Asia, in particular East Asia and the South China Sea, is one of the regions that are particularly exposed to geopolitical risk. We study the impact of an increased presence of the U.S. military in Asia on asset prices and capital inflows in the region. For that purpose, we construct a novel index from local newspapers reporting on the presence of U.S. Carrier Strike Groups in the region and estimate the market impact of a surprise change in this index. Our findings reveal that a higher military presence causes an increase in stock prices, an appreciation of the local currency, and an inflow of foreign capital, but also a higher level of geopolitical risk. Interestingly, during the first Trump administration, some effects change the sign. We also distinguish between newspapers reporting on the deployments of U.S. aircraft carriers related to tensions with North Korea and those related to tensions with China.

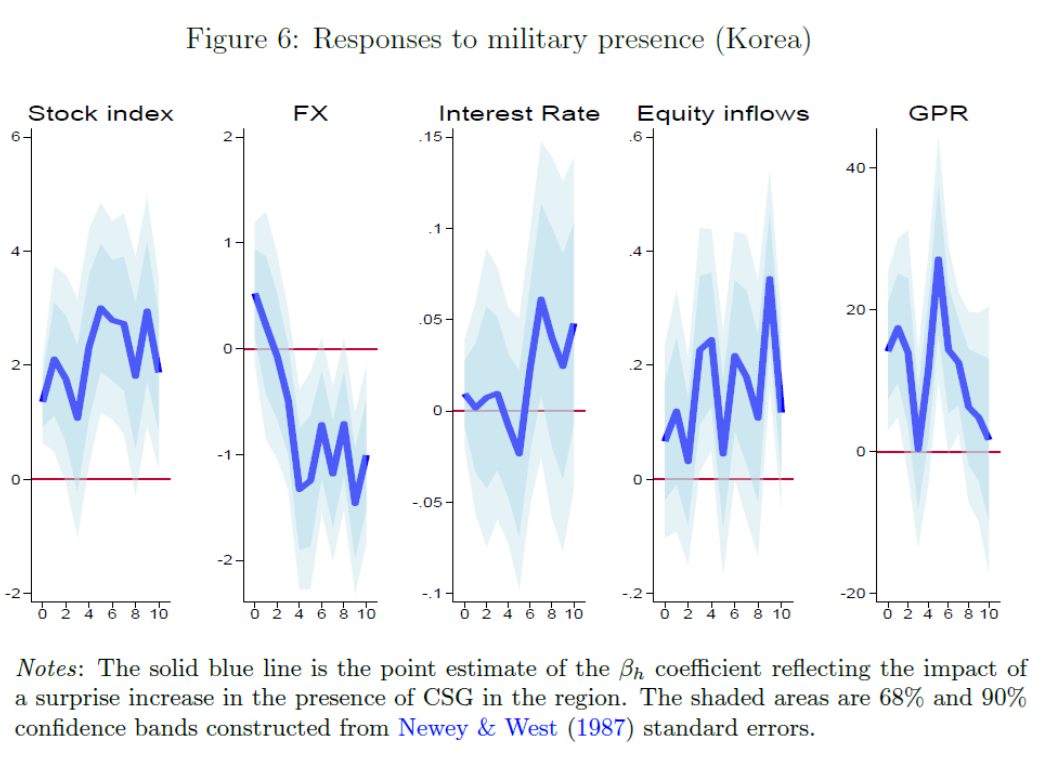

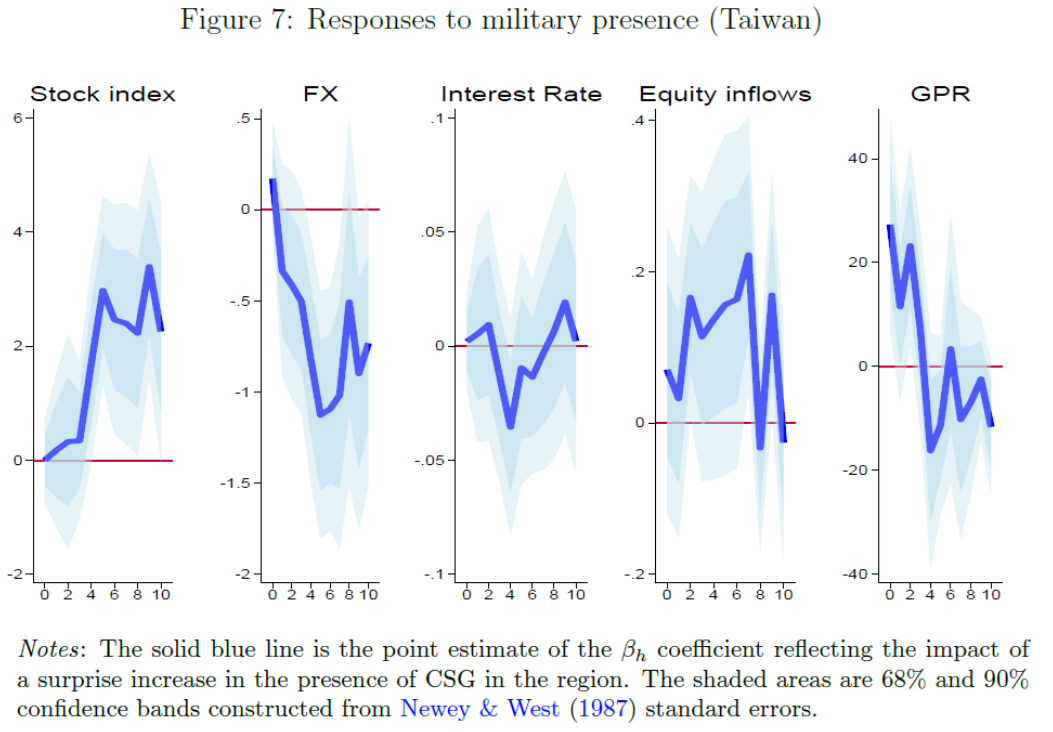

Here are the impulse response functions for variables associated with Korea and Taiwan.

Note that FX is defined so down is an appreciation of the local currency. CSG = “carrier strike group”.

Hence, the stock market, currency and equity inflows respond significantly to unexpected appearances of CSGs. In contrast, no such effect is found for China.

As an aside, here are CSG and ARG deployments as of 6 January 2025:

Source: USNI, accessed 1/11/2025.

DoD’s annual report on Military and Security Developments involving the PRC is here.

Makes sense to me and is consistent with the findings of other research. Repeating myself here:

“Origins of Stock Market Fluctuations”

https://www.nber.org/papers/w19818

The abstract:

“Three mutually uncorrelated economic disturbances that we measure empirically explain 85% of the quarterly variation in real stock market wealth since 1952… In the short run, shocks that affect the willingness to bear risk independently of macroeconomic fundamentals explain most of the variation in the market.”

