And CBO’s January projection:

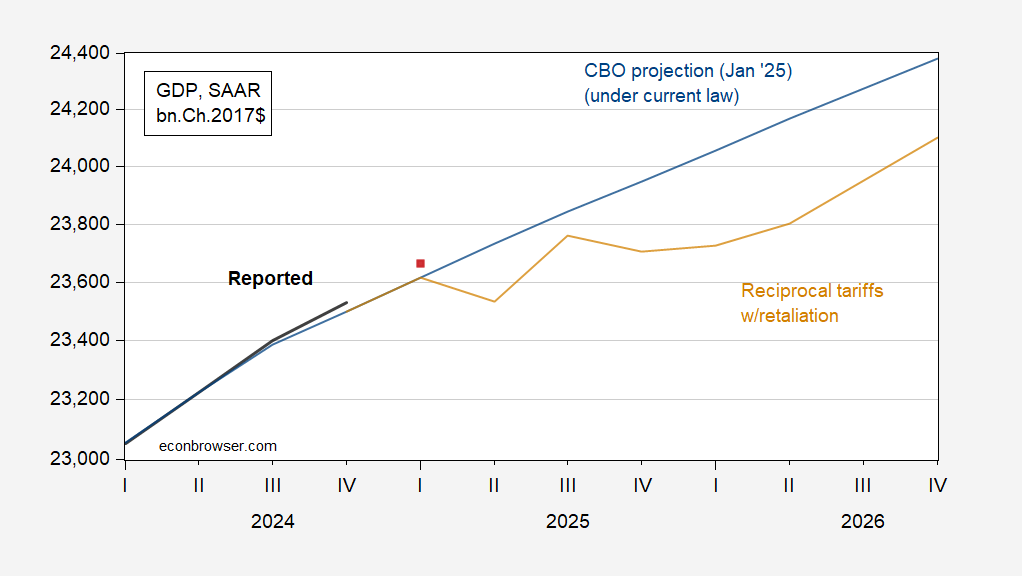

Here’s implied GDP using the Budget Lab’s analysis, and the CBO’s current law projection:

Figure 1: GDP (bold black), CBO January 2025 projection (blue), and Budget Lab reciprocal tariffs with retaliation GDP (tan), and GDPNow of 2/19 (red square). Source: BEA 2024Q4 advance release, CBO Budget and Economic Outlook, Atlanta Fed, Budget Lab, and author’s calculations. [graph corrected 2/21 – MDC]

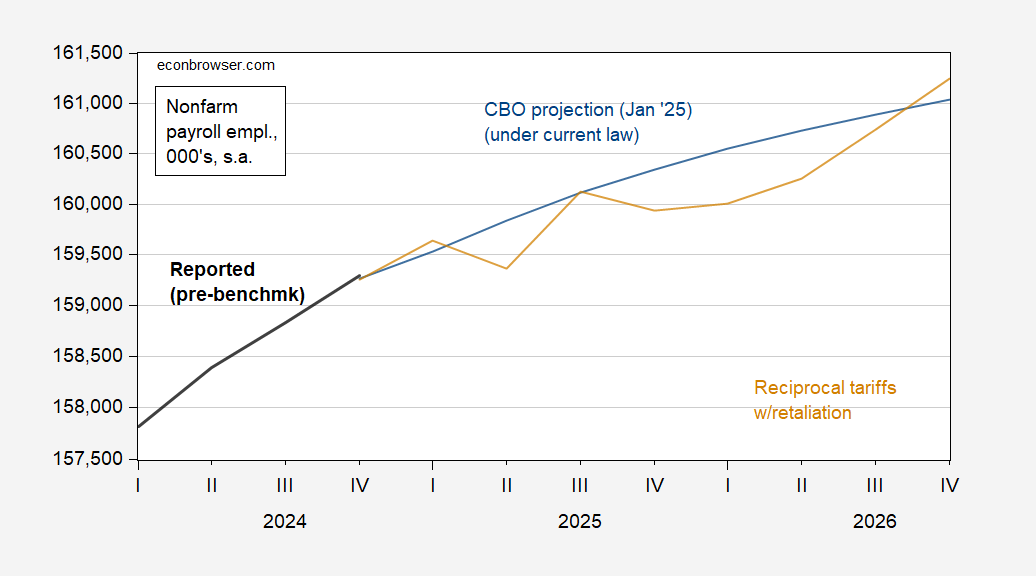

Since the NBER Business Cycle Dating Committee does not rely primarily on GDP as an indicator of whether the US economy is recession, I eschew the two-consecutive-quarter growth in GDP rule of thumb, and look to nonfarm payroll employment.

