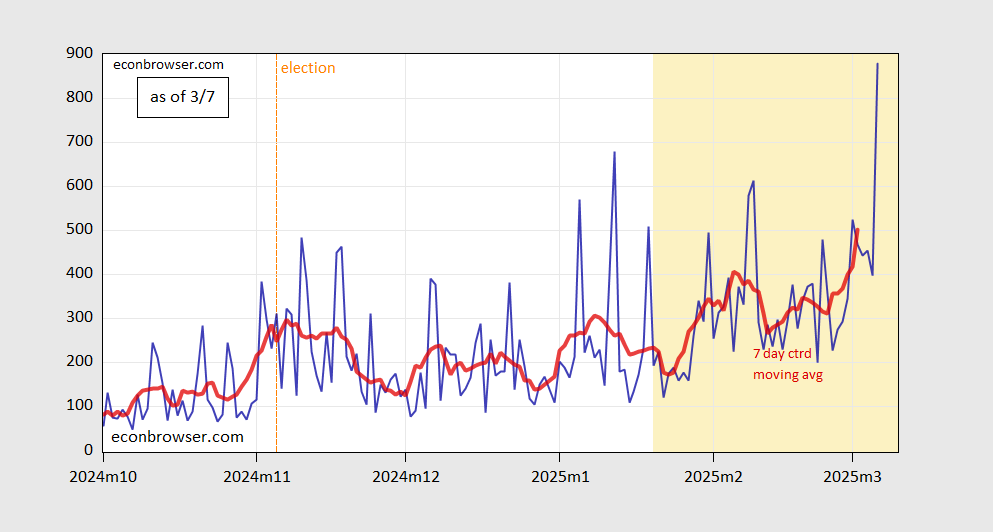

The 7 day centered moving average is only exceeded by the April 2 and April 23 observations (the latter is “bleach”, if you are wondering).

Figure 1: EPU (blue, left scale), and centered 7 day moving average (red, right scale), Source: policyuncertainty.com, and author’s calculations.

April 2 and 23, 2020?

First a Commerce Sec. who does not understand basic national income accounting and now a Treasury Sec. who is this dumb on exchange rates.

There is a new name for recession I guess: ”U.S. Treasury Secretary Scott Bessent said the U.S. economy may go into a “detox period” as it reached a more sustainable equilibrium.”

he also “inherited” an economy he does not like. these guys are more interested in playing games than helping the American people. a detox period for bessent means he makes less money for a while. for the rest of working class America, a detox period means defaults and foreclosures. something the trump cabinet has few worries about.

Pawel. you are a treasure to this blog Sir, never resist the slightest inclination you have to comment here. I’m kinda angry though, how come you speak/write better in your 2nd language than I do in my native language??

Meanwhile…

Eurozone long rates are climbing, as are rates in Japan and recently even in China. Germany’s commitment to defend itself and its European allies means fiscal expansion, so stronger growth and more debt, as well as a potential trial lift to inflation. There is a fair chance most of NATO will follow suit. China has pledged to increase its fiscal deficit by 1% of GDP. Japan has stopped twisting the curve from the long end.

This general rise in rates among major economies (not so much the UK, though) is context against which to consider the felon-in-chief’s shenanigans. Policy uncertainty breeds economic uncertainty which combine to create market uncertainty, while yields overseas are becoming more attractive.

The Great Gold Arbitrage has confused GDPNow, but it didn’t stir up trouble in financial markets (that we know of). Fixed income markets are vastly larger and are where real trouble can happen.

DXY is down 4.25% so far this year, a sign the rate differentials and increased risk in U.S. markets is driving substantial investment flow out of the U.S. It’s at times like these that financial crockery gets broken.

if rates rise in Japan, china and europe, how does that impact the US dollar. trump wants a strong dollar. is this counterproductive to his goals?

Hey, Baffling, apparently you didn’t get the message from Bessent:

“We’re also looking at currency manipulation,” Bessent said in an interview on Fox Business Network. “The U.S. has a strong dollar policy, but because we have a strong dollar policy, it doesn’t mean that other countries get to have a weak currency policy.”

You see, Bessent lives in a Lake Woebegone world in which all the currencies are above average.

Relevant to policy uncertainty and to Professor Frankel’s latest post, there is now discussion that the felon-in-chief wants to cause a recession. One flavor of this idea is that recession fosters his announced policy goals of weakening the dollar, reducing interest rates and making the economy less dependent on government (?):

https://www.marketwatch.com/story/is-the-white-house-trying-to-engineer-a-recession-this-wall-street-pro-explains-the-vision-fb3b4106

Another flavor draws on Naomi Klein’s “The Shock Doctrine: The Rise of Disaster Capitalism”. Crashing the economy drives down the price of assets, real and financial, so that richies can swoop in and buy them at distressed prices, a process which Klein calls “disaster capitalism”.

I don’t have a stake in these ideas, but they do show that people are grasping for an explanation of policy behavior which otherwise looks irrational. I’m conflicted over whether the felon is smart enough to connect the dots on either of these schemes; early in his first term, he called a general in the middle of the night to ask if a strong dollar was good or bad. That said, he is perhaps the most successful con man alive, so I’m reluctant to dismiss either idea out of hand.

Trying to make sense out of Trumps actions is a waste of time. He is about as ignorant as they come and has hired people based on their ass kissing abilities not professional competence.

Fourteen Ukrainians died during Russian missile and drone attacks yesterday. This is not a new development, except for one fact: the U.S. has stopped sharing intelligence with Ukraine, making it more difficult for Ukraine to defend against such attacks. The new policy is the rapist-in-chief’s attempt to erode Ukraine’s defensive ability, so that Ukraine will surrender to Russia. These deaths – civilian deaths – are on the rapists hands.

Of course, 400,000 excess Covid deaths are also on his hands, and we voted for him anyway. Who cares about 14 more?

Bessent’s “detox the economy” comments are very similar to Mellon’s supposed comments on “liquidate the farmers, etc to get the high living and moral rot” out of the system. Some will have to lose our jobs so the oligarchs can cut unlicensed healthcare and education spending for tax cuts for the wealthy and lower interest rates to leverage investments in stock buybacks and bitcoin.

Should be “public” healthcare – not sure why the comment box did that edit

Bessent’s “detox the economy” comments are very similar to Mellon’s supposed comments on “liquidate the farmers, etc to get the high living and moral rot” out of the system. Some will have to lose our jobs so the oligarchs can cut healthcare and education spending for tax cuts for the wealthy and lower interest rates to leverage investments in stock buybacks and bitcoin.