GDP is a measure of output from the spending side. A standard alternative measure is Gross Domestic Output (GDO), the average of GDP and GDI.

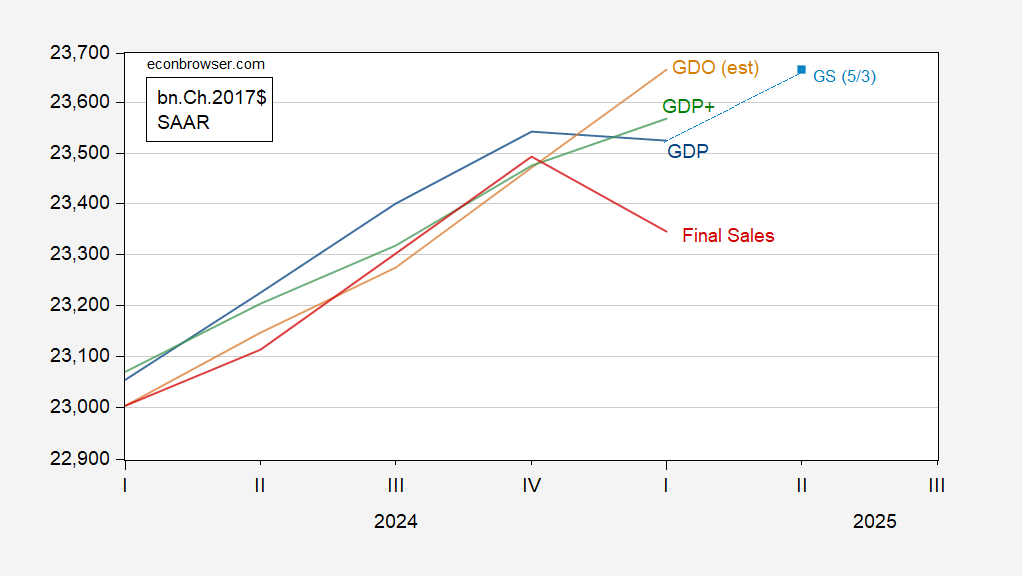

Figure 1: GDP (blue), Goldman Sachs tracking estimate of 53 (light blue square), estimate of GDO (tan), GDP+ (green), and final sales (red), all in bn.Ch.2017$ SAAR. Estimate of GDO calculated by using assuming 12.8% increase in net operating surplus, y/y. GDP+ calculated by iterating growth rates on 2021Q4 level of GDP. Source: BEA 2025Q1 advance, Goldman Sachs, Philadelphia Fed, and author’s calculations.

The increase in net operating surplus is estimated by applying a 12.9% estimated increase in corporate profits to 2024Q1 net operating surplus.

Goldman Sachs notes:

we believe inventory investment was significantly understated, which means that GDP was significantly understated too.

We expect this distortion to reverse in Q2. Our current forecast of +2.4% assumes that measured imports decline sharply but measured inventory investment remains solid as the distortion unwinds. However, this is highly uncertain, in part because the distortion could also unwind via upward revisions to Q1 GDP.

