No tariffs yet on Canada, Mexico (and EU for that matter). Still, 10% on $427 bn imports (on top of previous tariffs) is a big deal.

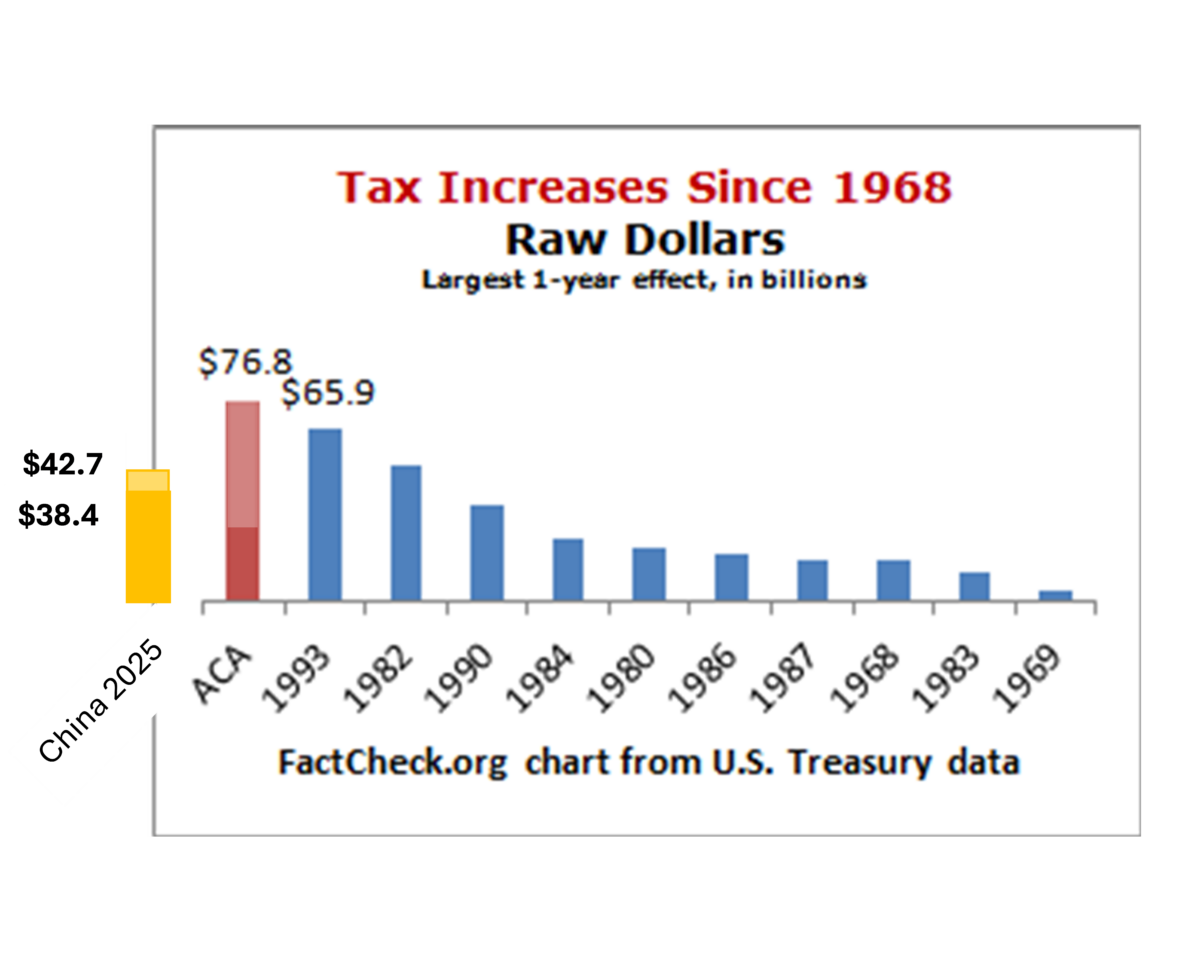

Notes: Tax increase associated with announced Trump tariffs on China assuming a unitary price elasticity of import demand (tan bar), and assuming zero (tan bar plus orange bar). ACA revenue estimate as of 2012. With numerous legislative changes, CBO estimate for 2016 is $24 bn (dark red bar). Source: graphic from Factcheck (2012), modified by author, CBO (Table 1).

In 2023, the US imported $427 bn worth of goods (goods imports are most of what we import from China). Assuming unit elasticity on a 10% tariff, we’d import $384 bn. The respective tariff revenue is $42.7 bn or $38.4 bn — this is the amount of tax revenue irrespective of what happens to the exchange rate or the gate price in China (if you don’t understand this point, it’s the difference between tax incidence and formal revenues).

Whether the China tariffs of 2025 constitute the third or fourth largest tax increase depends on how the ACA revenue estimates played out, after various legislative changes.

Combined two year 2018-2019 Section 232 and Section 301 tariffs amounted to $80 billion [Tax Foundation], so the taxes on imported goods coming from China still amount to the biggest one year tariff revenue increase.

How well does my estimate of $38 bn fit with other estimates. The Tax Foundation just released estimates of $20 bn revenue raised for the remaining 7 months of FY 2025, or $34 bn/year, so pretty close.

Trump has stated that the EU is now in the crosshairs [NYT].

Tariffs “will definitely happen with the European Union,” Mr. Trump told the BBC Sunday evening, and they are coming “pretty soon.”

Here is 2023 import value from the EU:

Source: ITA.

