Even if the answer is yes, we won’t know for a long time.

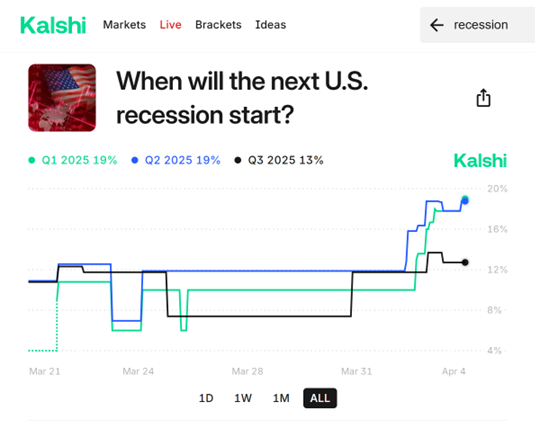

Here’s the odds on the recession start, with Q1 at 19%, same for Q2:

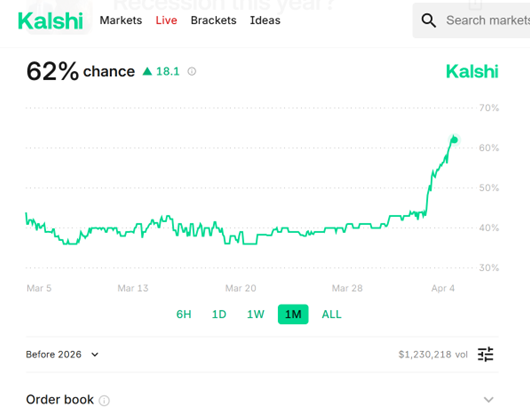

Combining with the probability of recession in 2025:

Between the two sets of betting odds, a recession start in Q4 has 11% probability.

Note we only have preliminary employment numbers for March, and non for other key indicators followed by the NBER BCDC. On the basis of those numbers, NBER BCDC would be unlikely to start date to March (although March could still be a “peak” month in the NBER chronology).

One thing we know about since the mid-March payroll survey is that new claims are looking quite tame, while continuing claims just rose to the highest level since November 2021. The rise in continuing claims has been gradual, a sign of the steady cooling in the labor market.

High continuing claims and low new claims means a slowdown in hiring and firing. That’s consistent with a late-cycle economy, and with what the JOLTS data show. So as of late March, just after March payroll data were collected, we’re seeing labor market data that isn’t showing evidence of a shock.

Labor data tend to lag, so other than the direct effects of government layoffs, we shouldn’t be surprised that labor data haven’t changed much; the shock is still to come. ISM data, orders data, financial market data, consumer discretionary spending – these are the sorts of things to watch for early signs of a shock.

As to that shock, here’s Powell’s comment today:

“While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent. Avoiding that outcome would depend on keeping longer-term inflation expectations well anchored, on the size of the effects, and on how long it takes for them to pass through fully to prices.”

Tightening words? I’d think so, but market pricing has pulled Fed easing ever-so-slightly forward, perhaps because the S&P has lost another 5% today – no short-covering yet. (See yesterday’s comment from PoppingMyStitches.) The VIX is now at its highest level since early 2021, not conducive to dhort-covering.

Credit spreads, while not yet dire, are widening pretty quickly. The Fed is very sensitive to credit-market conditions. This is also the kind of situation in which financial plumbing problems can crop up. Bessent has shown himself to be willing to say stupid stuff, but we don’t know yet whether he’s actually stupid or how he’ll respond in a crisis. Luckily, the Fed is still in professional hands.

Sure would be nice to have Yellen around.

“The S&P’s 9% loss since last Friday makes this stocks’ worst week since March 2020 and the fifth-worst week of the last 20 years, trailing only losses sustained in October 2008 and early 2020.”

https://www.forbes.com/sites/dereksaul/2025/04/04/tariffs-cause-another-stock-market-rout-losses-approach-5-trillion-as-dow-plummets-another-2200-points/

The stock market is not the economy. The Fed is much more sensitive to credit-market developments than to stock-market performance. Over-valuation may have led to a sharper stock market response, relative to underlying fundamentals, than in earlier episodes. Those things said, the stock market does give a sort of one-stop market assessment of new developments, and the judgement is dire.

In those earlier episodes, financial markets began to crack, and emergency measures had to be taken. I’ll be keeping an eye on the weekend and Monday financial press for cracks.

The S&P 500 is now down YoY, which satisfies one of the two criteria for my “quick and dirty” recession model.

The other part is the four week average of initial claims, which is currently higher by 3.4%. For a reliable signal, it has to be at least 10% higher. Surely just a couple of weeks’ work for the Magnificent Mister T—-p.

After a quick glance at the appropriately jiggered chart of initial claims, my impression is that the rise from 3.4% to 10% can happen in short order. In 1989-1990, it took about a year. Ahead of other recessions, it happened more quickly.

My worries about cracks in our financial plumbing should be soothed somewhat by the fact that Fed policy has not been accommodative, so leverage should be limited, right? Um…well…while that’s certainly true in the abstract, in fact financial leverage is pretty high.

