From Atlanta Fed today:

Source: Atlanta Fed, accessed 3/26/2025.

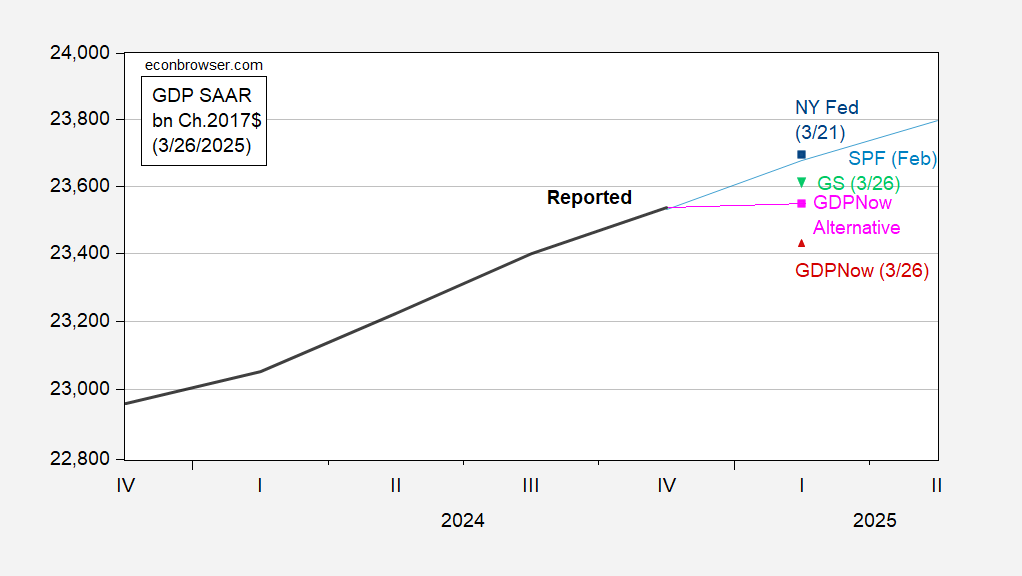

What’s this mean for the trajectory of GDP? Note GS at 1.3%, while NY Fed (last Friday) at 1.72%

Figure 2: GDP (black), GDPNow of 3/26 (red triangle), GDPNow adjusted for gold imports (pink square), NY Fed (blue square), Goldman Sachs (inverted green triangle), Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

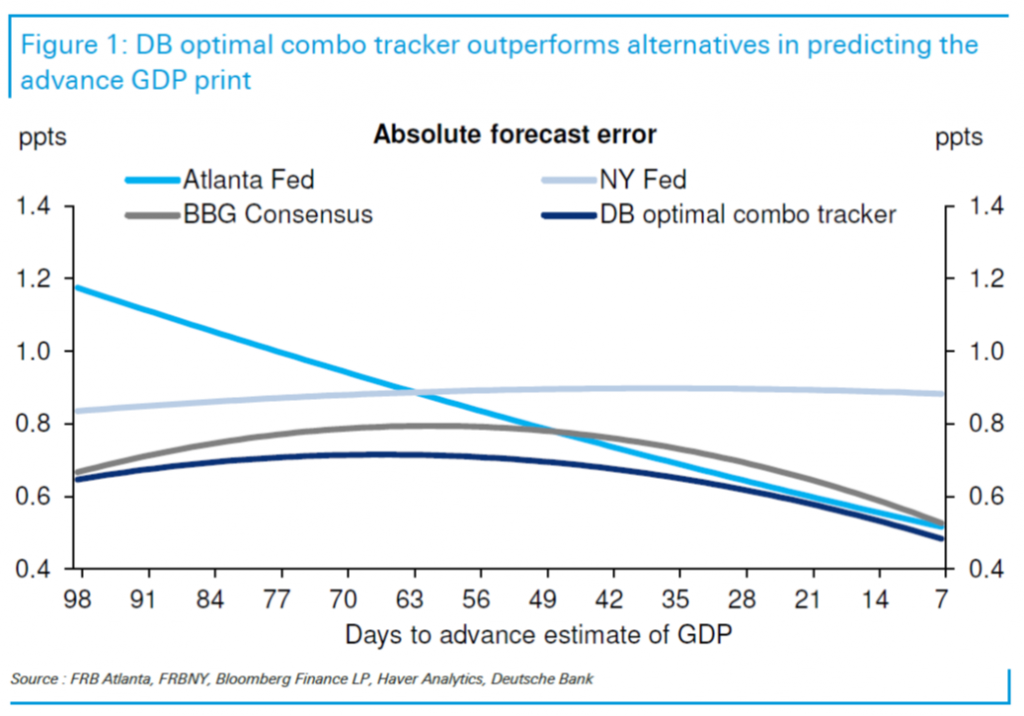

In normal times, with 34 days to the advance release, one would put greater weight on GDPNow than the (pre-Covid) NY Fed nowcast, or Bloomberg consensus. (The NY Fed nowcast underwent substantial revision during the pandemic.)

