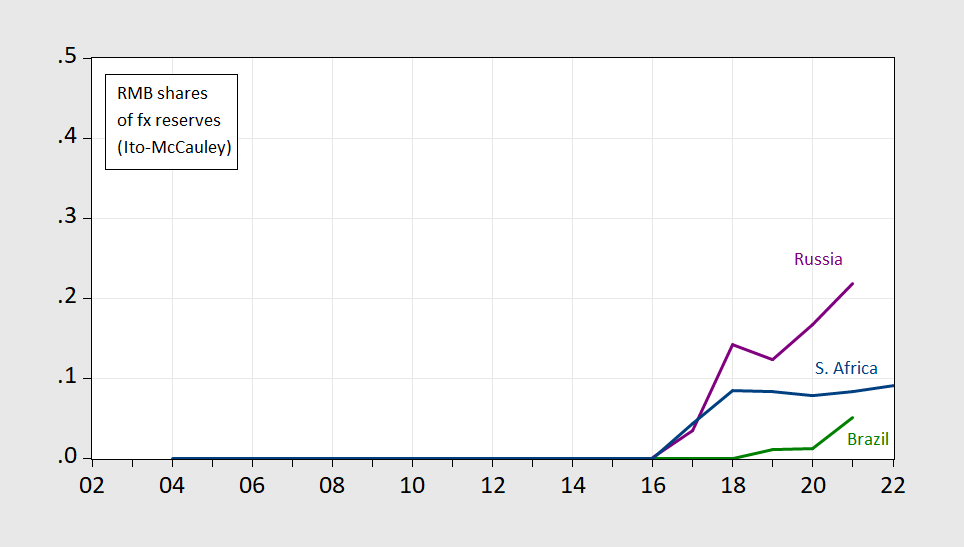

The holdings of USD exhibit a sharp drop only for Russia. What about the RMB? We have quite limited information here.

Figure 3: Share of foreign exchange holdings in RMB, by central bank. Source: Ito-McCauley database,.

