The IMF is pretty upbeat on the US economy…relatively speaking.

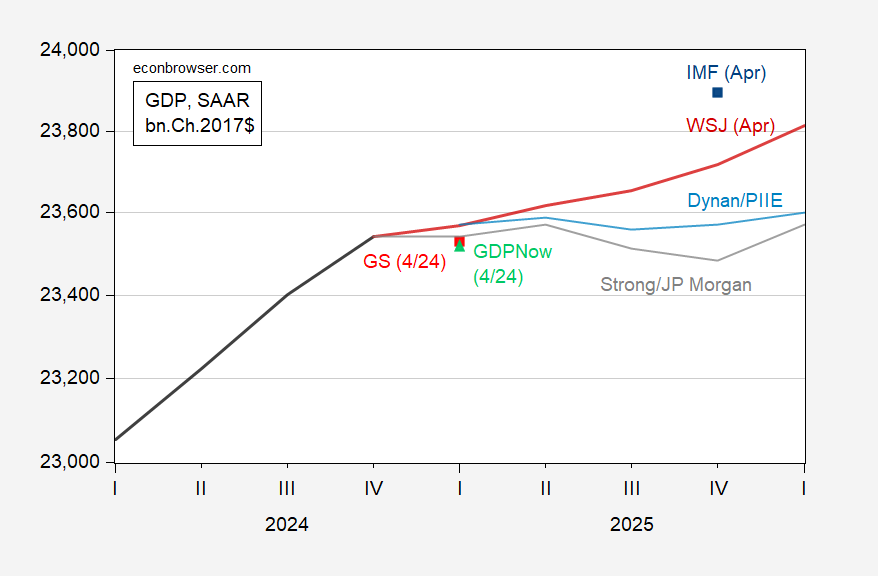

Figure 1: GDP (bold black), IMF April WEO (blue square), WSJ April survey mean (red line), Dynan/PIIE April forecast (light blue line), Goldman Sachs 4/24 tracking (red square), GDPNow 4/24 (light green triangle), Strong/JP Morgan – April WSJ (gray line), all in bn.Ch.2017$, SAAR. Source: BEA, IMF, WSJ, PIIE, and author’s calculations.

JP Morgan’s forecast, as provided by the WSJ survey, is the bottom 10th percentile forecast for 2025 q4/q4 growth, and projects two consecutive quarters of negative growth. The PIIE forecast by comparison has a rather shallow downturn, with only one quarter of negative growth, and essentially zero in the subsequent. Goldman Sachs tracking as of today is more in line with JP Morgan’s forecast. I have suggested (not proved) that the forecasts of GDP (rather than final domestic sales for instance) are being moved a lot by imports which have spiked due to tariff front-running.

GDPNow for today in 30 minutes…

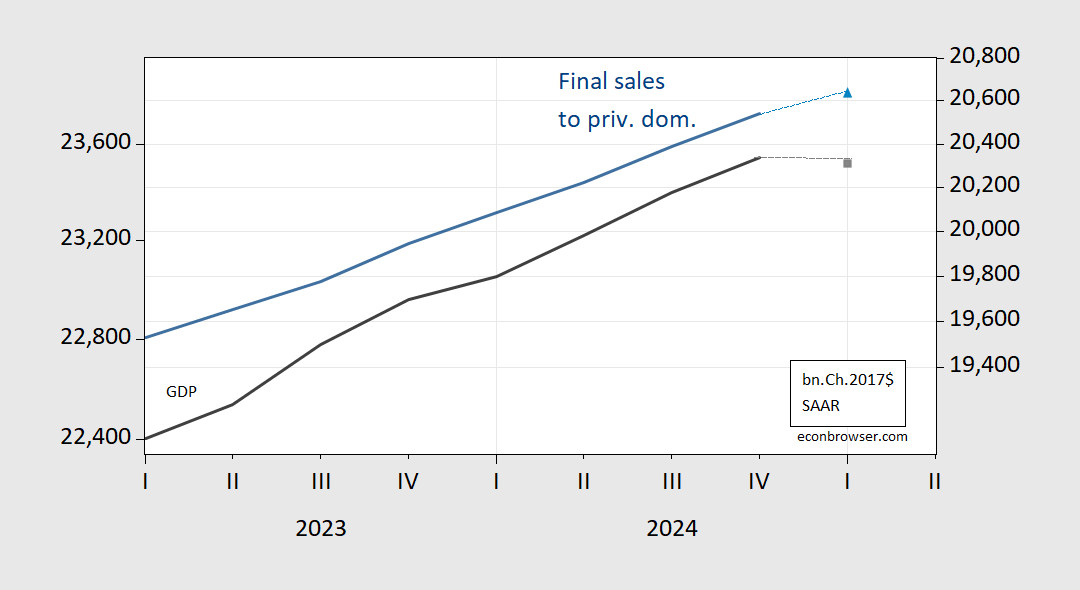

Update: GDPNow at -0.4% q/q AR, on decrease in nowcasted residential investment. It occurs to me that nowcasted final sales to domestic private purchases will still be a relatively healthy 2.0% (compared to 2.9% in Q4).

Figure 2: GDP (black, left log scale), GDPNow GDP (gray square, left log scale), and final sales to private domestic (blue, right log scale), and GDPNow final sales to private domestic (light blue triangle, right log scale), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, author’s calculations.

Bessent recently claimed imf no longer good at economics. So that rosier outlook probably not accurate either.

The Beige Book is out:

https://www.federalreserve.gov/monetarypolicy/beigebook202504-summary.htm

The gist is that hard data are still healthy, but that decisions about investment and hiring have gone on hold in response to tariff nonsense. (Professor Frankel’s post highlights the distinction.)

This confirms what we already knew, which is what the Book tends to do. With the release of the Beige Book, we can be even more certain that we are uncertain.

I was going to buy a new car this spring. Trump nonsense put that on hold, because of uncertainty. New car was a luxury, not a need. Née windows on house still needed. But delayed. As i look for more cost effective alternatives. Anderson windows are good, but expensive.