The Economist asks the question, and says — in part — yes.

Rebalancing the global economy is Donald Trump’s defining cause. China should produce less and consume more, the president thinks; meanwhile, America should produce more by reindustrialising. There is a final logical step to this equation: America should also consume less.

Such abstemiousness is unavoidable if MAGA-maths is to add up, as even the administration admits. Scott Bessent, the treasury secretary, calls for “less consumption”; more floridly, Mr Trump says his trade war might result in children having “two dolls instead of 30”. As J.D. Vance, the vice-president, puts it: “A million cheap, knock-off toasters aren’t worth the price of a single American manufacturing job.”

The article cites Hubbard, Navarro (back before “Death by China”), Bernanke, Obstfeld, Gagnon, and yours truly. On the latter:

Mr Chinn estimates that a reduction of a percentage point in the budget deficit would cut the current-account deficit by about half a percentage point. For his part, Mr Obstfeld is blunt about the alternative to a fiscal rebalancing: “If the government keeps borrowing the way it is, it is quite unlikely that we will ever achieve a trade surplus.”

Several potential paths to smaller budget deficits would have the additional benefit of encouraging consumers to save. For instance, if the government reformed health-insurance and pension programmes to make them less generous as the population ages, it would be rational for households to save more themselves. The government could also implement a well-designed consumption tax at the national level (the complete absence of such a levy makes America unusual). Unfortunately, the political reality is that no fiscal consolidation is in the offing. Mr Trump’s tax bill, which is making its way through Congress, will prolong enormous deficits.

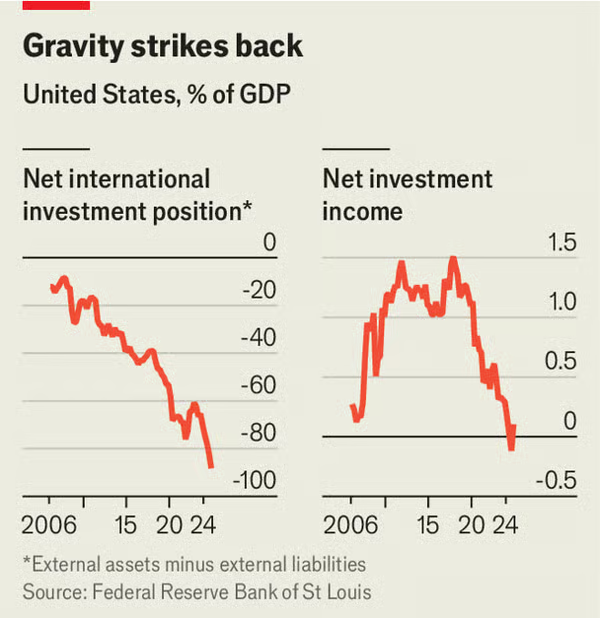

Here’s the graph from the article:

Source: Economist.

This point does not mean that one should go straight to government spending cuts. Rather, higher tax rates, increased saving in pension programs would, smaller budget deficits could all go far in stabilizing debt-to-GDP, and net external liabilities-to-GDP. I think that is likely to be a lot less painful than destroying American exorbitant privilege by way of making global investors worry about default on US Treasurys.

By the way, the 0.5 coefficient comes from my work with Hiro Ito, Barry Eichengreen and Eswar Prasad; most recently Chinn and Ito (JIMF, 2025), and Chinn and Ito (2021) for instance.

The obsessive focus of the GOP on manufactured goods is B.S. (I’ve heard similar crap from the GOP my whole life – Hey you can barely afford to pay your rent – why do you have a smart phone!? Because – they are a necessary communication tool. Or, why are you buying a doll for your child?? ) In the U.S., approximately 77.6% of the GDP is contributed by the services sector. This means a significant portion of US spending is directed towards services like professional, scientific, and technical services – in particular health care services. And, the GOP wants to cut at least $715 billion in health care spending, mostly from Medicaid, Meaning – at least 8.6 million people uninsured and health care costs to increase for the rest of us.

The U.S. is generally a net exporter of services. For example, in 2022, U.S. exports of services were $926.0 billion, and U.S. imports of services were $748.2 billion, according to the U.S. Bureau of Economic Analysis (BEA).

Also – I heard Senator Leghorn/Foghorn talking about we need tax cuts for billionaires to avoid the recession the GOP is causing. https://www.msnbc.com/morning-joe/watch/trump-s-bill-will-pass-u-s-headed-for-recession-if-tax-cuts-not-enacted-says-senator-240960069739

The US economy has only so much tax-revenue generating capacity. In the modern tax era, that is, since 1944, federal tax revenues as a pct of GDP look like this:

Average 16.9%

Max 19.8%

Median 16.9%

Latest (2024) 16.9%

Realistically, taxes could be set about 1% of GDP higher, say, to 18% of GDP. The last time we saw tax revenues on the level on a sustained basis was the second half of the 1990s.

