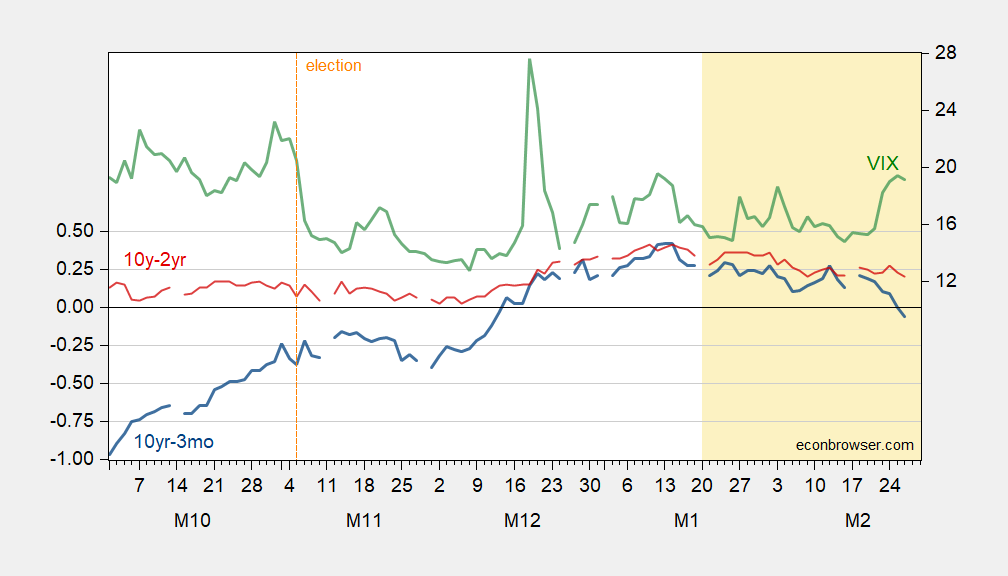

As of today’s close, the constant maturity 10yr-3mo spread is … -0.6% (as of 2/26 close):

Figure 1: 10yr-3mo Treasury spread (blue, left scale), 10yr-2yr Treasury spread (red, left scale), both in %; VIX at close (green, right scale). Source: Treasury, CBOE via FRED. [updated n 2/26]

In the wake of the term spreads failure (so far) to predict the recession of 2024-25, I’m not sure what to make of this. However, when combined with the measured collapse in expectations registered in the U.Michigan and Conference Board surveys, this all hints at a fast deterioration in perceived economic trajectory.

Addendum:

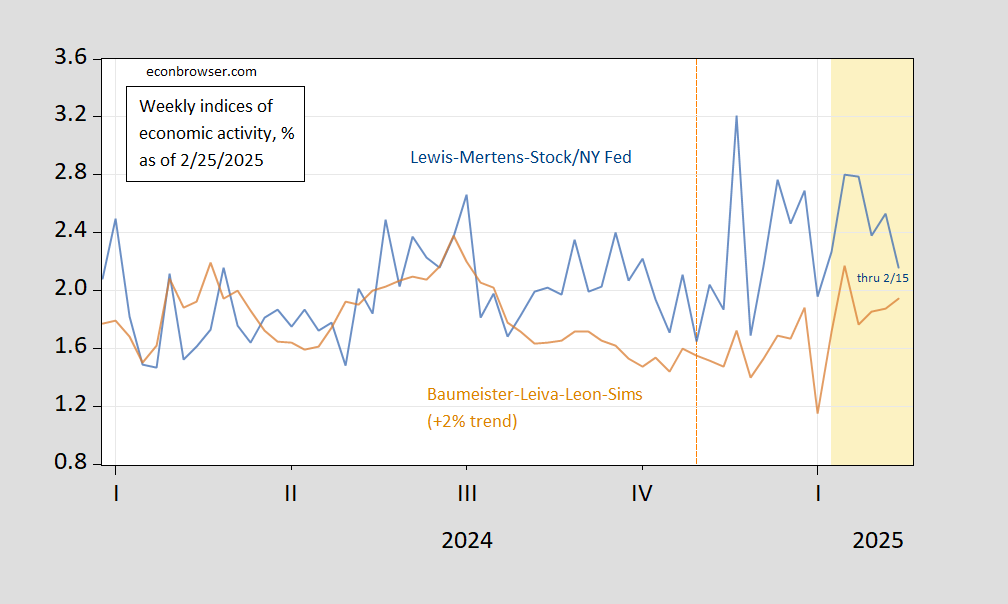

Weekly macro indicators for data available through 2/15.