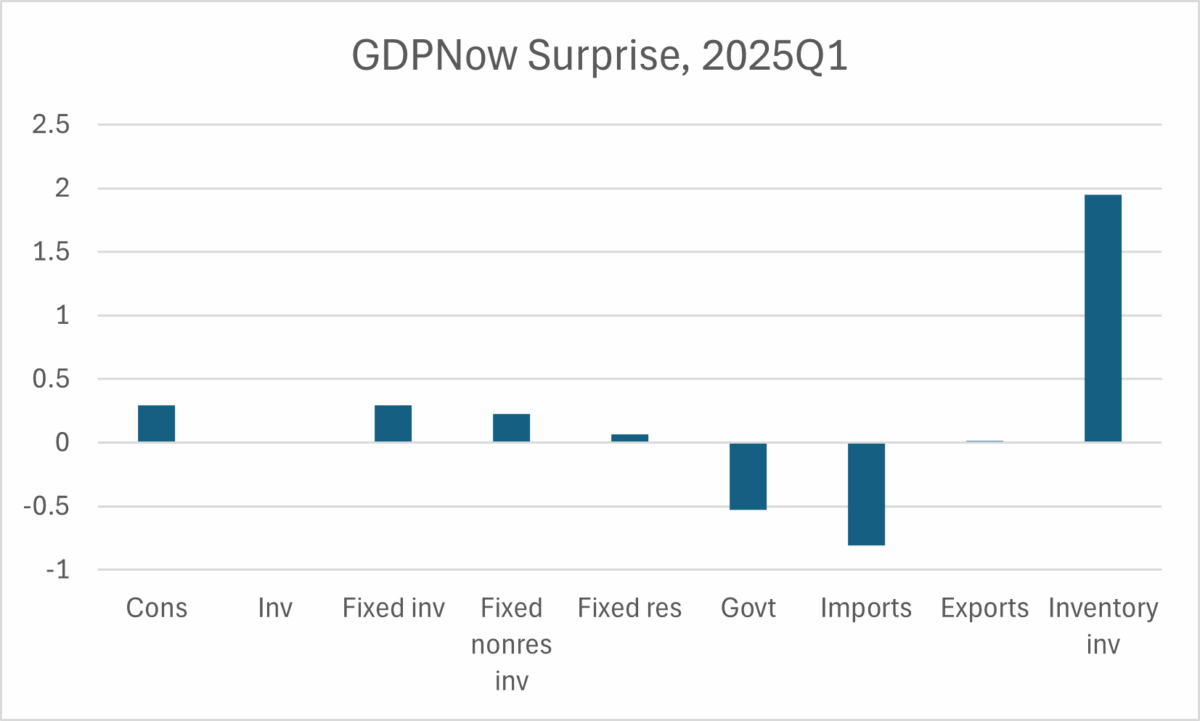

The miss in inventory investment is manifested in the miss in GDPnow (the last nowcast was for -1.5%, while advance estimate was -0.3%).

Figure 2: Forecast error in contribution to real GDP growth, % q/q AR from consumption, investment, fixed investment fixed nonresidential investment, fixed residential investment, government, imports, exports, inventory investment. Imports shown as negative of contribution. Source: BEA 2025Q1 advance release, Atlanta Fed, and author’s calculations.

The (absolute value of the) contribution of imports was underpredicted by 0.8 ppts, while the underprediction of inventory investment was 1.9 ppts. The entire miss in imports was on the goods side.

Final sales is way down (while final sales to private domestic purchasers is still growing smartly, around 2% q/q AR).

To an innocent like me, this reads as if the Goldman folk think BEA could be wrong about inventories through the second revision. If so, that doesn’t wash. That’s too much like them saying they know better than BEA. Absent a really good explanation, “the data are wrong because we disagree” is bad form.

Yes, huge imports matched with onlymedium-huge inventory accumulation looks funny, but the accounts balance. Asserting that they balance the wrong way without evidence won’t do. “Underpredicted” and “overpredicted” could simply mean bad forecasting.

Off topic – From “The unanimous Declaration of the thirteen united States of America” (The Declaration of Independence):

He (King George) has endeavoured to prevent the population of these States; for that purpose obstructing the Laws for Naturalization of Foreigners; refusing to pass others to encourage their migrations hither,…

He has obstructed the Administration of Justice…

He has made Judges dependent on his Will alone…

He has erected a multitude of New Offices, and sent hither swarms of Officers to harrass our people, and eat out their substance.

He has combined with others to subject us to a jurisdiction foreign to our constitution, and unacknowledged by our laws; giving his Assent to their Acts of pretended Legislation:

… (including)

For cutting off our Trade with all parts of the world:

…

For depriving us in many cases, of the benefits of Trial by Jury:

For transporting us beyond Seas to be tried for pretended offences:

…

He has excited domestic insurrections amongst us,…

…

In every stage of these Oppressions We have Petitioned for Redress in the most humble terms: Our repeated Petitions have been answered only by repeated injury. A Prince, whose character is thus marked by every act which may define a Tyrant, is unfit to be the ruler of a free people.

https://www.archives.gov/founding-docs/declaration-transcript

So there.