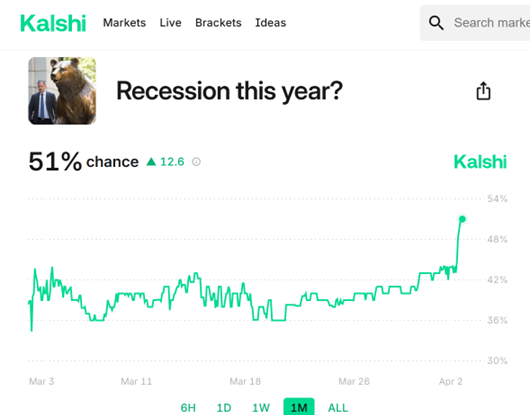

Odds of a recession in 2025:

Source: Kalshi, 2 April 2025, 8pm CT.

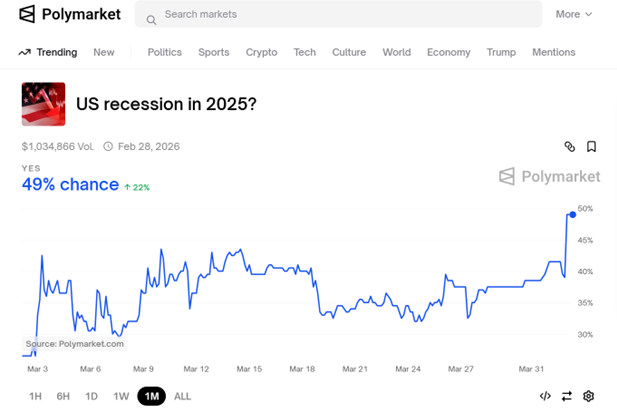

Polymarket confirms:

Source: Polymarket, 2 April 2025, 8pm CT.

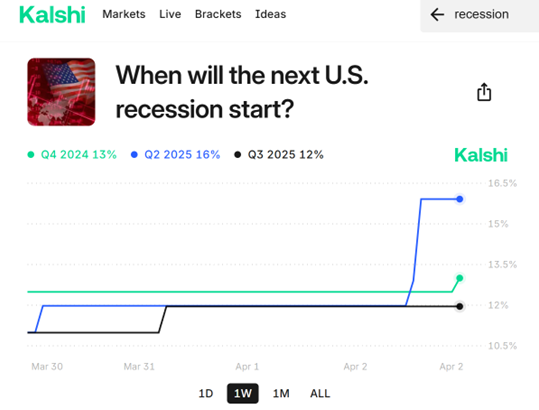

The recession has been moved forward, at least in betting odds (over the past week):

Source: Kalshi, 2 April 2025, 8pm CT.

Can this be true?:

“Take the US’s goods trade deficit with any particular country, and divide it by the total amount of goods imported from that country. Cut that percentage in half, and there’s the US’s “reciprocal” tariff rate.”

We must have a number. This formula generates a number. We will use this formula.

For those who care, USTR has revealed its tariff math, ostensibly the math used to decide what tariffs various countries would face:

https://ustr.gov/issue-areas/reciprocal-tariff-calculations

The link reveals a formula which is exactly what James Surowieki said and that joseph has mentioned in comments. The formula takes into account the trade gap, the elasticity of imports with respect to tariffs and the pass-through of tariffs to prices.

Notice that non-tariff barriers and value added taxes are not among the factors considered. Administration officials claimed that a “sophisticated system of calculation” including both those factors had been used. The “sophisticated system” guys are lying.

The tariff elasticity of imports is assumed to be 4. The pass-through of tariffs is assumed to be 0.25. There is also an assumption that foreign exchange rates and general equilibrium effects are too small to matter(?).

Let’s think about that 0.25 pass-through figure.

Notice that the inclusion of any pass-through of tariffs to prices contradicts the felon-in-chief’s claim that foreigners pay tariffs. His own tariff formula recognizes that we pay some of the cost of tariffs.

That 0.25 is for pass-through to retail prices, and is based on a study by Cavallo, etc. al. 2021. The Cavallo study says:

“At the border, import tariff pass-through is much higher than exchange rate pass-through. Chinese exporters did not lower their dollar prices by much, despite the recent appreciation of the dollar. By contrast, US exporters significantly lowered prices affected by foreign retaliatory tariffs. In US stores, the price impact is more limited, suggesting that retail margins have fallen. Our results imply that, so far, the tariffs’ incidence has fallen in large part on US firms.”

https://www.aeaweb.org/articles?id=10.1257/aeri.20190536

The study that USTR relies upon says the U.S. pays MOST of the cost of tariffs. U.S. firms absorbed most of the increase in tariffs on Chinese imports during the first felon-in-chief administration. Why is this not reflected in the USTR formula? Well, tariffs would end up being less than a quarter of those the felon has imposed if the entire pass-through had been included.

