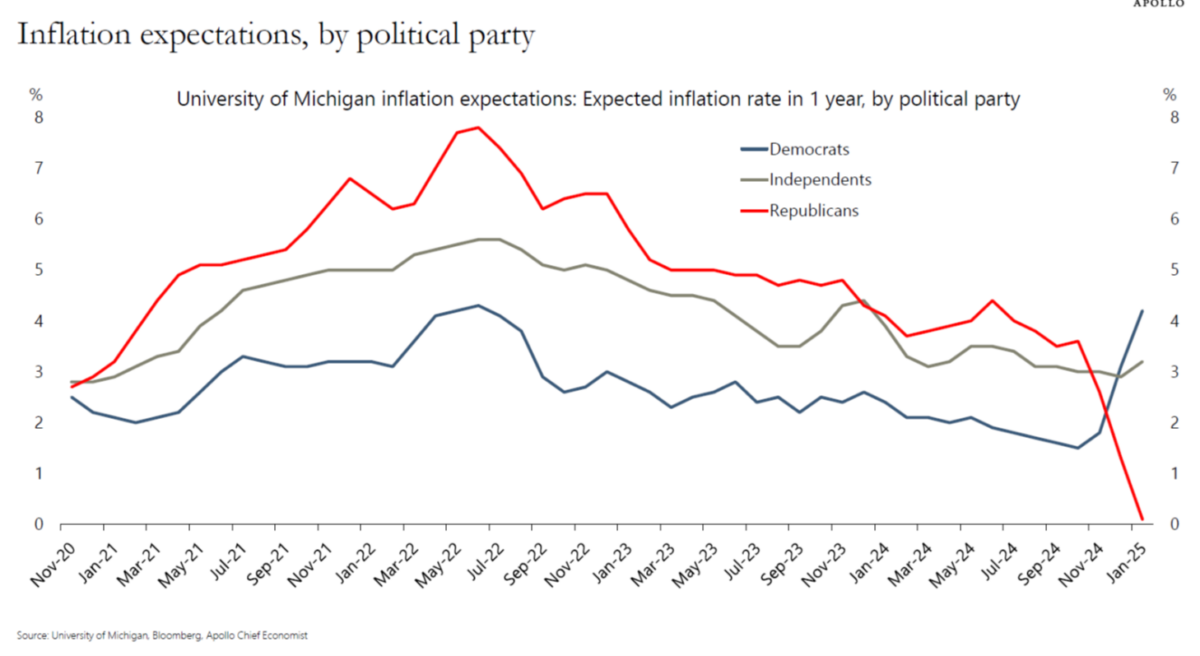

The Michigan survey of Consumers revealed that Republican respondents expected one year inflation to be zero as of January 2025. From Torsten Slok:

Source: Slok (2025).

While I’ve commented on the atavistic attributes of Republican sentiment as measured by the Michigan survey, I’ve not noted this inflation dimension.

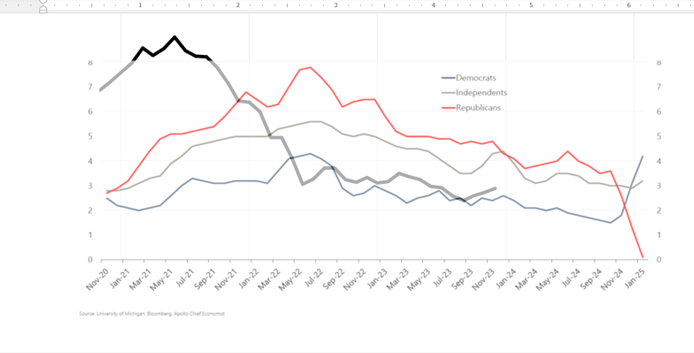

Who would you count as more reliable? I don’t have the raw inflation expectations numbers by party affiliation, but I can do an ad hoc overlay of actual inflation on expected (recalling the last expected inflation observation then pertains to February 2026).

Where bold black line is actual inflation. The dates refer to the month the expectations data were collected (December 2023 for December 2024 y/y inflation). By April 2023, y/y inflation realizations were closer to Democrats’ inflation expectations than Republicans, and have continued to be so thereafter.

Binder (2023) discusses the partisan nature of inflation expectations with respect to switches of party in Presidential power.

Kevin Hassett has gone full Navarro bat-sh*t crazy. He’s now defending Trump’s idea of making Canada the 51st state. He says “it’s not outlandish.” Canadians might think otherwise.

Hassett also defended Trump’s belief that Covid was no big deal in his first term. Now he’s back for more insanity.

Hassett also says that their plan to fight inflation is to increase the labor supply and reduce aggregate demand. Sounds to me like a plan for recession.

Funny he didn’t mention that whole deportation thing regarding the labor supply.

Off topic – carbon taxes and financial stability:

“Climate Minsky Moments and Endogenous Financial Crises”

Matthias Kaldorf and Matthias Rottner

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4899092

This study examines the effect of carbon taxes on the risk of endogenous financial shocks. The study finds that carbon taxes reduce financial risk in the long run, after a period of transition in which risk is increased.

In other words, abandoning climate goals will lead to greater risk of financial shocks in the long run.

We could, of course raise revenue with a carbon tax while discouraging fossil fuel use, instead of raising revenue with tariffs while discouraging trade.

Off topic – China’s demographics:

https://www.cnn.com/2025/02/10/china/china-marriage-registrations-record-low-2024-intl-hnk/index.html

China’s marriage rate had been declining for some time, a feature in the trend toward population decline. Marriages decelerate further in 2024, while divorce picked up.

It’s likely that the accelerated slump in marriage last year is partly a response to economic weakness. Starting a household is expensive as are the children (as is the child, more realistically) which results.

The idea that China’s economy needs more consumption, and that a stronger social safety net is the right policy to boost consumption, presents a dilemma. A stronger social safety net is generally assumed to mean, among other things, increased old-age pensions. With births now very low, preventing workforce decline depends heavily on delaying retirement. Providing a more generous old age pension would probably encourage retirement. A steep ramp in pension benefits with retirement age might alleviate that problem, but would probably undercut the effort to boost consumption.

One thing that could smooth over China worsening demographic problem is a rise in productivity. As it happens, China has recently been erasing the only notable rise in TFP it has experienced since the 1960s:

https://fred.stlouisfed.org/graph/?g=1DzEA