St. Louis and NY Feds have new nowcasts.

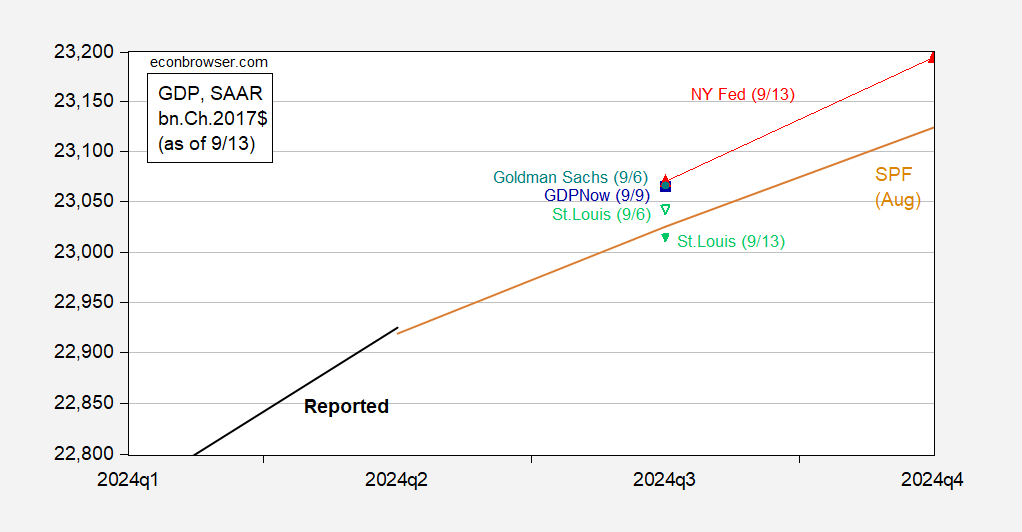

Figure 1: GDP (bold black), Survey of Professional Forecasters August median forecast (tan), GDPNow of 9/9 (blue square) and of 9/4 (blue open square), NY Fed 9/13 (red triangle-line), St. Louis Fed 9/13 nowcast (light green inverted triangle), 9/6 nowcast (inverted open triangle), Goldman Sachs (teal circle), all in bn.Ch.2017$. Nowcast levels calculated iterating growth rate to reported 2017Q2 2nd release GDP levels. Source: BEA 2024Q2 2nd release, Philadelphia Fed for SPF, Atlanta Fed (9/9), NY Fed (9/6), St. Louis Fed (9/6), Goldman Sachs (9/6), and author’s calculations.

Lewis, Mertens and Stock/NY Fed WEI at 2.27%, Baumeister, Leiva-Leon and Sim WECI at -0.19 implying 1.81% if trend is 2%.

First-ever net short in Brent futures? That’s what OilPrice.com finds Eric Nuttall saying:

https://oilprice.com/Latest-Energy-News/World-News/Oil-Net-Short-For-First-Time-in-History.html

https://x.com/ericnuttall/status/1834684336098230646

Nuttall also says global inventories are low. Net shorts in any market is often seen as a contrarian indicator, and low inventories should be good for prices, all else equal. The only obvious situation in which the short futures/short physical condition isn’t a pretty strong formula for a rise in prices – probably a sharp rise – is very low future demand.

Is there an argument for slack demand? OPEC, IEA and Macquarie all think so:

https://boereport.com/2024/09/13/macquarie-lowers-oil-price-outlook-for-2024-on-weaker-demand/

The link says “2024”, but the text says weaker demand than previously expected for the next 5 quarters, which sounds like all the way through 2025.

Even if the short futures/short physical position turns out to have been the right bet, it looks like a formula for volatility and possible local shortages.

No income tax on overtime. Comments?

Oh hell, I have comments! It’s a regressive tax policy. The extra wages, usually at higher hourly pay, is not taxed, but normal pay is taxed. Including FICA.

Or is overtime going to be exempt from FICA? ‘Cause that’s going to shorten the time to Social Security having to cut back on benefit payments.

What happens to those at the low end of salaries? No paid overtime, but lots of extra hours worked.

Big incentive for unionization, I think.

Oh, and it would need Republican support in Congress. So it’s a big lie to begin with.