Source: Luzzetti, et al. “Tracking the GDP trackers,” Deutsche Bank US Economic Perspectives, 24 July 2019.

If it is the case that increased tax evasion among higher income earners is going to result in hundreds of billions in additional after-tax income to those earners (https://archive.is/0VIgf), then the outlook for consumer demand has brightened in the near term. After all, since the labor market cooled off, it has been high-end earners who have driven consumption gains. So initially, GDP growth would benefit, with most of the benefit accruing to the well-off. No surprises so far.

There are other implications from a shift toward spending driven by what is essentially a government transfer to high-end earners, apart from a lift to C. There will also be a lift to imports, a drag on exports (we have a high marginal propensity to import) and an increase in bond issuance. The Fed will have less reason to ease, more to tighten. That will mean generally higher interest rates and a stronger dollar (absent an overseas lenders strike). It will also mean housing will remain expensive and scarce.

The net transfer to higher-income earners will be exacerbated by net transfers from borrowers (working and middle class) to lenders (upper-middle class and the rich). So the distribution of income and wealth will skew toward the rich. Again, no surprise.

The transfer of wealth to the wealthy would have ambiguous effects on investment. Higher interest rates would lower investment and stock values, but a transfer of income and wealth to savers would mean more money to invest, as well as to spend, among the well-off. Crowding out could be a problem, given a large enough swing toward deficit. I’m gonna guess the balance would shift to less investment.

The combination of more debt and higher interest rates would mean interest expense on the debt would increase, and a fair share of that interest expense would flow overseas. So the foreign sector’s income improves through both trade and interest payments.

Can’t wait to see the “seasonal and other adjustments.”

By the way, the next Treasury statement is due on April 10, at which time we may see early hints as to whether tax evasion will increase under the felon-in-chief.

The “Democrats won all the bi-elections” forecasting tool was a bust in the 2024 general election, and this is just one little place in one election, but running g against Musk seems to have worked in Lancaster county:

https://www.politicspa.com/stunner-in-lancaster-as-malone-defeats-parsons-for-36th-senate-seat/141051/

Some non-GDP griping about “tax evasion”, but that’s not a GDP issue. In fact, it is not an “evasion” issue with the implication of criminally not paying taxes. It is tax avoidance using the “features” of the tax code. Don’t like it? Ask the Democrats why they didn’t change the code when they had the power. Probably because they liked those features for themselves.

https://www.usatoday.com/story/money/taxes/2025/03/24/avoid-taxes-loopholes-top-1-percent-rich/80718765007/

But don’t worry. Everyone will be able to pay more taxes with the new import consumption taxes aka tariffs. Of course, if wealthier consumers buy American products, some will claim they are “evading” taxes.

Brucie is again making stuff up. The problem outlined in the Washinton Post article is criminal tax evasion. Law breaking.

I don’t know whether Brucie didn’t bother to find out that criminal tax evasion is the issue, or just decided to lie about it. Either way, he’s wrong. Either way, he’s unreliable as a source of fact or opinion. He’s just making excuses for the failures of the felon-in-chief.

Duckie, if you are interested in the breakdown of “evasion”, this is an interesting article.

https://finmasters.com/tax-evasion-statistics/

Of course, it is racist claiming Blacks account for 28% of all instances of evasion, but try to ignore that part.

Logically, by dollar amount, the greatest amount of evasion would be by those with the most income. However, by population, it occurs on a widespread basis given the definition of evasion includes “failure to file”. Some less educated may simply not file and their incomes may avoid withholding.

https://www.investopedia.com/articles/markets/032916/how-big-underground-economy-america.asp

Now that we’ve cleared that up, how does that relate to GDP? After all, “evasion” has been a time-honored tradition of the US tax system. The new consumption taxes on imports should help offset that somewhat. Or we could just do what Europe does.

https://www.nytimes.com/2019/05/17/business/value-added-tax-enforcement.html

bruce, we got another 700 point drop in the dow again today, due to chaotic trump economic policy. retirement accounts contracted over 1.5%, AGAIN. your hero trump is leading an economic catastrophe of which this nation has never seen. never has a president been so intent on destroying the economic value of our great nation. it will be nice to see your retirement income take cuts over the next few years, so that you learn there are consequences to supporting fools like trump.

“Logically, by dollar amount, the greatest amount of evasion would be by those with the most income.”

Yes, and since the deficit cost of evasion is the point made in the WP article, why are you raising race as an issue? And why raise it if you then insist we ignore it?

Should we care that men cheat on their taxes more than women?

Your claim that evasion is widespread seems at odds with your source:

“According to the latest tax gap estimates available, 85% of Americans paid their taxes on time.”

