Heritage Foundation EJ Antoni channels ShadowStats:

“Government economic figures hide the truth about the economy…” Thang [sic] you,

@mises , for highlighting a recent paper @profstonge and I wrote that explains how inflation has been greatly underestimated – read the article by @RonPaul here:

https://t.co/cVroe5QwCT

I have written a paper on the Antoni-St. Onge thesis that using the “right” deflators means GDP in 2024Q2 is below 2019Q2 levels, but here I want to highlight one fact – what their alternative GDP deflator entails.

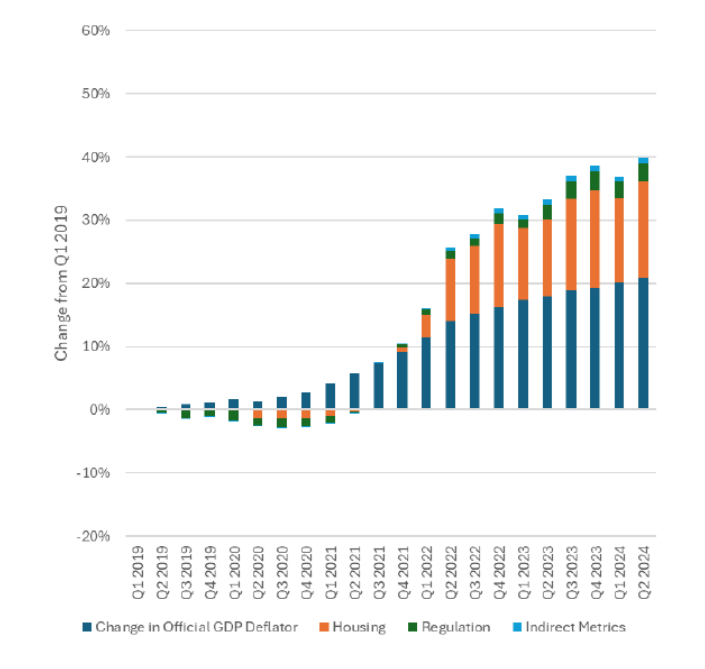

Source: Antoni and St. Onge (2024).

Notice the big orange area in the above graph, which Antoni and St. Onge attribute to their improved treatment of housing costs. I try to follow their argument, using the product of house prices (Case Shiller national house price index) and 30 year mortgage rates in place of the BEA’s component. I adjust real consumption accordingly (the authors do not mention adjustment to investment or government spending), and recalculate GDP (as shown in the paper). Updating the calculations with the most recent house price and NIPA data, I obtain the following picture of the implied deflators.

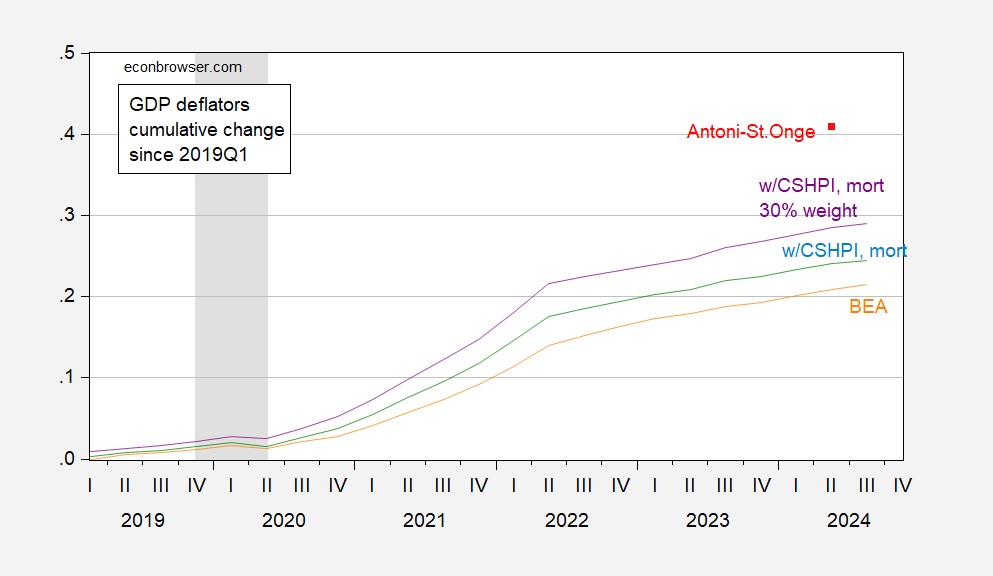

Figure 1: GDP deflator from BEA (orange), implied deflator replacing BEA housing costs with product of house prices and mortgage rate, at 15% weight in consumption (light blue), and at 30% weight (purple), and Antoni-St.Onge implied GDP deflator (red square), all relative to 2019Q1. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, author’s calculations.