For private equity, which can be thought of as leveraged equity, assets under management have risen from $440 billion in December 2020 to $3.1 trillion in October 2024:

http://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/4/us-private-equity-aum-hits-3128-trillion-in-2024-88099590

Margin debt, at 3.09% of GDP, is high, though not at a record:

http://www.gurufocus.com/economic_indicators/4266/finra-investor-margin-debt-relative-to-gdp

The immediate concern is equity market leverage, given that it is the equity market that was chewing its own leg off this week. One glimmer of good news is that margin positions were trimmed in February.

However, financial leverage overall is the greater concern when leverage begins to contract, as seems fairly likely in the near term. For starters, higher recession risk means banks will need to raise loan reserves, and that means tighter credit.

Leveraged loans outstanding at the end of 2024 totaled $1.337 trillion, up from 2023’s $378 billion. The previous record of $985 billion in 2017:

http://www.fitchratings.com/research/corporate-finance/leveraged-loan-market-breaks-records-with-trillion-dollar-milestone-in-2024-31-01-2025

Swap spreads are also showing signs of stress. The 2-year spread narrowed by 4 basis points to -23 today, the biggest single-day move since regional bank wobbles in March, 2024.

http://www.kitco.com/news/off-the-wire/2025-04-04/market-warning-lights-flash-amber-after-trump-tariff-shock

And what do you know, margin calls on gold are in the news, with forced selling part of the story:

https://www.fxempire.com/forecasts/article/gold-xauusd-price-forecast-margin-calls-trigger-liquidation-is-3000-the-next-target-1509453

Even Bloomberg’s editors see a problem:

http://www.bloomberg.com/opinion/articles/2025-04-04/shadow-banks-need-to-be-prepared-for-the-unexpected

So anyhow, leverage is fairly high, the motive to reduce loan exposure is high, and asset values are falling. That’s a pretty standard formula for marginal calls and a downward spiral. Liquidity problems crop up in downward spirals.

Here’s a little something for grad students looking for a way to get at tariff effects:

https://www.carscoops.com/2025/03/how-much-of-your-car-is-really-made-in-the-usa/

It’s a table showing domestic content by make and model of cars sold in the U.S. Comparing the price change of a high-domestic-content vehicle to that of a very similar low-domestic-content vehicle could be revealing, as could comparisons of changes in numbers of vehicles produced.

By the way, the highest domestic-content vehicle is the Kia EV6, at 80%. The F150 is at 45%. The Chevy Trailblazer comes in at 3%. In general, Acuras and Hondas have higher domestic content that Fords and Chevys. Should make for interesting shopping.

After several chats with AI, I thought the following was instructive as related to the tariff mess we currently have. Perhaps a way out through negotiating.

Title: Toward Fair and Reciprocal Trade: A Call for WTO Reform

Introduction: The Need for Equity in Trade

Highlight the importance of fair trade in fostering global economic stability and equitable growth.

Acknowledge past successes of the WTO while identifying shortcomings, particularly around asymmetric tariff policies among developed nations.

The Problem: Uneven Tariff Policies

Use the example of automotive trade (e.g., Asian countries with high tariffs on U.S. vehicles while accessing the U.S. market with minimal barriers).

Emphasize the impact on domestic manufacturing, middle-class jobs, and the social fabric, particularly in the U.S.

Proposed Solution: Rational and Transparent Tariff Framework

Suggest a WTO-based mechanism for evaluating tariff needs:

Developing countries could apply for temporary, time-bound tariff protections to nurture specific industries.

Developed countries, however, would adhere to reciprocal zero-tariff agreements in sectors where they are already globally competitive.

Introduce a framework to regularly review the necessity of these tariffs with clear benchmarks for economic progress and global market integration.

Enforcement and Incentives

Advocate for stricter WTO enforcement mechanisms to discourage unjustified protectionist policies.

Propose trade incentives for nations that adopt reciprocal tariff reductions, such as access to global development funds or trade benefits.

Rebuilding Manufacturing in the U.S.

Tie the reform to domestic policies aimed at revitalizing American manufacturing:

Investment in advanced manufacturing technologies.

Workforce retraining programs for displaced workers.

Tax incentives for companies that reshore production.

Closing Thoughts: Balancing Globalization with Fairness

Recognize the challenges of navigating global cooperation but stress the necessity of reforms to rebuild trust, fairness, and equity in international trade.

Don’t we already know the cracks with Fink (securitization and derivatization genius) begging for 401k bailout into private equity? Asking for a friend.

Apologies. I’m about to rant.

In September, 2022, Liz Truss and Kwasi Kwarteng tanked the UK bond market and currency by publishing a dumb-ass mini-budget. The market response was bad because the budget introduced a massive, dogma-inspired increase in the deficit, worse because of the arrogance of trying to slip through a massive increase in the deficit without even working through the economic implications – “no need to bother with formalities when you’reas clever as we are”. If the people in charge are arrogant AND stupid, sell bonds, sell Sterling.

