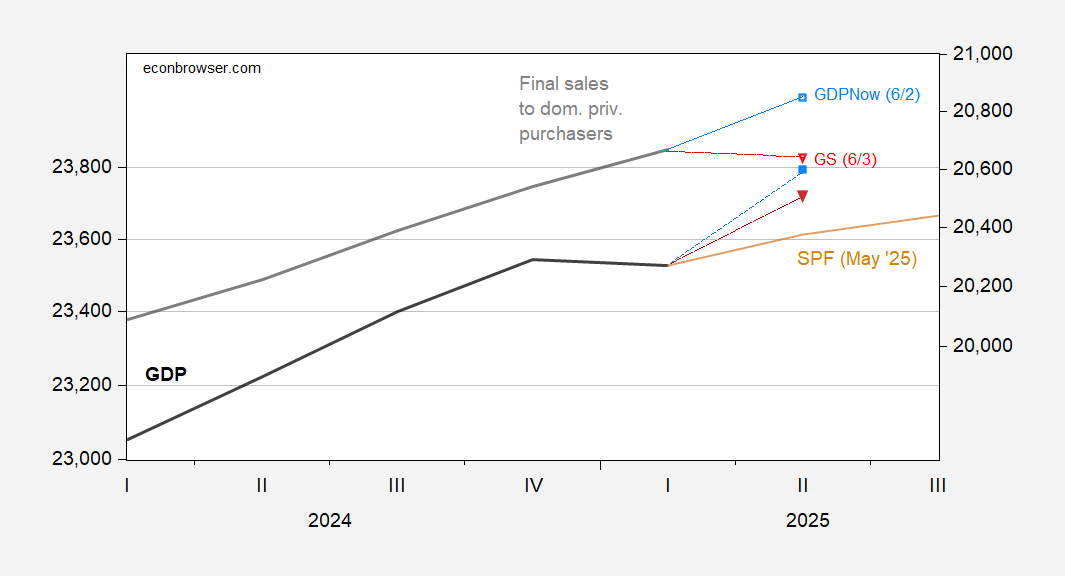

Atlanta Fed nowcast shows 4.6% q/q AR growth in GDP. Interestingly, this does not take GDP back to pre-“Liberation Day” trend.

Figure 1: GDP (black, left log scale), May SPF forecast (tan, left log scale), GDPNow of 6/2 (light blue square, left log square), Goldman Sachs of 6/3 (inverted red triangle, left log scale), final sales to domestic private purchasers (light blue square, right log scale), (inverted red triangle, right log scale), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 second release, Philadelphia Fed, Atlanta Fed, Goldman Sachs, and author’s calculations).

Note Goldman Sachs is somewhat more pessimistic, particularly with respect to “core GDP” (final sales to private domestic purchases).

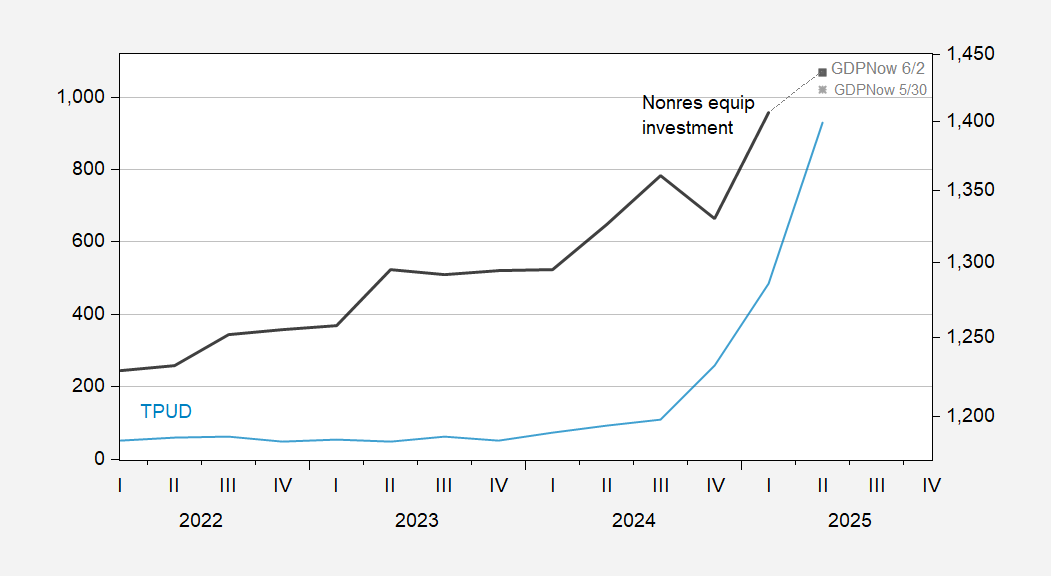

Even with the upgrade, the Atlanta Fed nowcast for equipment investment — which one would think would be very sensitive to uncertainty in general — has decelerated substantially.

