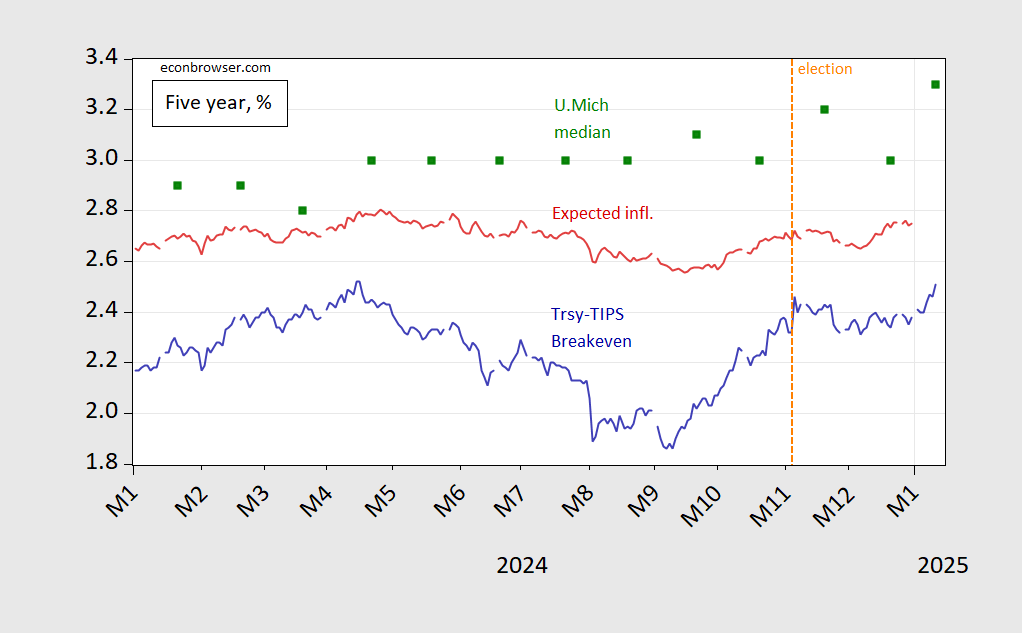

At 10am ET, 10 year Treasury yields were at 4.8%, up from 4.7% at Friday’s close (delta 8 bps). TIPS 10 year were at 2.35% up from 2.32% (delta 3 bps). Here’re some 5 year inflation expectations data over the last year.

Figure 1: Five year Treasury-TIPS breakeven (blue), expected inflation (red), and median expected inflation from U.Michigan survey (green squares), all in %. Last observation 1/11/2025. Source: Treasury, Fed DKW, and U.Michigan.

Median 5 year expectations went from 3.0% in October to 3.2% in November, and 3.3% in January (prel.). Interestingly, the 75th percentile (as opposed to median) expectation from the U.Michigan survey jumped from 5.5% in October to 7.7% in November.

The NY Fed consumer survey indicates the median 3 year ahead inflation jumped from 2.54% to 2.97% going from October to December.

May explain why the Fed has lost its influence over interest rates except for the one they command.

https://www.apolloacademy.com/the-move-in-long-rates-is-very-unusual/

People are quite convinced that Trump will fire up inflation and force higher rates quite soon.

Not all people. The MAGA Morons still believe Trump will lower prices and interest rates all the while cutting taxes.

That is absolutely true. But the MAGA morons are aspiring bond owners, not actual bond owners who drive prices.

Hatzius comments on inflation were eyebrow raising (for me anyway):

https://finance.yahoo.com/news/china-stimulus-offset-trump-tariffs-020029719.html