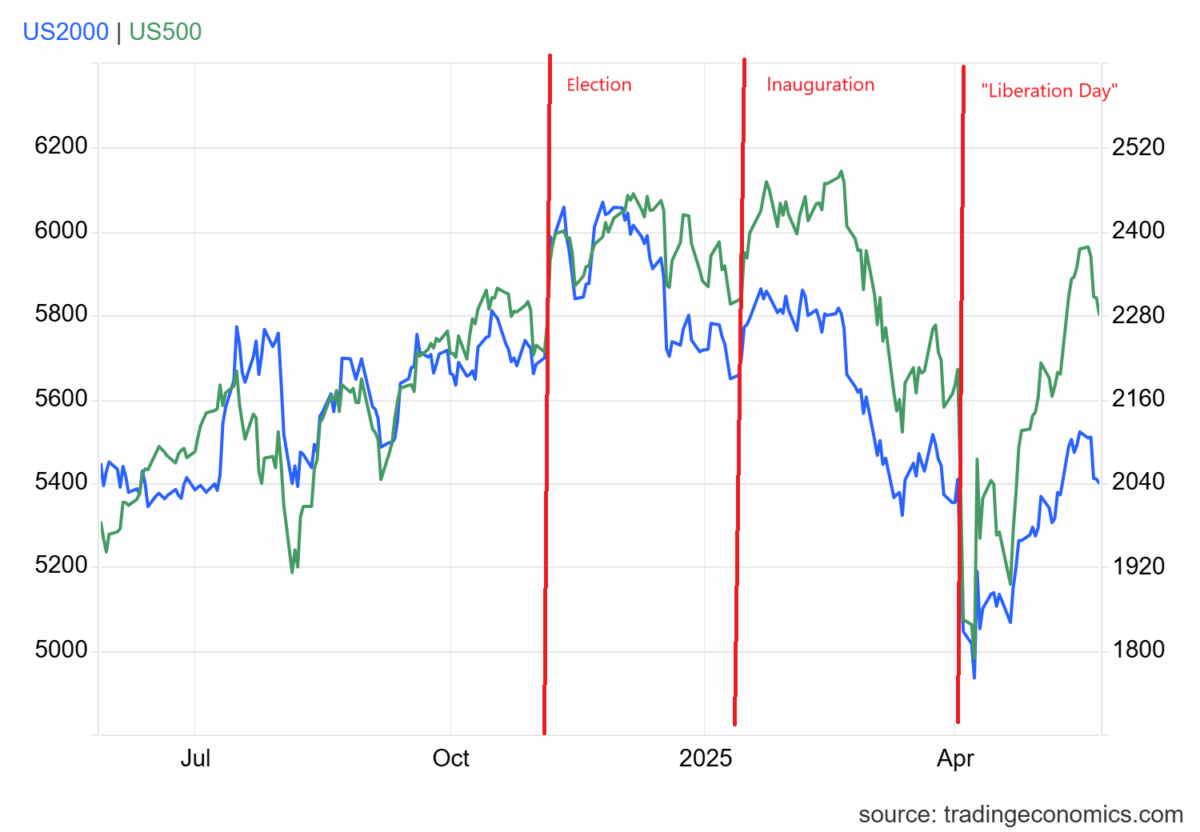

Some observers have noted the recovery in equity prices post-“Liberation Day”. This is an accurate characterization for SP500 (and DJ30), but not for indices pertaining to smaller firms, like the Russell 2000.

As of 23 May, the Russell 2000 is down about 1% from April 1st, the day before “Liberation Day”, and down 11.9% from January 21st, the day after inauguration day.

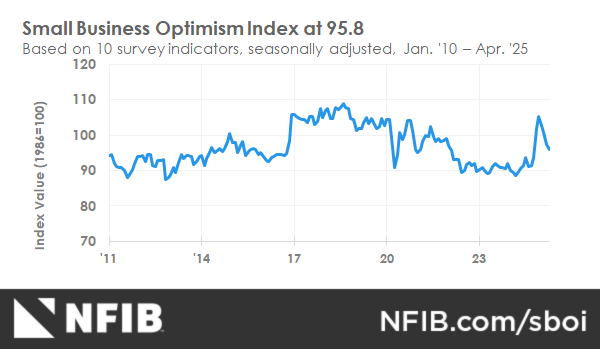

Small business optimism is down 7.8% in April, relative to January.

Source: NFIB (May 2025).

While the US stock market is down year-to-date, the total international stock market is up 13.5%.

https://www.google.com/search?&q=vxus

P/E ratio is getting more expensive by the day. And currency is not helping matters. With bond rates increasing. Equity markets will not overpower those headwinds. If 10 years breach 5.5% equities are in trouble. And if it breaks 6% look out below.

“The S&P 500 has delivered an average annual return of 10.33% since 1957…”

https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

A recovery to merely not much loss is well below average, hardly something to crow about. Even a 10% annualized rise would be just average. But then, below average performance is the norm for the Republican Party, with or without the felon-in-chief.