Or, “who needs a stinkin’ independent central bank, non-Trump edition.”

Could this article explain why at 1:30 AM CST as I awaited data on the Russian Central Bank’s interest rate decision… nothing happened?

From Bloomberg yesterday (before the decision):

ong feted as the savior of Russia’s economy in the face of sanctions over the war in Ukraine, central bank Governor Elvira Nabiullina is increasingly under attack from officials who say she’s now destroying it with record high interest rates.

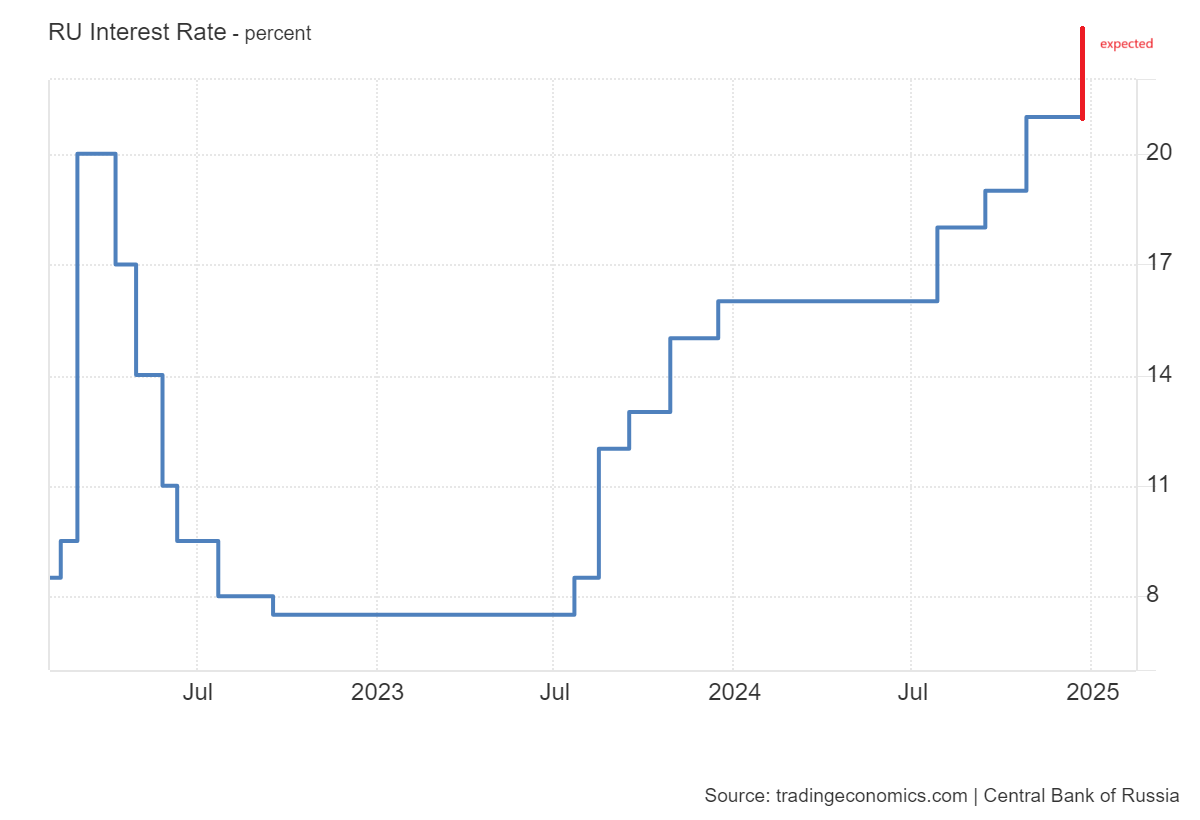

Nabiullina faces rising criticism within the Russian political and business elite ahead of the bank’s final rate-setting meeting of the year on Friday. Analysts forecast that policymakers may hike the key interest rate to 23% from 21% now, and possibly as high as 24% to curb persistent high inflation.

So, here’s the policy rate (red was what most people expected, an increase to 23%):