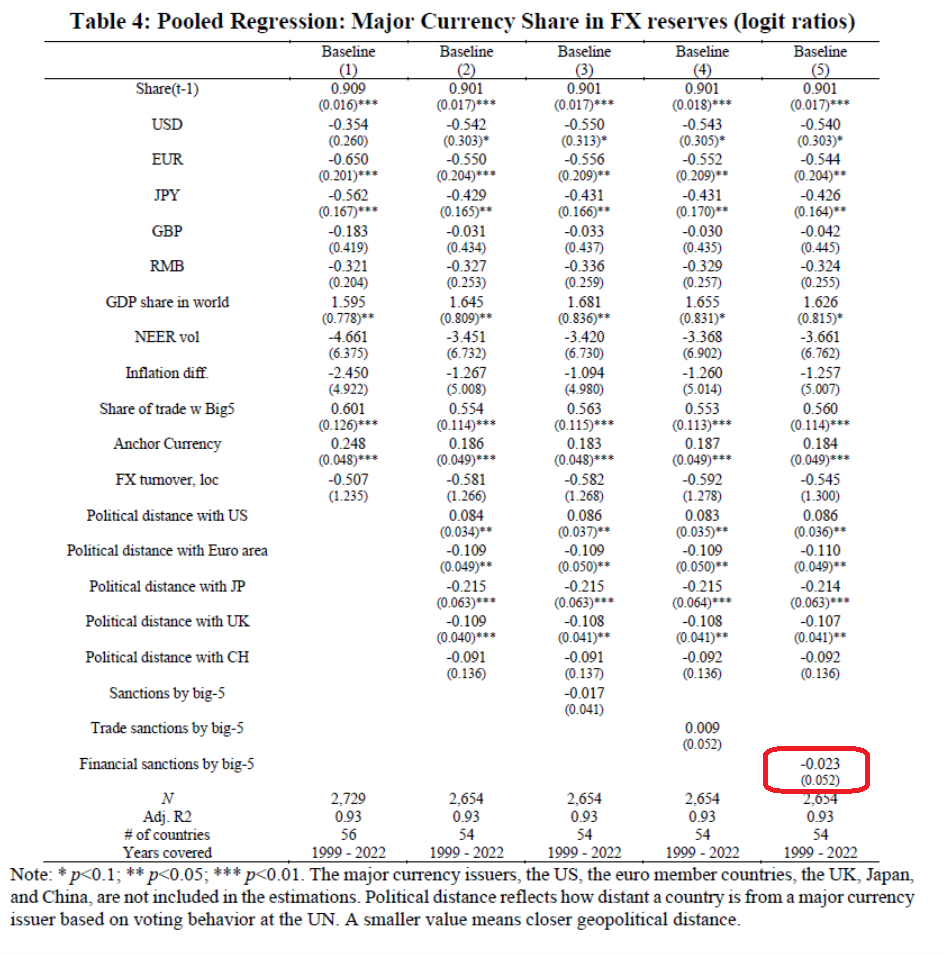

Will implementation of sanctions result in reduced dollar holdings? Unfortunately, we don’t have data for the period after the expanded invasion of the Ukraine, but we do have estimates encompassing up to 2021.

Source: Chinn, Frankel and Ito (JIMF, 2024).

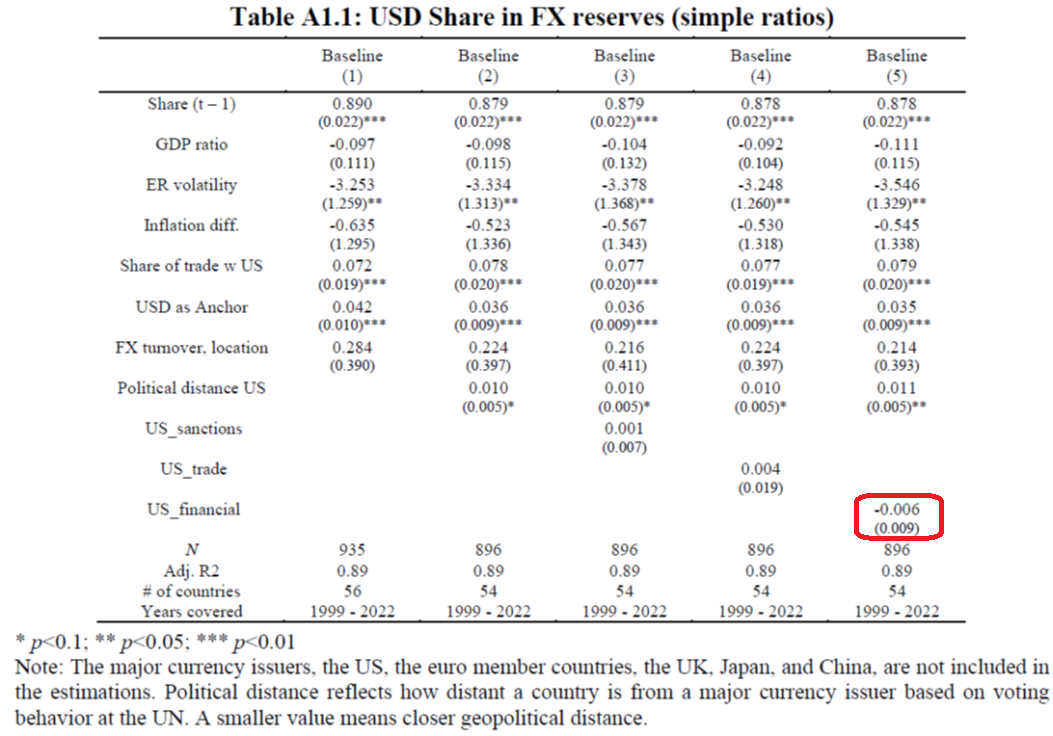

Note the estimated coefficient is not statistically significant. It’s also nonlinear, so a bit difficult to interpret. Table A1.1 in the paper presents estimates from a linear shares regression for USD holdings (only), so that the coefficient estimate is easier to interpret.