Figure 2: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (brown), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 2/25, and author’s calculations.

Tanking the stock market, increasing unemployment and killing consumer sentiment. You can’t say that Trump isn’t doing his best to fight inflation.

Might put a dent Bessent’s 333 plan, though.

Bessent’s 3-3-3 plan of course assumes both a pony and a unicorn.

That’s miscegenation. You have to report that to DOGE.

Off topic – Is everybody spineless now?:

https://www.npr.org/2025/02/25/g-s1-50551/joy-reid-msnbc-fired

What’s the point of MSNBC, anyway? Why should I ever tune in, ever again, if an effective black, female voice is unwelcome there? If any strong view is filtered out, what’s the point? Cowards.

yeah, and another nonwhite female, Katie Phang, was also let go over the weekend. Katie’s family has a very nice backstory on how immigrants can have a positive impact on America. it’s too bad those voices continue to be silenced in the world of trump. I am not sure why folks like bruce and rick are so hostile to a diversity of viewpoints in America today. exactly what are you afraid of?

What’s driving the turn toward inversion?

Priced-in inflation expectations have come down since January:

https://fred.stlouisfed.org/graph/?g=1DZ9P

That’s quite the opposite of what’s happening in consumer surveys of inflation expectations. A fall in priced-in inflation risk does seem consistent with rising recession risk.

The divergence between 5-year and 10-year inflation expectations has widened considerably since the election and somewhat since January. That, too, is consistent with a near-term recession.

A month ago, priced-in expectations for the year-end funds rate were pretty evenly split between a reduction of 25 basis points and 50 bps. Now, pricing centers on a 50 bp cut. As of February 21, term premium on the 10-year had come down about 18 bps since the end of January.

So expected funding costs, priced-in inflation and term premium have all worked to flatten the curve lately, all consistent with rising recession risk.

Interestingly, since exactly January 20, stock prices and bond yields have moved in the same direction on a daily basis.

I interpret that as the markets being relatively more concerned with deflation (I.e., economic weakness) than inflation.

A slow walk to safety?

I see stagflation becoming the most likely outcome. the market and economy are decidedly turning darker by the day. inflation is still a problem. the fed is going to face a difficult choice of keeping rates up to thwart inflation, principally driven by the tariff regime, and economic malice driven by doge cuts to employment and federal spending. making my prediction now. the economic condition in the United States will be very ugly in one years time. question is, who does trump blame for the recession?

When will ICE start raiding meat-packers across the Midwest? Or rounding up fruit & veggie pickers in California? Seems like low hanging fruit to me.

My banker, a U.S. citizen and a 20-year veteran in banking, has taken to carrying her passport, just in case some yahoo with a badge decides thst she looks deportable. She’s an immigrant. Her daughter is U.S. born, but is now reluctant to fly because she expects to be hassled because of her accent.

That’s who we are now.

This is all about how things look on TV – not reality. Last time Trump did a few high profile raids making sure the cameras were lined up to get big visuals for the Faux news programs. This time they spend 3 times as much on flying people out in military planes (and schacles) than it would have cost to put them on business class in commercial planes – but that would not have looked “tough” on TV. Trump knows what the deportation of illegals would do to the corporate elites – so he doesn’t want to do it.

The data suggest you’re right. Deportations in the first month of the felon-in-chief’s term are down from last year’s average.

I got a similar note from a colleague yesterday, noting that the 10 year was under the Fed Funds rate. My response was that, while it is obviously not exactly the same metric, there were re-inversions of both the 10 year minus 2 year and 10 year minus 3 month in 1989 and again in 2006. The 10 year minus 3 month also re-inverted during the 2020 COVID lockdowns.

I would interpret the re-inversion in the same negative light today, I.e., what might have been a soft landing is looking like a hard one again to the bond market (for today anyway).

Also worth noting that the S&P 500, which was up 40% YoY the week before the election, is now *lower* than it was a few days later.

Neither of the above are forecasts (yet), but definitely worth paying attention to

10 years are collapsing recently. and the stock market is showing big weakness. the high flyers of the past few months are collapsing. Tesla is down big. soft landing is no longer the most likely outcome. plane was on an ok path to landing, but it looks like the pilot forgot to deploy the landing gear. gonna get bumpy.

first child dead in texas measles outbreak. probably first of many. why do innocent children suffer because of the stooopidity of adults and their ideology? a simple vaccine would have saved this child’s life. instead, conservative republicans give legal cover for parents to kill their children. so spare me the sanctity of life arguments. you do not mean that one bit. anti-vax proponents are simply accomplices to murder. there is no defense for those opposed to these safe and effective vaccines, that have been used for decades.

