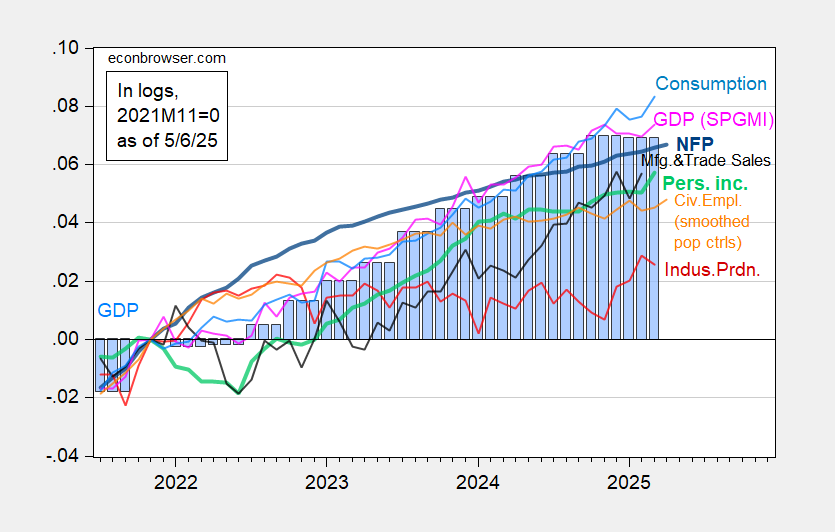

Monthly GDP is added to key indicators followed by NBER BCDC:

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is advance release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (5/1/2025 release), and author’s calculations.

Still no recession apparent in hard data through March (and April for employment). Although beware the peculiar aspects of the pre-tariff period, including surge in transportation/warehousing employment.

Off topic – let’s make sure “genocide” isn’t hyperbole:

https://www.nytimes.com/2025/05/05/world/europe/israel-buildup-soldiers-hamas-gaza.html

Netanyahu untends to turn uptheheat on the worse state violation of human rights since Pol Pot. What’s next, ovens?

Good ol’ Thorsten Slok, back with another nugget:

https://www.apolloacademy.com/the-daily-spark/

S&P500 profits from China are about 7% of total S&P profits and almost 4 times the size of the U.S. trade deficit with China. So China is in position do serious harm to stock valuations.

The stock market isn’t the economy and blah, blah, but this represents another potential shock to what is arguably an over-valued market.

Of course, the U.S. has recently taken around 15% of China’s exports, with exports accounting for a bitunder 20% % of GDP (0.15 x 0.20 = 0.3%). That’s important if we’re pursuing a trade policy of mutually assured destruction – which White House rhetoric sometimes suggests – but for assessing risks to the U.S. economy, China’s risks are a secondary issue.

“So China is in position do serious harm to stock valuations.”

I believe china is doing exactly that. everybody knows that a naked economic war would be bad PR for china. however, trump has given china an excuse to execute some economic warfare, judiciously chosen to maximize negative impact on the economic future of the usa. this provides china and its state controlled enterprises time to continue building out capabilities while the usa continues to shoot itself in the foot. the trump administration is so foolish in this aspect. the trump tariff policy will not permit the usa to regroup and reenergize quickly, and china will take advantage of that lag. foolish economic policy coming from the Republican Party right now. and china continues to invest in its educational and research enterprises, while trump is tearing down those once pillars of power in the usa. and fools like rick and bruce simply eat it up.

I am not convinced that the usual indicators mean much for now. The current administration’s endless lurching and thrashing with no apparent brain stem attached to the spasms means that all bets are probably off. What looks good now could be upended for no apparent reason tomorrow.