Source: Chinn, Frankel and Ito (JIMF, 2024).

The point estimate is very small (and not statistically significant). Taken literally, with an autoregressive coefficient of 0.88, the long run impact is 0.05, so that if the US has imposed financial sanctions on a country, on average that country’s central bank will hold 5 percentage points less US dollars. But, the 95% confidence interval encompasses a 6 percentage point increase in dollar shares.

Hence, arguments that use of financial sanctions will erode dollar dominance are not verified empirically, thus far (maybe with data to 2023, we would find something different).

“Economist Jim Rickards has shared insights on the U.S. dollar’s decline, driven by sanctions and mounting debt, and the potential rise in gold’s value as nations seek alternatives like the BRICS currency. He warns that internal mismanagement is the greatest threat to the dollar’s stability, stating to the U.S. government: “You’re taking confidence for granted. You’re assuming that people always have confidence in the dollar.”

What one would expect from BitCoin news. Rickards sounds a lot like Marjorie Taylor Greene. Is he her economic “expert”?

Rickards’ claim to fame is negotiating a bailout on behalf of LTCM. He has an MA un economics, but his professional experience is as a lawyer for financial firms. Economics isn’t his long suit.

Rickards is not arguing from empirical evidence. He’s repeating the very received wisdom that Menzie has debunked here.

He’s been a “precious metals” peddler for years. Don’t even humor the idea he’s genuine. He knows he is a snake oil salesman and has been from the word go.

The words “limited information” used in reference to official Chinese economic data. Who knew??? I mean the post in it’s entirety is solid and important information. I just had to say that.

Lot of interesting twists in this mining merger news:

Glencore is still pursuing Teck after $23bn bid rejected

https://www.miningweekly.com/article/glencore-is-still-pursuing-teck-after-23bn-bid-rejected-2023-04-04

“Glencore has proposed an ambitious multi-stage deal to acquire Teck for shares and then spin off both firms’ coal businesses into a new company. The plan would give Glencore control of Teck’s lucrative copper mines at a time when the world is bracing for a shortage, and allow it to get out of thermal coal — the most polluting fuel. It would be Glencore’s biggest deal since its 2013 acquisition of Xstrata, and the strongest sign yet that the world’s biggest miners are wading back into mega deals.”

Coal represents about 60% of Teck’s revenues but it seems the mighty Glencore may not want this line of business:

“But it also shows how large producers of coal like Teck and Glencore are grappling with the future of their businesses: mining companies are seeking to focus more on metals like copper and nickel that will benefit from the clean-energy transition, and yet coal still remains a big profit driver. For Glencore, the proposal represents the first concrete indication that it could be looking to get out of thermal coal. The company has continued to reap massive profits from the most-polluting fuel, even as rivals retreated. Until now it had simply said it would keep running its mines until they are empty, by 2050. Meanwhile, Teck announced in February it plans to split its own business into coal and base metals companies, in a move that spurred speculation that it could become be a target — that is, if the Keevils were willing to sell.”

Paraphrased from Wikipedia’s “Glencore” article:

Glencore has been accused, and in some cases found guilty of engaging Colombian paramilitary and official mitary forces and bribing officials to grab land away from locals to so that Glencore could open mining operations. In 2011, a Colombian court found that paramilitaries had killed locals and stolen land in order to sell it to Glencore.

Glencore’s CEO has admitted to dumping acid used in the refining of copper into rivers in the Democratic Republic of Congo. Also in Congo, Glencore paid $27.5 million in bribes and was fined $180 million.

After Russia re-invaded Ukraine, Glencore stated it had “no operational footprint in Russia” but continued to load Russian crude.

In the summer of 2018, Glencore was subpoenaed by the U.S. Justice Department, and in May 2022 pled guilty to several counts of bribery and paid $1.5 billion in fines.

