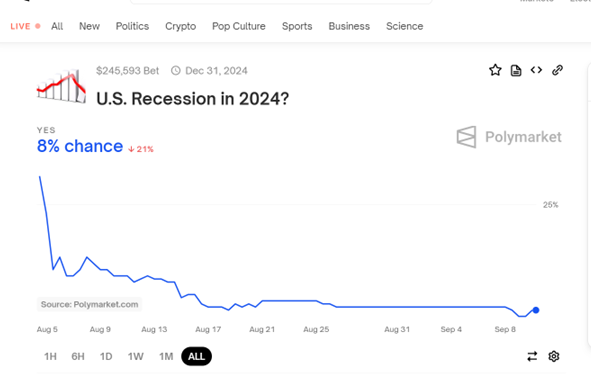

From Polymarket, accessed 4pm CT today:

So low probability…on the other hand, this is a bunch of non-American residents betting on a US economic event. For comparison, Polymarket (which cannot operate in the US) indicates 52-46 Trump/Harris, while PredictIt (which can operate in the US) rates 52-52. Polymarket has consistently predicted a higher likelihood of Trump winning (vs. Harris) than PredicIt.

I must confess some uncertainty about the betting, since outcome is to be determined by 12/31/2024, but we won’t have Q4 GDP until January 2025…Here are the rules:

This market will resolve to “Yes” if the Bureau of Economic Analysis (BEA) reports two consecutive quarters of negative GDP growth in the United States within the calendar year 2024, based on the seasonally adjusted annual rate. This includes any two successive quarters: Q1-Q2, Q2-Q3, or Q3-Q4. The determination will be based on the most recently released report by the BEA for each quarter.

If GDP data for Q1, Q2, or Q3 is revised before the release of the Advance Estimate for Q4, the most recent revision available will be used for market resolution instead of the initial Advance Estimate. Revisions made after the release of the Q4 Advance Estimate will not be considered for any quarters, including Q4 itself.

The primary resolution source for this market is the BEA’s official data on the seasonally adjusted annualized percent change in quarterly US real GDP, as available on their website. A consensus of credible reporting may also be used if there is ambiguity in the official data.

Weird…. I am….. I was just watching that psycho yesterday who rained down bullets over Las Vegas (on the YT video). Emotions can run high , over ANY situation. But Bets are a pretty good way to judge things in the sense people are betting their own money. The problem here, that I keep mentioning over and over and over again, even to my good friend MacroDuck, is that these polls are not catching the RURAL vote. It really quite literally puts them out of the “error margin” statisticians are so fond of mentioning. They say “plus or minus 4% error margin,” but if you include the rural vote, it’s more like 7% plus or minus margin, which makes the polls/surveys nearly useless

Right there with you, buddy.

I mentioned recently the view of a non-economist social scientist that election models cannot be calibrated. Nate Silver threw a hissy in response, but nothing in Nate’s hissy addressed the calibration issue.

The polls are way too close. Like 5 ppt too close. In every swing state.

so the goal is to convince those rural voters to stay home rather than waste the gas to go vote in an election they cannot win. don’t waste your time voting for trump in an election he cannot win. sit back and take a sip or two of that beer instead.

Okay, so a gallon of gas near my house just dipped below $3.00 a gallon. We can use this information to draw the following conclusions about the entire U.S. economy—even for places as far away as Wisconsin.

-Demand is cratering and we’re already in a recession—in fact, it’s a continuation of the recession that started in spring of 2023.

-Domestic oil companies, so beaten down by Biden and Harris, are engaged in a fire sale of reserves and a Mad Max style future awaits us all—except in rural areas of Wisconsin.

-Global demand is being tempered by a slowdown in China and other Asian markets and this impacts worldwide oil prices (okay, so this one isn’t satire)—and China’s appetite for electric cars will throw a monkeywrench into Putin’s plans for a sustainable, high value export market for his own black goo. (too soon to tell on this one)

-Trump’s victory in November will pave the way for gas prices lower than 50 cents a gallon, an abolition of CAFE, elimination of all auto safety standards, the end of public transit, and air strikes on solar and wind farms—even the ones in Texas.

On the China-Russia hydrocarbon deals it should be noted that Putin wanted a long term commitment and China refused. He wants (and needs) long term certain markets to make heavy investments for transportation of the goo. China understands that hydrocarbon is a short-term tie over as they shift to domestic alternative energy production. China dictated that their commitments to purchase will be for short periods – so Putin is still looking for a place to sell his goo.

Anybody notice what oil prices have been doing? Yesterday’s close was the lowest since December 2021. Year-to-date, Brent is down 10%, WTI down 8%. With a hurricane headed for Brownsville.

Maybe some Kamala votes in that.

But Trump will remind us of how low gasoline prices became during the end of his term. Of course that was because of the pandemic recession but hey!

https://fred.stlouisfed.org/series/GASREGW/

Gasoline prices are lower! But Team Trump compares them to the prices we enjoyed in late April 2020 under his superior management where he got these prices down by the total mismanagement of the pandemic! MAGA!