Remember, we’ve got tariff *pauses* (pl.), OBBB, debt ceiling limit, etc. Do you expect the folks in the present administration to have a handle on things?

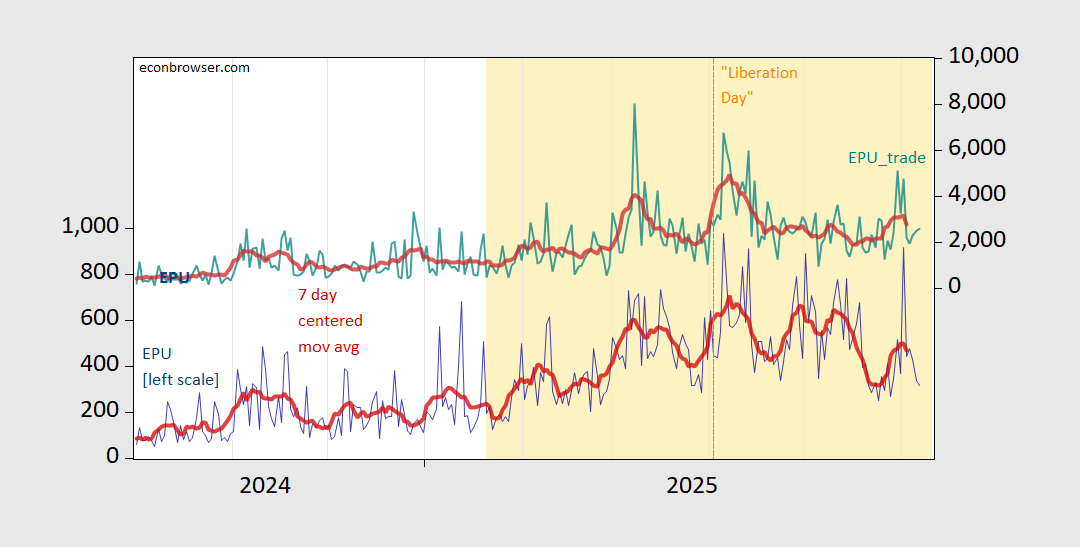

Figure 1: EPU (blue, left scale), EPU 7 day centered moving average (dark red, left scale), EPU-trade (teal, right scale), EPU-trade 7 day centered moving average (red, right scale). Source: policyuncertainty.com.

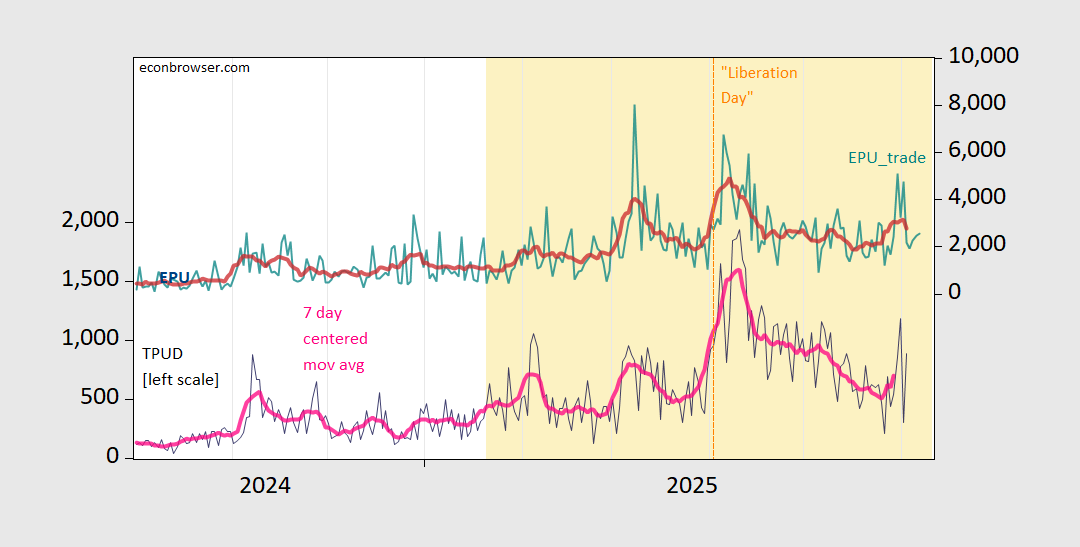

As a check, here’s the Caldara et al. measure compared against the Baker, Bloom and Davis measure of trade policy uncertainty.

Figure 2: Trade Policy Uncertainty (black, left scale), EPU 7 day centered moving average (pink, left scale), EPU-trade (teal, right scale), EPU-trade 7 day centered moving average (red, right scale). Source: policyuncertainty.com, and Iacoviella et al.

OK, Menzie, you wanna tell spooky stories? I’ll see you and raise you!

The UK bond authority has decided to cut down on long-end issuance in response to weak demand for duration:

https://archive.is/Koxrq

It ain’t just the UK running into this problem. You have documented the slippage in the long end in the U.S. Bidding was also light at Japan’s recent 30-year auction:

https://archive.is/IZAKb

As the article notes, several recent auction have shown tepid demand. In secondary market trade, the longer the maturity, the sloppier the trade.

Australian bonds are also finding weaker demand at auction:

https://archive.is/g6tN7

South Korea, same deal:

https://archive.is/GyPre

The bid-to-cover ratio is a rather different measure of demand than the interest rate. We all know rates are trending upward. Auction cover is an indication that accounts which want – or need – bonds just don’t want to end up with as many as the did before. That’s true even though rates are higher. Gotta have some, but I’ll have just the minimum, ease.