Deficit increasing regressive tax proposal. Something Bruce Hall will likely celebrate.

No Trump claimed lots of economists thought this was a brilliant idea but could not provide a single name. Hint folks – Kudlow is not an economist.

Great for firefighters and police, however, who are adept at arranging their weekly schedules to pick up a lot of overtime.

A few years ago a bunch of post-docs around the country got a small pay raise so that they qualified for salary only with no overtime pay. Imagine having to pay grad students and post docs for every hour they worked! In a sense, the ended up with no tax on overtime pay. Overtime was simply eliminated. Work load remained the same. Unintended consequences, but a small pay raise did occur for some.

Menzie – forgive me for posting a PSA here – I urge everyone to watch the Harris rally in Wilkes-Barre PA yesterday – Harris is an inspiring, competent, thoughtful, and serious leader – I also liked her policy positions on protecting women’s access to reproductive health care, protecting the healthcare/ACA, protecting voting rights – I also liked her economic policies – middle class tax cut, $6000 child tax credit, and creating opportunities for all – including those without 4-year college degree. She will also be a serious/excellent C-in-C and protect our allies.

Then watch Trump’s press conference at his golf course in California (or rally in NV) – on the same day as Harris PA speech – Trump was slurring and semi-coherent – Trump and Vance are not just doing racist dog whistles – but now shouting harmful xenophobic lies (ala trump’s top advisor Laura Loomer – look her up – Loomer is too toxic for even Lindsey Graham and MTG) – even Fox News cut away when Trump rambled on about how his golf course is available to host your wedding – in the best location on the ocean! The bloody mass deportations that Trump is promising are no joke. Come – on NYTimes and WashPost – Trump is dangerously mentally unwell – you need to report on this – https://www.theatlantic.com/health/archive/2024/09/trump-harris-debate-cognitive-decline/679803/

I want the $50 grand to start a mead brewery in my garage.

Al those promises are useless when the ICBM’s fly.

VP Harris from the ABC debate

“I actually met with Zelenskyy a few days before Russia invaded, tried through force to change territorial boundaries to defy one of the most important international rules and norms, which is the importance of sovereignty and territorial integrity. ”

Promises to the neocons!

Where is VP Harris on support for US missiles’ long range strikes into Russia?

Anonymous: Isn’t everything irrelevant when the ICBMs fly? So you want to deter use of ICBMs, maybe by deterring at a lower level of conflict use of nukes. Maybe by not letting the Sudetenland be taken?

Yes, ICBM’s are the end game.

I will share scuttlebutt from my end times in my career (mid level Air Force technical manager). “No war game ended with tac nukes, all ended in massive exchange”. How do you keep the genie (I am old enough to remember genie air to air missiles) in the bottle?

Here is what happens: Biden lets Storm Shadow loose. Storm Shadow flies intricate course using US high security “keys”. Hit Russian territory. The F-16;s were armed in Poland. Russia stakes out runways from which F-16 armed…. Or Russia introduces attack on GPS satellite network. Or….

Here is the “Daisy” ad. 1964.

https://upload.wikimedia.org/wikipedia/commons/transcoded/5/5f/Daisy_%281964%29.webm/Daisy_%281964%29.webm.720p.vp9.webm

US is back to summer 1964…

You are still chirping gibberish? Get a clue troll. No one care about your stupid babble.

You don’t have to be a neocon to think that countries invading other countries simply because they want to is a bad thing and should be stopped by force (usually the only way to do it.) Saying “we’ll let Putin do what he wants because Putin has nukes” either a) is a strategy that leads to Putin ruling the world, or b) is a strategy that is discarded at some point. If it will be discarded anyway, why not discard it up front?

Trump is infamously easy to influence. Some say he is like a tape recorder of whatever the last person he was with told him. Loony Laura is spending a LOT of times with him. He could go totally off the rail – if she gets to continue. Som GOPsters have complained that a democratic plant couldn’t do more harm than she is.

