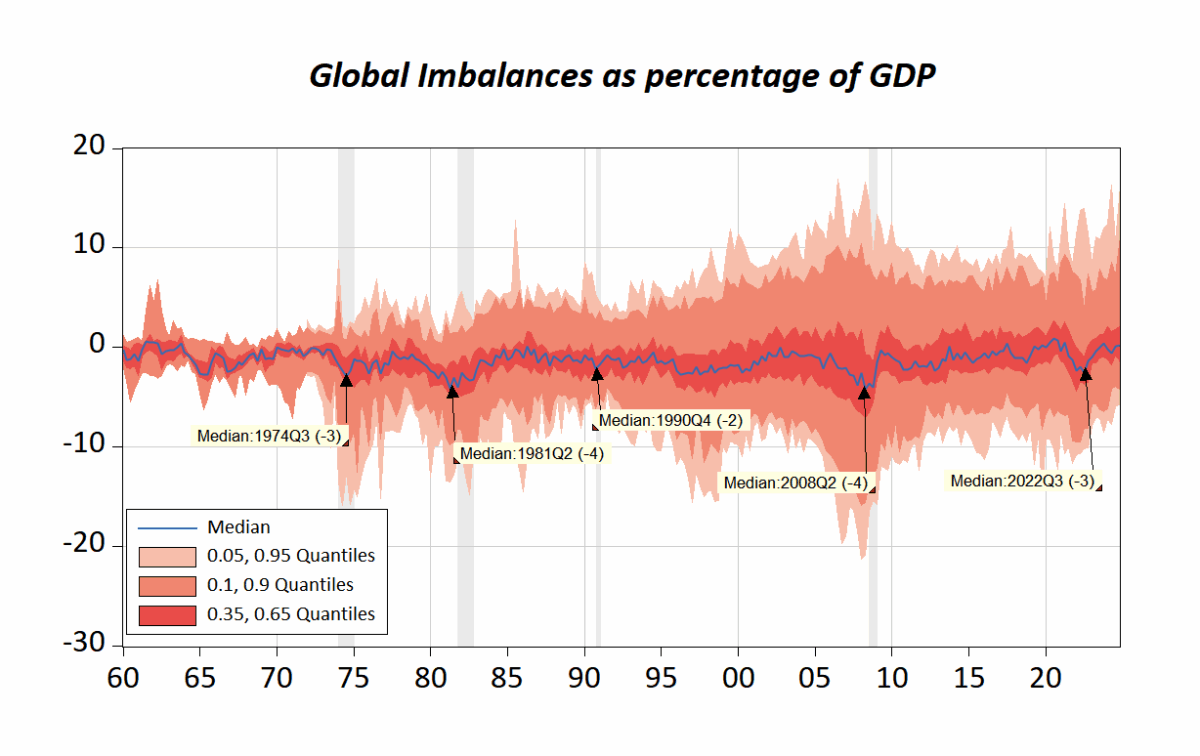

EWS = “Early Warning System”. Jamel Saadaoui has an interesting blogpost, investigating whether the median current account to GDP balance — namely when it becomes very negative, -2% to -4% — presages a global recession as defined by Kose et al. (2020).

Source: Saadaoui (2025).

As Saadaoui notes, there’s not a perfect record — there’s a false positive in 2022Q3 (well, Kose et al. is 2020, so didn’t assess this episode), and seems roughly contemporaneous rather than leading in the 1974 and 1990-91 recessions.

Nonetheless, even if not constituting a necessarily a highly reliable early warning system, this is an interesting stylized fact. Why should the median CAB be associated with a global recession? I conjecture large median deficits would mean lots of countries are running deficits, with a few offsetting surpluses. This in turn means that economies in general are running hot just before adjustment takes place. Just a surmise on my part.

David frum just published an article in the atlantic. Well written on the trump era. And this is a republican’s view of trump. Makes you wonder about the integrity of conservatives on this site like bruce hall and rick stryker. What reality are they living in? Again, frum is a conservative.

True ideological conservatives see Trump for the buffon he is

“I conjecture large median deficits would mean lots of countries are running deficits, with a few offsetting surpluses. This in turn means that economies in general are running hot just before adjustment takes place. Just a surmise on my part.”

I like that idea a lot. In addition to the fact that it’s testable, it also fits with other things we know about economic cycles. If imbalances are financed with borrowing, and are related to consumer demand and everything that supplies consumer demand, then this fits with my own little favorite, Mian and Sufi, et. al. – debt-finance pulling consumer demand forward in time, setting up a sluggish period of demand, and everything that supplies that demand.

Current account imbalances are the mirror image of capital account imbalances, and so are associated with debt accumulation. A nice circular flow thingie at work.

Thanks, I agree and the IMF is working on the capital-flow at risk concept.