In spring, 2019, the U.S. Commodity Futures Trading Commission notified Glencore of a corrupt practices investigation. Three years later, Glencore pled guilty and paid a $1.8 billion fine.

The Business & Human Rights Resource Centre has accused Glencore of over 70 human rights abuses.

The Guardian Australia has reported that Glencore has engaged in a global lobbying effort aimed at “undermining environmental activists, influencing politicians and spreading sophisticated pro-coal messaging on social media.”

There’s lots more. Glencore is too big to fail, so can continue to operate as a criminal organization. It shouldn’t be getting bigger; it should be made small enough to fail. That way, laws would matter.

There is a whole lot more. Wiki mentioned the Mopani copper mine in Zambia as a transfer pricing issue. It did not mention the battle over the copper from the Cobar mine in Australia or the zinc mined in Peru. I’m sure there is a lot more transfer pricing abuse that has not made the public domain. And Marc Rich style tax evasion is just one of the very shady business practices of this enormous and corrupt company.

All thermal coal companies recognize that it is soon game over for their sales in power generation – even other fossil fuels understand that the timeline is shortening. The basic investment into energy production has to look at 3 costs:

1. Cost to build (payments on loans).

2. Cost to maintain

3. Cost to fuel

For already build plants it’s a question of 2 & 3. For alternative energy, fuel is free. The basic lifetime calculation for a new power plant is all in favor of building alternative energy plants, provided interest rates are low. The initial investment in building the plant and energy storage for alternative energy, is still higher than fossil fuel – so loan payments for the life of a plant is still higher for alternative energy (in most places). However, cost of alternative energy production and storage is falling much faster than fossil fuel can ever dream of.

So the writing is on the wall and even those with big money in coal understand that there will soon be a lot of stranded assets in the coal industry, as producers will be competing for a rapidly shrinking market. It is not surprising that coal companies with other operations, are trying to wall off their coal business from the longer term viable parts. Then they can sell the sinking ship of coal based assets to some suckers who don’t know any better. Right now their coal mines may look like a good investment and their debt looks solidly backed by assets, so now is time to sell. In a decade, those mines will be environmental disaster sites with equipment that are barely worth the scrap metal.

Cost of shutdown?

I’m gonna guess that the public will be left holding the bag in many cases. Financial engineering to allow proceeds of the power generation business to be shielded in bankruptcy is already underway. Take Glencore’s intention to spin off its coal holdings and imagine the same approach for owners of power plants. Separating transmission from generation, separating fossil fuel from renewable energy generation, would do the trick.

If a coal-fire plant has a replacement cost of $400 million, or an original construction cost of $150 million, that looks like value of physical capital on the books. But once it no longer generates revenue, it’s actual value is negative. A firm which owns a power plant but doesn’t generate power and has transfered all of its past earnings to a legally separate entity is bankrupt. No way to cover shutdown cost.

A lot of combined cycle natural gas plants were build in the past decade because that new technology made natural gas plants the better profit choice for generating electricity. Their lifetime is about 30 years and they have a major overhaul every 10 years to refurbish the jet engine and replace turbine blades. If building is financed by a 30-year bond you have a good looking business plan to begin with – and bonds are easy to sell. At 10 years the refurbishing is financed by the profits saved for that purpose. But as you are getting closer to 20 years and the second refurbishing, the cheeper solar energy has ensured that there has been no way to save up profits for the second refurbishing. The insiders can see where it is heading. So they start/continue to transfer value out of the company and it goes bankrupt at 20 years. Bondholders who were not seeing what was coming are left with a loss.

Sounds like it is run by criminals. They should be the target. Clean out the criminal management and the company itself will clean itself up.

Pity we don’t do that.

Marc Rich moved to Switzerland to evade US prosecution.

