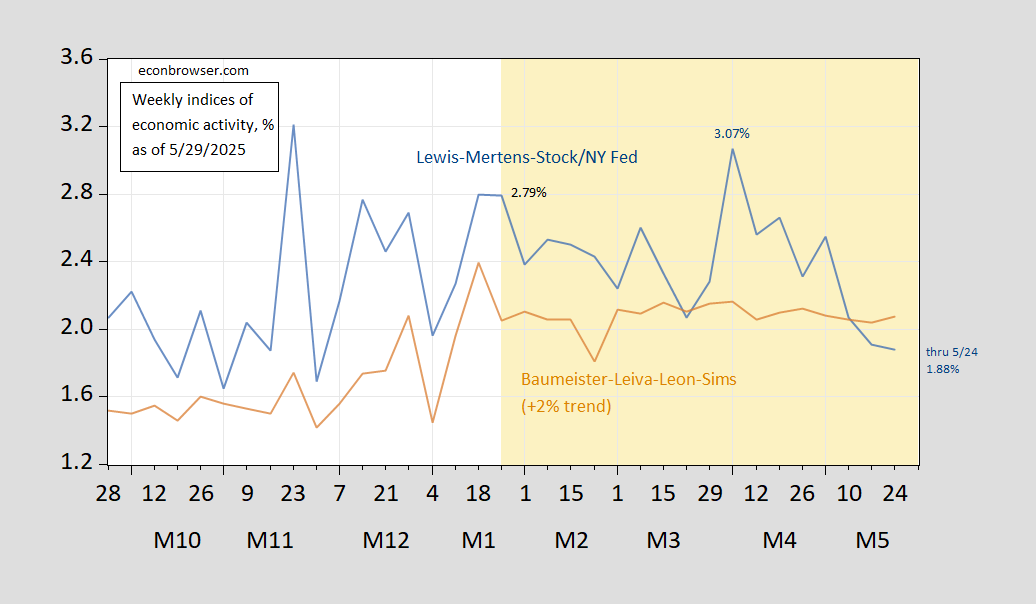

The Lewis-Mertens-Stock/NY Fed measure for data through 5/24 is down to 1.88%, down from 2.79% on the week of Trump’s inauguration, down from peak of 3.07%, recording data before “Liberation Day”.

Figure 1: Weekly Economic Index (blue), and Baumeister, Leiva-Leon, Sims Weekly Economic Conditions Index plus 2% (tan), both annualized %. Source: NY Fed via FRED, Baumeister et al.

Hence, there’s been a noticeable deceleration in growth as measured by the WEI, not so much the Baumeister et al. index.

The Lewis-Mertens-Stock/NY Fed measure was probably mainly affected by the jump in jobless claims as well as the decline in rail traffic.

Although the value is well above 0, it is now right where it was six months into the Great Recession in June 2008. I do not think it is nowcasting recession, but rather weakness.

Second estimate for Q1 GDP is out. Goes from -0.3% to -0.2%.

So I see a headline saying that Q1 GDP is up in the latest report. I kid you not.

Also, given that everyone is saying that Q1 GDP was improperly skewed negative by panicked imports into warehouses, will Q2 GDP be improperly skewed positive as these imports come out of the warehouses and are reported as domestic spending?

Normally we expect imports and sales of those imports to roughly cancel out in GDP each quarter but in this case we seem to have a big temporal separation between the import and the sales. It may take a while for this distortion to settle out.

GDPNow has (as of May 27, before the 2nd Q1 GDP release) inventories adding 2.25% to Q1 growth (SAAR) and trade subtracting 4.83%. In the latest estimate for Q2, GDPNow puts trade at -0.64%, inventories at -0.56%, for a total drag of 1.2%. PCE adds 2.49%.

The oddities of Q1 trade were well captured by GDPNow and so far, the Atlanta Fed’s gizmo doesn’t look for a boost from trade. That could change, obviously.

Latest GDPNow on May 30 is 3.8% for Q2. Do you still believe that or do you think it could be all those stockpiled imports hitting the market?

Seems that Q1 was biased downward by import stockpiling and Q2 will be biased upwards by import sales. Maybe an average of Q1 and Q2 would be a more accurate measure of real GDP.

GDPNow has flipped on trade with the release of Q1 GDP revisions. Trade is now put at a 1.45% add instead of a 0.64% drag. That swing of 2.09%, is more than the entire 1.6% swing in the GDP estimate. Inventories are now put at a 0.68% drag, vs a prior 0.56% drag.