Not only is the amount larger than for either Canada or Mexico (for just goods), it’s of a different character, much more characterized by intra-industry trade. You can guess the demand elasticity is probably lower.

The crotch-grabber-in-chief cannot reasonably claim the EU has agreed to strengthen the EU/U.S. border. The EU has now seen the baby-jailer-in-chief back down in three out of four tariff threats (Colombia, Mexico and Canada, but not China). So where does that leave things? Anybody other than Bruciething the EU is going to bow down to the mighty fraudster? Will Brucie claim that his cult leader has won another magnificent victory when, I dunno, maybe the EU agrees to tariffs on Chinese EVs (which they already have)? Probably.

M, I see you’ve taken over the snark from pgl. Well, good luck with that. Perhaps that is why this is such a small echo chamber. I’ve already written to your point previously, so no need to repeat. But I will say this: when you’ve dropped a nuclear bomb once (or twice), you don’t have to drop another one to make the threat credible. Trump and Biden already dropped the tariff bomb twice on China, so the threat is credible elsewhere, too. You may not like the way Trump uses an economic threat as a political club, but that doesn’t mean it hasn’t and won’t meet his political ends even if he doesn’t actually implement the threats in Columbia or Mexico or Canada. A little “crazy” can be very persuasive in politics.

It’s not just about lowest acquisition cost. And it’s not even about a $40 billion “tax” when the societal costs of illegal immigration and illegal opioids are factored in.

https://budget.house.gov/press-release/the-cost-of-the-border-crisis-1507-billion-and-counting

Yeah and I don’t care if you want to argue it is $50 billion instead of $150 billion. That’s not the point. You can also argue with Mayor Adams that it only $5 billion, not $12 billion just for his city. The basic dynamic has to change. And countries listen when their trade revenues are threatened. Like most things in life, it’s a matter of will.

Meanwhile, on a related issue: https://totalnews.com/largest-hedge-fund-founder-says-us-in-death-spiral-if-debt-not-cut/ So maybe Prof. Chinn’s “tax” and Elon Musk’s spending cut campaign are hand in glove. After all, the left has been demanding more taxes for decades.

We already knew your position. What you still haven’t done is offer a single fact in support if it. Your beliefs aren’t evidence of anything. You’re a cheerleader for a rapist and felon, and your argument amounts to a recitation of a serial liar’s statements.

What has the felon in chief gotten from Canada, Mexico or Colombia through bullying that other presidents haven’t accomplished through simple diplomacy? An actual result, not a talking point. Nothing.

Brucie, let’s have a look at what you apparently think is your good argument for Trump’s bad policy.

Nothing much has actually changed at either border. Fentanyl smuggling, as we know from reports by law enforcement officials, is mostly done by mail, and by people who cross the U.S./Mexico border legally. So while the felin-in-chief may claim to have bullied our neighbors into doing something about fentanyl, what they’re doing doesn’t address the fentanyl problem. It’s for show.

Meanwhile, as part of its response to new tariffs, China has ended cooperation with the U.S. on interdiction of fentanyl precursors. So while you insist that the threat of tariffs somehow addresses our drug problem, the evidence suggests it may have made the problem worse.

As to the cost of illegal immigration, well, you’ve tried this one before and failed, but let’s have a look anyway. The U.S. economy has grown in the Covid recovery period better than any other large developed economy, in part because immigrants have eased our labor shortage. Immigrants, legal and otherwise, pay more in taxes and FICA than they get out. They don’t eat our pets. They are more law-abiding than native-born residents. They build more houses than they occupy.

Faux news, the GOP and the felon-in-chief lie about all of this, and you seem to have fallen for their lies, but that doesn’t change the facts.

Your effort to justify Trump’s chest-thumping tariff fiasco is built on nonsense, as is most if what you write in comments here.

Bruce, egg prices continue to rise. Cost of living under trump is becoming excruciatingly painful. When are those 2% mortgages trump promised during the election going to marterialize? Or was it all just a con?

Off topic – JOLTS hires data for December:

https://fred.stlouisfed.org/graph/?g=1DpPQ

The level of hires (the solid line in the picture) is about the same as just prior to Covid. The rate of hires (dotted line) is down where it was in the early days of recovery from the housing collapse.

The saving grace is that layoffs remain muted. Looks like turnover is down. That’s not healthy, but it could be worse.

Notably, with labor market dynamism reduced, job switchers’ wages are rising at about the same pace as those who stay with their job. That’s unusual.

Wages for job switchers and stayers:

https://www.atlantafed.org/chcs/wage-growth-tracker

Last week Trump claimed that we would be getting so much revenue from tariffs that there would be no more need for income taxes.

Dr,. Chinn, can you pencil that out for the numerically challenged? Are we getting close?

Here’s the picture prior to the latest round if tariffs:

https://fred.stlouisfed.org/graph/?g=1Drjr

You can compare the $2.4 trillion figure for personal tax receipts to the estimate Menzie has provided for tariffs, also known as customs receipts. Business taxes of various kinds raise the figure for overall tax revenue consiserably.

Sorry if that wasn’t clear. It was a joke. Of course it’s not even close.

So if we go with Bessent’s 3-3-3 plan and take a trillion$ cut in public benefit spending out of the economy. And a tax increase on U.S. consumers of $42.7 bn and any additional tax increases from EU tariffs – how do we get to 3% GDP?

How did the combined Section 232 and Section 301 tariffs from 2018-2019 contribute to the largest one-year tariff revenue increase, particularly on imported goods from China?

Greeting : IT Telkom