‘Stop electing stupid people’: Rage as Marjorie Taylor Greene flunks American history test

https://www.msn.com/en-us/news/politics/stop-electing-stupid-people-rage-as-marjorie-taylor-greene-flunks-american-history-test/ar-BB1pzrOn?ocid=msedgdhp&pc=U531&cvid=e43faad9670944f79466e9f1ea25c6f3&ei=12

“The average age of the signers of the Declaration of Independence on July 4, 1776 was 44 years old, but more than a dozen were 35 or younger: Thomas Jefferson: 33 John Hancock: 39 James Madison: 25 Alexander Hamilton: 21 James Monroe: 18 Aaron Burr: 20 Paul Revere: 41 George Washington: 44,” the lawmaker wrote.

John Hancock and Thomas Jefferson signed this document but not James Madison, Alexander Hamilton, James Monroe, Aaron Burr, Paul Revere, or George Washington.

But shhh – don’t tell the bleach blonde badly built buffed bimbo as she owns a gun.

She won’t shoot you herself. She’ll have the Gazpacho do it.

With space lazers.

Sanctions are an alternative to other, more violent forms of coercion. There is a considerable literature arguing both that economic sanctions are useless and that they are useful, that they are an alternative to war or a step toward war. To a considerable extent, the absence of counter-factual evidence undermines the whole debate.

Current happy talk about de-dollarization is symptomatic of China’s concern that it will become the target of sanctions and China’s interest in stirring up concern among other countries that they may become targets. China is playing for a bigger role in the world, and undermining U.S. strengths is a big part of that effort. When Yves Smith or Michael Hudson focus on sanctions as a threat to U.S. financial power, it’s because they have swallowed Chinese – and Russian – propaganda. We’ve seen similar things from now-abscent commenters onthis site.

None of this means the U.S. will maintain its perch at the top of the financial heap. However, every time we see a headline about Xi consolidating power rather than a headline about China’s government taking painful steps to deal decisively with its myriad problems, we can push back our forecast of when U.S. financial power will crumble.

The demise of the dollar as the reserve currency has been around since Japan was going to take over from the USA as the major economy in the world. This of course di not occur despite very confident predictions it would.

As for China these days i am with Noah Smith with regard to how competent Xi is. China’s economy is now more closed than before

Arguably the Japan scare was more legit, in the sense Japan was/is WAY more efficient about doing tings (nearly anything) than China is. Though seemingly quaint looking back at it now, that fear was probably healthy for America in many ways because of our own false arrogance under Reaganism at the time.

Which actually brings up an interesting question. Now the Republicans are making medical diagnoses when older people make verbal gaffs~~How is it that when Reagan’s wife, Nancy Reagan was standing next to Reagan during press conferences to give verbal cues to Reagan, and years later many of Reagan’s own staff admitted the man had Alzheimer’s towards the latter part of his first term in office, when exactly did Republicans become so worried about senility in the White House??

My cursed internet news feed just popped up another Faux News interview with Art Laffer where they claimed Biden lied about the 2017 tax cut. Where to begin with these two lying morons?

Faux News dude claimed Federal revenues up by 47 PERCENT since the end of 2017. Not even close dumba$$. Try $47 billion in nominal terms over a 6.25 year period. I asked this idiot to do this in real terms but that would be over his head.

Now Laffer claimed he was right because the US economy over the next two years grew faster than the EU grew. Wait – real EU GDP was growing at only 1.4% per year for those two years. Maybe Laffer does not get the fact that EU population growth has been less than US population growth.

Why does Faux News viewers love Trump? Because they are too stupid to know how much their news station lies to them.

Could somebody else handle this, please? Like a blob of spilled paint, it needs to be cleaned up before it sets, but I have other things to attend to right now.

I have decided to stop reading his gibberish. Life is short and he is clearly a deformed early version of ChatGPT.