Now, the authors did err on the side of a high-end-of-the-range elasticity estimate. If tariff elasticity were put at 2 rather than 4, then the “appropriate” tariff would be about half of what has been imposed.

So what we have is a simplistic, dummied-up formula based on at-best adventitious assumptions. Our fancy new tariffs were pulled out of somebody’s backside.

this formula was derived and taught in rick strykers Econ class for years. rick spent a decade researching and developing this sophisticated trade model, before finally unceasing in on the world this week. it ranks right up there with his research work on r0 during the pandemic.

The U.S. runs bilateral trade surpluses with Central America and the Caribbean, as well as with Peru, number of African countries, Mongolia, Lebanon, the Marshall Islands, Micronesia…the list goes on.

What many of the countries with which we run surpluses have in common is that they are poor. The felon-in-chief has imposed 10% tariffs on them, despite the fact that we run surpluses with them. This is pure hypocrisy, pure meanness. It is evidence that the felon’s rationale for imposing tariffs is a mere excuse; you don’t get better treatment in return for “better” behavior.

Off topic – Musk is on the way out:

https://www.politico.com/news/magazine/2025/04/02/trump-musk-leaving-political-liability-00265784

Politics, not policy. Musk is too unpopular to be allowed to stay. The felon-in-chief approves of what Elon’s apes have been doing.

So, is the felon-in-chief negotiating a better deal for the U.S., or is there no room for negotiation? Businesses would certainly like to know. So would our (former?) trading partners.

Eric Trump on Twitter: “I wouldn’t want to be the last country that tries to negotiate a trade deal with @realDonaldTrump,…The first to negotiate will win — the last will absolutely lose. I have seen this movie my entire life.”

White House press secretary Karoline Leavitt: “The president made it clear yesterday, this is not a negotiation.”

Commerce Secretary Howard Lutnick: “I don’t think there’s any chance that President Trump is gonna back off his tariffs.”

Glad they cleared that up.

S&P500 down 4.8% today.

Crude down 7%, with an assist from a larger-than-expected OPEC output increase.

The ten-year Treasury yield fell 17 basis points to 4.02%, the lowest yield since October.

The modal priced-in estimate for the year-end fed funds is now 1% lower than today’s rate, vs 75 basis points lower as of yesterday.

In other news, ADP reported 155,000 new private jobs for March. That’s up from 84,000 in February, but otherwise the smallest gain since last July. Not bad, but the cooling in the job market continues. We’ll see what BLS has to say tomorrow.

“The ten-year Treasury yield fell 17 basis points to 4.02%, the lowest yield since October.

The modal priced-in estimate for the year-end fed funds is now 1% lower than today’s rate, vs 75 basis points lower as of yesterday.”

in all seriousness, I have a boatload of cash earning 4% and a large mortgage that I would like to refinance. what would be a good mortgage refinance rate, and should I lock in the cash now for a few years or simply dump it into the lower mortgage rate refinance package? how low is the 10 year going to go? another 1 or 2%? and is the 1% fed drop expected to grow? some of us will try to benefit from the chaos that has been thrust upon the world.

Current policies seem to be steering us into stagflation. Normally you would expect the Fed to fight the inflation at any cost. But things are not normal.

We also seem to be driving foreigners away from purchase of treasuries (threatening to default selectively). That may make Fannie & Freddie bonds more attractive/safe to foreigners than treasuries.

I would place savings in inflation adjusted short term bonds then wait at least 2 years before looking at refinancing.

For Bruce Hall in particular:

Paul Krugman has about the most concise presentation of the insanity of the tariffs. Below are the justifications for the tariffs as presented by both Bruce Hall and the administration.

1. Tariffs won’t increase prices, because foreign producers pay the tariffs

2. Tariffs will cause a large shift in U.S. demand away from imports to domestic production

3. Tariffs will raise huge amounts of revenue

One and two above are inconsistent. If the tariffs don’t increase prices of imports, why would consumers shift to domestic products?

And two and three above are inconsistent as well. If consumers shift to domestic goods, then how can the tariffs raise huge amounts of revenue.

So none of the excuses make any sense. It is total insanity.

https://paulkrugman.substack.com/p/stop-looking-for-methods-in-the-madness

as I have said before on this blog, if you want to use reason to explain trump policy, you are an idiot as well. trump does not operate by logic or reason. trump operates by trump intuition. contradictions will never appear in a world devoid of rules which must be followed. it will produce an unfortunate state of affairs. the republican tariff economic policy is simply a worldwide disaster.