In other words, I cannot figure out how Antoni and St. Onge calculated their alternative GDP, nor their alternative deflator.

Off topic – Chinese economic policy:

https://www.foreignaffairs.com/china/why-china-wont-give-failing-economic-model?utm_medium=social

The author makes two broad points. First is that China’ stimulus effort relies mostly on asset prices – the wealth channel – rather than direct stimulus to spending. She compares this to U.S. quantitative easing policy, and is not a fan.

Her description of China’s recent policy efforts is the clearest I’ve read, worth the effort for that alone.

Liu’s second point is the reason that China is sticking to using financial levers rather than demand stimulus, and it’s not a big surprise. She argues that Xi is unwilling to hand resources to households, because household choices might not support his policy agenda; Liu sees something like autarchy as Xi’s ultimate goal.

For what it’s worth, Zongyuan Zoe Liu is a CFR fellow, formerly at “Foreign Affairs”, sheepskin from SAIS.

Amazing how the truth is only hidden and faked during democratic Presidencies – whereas under GOP presidents it’s all good.

and yet its the same folks at those agencies doing the work and publishing, no matter which party is in charge. or at least that has been the case through the current administration. I believe trim would like to change that in the future.

by the way, ladies, how do you feel about folks like Jesse Watters arguing that the husband has the right to tell his wife who she may/not vote for? seems like Jesse Watters is a fighter of freedom only for those who agree with him. all others should be told what to do. is that what you want the next 4 years to look like?

” I cannot figure out how Antoni and St. Onge calculated their alternative GDP, nor their alternative deflator”

But Professor, it’s quite simple. They decide what number they want it to be – then apply a Fudge factor to “make it so”. Deliciously simple. Don’t complicate science with facts. Just make it up and cash your paycheck.

I doubt they understand what they write

Ivan is onto something.

The deep state manipulates figures when Democrats are President but doesn’t when republicans are in. The enemy within are obviously in the commerce department.

cleanse the lot.

clearly their rubbish is merely to maintain the rage of the MAGA types!

I will add that I have experienced talking to paranoid morons who were convinced that there was this extensive, coordinated and secret deep state network of thousands of “liberals” who specifically doctored the numbers worse or better, depending on what party was in charge of the White House. But, there was no way to rid them of their “blessed ignorance”. You can tell them that:

1. There are no such thing as a secret conspiracy of thousands (or even a handful of people) – it always eventually comes out.

2. The political bosses could easily “dig out” massive and/or systematic falsification that flip-flopped depending on political leaders.

3. Almost all raw data is available to the public, so outsiders could do the same.

4. Most data is connected to other data (collected by other people), and every time there is strange variability, professionals dig in to understand why.

However, ridding ignorant people of their paranoia is impossible – because as soon as you begin to tell them they are wrong, that is to them “proof” that you are part of the conspiracy.

there is a reason the Republican Party is against quality education. and educated person, with knowledge of the truth, is dangerous to those who survive in a world of lies. logic is their enemy within.

“In other words, I cannot figure out how Antoni and St. Onge calculated their alternative GDP, nor their alternative deflator.”

so there is an argument out there that academia is biased against conservatives. that is not really true. what is true, however, is that often conservatives don’t want to play by the rules of academia. in academia, you should freely publish your work, and accept the scrutiny of others. a big part of that is to provide details of methodology-how you computed your work. if one does not do that, then fair scrutiny cannot be made. since the work cannot be critiqued fairly, it is not accepted into the academic profession. this is an example of that exact situation. the work of Antoni and st Onge cannot be replicated and scrutinized, because details of the work were not provided. what they want is for people to accept their conclusions without scrutiny. and that, my friends, is why folks like Antoni, rick stryker, econned, etc are not part of the academic world. it has nothing to do with bias. they simply don’t want to have their work examined in detail. mostly because it is flawed.