I translate (log) GDP to (log) NFP using the observed relationship 2022Q4-24Q4, where a one percent increase in GDP results in an about 0.5 percent increase in NFP (Adj-R2 = 0.99, DW = 1.75):

Figure 2: Nonfarm payroll employment (bold black), CBO January 2025 projection (blue), and Budget Lab reciprocal tariffs with retaliation NFP (tan), Source: BLS December 2024 release (for consistency with CBO projection), CBO Budget and Economic Outlook, Budget Lab, and author’s calculations. [graph corrected 2/21 – MDC]

This outcome suggests a recession starting in 2025Q4, with the business cycle peak at 2025Q3, although a starting date of 2025Q2 is plausible. Note the analysis does not include the likely depressing impact of economic and trade policy uncertainty on economic activity (see Steven Kamin’s analysis).

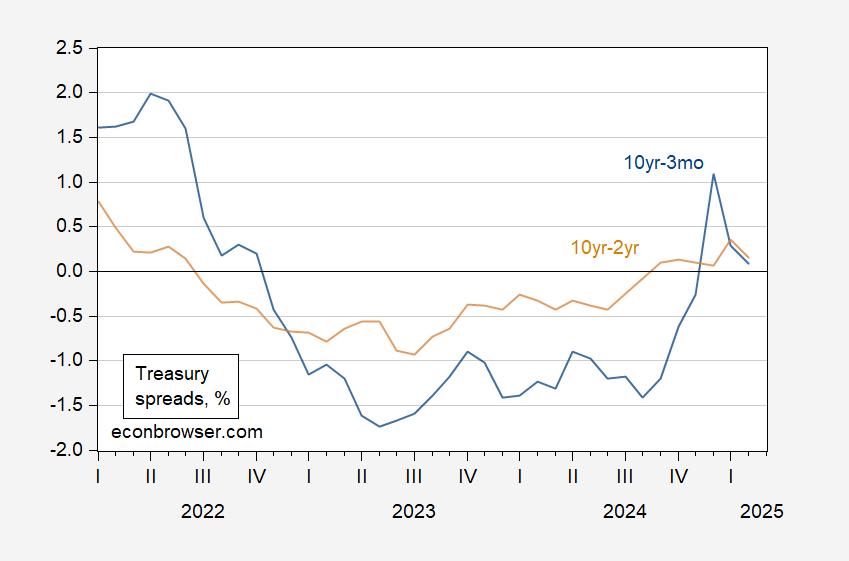

Does a recession seem a near impossibility, given the recent strength in almost all indicators? I’ll just note both the 10yr-3mo and 10yr-2yr seem close to inverting again. Not sure what that means, given the failure of a recession to show up after the last inversion, but here they are.

Figure 3: Treasury 10yr-3mo term spread (blue), t0yr-2yr (tan), both in %. Source: Treasury via FRED and author’s calculations.

there are significant numbers of newly unemployed federal workers who will show up on the books in the next few months. I think these numbers are going to be revised downwards by the deliberate tanking of the us economy by trump, musk and doge. I guess this is trumps way of lowering interest rates. god bless the rick strikers of the world, who advocate for such economic policy. it’s out of the box thinking, for sure. why rely on the fed to lower rates, when you can simply increase unemployment and contract gdp all in one unapologetically immoral firing spree. well done rick stryker. I can only imagine trump learned this from your economics class.

and a recent study indicated that the social security system will save over $200 billion dollars due to the early deaths from covid. again, this must have been trump playing chess while everybody else played checkers. who knew his incompetent covid response was really a brilliant plan to reign in social security spending years ago? well played king trump.

“Does a recession seem a near impossibility, given the recent strength in almost all indicators? ”

The top is always when the downslide begins.