From a VoxEU article today, by Robert N. McCauley with Hiro Ito and Menzie Chinn:

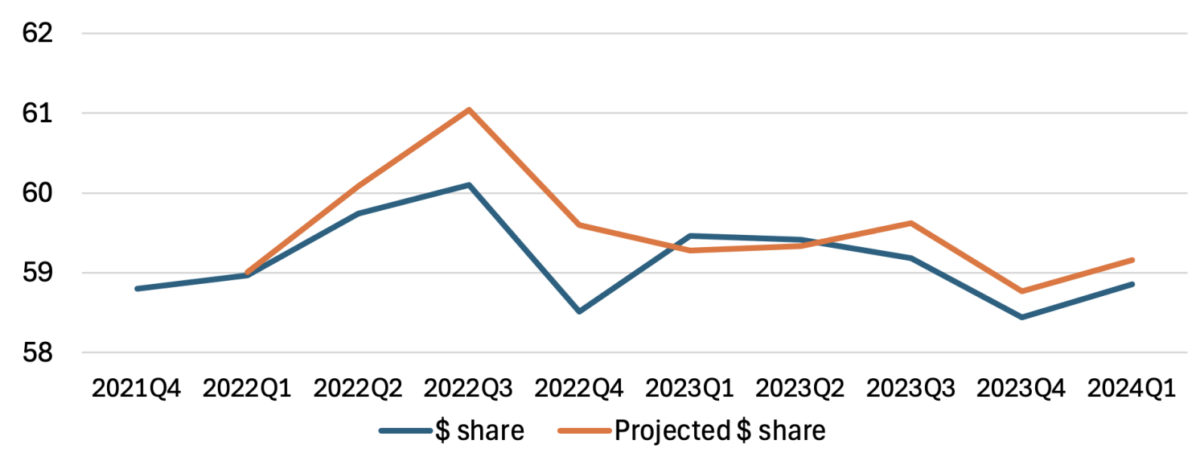

Will the freezing of the Bank of Russia’s foreign exchange reserves undermine the dollar’s predominant role in official foreign exchange reserves? This column examines the aggregate evidence since end-2021 for any reduction in the dollar share of official foreign exchange reserves against a baseline constructed with data from 1999 through 2021. The observed dollar share in March 2024 differs little from the out-of-sample projection based on this baseline. On this showing, official reserve managers have not reduced the role of the dollar since the freeze of the Bank of Russia’s assets.

The key graph (Figure 1 from the article):

Source: IMF Cofer; authors’ calculations.

Note: Projection uses 2021Q4 dollar share of 58.8%, constant of -.121 and coefficient for the effect of valuation change of .735. where the latter two are estimated from quarterly changes in the dollar share over the 91 quarters 1999Q2-2021Q4.

Link to Chinn, Frankel and Ito (JIMF, 2024), cited above.

Team Harris turns the competency issue on Team Trump by suggesting J D Vance is not qualified to be President.

https://www.cnn.com/2024/07/29/politics/kamala-harris-jd-vance-vp-pick/index.html

Truth be told – Vance is not qualified to be dog catcher.

Joe Biden has expelled nearly 7 million illegal immigrants

https://jabberwocking.com/41344-2/

Kevin Drum’s discussion and charts are a must read. It seems Trump expelled 4 million illegal immigrants while Biden has expelled almost 7 million. Something you will not from the Trumpian liars like Bruce Hall or the Faux News crowd.

That is a beauty. Sort of tells you who is actually tough on illegal immigration and who is just pretending.

There is an assumption buit into the argument that financial sanctions would lead to shedding dollar reserves. That assumption is that reserve-holding countries anticipate engaging in activities that would lead to sanctions. A number of countries have, but how similar is the behavior o large reserve-holding countries to sanctioned countries? Libya, Iran, Venezuela and Afghanistan are not examples many other countries would want to emulate. Libya, Iran and Afghanistan have all engaged in terrorism. Venezuela is no worse than a number of other countries, but is located in the Americas, where the U.S. imposes particular standards.

The only country which has enough reserves to make a big difference and which is also itching to violate established norms is China. China has made the argument to other countries that they ought to be concerned about U.S. sanctions, but China is the real focus of the debate over reserves. Chinese leaders envy the power that financial hegemony provides the U.S. Political leaders elsewhere aren’t naive; they know China is really aiming to gain the power the U.S. has.

The big appeal, other than access to Chinese markets and credit, is China’s non-interference approach to foreign policy. Saddle up with China and you can treat your citizens any old way you want. China won’t come storming in if you invade neighboring countries, either. No sanctions, we promise.

Except, China by god will come storming in, once hegemonic power has shifted. China stormed into Tibet, fought wars with India, Burma, the Soviet Union, Vietnam and South Korea and regularly threatens Taiwan. Non-interference looks more like a lack of reach than a principle, and China is expanding it’s reach. China uses it’s economic power as a weapon already – ask Australia. If China gains financial hegemony, China will use it against other countries, just as it uses trade.

Meanwhile, China’s own finances don’t lend themselves to using reserves as a weapon. Self-interest prevents China, and most other countries, from shedding dollar-denominated reserves in a hurry.