That looks consistent with the gunboat effect described by Tillman and Yun.

The other two determinants? Allocation of returns between factors is the biggest determinant of returns in the long runs, with productivity a smaller factor.

Also, tangentially, this:

“Do Financial Crises Differ Between Periods of Hegemony and Power Struggles?”

https://archive.ph/o/F5Z3r/https://www.lse.ac.uk/Economic-History/Assets/Documents/Workshops/Financial-Crises-Cassis/Papers/Final-Brezis-financial-crisis-June-2024.pdf

From the abstract:

“…hegemony is associated with (financial crisis) ‘isolation’ periods, while (financial crisis) ‘contagion’ tends to occur during phases of ‘struggle for power’. In consequence, during periods of ‘struggle for power’, financial contagion tends to occur, whereas hegemony fosters containment.”

It may be a stretch, but while we are pretty clearly in a ‘struggle for power’ period, it may be that reassertion of hegemony ‘fosters containment’ sufficiently to support risk taking in regional financial markets.

Or not. I dunno.

Not to get all Yves Smith “military industrial complex” conspiratorial, but knowing that U.S. gunboats improve equity performance does look like a reason for richies to support military spending. The investor class benefits from the taxes (interest payments) imposed on the general public.

Macroduck: I agree we shouldn’t use equity returns as sole reason for undertaking *public* policies. However, to the extent that equity returns signals positive economic activity in our allies’ economies, I’m for it.

Yep. The piece on hegemony and transmission of shocks has, I suspect, much wider implications. Trade, peace dividends, a shift of technological advancement toward peacetime applications. The good stuff.