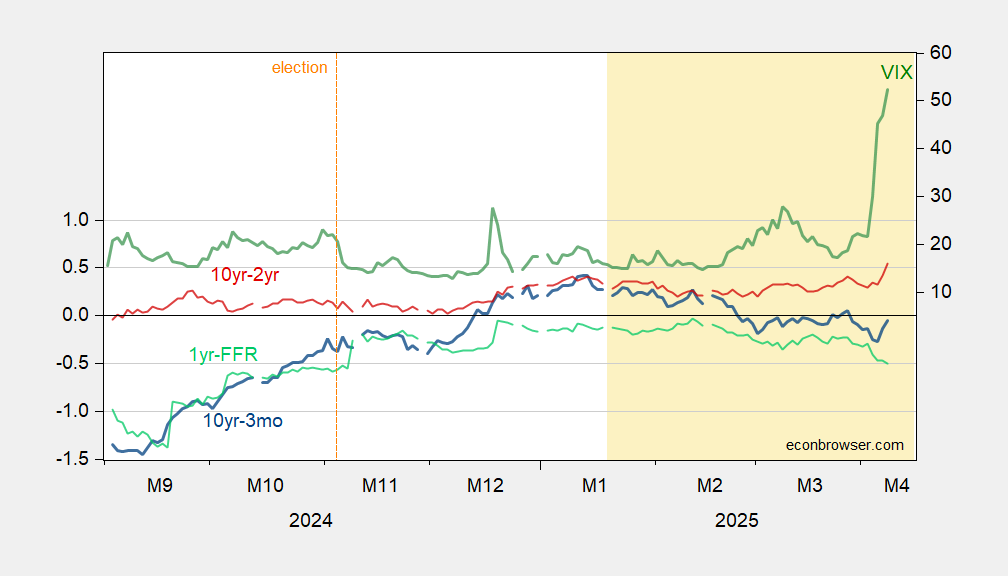

The time series, for 3m10s, 2s10s, as well as 1yr-FFR spread Miller (2019) identifies as max AUROC recession predictor at 1 month horizon.

Figure 1: 10yr-3mo Treasury term spread (blue, left scale), 10yr-2yr Treasury term spread (red, left scale), 1yr-Fed funds (light green), all in %, VIX at close (green, right scale). Source: Treasury, CBOE via FRED.

Lee, Semenova, Tsekova, Reinecke/Bloomberg suggest an expanding budget deficit due to slowing anticipated growth driven by tariffs is pushing up yields; indeed the 5 year TIPS has risen by 15 bps over the last two days, as the nominal 5 year has risen 16 bps.

