While (UMich) economic sentiment (preliminary) falls.

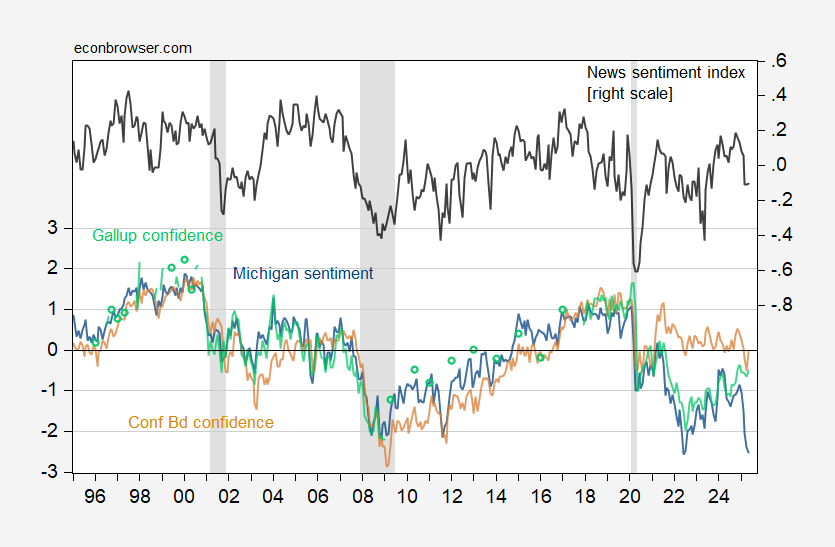

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), Gallup Economic Confidence (light green, left scale), all demeaned and normalized by standard deviation (for the 1995-2024 sample period); and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The U.Mich sentiment index for May is preliminary. The News Index observation for May is through 5/25/2025. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, Gallup, SF Fed, NBER, and author’s calculations.

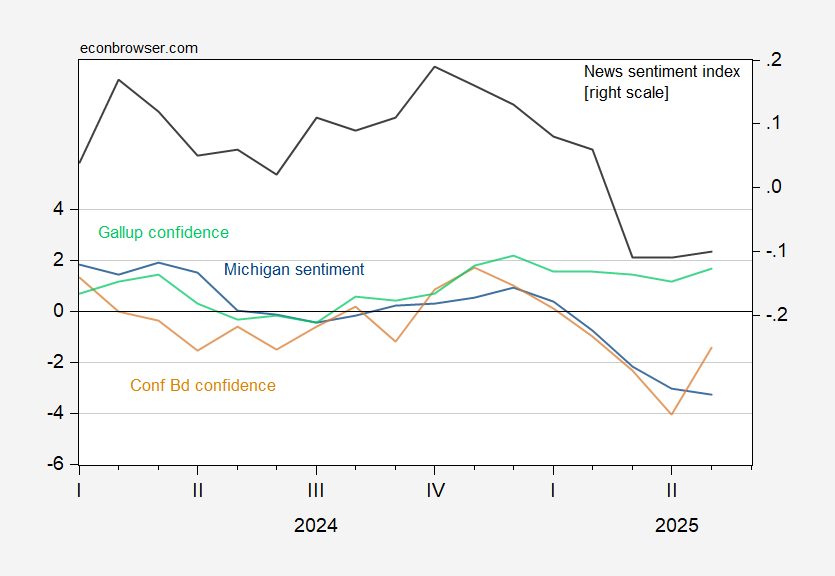

Here’s a detail:

Figure 2: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), Gallup Economic Confidence (light green, left scale), all demeaned and normalized by standard deviation (for the 2023-2024 sample period); and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The U.Mich sentiment index for May is preliminary. The News Index observation for May is through 5/25/2025. Source: U.Mich via FRED, Conference Board via Investing.com, Gallup, SF Fed, and author’s calculations.