Flip ahead to this week. The felon-in-chief introduced a dumb-ass tariff increase. The justification for the increase is a tangle of made-up economic nonsense. The market response has been one of the largest two-day declines in U.S. equities ever. In each of the prior cases – Black Friday, the 2008 mortgage crisis, the Covid shutdown – some external shock combined with policy to drive the sell-off.

This time, it is purely policy, a choice by the President to impose a massive increase in costs on businesses and households to satisfy his vanity, which has driven the sell-off. This is like the Truss/Kwarteng fiasco, in which stupidity and arrogance are entirely the cause of problem. No bad luck required.

The UK has a parliamentary system, which allowed for a quick change in government; Truss and Kwarteng were out in record time. We do not have a parliamentary system. We’re stuck with the felon, in all his arrogant idiocy. Our system, instead, has checks and balances through a separation of powers. That dividing of powers between branches of government is supposed to protect us from idiot ideas.

Look what’s going on in the legislative branch. The House has canceled voting because leadership will not tolerate a bipartisan effort to allow Members with new babies to vote by proxy; that’s what’s important to the Speaker. The House and Senate are squabbling over how massive a massive tax cut should be and whether they should pretend to pay for the entire tax cut with spending cuts or – I can’t think of a clearer way to say this – or whether to pretend that they will pretend to pay for tax cuts with spending cuts at some future date. We may be on the verge of the first ever recession of choice, an indefinite period of stagflation, annf Congress is fiddling with partisan projects. The felon intends to burn down the global system of trade that the United States invented to suit his own vanity, and Congress hasn’t held a single hearing. Tariffs are the responsibility of Congress, the felon-in-chief is ripping apart the tariff system, and instead of stopping him, or even objecting, they’re arguing over which bathroom a transgender Member pees in. They’re having a Truss/Kwarteng moment over how big a hole to blow in the budget.

So congratulations to us. We get the stupidity of a Truss/Kwarteng budget fiasco and a King Kong-sized Smoot-Hawley tariff fiasco, wrapped up together. Historically stupid, historically arrogant. Historically bad government.

The consumer is going to be key and will be very difficult to parse out with traditional measures – because of the way this time is different. There are forces both for pushing and reducing consumer spending.

A lot of people who are not living paycheck to paycheck are and have been trying to front run the tariffs. Personally, I purchased a TV in early January even though I would have waited with that purchase if not for terrifying tariff trump. Some car sales stories have been indicating similar sales pull forward in that sector.

On the other hand there are also people holding back on purchases. For political reasons (refusing to support the Trump economy) I have decided to not replace my old car until 4 years from now (provided it holds up). A lot of people dependent on foreign tourists are concerned, and so are people who directly or indirectly depend on federal government spending/salaries. Even before they actually loses income they will cut back spending to be prepared. The current stock market shock will have similar dampening effects on consumer spending (70% of GDP).

My guess is that the economy will do a head fake with better than expected numbers in Q1, then just as people begin relaxing (and Trumpets are trumpeting victory) the second and third quarter will surprise to the downside and put us in a recession.

The Senate GOP passes their tax cuts for billionaires and austerity for the rest of us spending cuts in a late night session while Trump crashes our economy and waddles off to play golf with the Saudis – Also I wonder what impact unfunded tax cuts will have on our economy? I foresee massive amounts going into speculative assets and increasing inflation.

Notice that a “current policy” baseline for the effects of the tax cuts has been introduced into the debate, as a replacement for the “current law” baseline written into law. The point is to hide the actual cost if the tax cuts.

When the felon-in-chief and a Republican-controlled Congress passed a massive tax cut during the felon’s first term, the tax cut was limited in duration so as to limit the reported increase in the deficit. Scoring of the deficit by the Congressional Budget Office had to assume that the tax cut would expire, because that’s what the law said. Now, as the tax cut is about to expire, Republicans want to change the rules in order to make extending the tax cut look less expensive than it really is. By calculating the deficit effect based on current policy – the tax cut that’s still in effect – rather than current law – the expiration of the tax cut – the GOP is attempting to hide trillions of dollars of increase in the deficit.

Why bother with this? Partly because when you live in the Washington bubble, you think the terms of the Washington debate matter. Partly because a large part if the GOP voter base does fall for this sort if stuff, over and over. They simply want to know what they should say when shouting at the TV.

“Current law” is the law. The CBO works for Congress, and is expected to be non-partisan, and so should, by law, report deficit effects based on “current law”. Obviously, the GOP is going to try to corrupt the CBO, just like the Supreme Court, just like the FBI and Justice, just like the Kennedy Center (that’s RFK Jr., right?).

That’s who we are now.

Peter navarro is simply getting even with a society that tossed him in the slammer for a few months. My guess is the turd owns no stocks right now. Revengeful and spiteful, which is why he has trumps ear.

Here we go – margin calls

https://www.ft.com/content/8ba439ec-297c-4372-ba45-37e9d7fd1771

Don’t know whether margin calls were involved in the DJT slump:

https://finance.yahoo.com/quote/DJT/

Down 50% so far this year. The election bounce is gone. Schadenfreude? Yes.