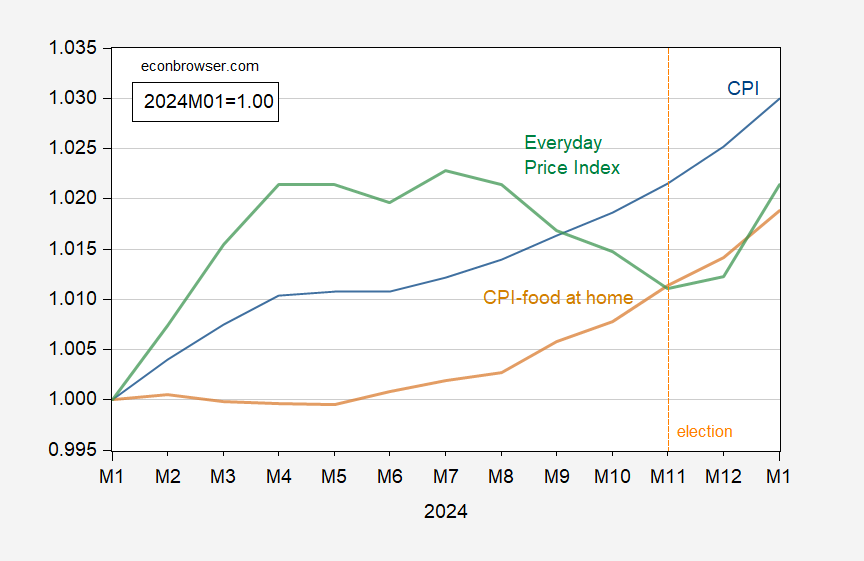

We’re a month into Trump 2.0. We don’t have February’s prices yet, but since Trump was going to do everything “Day 1”, I thought it useful to take a look at various indices.

Figure 1: CPI (blue), CPI – food at home component (brown), and AIER Everyday Price Index (green), all 2024M01=1.00. Source: BLS, AIER.

On eggs:

Figure 2: Consumer Price of Dozen Eggs (blue, left scale), ERS forecast of January 2025 for end 2025 (blue square, left scale), OLS forecast based on price-lagged PPI relationship (red triangle), all in $, and PPI for fresh eggs (brown, right scale), and TradingEconomics forecast (2/13/2025) implied PPI for eggs (tan square), all in1991M12=100. Trading Economics futures price for dozen eggs (blue), and TradingEconomics model and analyst based forecast (gray). Source: BLS, ERS, TradingEconomics.com.

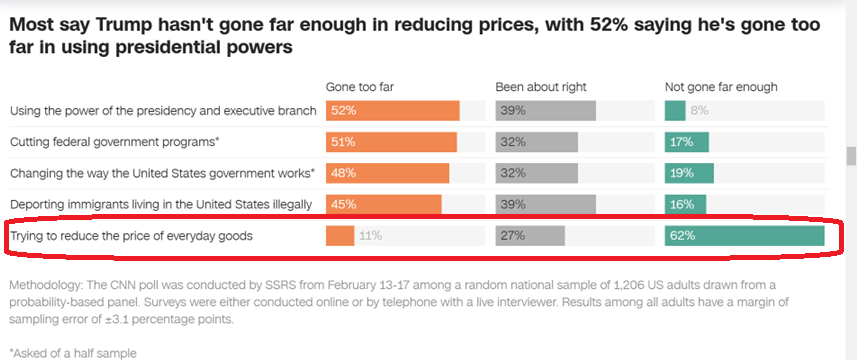

No wonder CNN’s poll shows some dissatisfaction with progress in lowering prices (remember, he made the promise on price levels, not inflation).

The Kennedy Center has become a home for bigotry:

https://www.washingtonian.com/2025/02/18/kennedy-center-pride-concert-gay-mens-chorus-canceled/

I guess Chanticleer won’t be welcomed back.

Bigotry??? Considering the anti-white Zionism of the Drumpf Administration, you shouldn’t cherry pick.

Find root cause:

“Our research shows mathematically that the overwhelming driver of that burst of inflation in 2022 was federal spending, not the supply chain,” said Mark Kritzman, a senior lecturer at MIT Sloan.

https://mitsloan.mit.edu/ideas-made-to-matter/federal-spending-was-responsible-2022-spike-inflation-research-shows

Address root cause:

https://www.tampafp.com/trump-executive-order-calls-for-radical-transparency-on-federal-spending/

Sort of like drying out a flooded room:

1) determine water source

2) shut off water source

3) allow room to dry out

The sequence can’t be reversed.

Bruce Hall: You do know there are numerous studies that apportion a greater share of the 2022 inflation burst to supply side shocks? Several I’ve mentioned on this blog. And do you even know what a Mahalanobis distance measure is? (By the way, the authors’ previous paper on business cycles is discussed in this post. Did not see you argue in support of that metric in that post. By the way, one of the key indicator variables in that paper was…the term spread! How do you think that paper’s approach is doing now?

