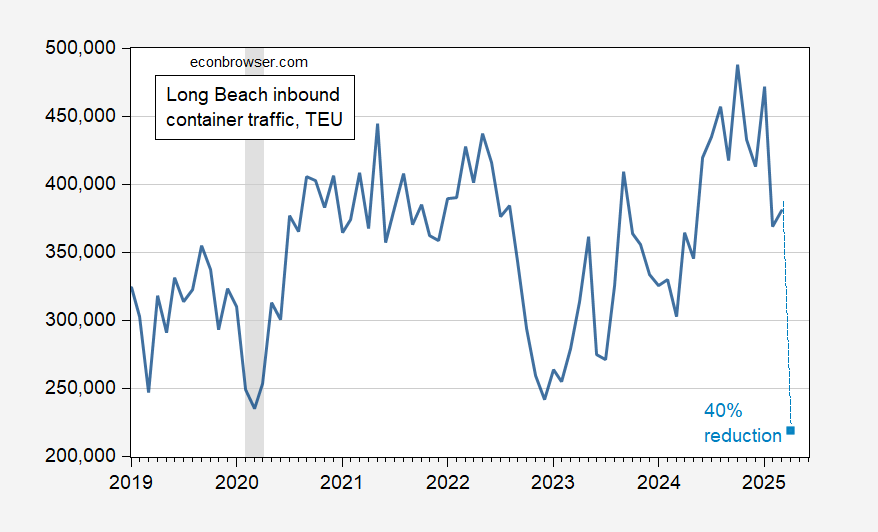

“LA County ports expect roughly 40% drop in traffic as Trump’s tariffs continue”:

Figure 1: Long Beach inbound TEUs by month (blue), and 40% reduction on year (light blue square). NBER defined peak to trough recession dates shaded gray. Source: Port of Long Beach.

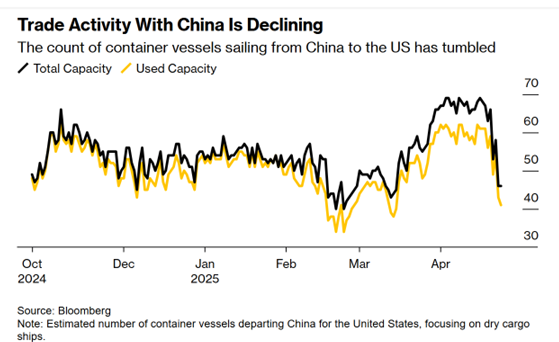

Update: via Bloomberg, 4/25/2025.

First they came for the protesters, but I did nothing because I’m not a protester:

https://www.npr.org/2020/07/17/892277592/federal-officers-use-unmarked-vehicles-to-grab-protesters-in-portland

Then, they came for the immigrants, but I did nothing, because I’m not an immigrant.

Then, they came for the judges:

https://www.nbcnews.com/politics/justice-department/fbi-arrests-milwaukee-judge-alleging-interfered-immigration-operation-rcna203006

Remind me – who else has gone after the judiciary? Oh, yeah: Nigeria, Zimbabwe, Malaysia, India and Israel, of course. You know – shithole countries:

https://www.researchgate.net/publication/357992578_The_Administration_of_Justice_in_Nigeria_Issues_and_Challenges

https://scielo.org.za/scielo.php?script=sci_arttext&pid=S1682-58532023000300003

https://m.malaysiakini.com/columns/620611

https://www.jyotijudiciary.com/extortion-under-ipc/

https://foreignpolicy.com/2025/03/24/israel-court-stop-netanyahu/

U.S. ports are among the least efficient in the developed world. That is in part the result of labor contracts, but not entirely. We don’t “do” infrastructure without government incentive. Destructive tariffs are a disincentive to imvestment.

Predictably, Moody’s has just downgraded the ratings outlook of the port sector in response to the felon-in-chief’s tariff policies and retaliatory tariffs abroad:

https://finance.yahoo.com/news/moody-downgrades-us-port-outlook-200523338.html

The good news is, as of last October, the sector as a whole was looking reasonably resilient, despite East Coast strikes and the Baltimore bridge whoopsy:

https://www.fitchratings.com/research/infrastructure-project-finance/us-canadian-ports-able-to-withstand-recent-disruptions-18-10-2024

That has obviously changed now. Ports engage in trade, and are “coastal”, so maybe the felon is OK with dumping on them.

Port volumes will vary by market. That 40% drop is far more than the average drop anticipated across the port sector, ’cause China. So the outlook downgrade for the sector applies in spades for L.A. County ports. Look for ratings downgrades and the accompanying increase in the cost of credit; higher interest costs on lower revenue.

By the way, the Baltimore bridge reconstruction is going to be much more expensive under the new tariff structure. Concrete and steel.

On the plus side, the truck traffic coming out of the port will be reduced, road congestion will be reduced, and CO2 emissions will be reduced. See, always a plus side.

Yes, you identified the “degrowth” approach to combatting climate change. Assuming you know enough about this approach to have an opinion – and I’m sure faux news can issue you an opinion if you don’t – can I put you down as supporting “degrowth”?

I’m interested to know whether you have any firmly-held beliefs; I haven’t been able to discern any.

Where is Congress in all this chaos? Are they attempting to do anything at all to stop Trump and his crazy tariffs? Shit will hit the fan if things get really bad and it will not be a good situation for Republicans. I am just overwhelmed of the lack of action from those we elect to protect our interests and quality of life?

right now republicans in congress are simply a bunch of political hacks, or cowards. I cannot appeal to the political hacks. but to those cowards (you know who you are, Rubio), history will not look kindly upon your actions in recent years.