Figure 2: Trade Policy Uncertainty (light blue, left scale), equipment investment (bold black, right log scale), bn.Ch.2017$, SAAR. Source: Iacoviello, BEA 2025Q1 second release.

It is a lottery at this point. Very much depends on imports in May. How much did imports increase? Likely visibly given the tariff revenue in May we already know (https://sites.google.com/view/pskrzypczynski/home/average-effective-tariff-rate-in-the-u-s). But still a lot of uncertainty left especially with respect to domestic demand.

Charles Gaba – health care policy and data expert – had an in-depth discussion about the tremendous damage the GOP’s systemic assault will have on health care in the U.S. In his estimates close to 50m people – 15% of the population – are likely to lose care or see huge premium spikes. According to AMA- US healthcare spending represented 17.6% of the nation’s Gross Domestic Product (GDP) in 2023. Imagine what taking out a large chunk of that does to the U.S. economy while also giving out millions in unfunded tax cuts does to the US debt service. https://podcasts.apple.com/us/podcast/magas-savage-assault-on-health-care-in-america-my-conversation/id1818118673?i=1000711168312

its going to be worse once you realize that a generation worth of health care related research is going to be lost and wasted due to the nih and other research funding that has been gutted for spite. for spite. simply because Donald did not get admitted into Harvard or any other Ivy League school when applying out of high school. he is holding a grudge out of spite. and the public will pay the price, long after he has passed away.

Basically we are now flying blind without economic data reporting in many areas – “Trump administration officials delayed and redacted the forecast because the increased agriculture deficit ran counter to the president’s messaging that his policies will reduce US trade imbalances” https://www.bloomberg.com/news/articles/2025-06-04/usda-to-review-reports-following-delay-of-latest-trade-outlook?srnd=homepage-americas

It gets worse:

Notice of CPI collection reductions, June 4: “BLS is reducing sample in areas across the country. In April, BLS suspended CPI data collection entirely in Lincoln, NE, and Provo, UT. In June, BLS suspended collection entirely in Buffalo, NY. … BLS makes reductions when current resources can no longer support the collection effort.”

This is Elon Musk and his “super-high IQ” DOGE boys at work.

https://www.bls.gov/cpi/notices/2025/collection-reduction.htm

Bias CPI downward and you bias Social Security cost-of-living adjustments downward – a backdoor benefits cut for retirees.

Add that to likely Medicare PAYGO cuts and you get a GOP/Peterson dream come true.

Wait until the bond vigilantes discover their TIPS bonds are a scam.

Here are imports and exports of foods, feeds and beverages – not quite the same as “agriculture”, but you get the picture:

https://fred.stlouisfed.org/graph/?g=1JrfN

Here’s a look at the history and structure of the U.S. agricultural trade balance from a group with a chip on its institutional shoulder:

https://prosperousamerica.org/u-s-faces-record-agricultural-imports-worst-trade-deficit-in-history/

Note that the balance went into deficit in 2018-2019. Remind me, what was happening with soybeans back then? Something with us and Brazil and China… Well, whatever it was, we should probably try to avoid doing THAT again.

I attach a lot of importance to an economically weighted average of the ISM manufacturing (25%) and non-manufacturing (75%) indexes, and separately their more leading new orders subindexes. In May the three month economically weighted average of the headline indexes was 50.3. But the three month economically weighted average of the more leading new orders subindexes was 49.0.

That new orders reading below 50 has only previously happened shortly before the 2008 recession, and in the COVID lockdowns.

This is enough for me to go on “recession watch.” Not a “warning” yet. But the ADP report and heavy truck and light vehicle sales weren’t very encouraging, either.

Pawel’s point about imports runs directly into what’s happening in warehouses. I only know of anecdotal reports, but warehouses are apparently full to the brim. That pits a hitch in any new, precautionary inventory stocking.

As someone who works for a very large retailer whose name does not begin with “A”, and who is in an inventory-adjacent position, I can assure you that at least one very large retailer’s warehouses are full to the brim, and then some.

if recession hits, those warehouses will get sold at a discount. deflation. and profit losses to reinforce the recession.