Off topic- a Russian assessment of the effect of financial sanctions on Russia-China cross-border payments:

https://valdaiclub.com/a/highlights/cross-border-payments-in-a-multipolar-world/

The gist is, sanctions are working. Chinese banks are reluctant to deal with Russia entities.

This is particularly interesting:

“Since 2014, Russia has been attempting to build a financial settlement system independent of Western counterparties, which involves switching to mutual settlements in national currencies and abandoning SWIFT…(but) an alternative to the American payment system was never introduced, although the integration of the national SFPS and CIPS has been discussed many times.”

Now that the U.S. and Ukraine are about to engage in a sort of joint venture in the minerals business, and oligarchs are about to line up for golden visas, the whole “Ukraine has to surrender” thing is looking different.

Can anyone make any sense out of the minerals agreement between the US and Ukraine?

https://kyivindependent.com/exclusive-the-full-text-of-the-final-us-ukraine-mineral-agreement/

From what I can tell the US gets — nothing. That doesn’t mean that Trump won’t declare it a great victory deal, just like the empty agreements with Canada and Mexico on immigration.

The agreement establishes a sovereign fund based on profits from mineral extraction that will be used for reconstruction in Ukraine. Ukraine gets it all. The US gets nothing. This is the exact opposite of the original agreement that Zelinski rejected that gave the US 50% of the mineral rights.

So what is the point of this agreement? It’s a mystery to me other than to say that Trump signed some sort of meaningless deal.

The U.S. provides capital. Ukraine provides natural resources. The U.S. has the final say on investment decisions, and maybe on business decisions. The two parties share in the net, and both are required to reinvest. There’s a 50% in there somewhere, but it’s not clear to me what it means. Another few hundred pages ought to be enough to clear up the actual terms.

NYT Pitchbot: “Our new editorial line is to always support free markets. Here’s why we will never criticize Trump’s tariffs.” By Jeff Bezos

NYT Pitchbot: “My businesses depend on government contracts. Here’s why my newspaper will only publish editorials supporting free markets.” By Jeff Bezos

Speaker Johnson has announced that his is going to offset tax cuts in the reconciliation bill with DOGE cuts, “gold visas” and tariffs.

We know that the DOGE cuts are phony, as an example calling an $8 million contract cut as saving $8 billion.

But the gold visas is a new scam. EB-5 “investor visas” have been around for 35 years. A person who pledges a $1 million investment in a US business can get a green card and a path to citizenship. But Trump wants to up the ante to $5 million, and he says there will be 10 million of them, which he claims will balance the budget.

As a reality check, there were 8,000 EB-5 visas issued last year at the $1 million level, so Trump believes there will be 10 million of them when he raises the price to $5 million? And doing the math, that amounts to $50 trillion a year flowing into the US?

Does anyone believe that? And keep in mind that the money for the visas doesn’t go to the government so it can’t directly offset the budget deficit. The money presumable gets invested so Republicans are inventing an economic growth effect that can be any number they like.

The reconciliation bill is going to be filled with magic asterisks.

Off topic – the House budget plan and Medicaid:

The House has passed a budget plan which requires that the Commerce Committee identify spending cuts which amount to $880 billion over ten years. The only spending categories large enough to accomplish this are Social Security, Medicare and Medicaid. It is generally understood that only Medicaid has little enough public support to be vulnerable, and so will absorb the entire cut. This is odd, given that roughly 72 million people are enrolled in Medicaid, but themselves the facts as I can discover them.

Here is what the Kaiser Family Foundation has to say about the state-by-state impact of cuts to Medicaid:

https://www.kff.org/medicaid/issue-brief/a-medicaid-per-capita-cap-state-by-state-estimates/

A point that has been made endlessly, but which doesn’t seem to sink in where it counts, is the Republican-dominated states are the big losers when federal spending is cut, and Medicaid spending is no exception. As a graphic far down in the Kaiser article shows, the states which will suffer the largest per capita spending cuts are, with a few exceptions, reliably Republican-leaning.

Republicans have squawked at killing off Inflation Reduction Act spending, because that spending goes mostly to rich guys and their construction worker employees. They opposed it when it was in Congress, but don’t want to let go of it now. Cutting spending on their own poor, on the other hand, they’ll do every time.

“This is odd, given that roughly 72 million people are enrolled in Medicaid, but themselves the facts as I can discover them.”

many of that subset of people do not vote. and a surprising number voted for trump. democracy only works for people who participate. many folks are going to learn this lesson the hard way, with all of the doge cuts upcoming.