Unless Putin’s puppet Trump gets installed and bails him out – I expect Russia will drop out of the G15 counties as measured by GDP in coming years – maybe even the G20. An estimated 1 to 1.5 million of Russia’s best workers have emigrated and are not going back, 500,000+ killed and wounded in Ukraine, economy fully switched over to making artillery shells and refurbishing Soviet-ear tanks for war – economically and demographically Putin’s Russia is in terrible shape. Official figures indicate inflation is at 6.4% and they are increasing interest rates to 18% – https://www.reuters.com/markets/rates-bonds/russia-seen-hiking-rates-by-200-bps-18-july-inflation-quickens-2024-07-02/

By the way – 20% of Russians do not have access to indoor plumbing (figures from 2019 – and they have drastically reduced spending on public infrastructure since then) – Hey U.S. voters expect to be treated the same by second Trump regime – as he gives out tax cuts to his oligarch billionaire friends, cuts safety and environmental regulations and cuts social spending. – https://www.themoscowtimes.com/2019/04/02/indoor-plumbing-still-a-pipe-dream-for-20-of-russian-households-reports-say-a65049

“Official figures indicate inflation is at 6.4% and they are increasing interest rates to 18%”

Which would put the real interest rate at something north of 10%.

Which reminds me – our resident Arrogant Moron aka Steven Koptis is convinced that Russian real interest rates cannot be more than 2% so he forecast of Russian inflation has risen to 16%. His logic seems to be something like confusing what Irving Fisher sensibly wrote in 1907 with Stevie’s incoherent abuse of the Taylor Rule. Yea – he has tried to explain his insanity which only proves how utterly clueless he is.

That’s an exciting fantasy role-playing game you’ve got going on there! But I think this post was intended for whatever Discord channel it’s on, and got posted here by accident. What gaming system is it using? Can you post a link to the game?

Thank you.

NP, you do the Lord’s work around here, glad I could take a little of the burden off your fingers.

Tangentially related, the government of Argentina’s LaRioja state is issuing its own currency (called a “quasi-currency” in the article, but I see no basis for a distinction):

https://buenosairesherald.com/economics/la-rioja-issues-argentinas-first-emergency-quasi-currency-in-20-years

Argentina has a history of such currencies. The roll-out is looking sloppy, but that’s understandable. This is an emergency effort to pay wages in the absence of funds; the national government hasn’t transfered funds due to the state.

Argentina continues to suffer from high inflation and a high poverty rate (50%) in the first year of libertarian President Milei’s tenure in office. Despite his party’s minority status and the fact that no state governor is a member of his party, he is managing to pass legislation and to cobble together joint national/state reform agreements. None of this seems to have help do far. S

Stiffing government workers is no way to build political support, but I’m not sure many public sector workers voted for Milei.

“La Rioja province issued the first quasi-currency under President Javier Milei’s administration known as Debt Cancellation Bond (BOCADE, for its Spanish initials) on July 1. Quasi-currencies (cuasi monedas) are bonds intended to be used as cash, usually issued during liquidity crises. Neither phenomenon is new for Argentines: there were 16 types of quasi-currency in 2001 and 2002 when the monetary scheme that pegged the peso to the U.S. dollar started to break down. La Rioja’s new BOCADE — known as “chachos” because the bills feature local strongman Ángel Vicente “Chacho” Peñaloza — can be used for purchases in any store within the province. The government also said people can pay provincial taxes and public services with them. One chacho is worth one peso, and stores cannot accept them at a lower value or apply surcharges. The provincial government’s website said the chachos were being issued because the national government was “not sending the funds due to the province.” It also cited “the devaluation, the austerity measures, and the deep crisis all the provinces are going through.”

Like 2001 and 2002 were all that great for Argentina – not. But I do need to bone up with my Spanish to keep up with this lingo.

https://fred.stlouisfed.org/series/ARGCCUSMA02STM

Currency Conversions: US Dollar Exchange Rate: Average of Daily Rates: National Currency: USD for Argentina

The Argentine peso has been devaluing very rapidly of late.

Sadly, the roughly 2%-per-month devaluation of the Argentine Peso is policy – it’s what Milei announced as his official currency policy, once he had devalued by (if memory serves) 54% in a single day upon entering office. The black market still values the ARG at less than the official rate.

A 2%-per-month devaluation is not, in itself, enough to push inflation to 289% y/y, but it doesn’t help:

https://fred.stlouisfed.org/series/ARGCPALTT01GYM

So when Trump said food prices had quadrupled – he was measuring this in terms of Argentina pesos rather than US$.