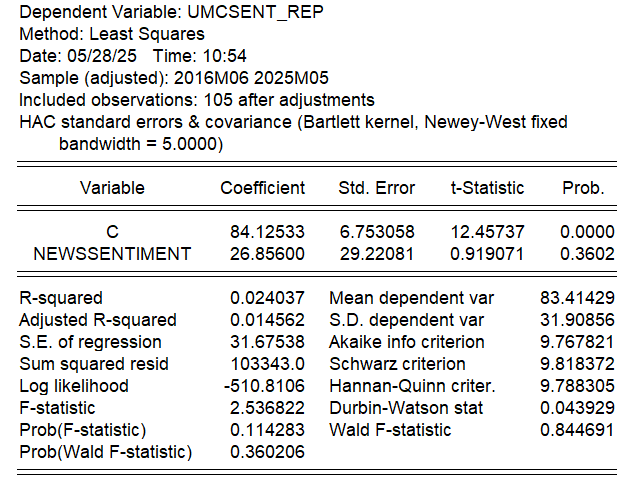

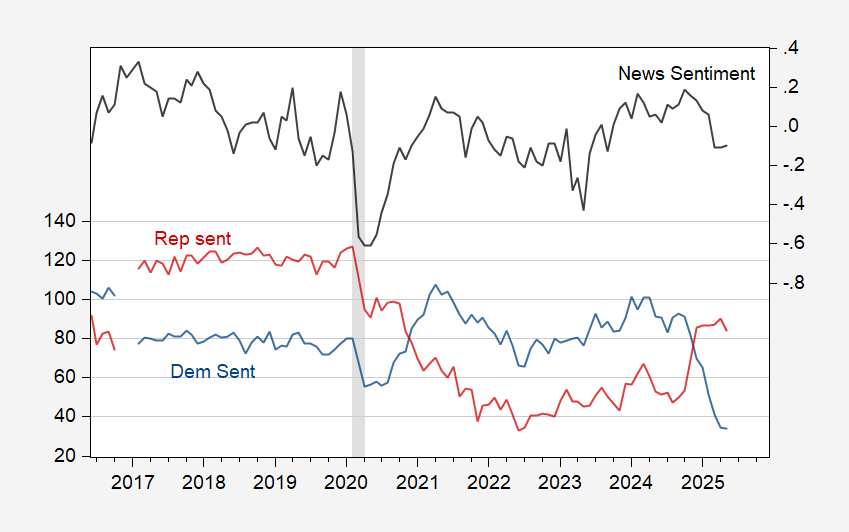

Given the well-known partisan component of the sentiment indicator, I thought it of interest to see how well Democratic/lean Democrat survey respondents respond to economic news (as measured by the SF Fed index) vs Republican/lean Republican. For the 2016M01-2025M05 period, it turns out Republican/lean Republican sentiment is virtually impervious to economic news.

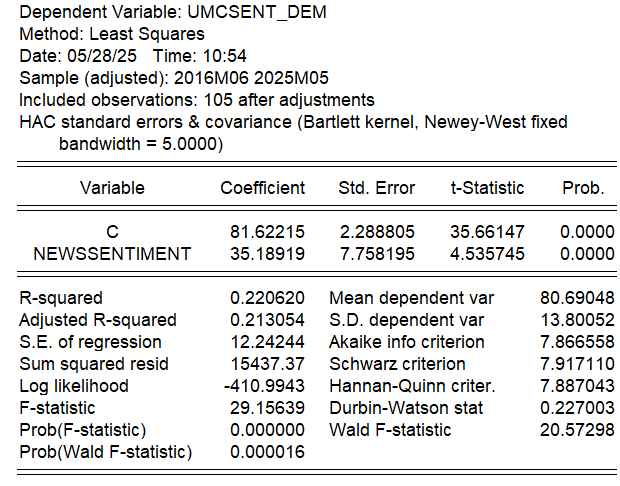

On the other hand, Democratic/lean Democratic respondents sentiment covaries with economic news with statistical significance (and much higher R2).

Here’s a plot of the data:

Figure 3: University of Michigan Consumer Sentiment for Democratic/lean Democratic (blue, left scale), for Republican/lean Republican (red, left scale), and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The U.Mich sentiment index for May is preliminary. The News Index observation for May is through 5/25/2025. Source: U.Mich via FRED, SF Fed, and author’s calculations.