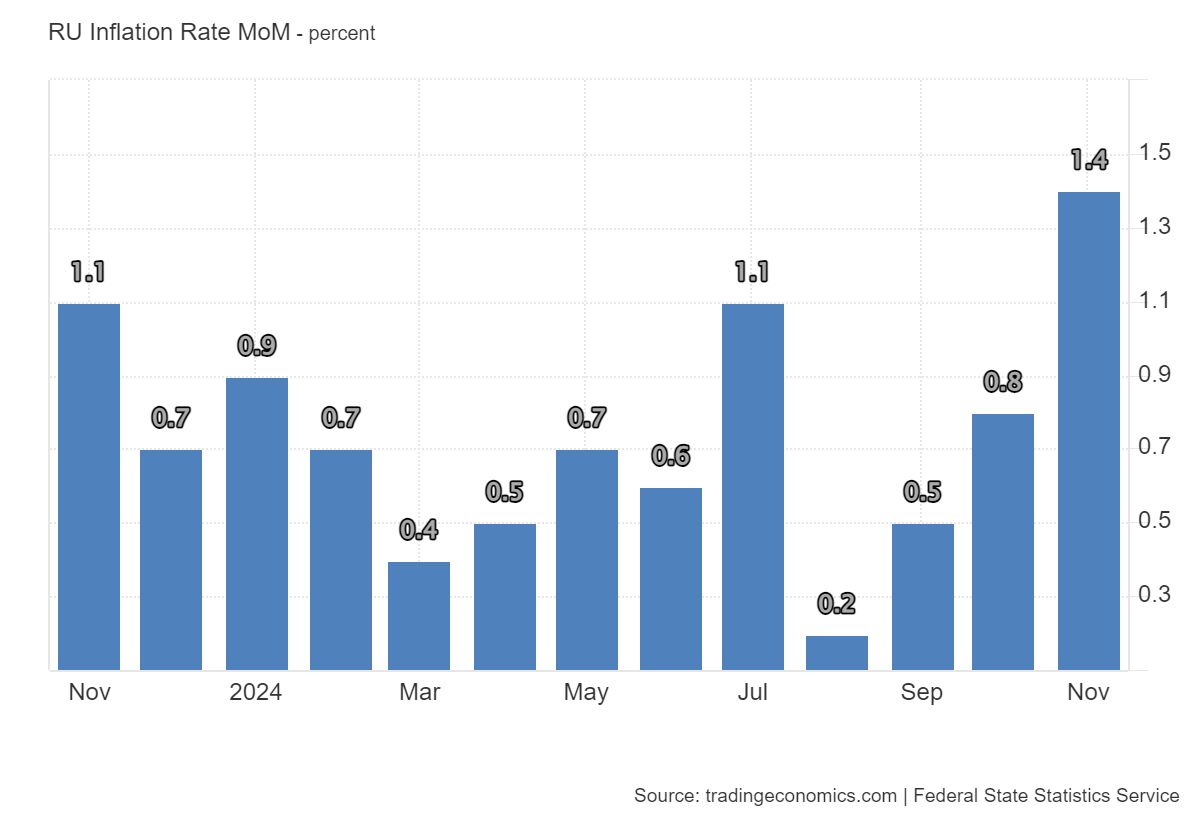

Here’s November official inflation (m/m):

November inflation at 1.4% m/m is 18.2% at an annualized rate (y/y is 8.9%).

If you were wondering what Romir’s FCMG indicated was inflation (see discussion here), you are out of luck, as the publication of this series has “ceased”.

So, as Mark Sobel noted, Russia’s economy looks a lot weaker than the reported (official) statistics indicate.

Nabiullina is running into more criticism now BECAUSE Russia’s situation is more dire now. It’s symptomatic. Damned if you do, damned if you don’t.

When everybody understands initially that inflation must be countered, OK fine. But when the cost to individual interests becomes apparent, not so fine. The costs are mounting, as Menzie’s text and links testify.

The war economy and related sanctions are the ultimate cause of Russia’s economic troubles and of Nabiullina’s unpleasant policy choices. As the war approaches its end (as all wars do, eventually), the question is, what policies do NATO governments take toward Russia’s economy?

Remember, governments began measuring total economic output in part as a way of comparing their relative capacity in war. Keeping Russia’s economy weak weakens Russia’s capacity to harm other countries.

Over time, a weak Russia will probably be a less attractive partner for India, a less useful one to China. It was, after all, Russia’s relative economic weakness which led to the dissolution of the U.S.S.R. and, for a while, convinced Russian leaders to seek accomodation with NATO. Putin either forgot that lesson, or thought we had. We shouldn’t.

Nabiullina has actually done a good job of stabilizing the ruble. China, Western Europe, South Korea, Canada and the UK are all having troubles of one kind or another. Those troubles, along with the Fed’s continued hawkish guidance, has put considerable upward pressure on the dollar:

https://fred.stlouisfed.org/graph/?g=1Cmdo

In that environment, kudos for preventing an utter collapse of the ruble.

The argument has been made that the ruble is so isolated from broader international markets that it doesn’t matter much to domestic performance. That may be true, but if so, it’s true in a way that’s bad for Russians.

Similar to the current strength of the dollar, and closely related to it, U.S. equities are on a tear, relative to equities worldwide:

https://www.longtermtrends.net/msci-usa-vs-the-world/

The latest presentation to the Treasury Borrowing Advisory Committee shows the foreign share of holding of Treasury debt picking up:

https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding/most-recent-quarterly-refunding-documents

It is often noted, outside of the Republican echo chamber, that the U.S. economy is the wonder of the world right now. The point I hope I’ve made is that the same is true for U.S. financial markets. Yes, but…,being better than the rest is in part a reflection of how messed up the rest are right now. It’s entirely possible that we could join them.

So, let’s see if we can screw it up. The government isn’t shut down just yet. No new tariffs just yet. No Krystallnacht for immigrants just yet. Not yet.