On the other hand, federal outlays are running at 23% of GDP. To bring the budget into something closer to reality, spending has to be cut by 2% of GDP. This would yield a deficit around 3% of GDP, still not equal to GDP growth, but at least something closer to reason.

Both are pretty big asks, but the reality is that the combination of the Great Recession and Covid pandemic raised structural spending by about 4% of GDP and Trump’s tax cuts reduced revenues by about 1% of GDP. That’s how we got into the current mess and therefore more or less determines the necessary corrective steps.

Brucie has once again taken a common GOP talking point – that there’s a fairly low limit on the revenue that can be raised through taxes – and pretended it’s an established fact. This particular talking point is clearly false.

The average income tax rate in NY state is 5.8%, and that’s on top of a higher than average share of federal income tax being paid by New Yorkers, so we have absolute evidence that tax collections can run in the range of 25% in the U.S. without problem. States with the highest income taxes also tend to have high output per worker, so it cannot be argued – at least not based on the facts – that higher taxes are unsustainable.

Why did Brucie choose 1994 as the starting point for the “modern era”. Seems an oddly specific choice, doesn’t it? And just a little whacky? Maybe it’s because if we were to define “modern” as post-WWII, the average in Brucie’s little table would be higher. Maybe it’s because Brucie cribbed his table from somebody else and doesn’t even know why 1994 was chosen. It’s Brucie we’re talking about, after all.

Among OECD countries, tax revenue as a share of GDP averages around 34%, roughly twice the U.S. rate. The IMF suggests that 15% as a sort of lower limit, below which a country’s ability to sustain economic growth is called into question. Brucie is saying the U.S. can’t do much better that that crawl into the lower teir of the big leagues.

Brucie carries on with the same unjustified nonsense when he discusses spending: “To bring the budget into something closer to reality, spending has to be cut…” Reality? The dictionary definition of “reality” certainly makes 23% our reality. It’s nothing but rhetorial claptrap to say otherwise. What Brucie means to say is that 23% is too high by some measure, some unspecified limit. “Unspecified” is a serious weakness to his argument. Again, look at how much total government spending, across levels of government, is sustainable by some U.S. states or among OECD countries, and it becomes apparent that Brucie pulled his spending argument out of thin air. Or off of faux news.

Brucie is merely arguing by assertion. He waves some numbers around and pretends they mean things that they don’t mean. That’s all he’s got.

Sorry, not Brucie. This time it’s Stevie who made stuff up. Stevie actually claims to be an analyst, so this is even more shameful. Steve’s argument was so Brucie-level that I tricked myself into thinking it was Brucie.

The late 90s were the last time we had a surplus so it is possible to have a higher tax rate, have growth and reduce deficits.

Steve

A look at sectoral balances is useful. Japan currently runs a government debt/GDP ratio over 200%. The U.S. is at 120%. Despite a very high rate of government debt, the national saving rate for Japan is around 25%, vs just below 16% for the U.S. China’s is 44%.

https://data.worldbank.org/indicator/NY.GDS.TOTL.ZS?locations=JP

What the felon-in-chief’s minions are arguing is that we should be more like Japan, or like China. That’s what they are arguing, while pushing a budget that will, indeed, make us more like Japan in terms of government debt. How we get the rest of the economy to behave like Japan’s is not stated. If higher debt is to be sustainable, we’ll certainly need higher private-sector saving. The felon and his guys simply don’t have a plan for that. It’s all “should”, like “should” helps anything. What they have control over is their budget submission to Congress, and that budget lowers the national saving rate, raises the debt, and is pushing up the government borrowing rate.

Is consumption too high? With K-shaped retail sales, it is clear that there is plenty of room to lower consumption by raising taxes, addressing the deficit, bolstering investment in and support for research and education, expanding Medicaid and preserving social services.

“f you are a frequent listener of “Marketplace” — or even an infrequent listener, for that matter — you are well aware that the American consumer is the beating heart of this economy, accounting for almost 70% of U.S. GDP.

Turns out though in recent years, all that spending has been increasingly driven by a relatively small group of people. Namely, pretty well-off people.

According to a recent analysis from Moody’s Analytics for the Wall Street Journal, households with the top 10% of incomes, making about $250,000 or more a year, now account for nearly half of all consumer spending — the highest share since they’ve been collecting data on this stuff.” https://www.marketplace.org/story/2025/02/24/higher-income-americans-drive-bigger-share-of-consumer-spending