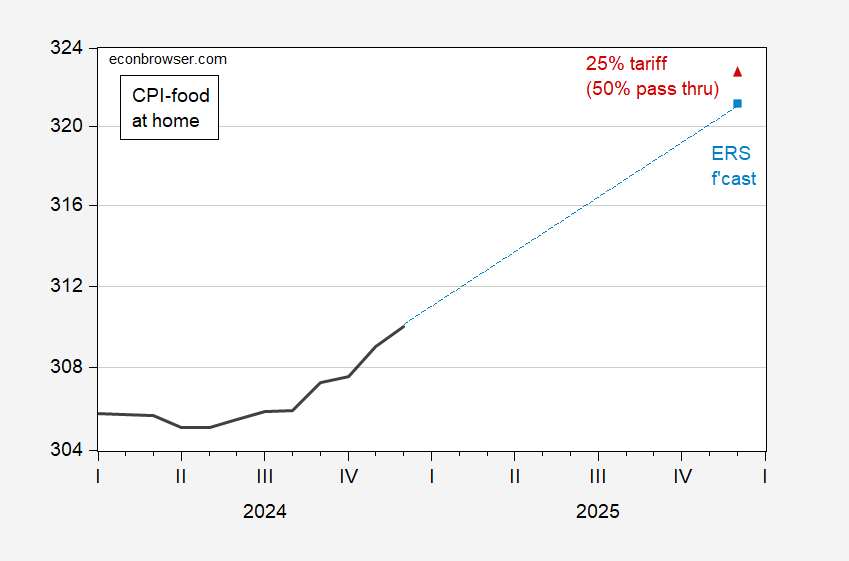

CPI food at home is 8% of total CPI weights, fresh vegetables and fruit are 1.1%. Assume half of fresh vegetable and fruit are imported from Mexico (about 2/3 of fresh vegetables are imported from Mexico), and assume only half of the 25% tariff is passed on to US consumers (large country assumption). Then here’s a picture of the CPI for groceries, the January USDA ERS forecast and the implied level of grocery prices, assuming the tariffs are eventually placed.

Figure 1: CPI for food at home (black), USDA Economic Research Service forecast (blue square), implied level including tariffs on Mexican food imports (red triangle). Source: BLS via FRED, ERS, author’s calculations.

The object of tariffs is to raise prices going to domestic producers, to encourage production. Hence, assuming that domestic producers don’t raise prices (as is assumed in the above calculation) seems silly — so the above is an understatement of price increase.

The only part ofthe U.S. likely to take up the slack on produce has a water problem:

https://www.politico.com/news/2025/01/31/trump-california-water-00201909

The felon-in-chief just tried to flood central California farms to resolve a drought. When every act is a show of unbridled power, you can’t expect good policy. Each bad decision is compounded by another bad decision.

More elephant repellent:

https://www.politico.com/news/2025/02/03/canada-tarriff-paused-trudeau-trump-00202212

Trump agrees to 30-day pause on Canada tariffs

“I just had a good call with President Trump,” Trudeau wrote on the social media platform X. “Proposed tariffs will be paused for at least 30 days while we work together.”

Also, more spineless bully saying “I’d have kicked his ass, but it wasn’t worth it.”

Sovereign wealth fund, Trump style:

https://thehill.com/policy/technology/5123831-trump-sovereign-wealth-fund-tiktok/

No need to invest too much trust in this article’s view of how a U.S. sovereign wealth fund would operate, but I’ll take it at face value, for the sake of argument.

The goal of such a fund, says The Hill, would apparently be to make up for the defects of the market (long supply chains, vulnerability to adversaries economic actions). rather than to invest surplus government funds. In the U.S., there are no surplus government funds. In fact, the implication of government purchase of assets when the budget is in deficit is an increase in the deficit; an increase in outlays necessarily means either higher taxes – not currently in the table – or increased debt.

There is also the problem of interest costs and returns on investment. When private investors borrow in order to buy assets, they anticipate a net gain – ROI higher than the cost of borrowing. The textbook tells us that investors take on risk when they borrow, and that more borrowing means more risk.

A wealth fund in a deficit country means increased budget risk. Surplus countries don’t pay interest for their investment funds, and their surplus funds have to go somewhere – no increase in risk, necessarily.

The Hill’s article buried the problem with the U.S. being a deficit country – shame on them – buy at least mentioned it. The felon-in-chief pretends that a wealth fund creates wealth, ignoring the funding problem.

Wealth funds manage wealth. They don’t create it, contrary to the felon-in-chief’s claim. Wealth is created through real investment, not financial investment. Financial investment makes real investment possible by mobilizing funds from under mattresses into activity – everything else un finance is rent seeking.

When a serial bankrupt, liar and felon starts talking about creating a “wealth” fund in a deficit country, we might want to keep this rent seeking problem front and center in our discussions.

Treasury Secretary Bessent is seen grinning like a fool standing next to Trump as he signs his sovereign wealth fund executive order.

For funding Bessent says: ““We’re going to monetize the assets side of the U.S. balance sheet.”

What the heck assets is he going to monetize? Is he going to auction off Yosemite Park to the highest bidder? Rent out Air Force bombers as in Catch 22? Sell billboard advertising rights on the Washington Monument?