Antoni alert! His latest attempt to say liberals are destroying our economy frets over US mining production which he claims has been “cratered” by going off the gold standard and by the creation of the EPA. But wait – mining production is up over the past 14 years. Yes – EJ rants tend to be fact free!

https://fred.stlouisfed.org/series/IPMINE

Industrial Production: Mining

The more I check out Antoni’s blog, the more I realize that this fake Ph.D. never took a real course in economics. He has a graph showing that US production of electricity has grown over the past half century but not as much as real GDP. Huh – maybe the rightwing joke has not read this:

https://www.monash.edu/business/ebs/research/publications/ebs/wp28-2020.pdf

On Income and Price Elasticities for Energy Demand: A Panel Data Study

Jiti Gao, Bin Peng and Russell Smyth

August 2020

Obtaining reliable cross-country estimates of the income and price elasticity of energy demand requires a panel data model that can simultaneously account for endogeneity, heterogeneity, nonstationarity and cross-sectional dependence. We propose such an integrated framework and apply it to a very large dataset of 65 countries over the period 1960-2016 recently assembled by Liddle and Huntington

(2020). We find that while the elasticities of income and price are non-linear, the income elasticity is generally in the range 0.6 to 0.8 and the price elasticity in the range -0.1 to -0.3. We also find that the income elasticity has been declining since the 1990s, which broadly corresponds to increasing awareness of the negative externalities associated with burning fossil fuels associated with the Kyoto Protocol. From a policy perspective, that the income energy elasticity is less than one, and has been declining since the 1990s, bodes well for climate change mitigation because it suggests that energy intensity will fall with economic growth.

I wonder if Antoni even understands what it means to have an income elasticity of demand less than unity. He also forgot to tell us anything about the relative price of electricity. One would think an economist would do that but not Antoni.

And it does seem that this Heritage dude is a climate change denier. MAGA!

Natural gas and electricity are substitutes in a number if applications – home heating, cooking, industrial ovens. Any discussion of electricity demand which ignores this point is…oh never mind. It’s Antoni, after all.

I was less than clear. His chart showed production form electricity and gas utilities which had risen by almost 140% since 1972 while real GDP had risen by around 280% over the same time period. Yea – I’m not in the habit of linking to a rightwing hack job’s Twitter as I do not want to highlight incessant stupidity.

But come on – we have managed to see big increases in real income without corresponding increases in the use of fossil fuels and this MAGA moron sees this as some evil liberal plot?

Is he suggesting that it is a bad thing if we “make more GDP” per unit electricity ?

Average Price: Electricity per Kilowatt-Hour in U.S. City Average

https://fred.stlouisfed.org/series/APU000072610

Checking the data because Antoni was too stupid, lazy, or dishonest to do so. Electricity was 5 cents per KW hour in 1980 and was 14.2 cents per KW hour in 2021, which represented an increase by a factor of 2.84. CPI went up by a factor of 3.6 over the same period. In other words, the relative price FELL over this period.

Antoni wants his moronic sheep readers to think liberals cause an inward shift of the supply curve. This data suggests a downward shift of the demand curve instead. But I should stop as we are all ready way about the pathetic ability of Antoni to grasp basic economics.

Macroduck raised this issue earlier:

Trump proposes ending taxes on overtime pay. Economists are skeptical.

https://www.msn.com/en-us/news/politics/trump-proposes-ending-taxes-on-overtime-pay-economists-are-skeptical/ar-AA1qxKtB?ocid=msedgdhp&pc=U531&cvid=803127ac64f64e369b02d778e1e39d7a&ei=14

“If you did not put any guardrails on this, it would be a huge revenue loser,” said Brendan Duke, senior director for economic policy at the left-leaning Center for American Progress. Such a shift, he said, could lead employers to classify as much of a worker’s wages as overtime as possible. “As long as you’re not violating the federal minimum wage or the state minimum wage, it’s off to the races.” … Economists raised concerns that Trump’s proposal might distort how workers report their income. People who are currently salaried could press their employers to reclassify them as hourly workers, for instance. Employers could reduce their workers’ base pay but greatly raise their overtime pay. “You can game the system here pretty easily,” said Rajesh Nayak, a former assistant secretary for policy at the Labor Department. “CEOs can get a base pay and get most of their pay in overtime, then suddenly they don’t have to pay taxes on that.” Others wondered why an hourly worker should pay less in taxes than a salaried worker with comparable annual pay.

I did not include the comments from Stephen Moore as he is not an economist. But Moore basically said this proposal would not likely reduce tax revenues that much – which of course is on par with other Heritage BS.