Duration risk is the thing that bidders at auction are avoiding when the bid is light at long-end auctions. When questions about fiscal sustainability crop up, duration is not your friend. Duration risk doesn’t go away – the UK government is taking on duration risk by shortening up its issuance. That’s fine for now, but for the Exchecker, that decision increases roll-over risk. Eventually, the UK has to pay for their own risk profile – all governments do – in market rates.

I’ve moaned enough about the problems of financial plumbing in comments here that I won’t bother to repeat it. Suffice it to say that the symptoms of financial risk can turn into triggers for breakage in plumbing. Boo!

Oh, almost forgot! Y’all have heard of this “Mar-El-Lago accord” notion that Stephen Miran used to audition for a job in the felon administration. It’s easy to think “accord” means Miran’s destructive ideas will be bundled into a single deal and maybe even be negotiated with other countries.

Surprise! The Big Bloated Bill already includes one of the worst of Miran’s ideas. Called “Section 899”, this element of the Bloat allows for retaliatory taxes on foreign entities – companies and people. Here’s a look at what it is and does:

https://www.mayerbrown.com/en/insights/publications/2025/05/us-house-passes-bill-targeting-unfair-foreign-taxes

By the way, this looks like another one of those “But, but, I didn’t know that was in the bill!” parts of the bill. House members can plead ignorance id somebody asks why the hellthey’d vote for such a thing. Note also that this shifts a bit of the power of taxation away from Congress and to the White House – yet another abrogation of responsibility by our elected representatives.

This is political cowardice on a grand scale. It also happens to increase the cost of capital for the U.S. Retroactively. Ya know, like “sell, sell, sell!”

Speaking of policy uncertainty, here’s what reads like a change in anti-immigrant policy:

https://www.politico.com/news/2025/06/07/donald-trump-immigration-agenda-ice-00392530

The felon-in-chief may have graduated from using ICE as a tool to silence dissent to actually deporting large numbers of immigrants. Maybe it’s just theater, or journamalistic hyperbole. Maybe it’s the real thing.

Rounding up 2,200 or so immigrants per day would mean 730,000 in a year, assuming no breaks for weekends and holidays. That’s something, but still, assuming 17 million illegal residents (the high end of legitimate estimates), and no new or returning arrivals, it would take 23 years to get rid of all illegal immigrants. There’s plenty of scope for worse things than reported in the politico link.

If we are, in fact, witnessing the ramping up of a persistent effort to remove immigrants – only some of whom are here illegally, by the way – then all of the analysis done on the economic drag from lost workers and lost tax and FICA payments is about to play out in the real economy. Rounding up, incarcerating, adjudicating (hey, it could happen) and deporting workers will contribute to the deficit. We are spending government money in order to reduce government revenue. Smart.

Let’s not forget that the felon-in-chief promised to go after “criminals” and “the worst of the worst”*, but is now revoking the status of those who arrived legally and is engaging in mass round-ups which do not take notice of criminality other than, sometime, the breaking of immigration law. All while normalizing the use of the military against U.S. residents.

*Self-deportation by the felon-in-chief? Nah..

Again, speaking of policy uncertainty, we got jobs data on Friday, and an ever-so-slight tightening in fed funds market pricing. The modal estimate is still for 50 basis points of Fed rate cuts by year end.

Conventional settings of the Taylor rule suggest the funds rate is close to neutral, but with some room either way. No strong bias for cuts:

https://www.atlantafed.org/cqer/research/taylor-rule

The latest FOMC Summary of Economic Projections anticipates the funds rate will be 3.9% at year end, vs 4.33% now, so 50 basis points of cuts this year. Market pricing is now roughly in line with the SEP, having anticipated more like 75 basis points of cuts a month ago:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Pretty obviously, Fed policy makers are not at all confident in the policy outlook. They not only don’t know what the felon is likely to do, but also don’t have a good feeling for what effects various degrees of stupidness in trade and immigration policy might have. Never seen something like this before.

The tightening up of fed funds market expectations over the past month has come despite growing evidence of economic weakening. The financial press seems to interpret this as a TACO thing; real economic activity is cooling due to uncertainty, but that uncertainty is all due to the felon-in-chief, and he’s going to fold before a crisis strikes. The TACO fad certainly makes life easier for equity professionals*; they need a story, and bonuses are bigger when one’s particular asset class perfoms well, so TACO!

An interesting (to me) sidelight to what’s happening in equities – routinely now, market pundits bemoan the lack of worry priced into equities. Well hang on, kids. The average gain in the Nasdaq over the past 20 years has been 12.3% per year. (I’m using the Nasdaq because FRED has years of data, unlike for the S&P or NYSE.) So far this year, the Nasdaq is up just 1.3%, and we’re nearly half way through the year. That’s only about 1/5th the average pace of rise. And that’s for domestic accounts. Tack on the 8.7% decline in the dollar so far this year, and the Nasdaq is OFF 7.4% in “rest of the world” terms. Equity investors are not oblivious risk. “Up” isn’t the same thing as “unthinking”.

*TACO also makes life easier for the financial press. Just like market pros, reporters need a story, and all telling the same story means that story must be right. Right?

The Trump administration’s tariff policies have faced legal challenges 필스토리

Struggling to turn Facebook engagement into real revenue? The DFY Facebook Revenue Kit delivers a turnkey promo system: 75 attention-grabbing posts, 50 conversion-focused emails, and 75 designer-grade images & prompts…so you can launch scroll-stopping campaigns in minutes without an ad agency.

For a limited time, this $147 package is yours for just $37: a 60 % intro discount and less than the cost of a single “Boost Post”

++ Lock in the deal here: https://dfydeals.com/?wpam_id=5