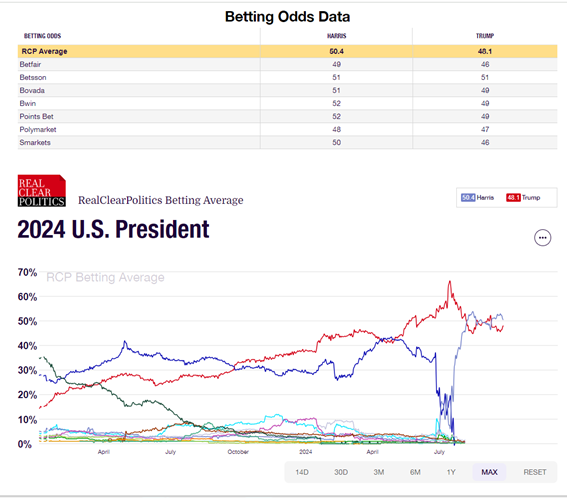

Perhaps someone can tell me why we get such different bets depending on platform (and why doesn’t RealClearPolitics include PredictIt)?

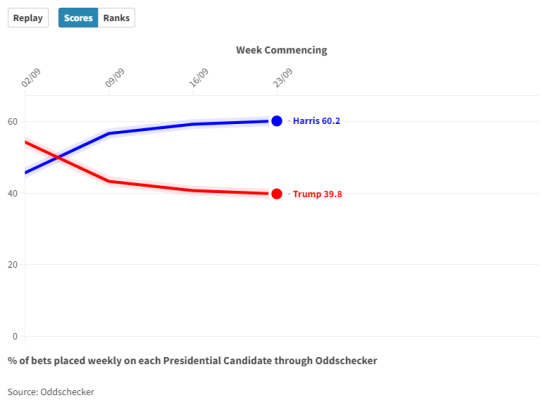

First, something that popped into my mailbox this AM from the UK’s OddsChecker.

Compare against RCP:

All of these covered by RCP have much tighter odds.

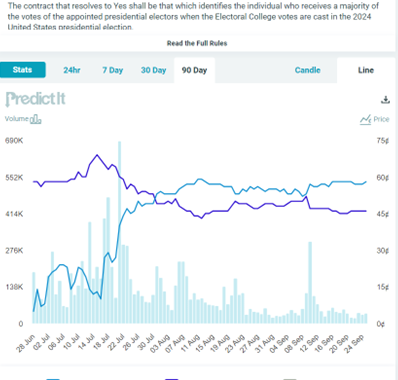

Then there’s PredictIt, which is much closer to OddsChecker.

Off topic – I’m not the only one who sees a possible link between new Chunese economic stimulus plans and public recognition that a prominent Chinese economist has disappeared. I give you Brad Delong:

https://braddelong.substack.com/p/xi-jinping-as-aging-emperor

“Chinese economist Zhu Hengpeng criticized Xi Jinping’s economic policies, and apparently vanished last spring. Now his vanishing is being publicized—just as there is what is being sold as a major shift in Chinese economic policy… Is there any connection here?”

That Delong guy, always copying off my homework.

Hahahahahha!!! I lost track of Brad Delong—seriousely MD. Thanks for reconnecting me to Delong MD. I got 3 glasses left here MD–wanna sing me a sad song??? : )

It makes me Angry MD,

RPC will publish just about anything, no matter how stupid or vile. Perhaps it is the tendency of the right wing to utter more stupid, vile stuff that gives me the impression that RCP is a right-wing organ mascarading as an aggregator of political opinion. In any case, tracking U.S. presidential election betting without including the only (for now) legal U.S. site for electionbetting is a bit like analyzing the U.S. fixed income market without looking at Treasuries. Not good for credibility.

The right wing is far louder and more shrill. I have experienced that personally with friends and colleagues who lean right. It makes no sense to me. Shouting down factual information doesn’t change reality. As a pragmatic person, I just don’t get it. But there it is. RCP just passes along the shouting without any filter. Hence, it leans right in effect.

RCP’s poll aggregates should be less biased, accidentally or not. I don’t think they are accurate. That is based more on hope than evidence. Count that up as a wish.

Off topic again – Florida’s storm surge and the insurance market:

“Florida accounts for only 9 percent of the country’s home insurance claims but 79 percent of its home insurance lawsuits, many of them fraudulent.

“Because of the fraudulent lawsuits and the high overall claim risk in Florida, insurance companies have faced multiple years with net underwriting losses over $1 billion.

“Florida has lost some form of home coverage from over 30 insurance providers in the past few years.”

https://www.bankrate.com/insurance/homeowners-insurance/florida-homeowners-insurance-crisis/

The state of Florida has passed legislation putting the state on the hook for weather-related insurance to keep the private insurance market from collapsing. Well and good, but where is Florida going to get the money? Perhaps Florida has legislated an exception in this case, but the state constitution forbids running deficits. Tax increase? Seems unlikely.

By the way, the “bend” where this hurricane is landing has some of the lowest rates of home insurance in the state.

Watch Florida if you’re curious about the future of property insurance in much of the U.S.

fortunately, not a lot of people live along the coastline where this hurricane is striking (although the eastern drift of the storm maybe increased the population a little bit).

from what I understand, there is an issue with both insurance companies who deny claims, as well as lawsuits. I think the state passed some laws to address the lawsuits, but it meant fewer people could easily challenge the claims denial issues. and since the deductibles for a tropical storm can be quite high, it can be difficult to get a claim started to begin with. the problem is spreading to the entire gulf coast. many lawyers won’t even touch as case that is less than $100k.

Insurance is, bizarrely, private socialism. Has Florida figured that out? Profit motive ans socialism don’t end well.

That UK place is sports dominated. Of course we always have this stock:

https://finance.yahoo.com/quote/DJT/

Trump Media & Technology Group Corp. (DJT)

Back below $14 a share.

Trump Media is up from around $14 a share to $15 a share.

Is this a Dead Cat Bounce?

Or maybe some Haitians are eating your Cat for dinner?

Or could this be grab them by the ?

Off topic – working from home and managerial irrelevance:

https://crookedtimber.org/2024/09/27/in-their-plaintive-call-for-a-return-to-the-office-ceos-reveal-how-little-they-are-needed/

John Quiggin is annoying; he sees implications that most of us miss. In this link, he sees grim news in working from home not just for commercial real estate, but also for senior executives. He begins with an assertion of fact – despite a steady flow of headlines about firms insisting on a return to the office, rates of working from home are unchanged. There is good news in this for firms – worker retention, productivity and lower real estate cost.

Quiggin’s points out that highly paid executives have apparently long missed this opportunity to reduce costs while boosting worker retention and productivity, and continue to try to undo the good that work from home has done. Most of the influences on firm performance – economic cycles, customer preferences, capital costs and the like – are outside the control of the firm. The organization of labor resources, on the other hand, is directly within the control of managers, and they are apparently doing it badly. Why? Perhaps because they feel that the buzz of an office must mean things are as they should be. Perhaps because they feel that workers need to be under direct observation – contrary to evidence.

Whatever the reason, it’s apparently mistaken. That raises questions about the value of management, as it’s practiced, and about managerial pay. The one major factor over which management has most control is being mismanaged.

Remember, boys and girls, that along with great wealth disparities, there are great income disparities in the U.S. I’ve never seen much reason for the high level of executive pay. Professor Quiggin has added to my doubt.