Brucie, you seem to prefer the Kritzman study to other studies which identify supply shocks as the most important cause of Covid-era inflation. If the only reason you prefer Kritzman is that it agrees with your own bias, then who cares? We already know your biases.

But here’s a way you might be more persuasive – tell us why you find this research method superior to the many studies which have found that supply-chain disruption was the primary cause of inflation in the Covid era. A simple sketch will do, so long as you don’t just repeat a bunch of fancy terms from the study. Can you do that? Can you explain why distance from the center of a multivariate normal distribution is the appropriate measure of causal influence? How does Kritzman go from establishing correlation to causation in this study?

Or are you just shopping the research Dollar Store for knickknacks that fit you mental decor?

Brucie? Hello? Waiting to hear why you cherry-picked this study.

the ppi was used as the item to justify your argument that supply chain was not a big issue, bruce. however, a lot of the inflation occurred because imported final products (not intermediate products) were transportation constrained (ships and trucks were operating well below capacity). I don’t believe this type of inflation will show up in the ppi-at least not directly. economists on this blog will better be able to address this item. so if you want to identify supply chain constraints with the ppi, that may not be an accurate proxy for the supply chain issues and inflation that occurred during that time period. there may be a part of that federal spending category that is capturing these transportation issues, because it needs to be captured by some parameter in the model-but it is not accurate. that would reduce the federal spending category to a lower level.

nevertheless, bruce, let me remind you that the federal spending was used to eliminate a depression style contraction of the us economy. that was occurring under the trump watch. I find it completely disingenuous for trump supporters to crash the economy, let somebody else to the heavy lifting of reviving the economy, and then complain incessantly about some residual inflation that resulted from fixing the trump mistake to begin with. we would have been in much worse shape economically today if trump had been reelected to his second consecutive term, and continued with his bumbling of the economic recovery. he has benefited from coming into office after two democratic presidents provided him with well operating economies. neither of the previous two democratic presidents can make the claim that their predecessor left them with a good economy.

trump inherited a strong economy in his return to office. it is going to take him and musk less than 6 months to plunge us into a recession….again.

Mark Kritzman said this: “The narrative at the time was that the cause of inflation was interruptions to the supply chain because of COVID-19,” Kritzman said. “But that didn’t show up in producer prices. In other words, if supplies became scarce, then the prices of those supplies would go up, which we don’t see in our results at that point in time.”

I’m confused. When I look at the PPI (all commodities), I’m seeing a 47.3 percent rise in the PPI between May 2020 and May 2022. I dunno Yogi, but that sounds like a pretty sharp increase over a mere two years.

Get a load of Trump’s brilliant new plan for the national debt. It’s called the Mar-a-Lago Accord, ala the Plaza Accord, because Trump has to name everything after himself.

A major part of this plan is to force foreigners to convert their holdings of US Treasuries into 100-year, non-tradeable, zero-coupon bonds. This is brilliant because it instantly erases the nominal national debt, reducing each $1 trillion of debt to around $8 billion, assuming a 5% rate. Quite the magic trick. And what about the erased trillions — well, that’s a only a problem for the folks running things 100 years from now.

Now, the word “accord” means agreement, and if Trump and his genius sycophant economists think creditors are going to agree to this, they must be getting into Elon Musk’s drug stash.

I suspect Trump’s negotiation will go something like this: “We could just default your Treasuries right now or promise to pay you 100 years from now. Your choice.” Hilarity ensues.

https://www.bloomberg.com/news/articles/2025-02-20/-mar-a-lago-accord-chatter-is-getting-wall-street-s-attention

“A major part of this plan is to force foreigners to convert their holdings of US Treasuries into 100-year, non-tradeable, zero-coupon bonds. This is brilliant because it instantly erases the nominal national debt, reducing each $1 trillion of debt to around $8 billion, assuming a 5% rate.” A fancy way of defaulting. Of course Trump mastered in defaulting on debt.

Speaking of questionable research (Brucie?), “Nature” has published a list of the institutions which are most frequently forced to retract research results:

https://www.nature.com/articles/d41586-025-00455-y

Seven of the top ten institutions were in China, with ine each from India, Pakistan and Ethiopia. The Chinese institutions were all engaged in medical research, reflecting an official crackdown on shoddy medical research associated with resume padding.

There is other evidence of poor research coming out of China – for instance, the share of patent filings which are of no economic value. We no longer see much China cheerleaders in comments here, but when ltr was active, the glory of China’s intellectual advancement was a regular feature in comments. Like China’s economy, Chinese intellectual culture has fallen on hard times, thanks to artificial numerical requirements imposed from above. Rather like U.S. health care in the age of private equity.