That’s the title of an article from yesterday. Maybe, but the drop in consumption spending might be. Also, personal income excluding transfers also decline in May…

The recession talk started heating up again on Friday when the personal income data for May hit the news. Total personal income from all sources fell by 0.4% in May from April, the first month-over-month decline since September 2021. Personal income drops during a recession. So a drop in personal income, if persistent, is a worrisome event.

This is total consumer income. It includes wages and salaries, contributions by employers to retirement funds and social insurance, rental income, interest and dividend income, farm and small business income, and personal transfer receipts such as Social Security benefits paid to beneficiaries. In May, this income fell by 0.4% to a seasonally adjusted annual rate (SAAR) of $25.7 trillion.

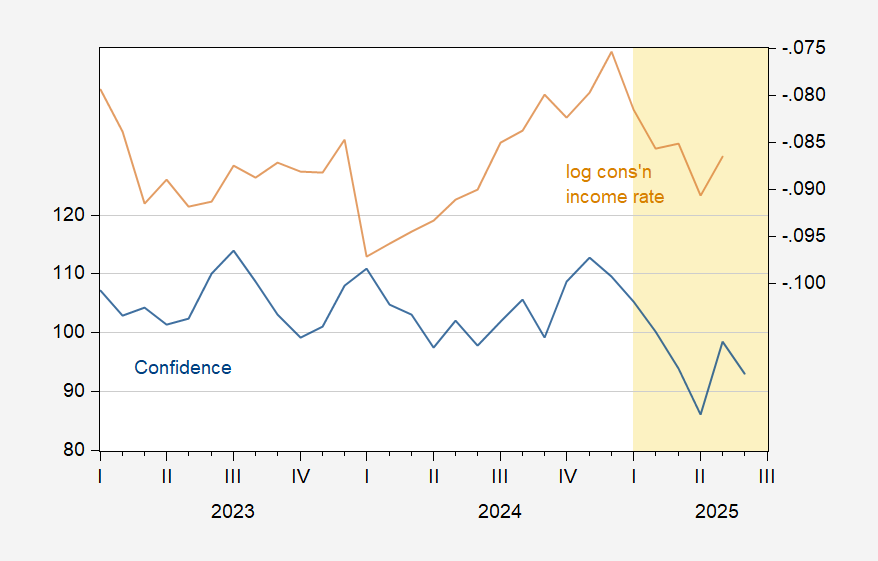

Ok, insofar as the recent blip. Overall, I’m not sure the author is right. Here’s Economic Confidence (Conference Board) and log consumption to disposable personal income.

Figure 1: Economic confidence (blue, left scale), log consumption to disposable personal income (tan, right scale). Trump 2.0 administration shaded orange. Source: Confidence Board, BEA.

Note the correlation from November onward. In level terms, consumption decreased (see this post).

I’d love to read a post about employment in industries affected by immigration policies, e.g. employment in agriculture was down about 10% relative to trend in May 2025:

https://fred.stlouisfed.org/series/LNS12034560

While residential construction employment seems unaffected despite anecdotal stories of abandoned construction sites:

https://fred.stlouisfed.org/series/CES2023610001

(However residential construction spending has been trending down)

https://fred.stlouisfed.org/series/TLRESCONS

How is employment counted in these industries? What do we expect from deportation policies and employment in industries where over 20% of labour is undocumented? (knowing that ICE is deported documented migrants too)

We should expect an impact on both GDP and inflation from these immigration policies, but how much and when?

Also, Personal Income was down in May for the first time since 2012 (ex-Covid):

https://fred.stlouisfed.org/series/PI

I was going to leave this comment in an earlier post, but it works just as well here.

I don’t think there is any question that there was a slowdown in May. The real question is whether it is more than simple payback for the front-running we saw in March and April?

One series I’ve been paying a lot of attention to is the weekly Redbook retail sales report. During the first quarter, the YoY increase averaged about 5.5%. Then in April and early May it surged to 7%. In the last 4 weeks it has fallen back to about 5%. That’s not enough (yet) to be more than payback for earlier front-running.

You are still a quarter away from economic slowdown if it occurs. It will not occur until after price inflation from tariffs hit. Only then will consumers pull back. The business cuts back on employment and inventory. Trump tanking the economy is not an overnight event. Which is why he is desperate for rate cuts and to claim inflation victory now, to control the narrative.

Exports are down and the trade gap widens. The exact opposite to what trump and bruce hall claim. I thought we would be rich again exporting our manufactured products to the rest of the world. What happened to that economic plan bruce. Does not seem like winning to me.

There does appear to have been a pick up in domestic investment in the 1st Quarter per FRED. https://fred.stlouisfed.org/series/PNFIC1 I expect this was the result of an increase of “animal spirits” in America’s business and finance class on Trump’s election, which from the comments I see of CEOs & Hedge Fund managers appearing on CNBC and Fox Biz, an election they wholeheartedly supported. But occasionally things leak through: one thing is that the current very high historical P/E ratio of the SP 500, (its been bouncing between 35 to 37 x $1 of earnings the last 6 months) is due to companies borrowing money to buy back stocks on the dips to support the price. Of course loading up firms with debt that to buy back stock make the survivability of those firms questionable if there is a fall in the rate of cash flow that allows servicing of the debt.

I think the FISCAL austerity on the spending side will hit the economy in the last quarter. September 30 is when about 200,000 employees who have taken DRP stop receiving compensation. Some of these will be retired and some will have found other jobs, but in both cases there will be a drop in income. I expect there will also be retrenchments in employment in Solar and Wind related industries, manufacturing, medicine, education, state governments, as well as the Federal government outside of DoD and in secondary businesses.

Also, ironically given Trump’s vocal support of fossil fuel industry, he also is a big fan of low oil prices. The domestic oil and gas producers need a price of at least $62 to $64 to breakeven, which is about where it is today and the rig count has been slowly falling all year. https://www.aogr.com/web-exclusives/us-rig-count/2025

Also, Trump is prioritizing an industry that is now highly automated and only employs 626,000 workers directly. https://fred.stlouisfed.org/series/USMINE

Meanwhile he, Vought, Thune, & Johnson are trying to devastate the education and health services industries that employ over 26 million. https://fred.stlouisfed.org/series/USEHS