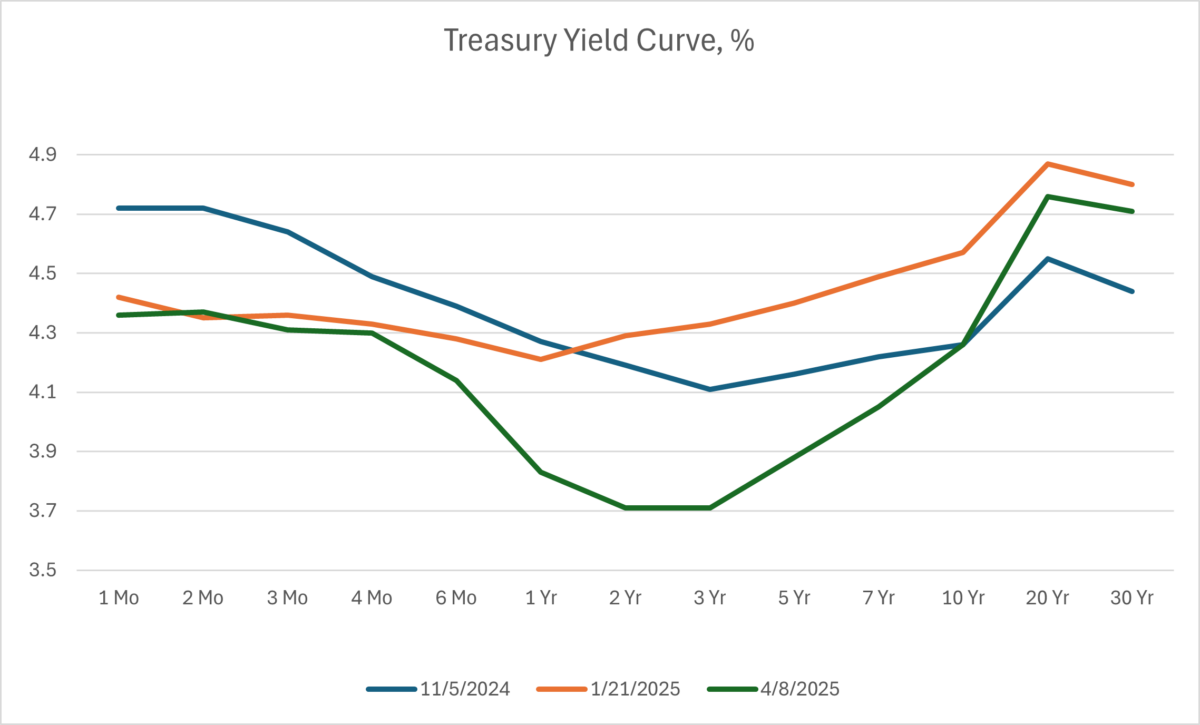

In any case, I find the evolution of yields at the 1 to 2 year maturities of key interest.

Figure 2: Treasury yield curves for 11/5 (blue), 1/21/2025 (orange), 4/8/2025 (green), all in %. Source: Treasury.

The inversion is deepening at the 6 month to 2 year part of the spectrum. The implied one year rate one year ahead is 3.59%, according to the expectations hypothesis.

In other news – Russia’s economy hit a slippery patch in February:

https://www.reuters.com/markets/europe/russian-economy-slows-sharply-with-more-turmoil-horizon-2025-04-08/

The usual qualifications apply: one month’s data isn’t enough to identify a change in trend; there could be data problems…

However, as Reuters points out, the sharp drop in oil prices is bad for Russia. IIF recently put Russia’s externl-account break-evn price at $77/bbl:

https://www.intellinews.com/russia-s-budget-oil-breakeven-price-world-s-second-lowest-as-oil-revenues-recover-343171/

Press reports indicate Urals trading around $50. That’s enough to pay the domestic bills, but not much more; production costs roughly $44/bbl.

Back in February, when the economic data turned squishier, Urals traded at around $65. Even before the bad news from February, there was growing concern that Russia would suffer badly from falling oil prices. Seems now that the hole was already pretty deep.

So the felon-in-chief is burying his good buddy Putin right along with the rest of us. It’s a funny world.

Oh, this ain’t good – soft demand at this week’s 3-year note auction:

https://www.bloomberg.com/news/articles/2025-04-07/global-yields-whipsaw-higher-as-treasuries-rocked-by-tariffs

Two more note auctions this week, so let’s remain calm. Press coverage of the Treasury market indicates a bit of bafflement at the weakness of the 3-year. I kinda maybe think the stagflation story makes pricing fixed income difficult? Maybe?

Anyhow, the hint of “we’re doomed!!!” in the Bloomberg text seems a bit premature. Maybe we are, but there is a lot of adjustment going on in portfolios, so let’s take a breath.

As of Friday, according to the Globe and Mail (which I trust), market function was good. FRA/OIS spreads were moderate across the major currencies:

https://www.theglobeandmail.com/investing/article-market-warning-lights-flash-amber-after-trump-tariff-shock/

Notice the point about the dollar being out of favor. That could account for some of the 3-year auction slop.

Commenter baffling has been a little ahead of the press in highlighting the oddity of Treasury pricing, so maybe Bloomberg, or Blackrock, should offer a job.

One more thought about the 3-year note auction – maybe you don’t buy the lowest yielding auction of the week. Take a look at Menzie’s yield curve picture; threes are expensive.

so this is a little conspiracy theory thinking, which i dislike, but still. today trump changed course on a lot of the tariffs, and the market rallied quite a bit. what if this move has been leaked? those selling 10 year notes were cashing out so they could put back in the stock market? i don’t think this is really the case, but who the hell knows? the world markets are fluctuating at the whims of an egotistical maniac who simply loves the illusion of power. this is simply a game being played by trump, at this point.

i think china is going to feel that the only way to play this game out is to let a trade war continue into something of a stalemate. china may not be able to win. but i think china is more willing to suffer than the american people, and so they will play this out long enough to cause significant political damage to trump going forward. and china will ultimately influence southeast asia as well. this trade war could linger for quite some time, although i want it to end today.

barrons (and others) had an article indicating the “basis trade” is the cause for weird treasury action lately. not too familiar with this, but certainly seems like it could be an issue. almost plays out like somebody is shorting the treasury market and getting squeezed. anyways, seems to be one of many options out there.