I bet our Bruce Hall did the arithmetic for him!

Trump owes Rudy $2 million and of course Rudy has a $148 million judgment hanging over this drunk little head!

Rudy Giuliani Creditors Urge Investigation Of Donald Trump Payments

https://www.msn.com/en-us/news/politics/rudy-giuliani-creditors-urge-investigation-of-donald-trump-payments/ar-BB1pGfcD?ocid=msedgdhp&pc=U531&cvid=e73c85ddf7dd400ead573dd589295b90&ei=10

Rudy Giuliani’s creditors have told a judge that they want an investigation into the $2 million in legal fees that Donald Trump owes the former New York mayor. Giuliani lost a $148 million lawsuit and has been disbarred as a lawyer as a result of his work for Trump, yet has never been paid for his services. He told the deposition that the former president’s campaign officers have ignored the numerous invoices he has sent and have only ever paid his expenses. Newsweek sought email comment from Giuliani’s spokesperson and from Trump’s attorney on Tuesday. In a court filing on Monday, lawyers for Giuliani’s bankruptcy creditors appealed to Judge Sean Lane to appoint a trustee to take control of Giuliani’s finances because they no longer trust him. The creditors say that only an independent trustee will be willing to take the steps necessary to recover the $2 million that Trump owes Giuliani for legal fees incurred during the 2020 presidential election. They wrote that a trustee is needed to get past Giuliani’s constant evasion of his creditors.

I wonder if the creditors will accept Trump Bibles.

https://jabberwocking.com/behold-the-2024-republican-party-platform/

Kevin Drum brings us the Republican Platform for 2024 and does a neat job of rebutting its key “points”. News has it that the authors of this platform are the same clowns who wrote that Project 2025 document that Trump denies all knowledge of.

Comic relief – One of Iran’s biggest naval vessels turns turtle:

https://edition.cnn.com/2024/07/09/middleeast/iranian-warship-sahand-capsizes-intl-hnk-ml/index.html

Seems like some tanks on one side of the ship flooded, causing it to tip. As the article notes, warships are top-heavy. Empty fuel and/or ballast tanks exaggerates top-heaviness. Flood tanks on one side and physics takes over.

Whether this will have any effect on Red Sea shipping is not something I can figure out.

Off topic – Are Democrats about to stop self-immolating?:

There is some evidence that Democrats are going to stop dousing themselves in kerosene over whether Biden should stay in the race for the presidency. The Hill reports that the majority of House Democrats want him to stay:

https://thehill.com/homenews/house/4762148-democrats-back-biden-debate/

The Congressional Black Caucus has given him their whole-hearted support:

https://www.washingtonpost.com/politics/2024/07/08/black-house-democrats-cbc-biden-congressional-black-caucus/

Alexandria Ocasio-Cortez, who may be speaking for House Progressives, is all in for Biden:

https://www.nytimes.com/2024/07/09/us/politics/aoc-biden-2024-election.html

The press has been in a feeding frenzy – it’s what they do, after all – same as when Clinton was on his way to a 60% approval rating at the end of his tenure. Press feeding frenzies aren’t reality. Trump’s effort to obscure his second-term agenda, Ukraine’s military problems, Biden’s accomishments, the economy – none of those generate the breathless interest of dragging down a U.S. president, so by all means let’s stay focuses on that.

Anyhow, the dumpster-fire-of-the-week story needs fuel, and Democrats may be realizing they should stop fueling this one. We’ll see.

I have an idea given CNN has brought back Dr. Sanjay Gupta. Mind you I began to hate CNN asking him about everything health related including health economics. After all a neurologist knows everything in CNN circles – right?

But yea – let’s have a good neurologist test BOTH Biden and Trump. No kindergarten cognitive tests that Trump can “ace” but a real check up on their mental states. I may be only a lay person but I’d bet the ranch that a qualified expert would tell us Trump is beyond delusional.