Or is “by population” your way of keeping race front-and-center?

So, for innocent bystanders, a recap. Brucie claimed that the huge rise in the deficit predicted in the Wahington Post would not result from criminal tax evasion, but rather from tax avoidance. He was wrong. He has come back to distract us from further from the point of the article by raising race as an issue. I don’t see how a half a trillion dollar widening in the annual deficit is a racial issue, but perhaps Brucie can explain.

This is the same Brucie who pretends to read minds so that he can claim that any objection to the blundering of the DOGE crew is mere envy. The same Brucie who routinely dismisses any criticism of Trump and Musk, and just as routinely sneers at Democratic leaders. Brucie 8s always trying to distract readers from the bad judgement, crimes and self-dealing of the felon-in-chief, always trying to distract from the accomplishments of first Obama, then Biden. Because distraction is all he has. Attention to the actual facts means his masters are wrong, damaging and dangerous. Brucie is a partisan troll.

“Everyone will be able to pay..”

Unfortunately, not everybody will be able to.

It is remarkable that Trump admin has managed to trash the best economy in the world in their first quarter. But that is what you get when you put Republicans in charge.

Off topic – I’ve recently been reading about David Ricardo – I find his mathematical argument about comparative advantage and for free trade compelling. And, not an exact match – but I think of trump tariffs as equivalent to the Corn Laws as a protectionist scheme for the oligarchs.

Bye-bye, post office?:

https://usmailnotforsale.org/wp-content/uploads/2025/02/Wells-Fargo-USPS-Privatization-A-Framework.pdf

something to think about. three weeks ago, Sylvester Turner, a democratic congressman from Houston, passed away. leaving an empty seat. gov abbott has deliberately chosen not to run an election to replace him. leaving a million constituents in houston unrepresented in congress. why? because he is a democrat, and the new election will produce another democrat in the house. keeping this vacant helps the slim republican majority. partisan hackery all the way around. this crap does not happen in a functioning democracy.

Baffling, the same thing happened when Trump announced Elise Stefanik would be his choice for the UN Ambassador. Gov. Hochel then announced she would be in no hurry to have an election for a replacement in that Republican area, so Trump removed Stefanik from that post’s nomination and she will stay as a representative.

Had Stefanik been confirmed to the U.N. ambassador post, it would have opened up another GOP-held seat and set up a special election in upstate New York that may not have taken place for months. Trump’s Truth Social post hinted at concerns about holding the seat, even though he easily carried it in the 2024 election.

https://www.nbcnews.com/politics/trump-administration/trump-preparing-pull-elise-stefaniks-nomination-un-ambassador-rcna198389

“Baffling, the same thing happened when Trump announced Elise Stefanik would be his choice for the UN Ambassador. ”

bruce, are you a turd or simply a dishonest turd? the same thing did not happen. Stefanik never left her congressional seat, and no representation was lost. on the other hand, in texas the seat has become vacant. and abbott has refused to call a special election to replace the seat. so this is no hypothetical. abbott is actively disenfranchising citizens of his state. in the past, he has called a special election within 3 days of a seat becoming vacant, so he obviously knows how to complete the process. he has simply decided to thumb his nose at democracy. bruce hall, you seem to be ok with that effort. pathetic.

here is to hoping that musk guts YOUR access to social security and medicare, bruce.

Bruce: “In fact, it is not an “evasion” issue with the implication of criminally not paying taxes. It is tax avoidance using the “features” of the tax code.”

Nope, they are definitely talking about plain old criminal tax evasion. Tax payers have always exploited every legal avoidance loophole and continue to do it under Trump unchanged. That can’t explain a major reduction in revenue. What has changed is an increase in criminal tax evasion due to a well advertised reduction in enforcement. Republicans haven’t made any secret of their intention. They think paying taxes is evil and refusing to pay them is a virtue that should not be punished.

After my little rant a few days ago about U.S. soft-power failures, I’m interested to see a handful of articles out today, pointing out that the bullying style and betrayal of allies from the felon-in-chief provides China with an opportunity to fill the void left by the U.S.

https://www.nytimes.com/2025/03/27/world/asia/trump-china-japan-korea.html

https://www.businessinsider.com/china-replace-usaid-shutdown-humanitarian-aid-funding-development-assistance-2025-3

https://cepa.org/article/china-moves-to-exploit-transatlantic-turmoil/

Interestingly, Foreign Affairs carries an article identifying Latin American as one place China is likely to have success (the author is affiliated with RAND), while Foreign Policy carries a piece arguing that China will have a hard time capitalizing on the felon-in-chief’s mistakes (the author is affiliated with CSIS):

https://www.foreignaffairs.com/china/china-sees-opportunity-trumps-upheaval

https://foreignpolicy.com/2025/03/27/china-latin-america-trump-united-states-competition/