Change in NFP below consensus, but previous months upwardly revised. Big benchmark revision (-610 thousand), but even larger — 2 million upward — revision to December 2024 civilian employment.

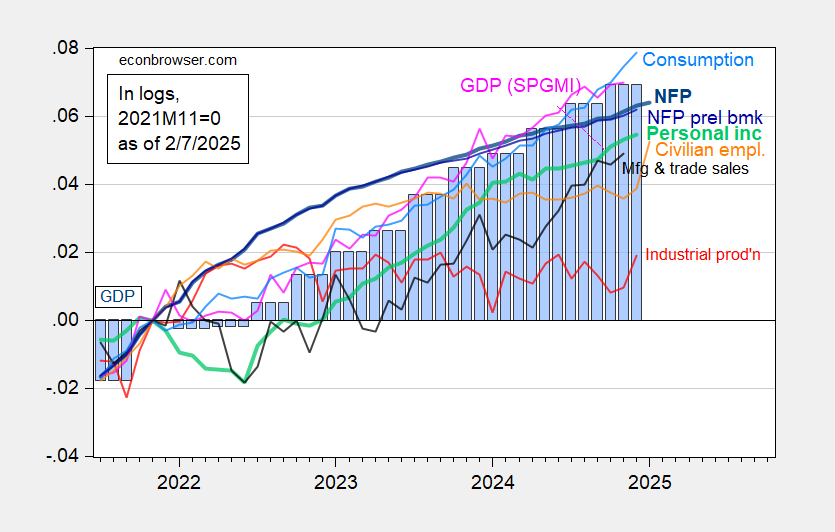

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (1/2/2025 release), and author’s calculations.

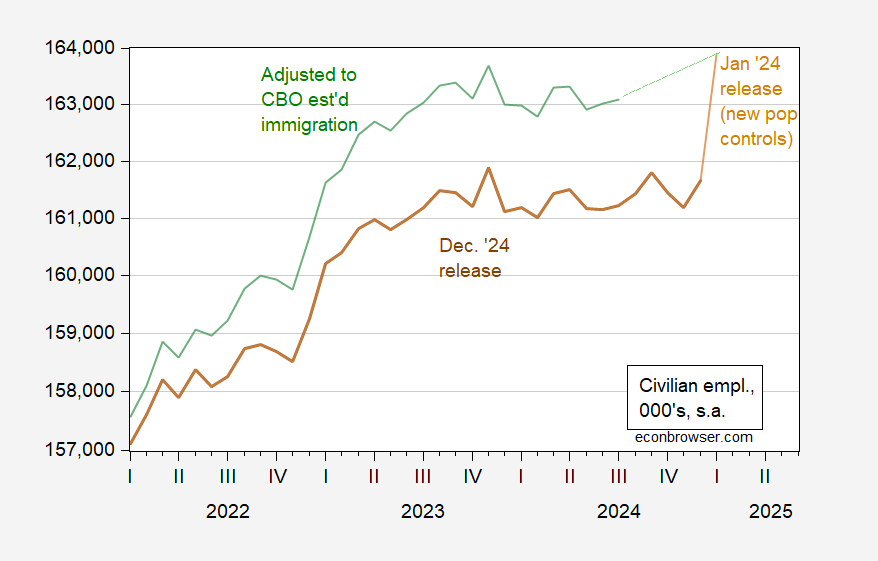

As I noted in the last post, don’t take the trajectory of the civilian employment series literally, as new population controls have been applied for 2025, but not 2024. A more reasonable trajectory is to take the household series, applying implied controls using CBO estimates of immigration through mid-2024.

Figure 2: Civilian employment, December 2024 release (brown), January 2025 release, incorporating new population controls (tan), and previous civilian employment adjusted to CBO estimates of immigration, by author (green), all in000’s, s.a. Source: BLS via FRED, CBO, and author’s calculations.

Nowcasts for Q1 as of today are 2.7% (Atlanta Fed GDPNow) and 3.12% (NY Fed).

The Trump administration has stated that Elon Musk, as a designated Special Government Employee and required by law, will file a “confidential financial disclosure.”

Confidential disclosure. Is that like jumbo shrimp?

The whole point of financial disclosures for public officials is so the the public can see with their own two eyes that corruption is not occurring. A “confidential” disclosure that Trump can shove into his desk drawer is useless.

Among the cycle indicators, personal consumption appears to be running hotter than most others. Here are PCE, personal income and the savings rate:

https://fred.stlouisfed.org/graph/?g=1Dvcr

Income and spending have diverged a bit as the savings rate has fallen. A low savings rate means consumers are running out of room to boost spending beyond the growth in income.

As to the growth in income, average hourly earnings rose nicely in January, but gains in the payroll index (hours X jobs X hourly earnings) have come back down to earth:

https://fred.stlouisfed.org/graph/?g=1DvdV

My guess is that personal spending growth will cool off soon. GDPNow agrees, with Q1 real PCE growth at 2.8%, which would be the slowest pace of rise since Q2 of last year.

Hey, Musk’s “Fork in the Road” federal employee buyout is working great. They claim 65,000 have taken up the offer of 8 months extra salary to retire. But it turns out that 165,000 federal employees retire voluntarily every year. So it likely that most of those 65,000 are people who were going to retire for free but now will get an extra 8 months salary. Good for them! Not so good for reducing deficits.

And they say that Musk is a genius. He has no idea what he is doing.

Off topic – understanding who backed down on tariffs:

https://public.hey.com/p/eWiubkVnLQm2VKVojzXQGAg8

John Authors at Bloomberg says Canada’s Trudeau and Mexico’s Sheinbaum called Trump’s bluff and Trump backed down. The “consessions” Canada and Mexico offered don’t amount to much.

One of the usual suspects in comments here recently declared just the opposite, that the felon-in-chief had intimidated Canada and Mexico into making substantial policy changes. The usual suspect offered no evidence – he rarely does – but claimed tariffs on China were so scary that the threat of tariffs is now all we need.

Authors is a seasoned political economy reporter, and our usual suspect is a faux news watcher.

By the way, Authors also does a good job of documenting the decline in inflation expectations immediately upon Sheinbaum announcing that tariffs had been delayed.

The annual revisions, as expected, have pretty much eliminated the gap between what the Establishment Survey and the QCEW were reporting through midyear last year, with particular emphasis on Q3 of 2023 and January of last year, also close to what was anticipated.

On the other hand, the annual population revision in the Household Survey only added 1 million foreign workers. Which is a lot, but much less than what the CBO has been suggesting.

Still, about half of the discrepancy between the two series has been resolved.