GDPNow as of today:

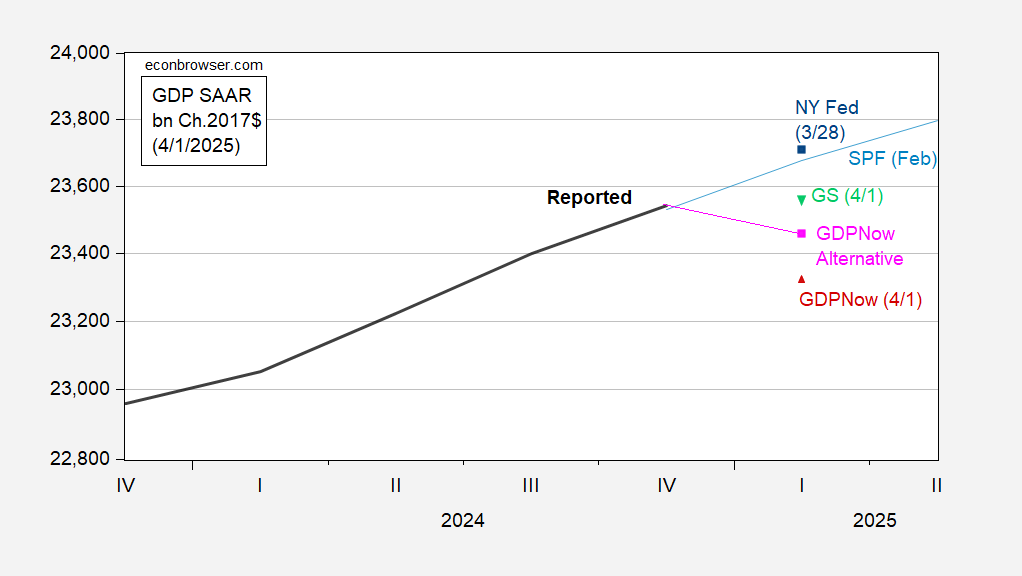

Here’s a picture of the level of GDP implied by these nowcasts and tracking forecasts.

Figure 1: GDP (black), GDPNow of 4/1 (red triangle), GDPNow adjusted for gold imports (pink square), NY Fed (blue square), Goldman Sachs (inverted green triangle), Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

Betting is now for 0% growth in Q1.

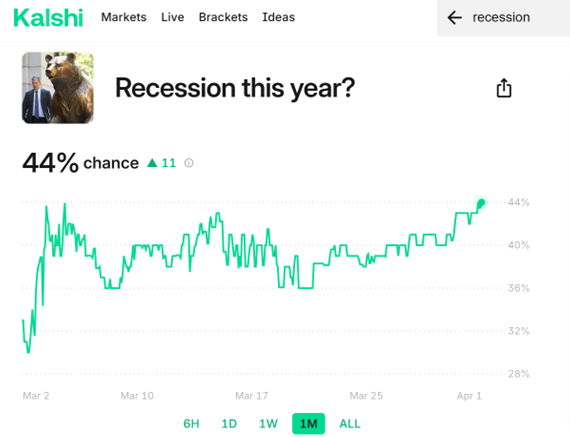

As noted on numerous occasions, GDP is not a primary input into the NBER’s decisions regarding recession dates. However, this graph on odds is of interest.

“…both the standard model’s and the alternative model’s forecasts of first-quarter real final sales to private domestic purchasers growth declined from 1.5 percent to 0.4 percent.”

The tariff-driven drag from trade and the quirk introduced by physical gold arbitrage have featured prominently much of the discussion of Q1 data weakness. Neither of those factors figures in real final sales to domestic purchasers. The 0.4% estimate is home-grown demand weakness.

One big remaining question is whether New Deal Democrat’s observation about seasonal distortions accounts for most of this weakness. Here’s a picture of the quarterly change in real GDP (SAAR) vs the monthly change in personal consumption (SAAR):

https://fred.stlouisfed.org/graph/?g=1H21g

Note that the weakness in PCE is more pronounced so far this year than in the same period last year; if last year was driven by seasonals, there is something extra going on this year. Note also that GDP grew at a 1.6% pace a year ago, vs a GDPNow estimate of a 1.4% contraction in this Q1. That’s a 3.0 ppt swing downward. Real final sales to domestic purchasers rose 2.9% (SAAR) in Q1 last year vs the GDPNow estimate of 0.4% (SAAR) in Q1 this year, a 2.5 ppt slowing.

I think NDD has identified a real issue, but it doesn’t seem to account for nearly all the weakness we’re seeing in recent economic data. Them recession forecasts we’re seeing are not just attempts to grab headlines. We got troubles.

today’s decrease in the trade deficit was all due to higher exports, imports were flat…exhibit 10 in the full pdf for the trade report (https://www.bea.gov/sites/default/files/2025-04/trad0225.pdf ) , which gives us trade figures in 2017$, indicates imports have increased at an 83.6% rate for the two months of import data that we have so far: (((285,316 + 283,289 ) / 2) / ((234,628 + 244,332 + 253,764)/ 3) ) ^ 4 = 1.8358875

that’s a pace that would subtract about 9.65 percentage points from 1st quarter GDP if it’s calculated as usual…the trouble is imports in national accounts aren’t in a vacuum; they’re only subtracted from GDP because they had been added to another GDP component, such as PCE when consumers buy imported goods, or inventories, in the case of imports front running tariffs…but so far, we’re not seeing evidence of these imports in any other GDP component, and if they’re not there, subtracting them would inaccurately lower Q1 GDP…

i don”t know if non-monetary gold has been pulled from these 2017$ trade figures, but they are provided by the BEA, suggesting they’d be used in figuring GDP…