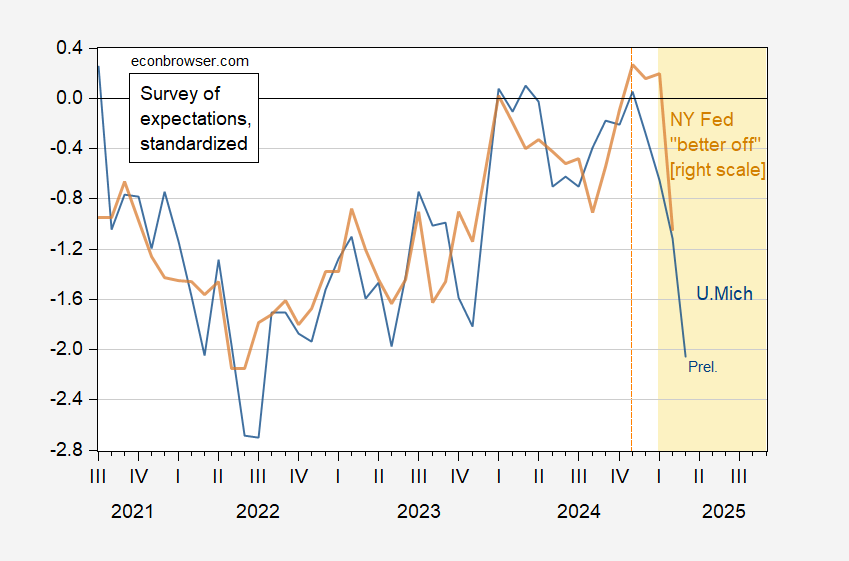

Expectations in March (prel.) at 54.2 vs. 64.3 Bloomberg consensus. Thanks, Drumpf.

Figure 1: U.Michigan expectations index (blue), and NY “better off” aggregate (tan), both demeaned and standardized (2013M06-2025M02). Source: U.Michigan, NY Fed, and author’s calculations.

Among Republican-leaning respondents, the expectations index fell from 106.6 to 95.7. Among independents, from 59.1 to 51.8. Among Democratic-leaning voters, from 36.8 to 28.2. So pretty much everybody is in a mood right now.

Among all of the partisan scales across all three measures, the only one to rise in March was the current conditions index for Republicans, to 65.4 from 55.7. Not sure why, what with expectations falling so much, except for maybe a seasonal preference for Q1 in recent years.

There is some evidence of Michigan data being more reflective of financial market conditions, while Conference Board confidence data are more sensitive to labor market conditions.

Price of gasoline at local Costco on March 14:

2022: $3.929 (regular)

2025: $2.669 (regular) $3.669 (premium)

Thanks, Trump! (okay, just playing along). It’s fun to play games with data. But seriously, the cost of oil (gasoline) permeates the cost of many goods. So, this is good news. It may take awhile to show up, but it will.

https://www.nbcnews.com/business/business-news/rising-oil-prices-affect-thousands-products-rcna18985

https://fred.stlouisfed.org/series/DCOILWTICO

Bruce Hall The Domar weight for oil just ain’t what it used to be. You’re still living in the disco era.

A few days ago, you suggested that the recent stock market correction might have nothing to do with consumer sentiment. I responded, because your point seemed unsupported, but you didn’t seem to notice. Now, you’re back with another effort to defend the felon-in-chief in chief from any blame. I’ll give you another chance to respond to my earlier comment:

Odd that you have commented here, when Menzie has already published a new post about the economic consequences of policy uncertainty, a post which makes obvious how policy uncertainty could lead to stock market decline.

Stocks have been overvalued for some time. So tell us, why would investors change their minds now? As demonstrated in the featured study, uncertainty has real economic consequences. Uncertainty is elevated, suggesting rising economic risks, and stocks have fallen just as one would expect.

The Vix is absolutely correlated with stock performance – negatively correlated. The Vix is colloquially known as “the fear index”. What is the most likely cause of fear among stock investors now which wasn’t present 2 months ago?

And let’s not ignore the point of the study; uncertainty is associated with bad economic outcomes. Menzie has drawn a perfectly reasonable connection to stocks – which you seem to want to dismiss – but the risk to the economy isn’t a matter of over-priced stocks. Inconvenient for your point, but let’s not dodge the issue.

So why, exactly, do you think uncertainty might not be to blame for the sharp drop in equity values? You think $4 trillion in value evaporated now, rather than 2 months ago, just at random? Or is this another of your efforts to defend the felon-in-chief?

Elon Musk posted yesterday: “Stalin, Mao and Hitler didn’t murder millions of people. Their public sector workers did.”

Not only that, but Hitler killed Hitler and Stalin more or less drank himself to death, so another win for the autocrats and black eye for the civil servants.