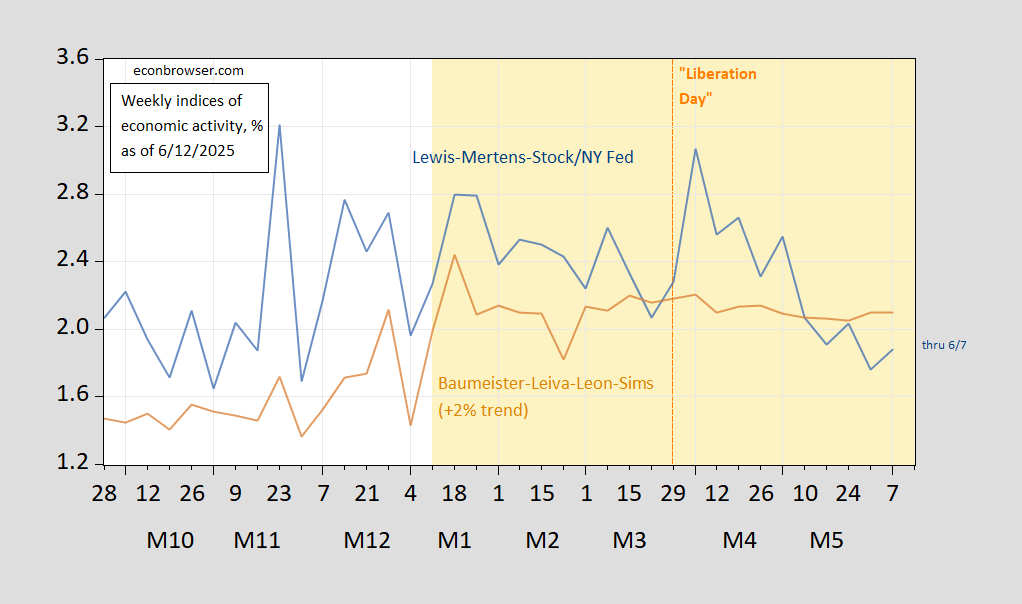

Lewis, Mertens & Stock WEI vs Baumeister, Leiva-Leon & Sims WECI:

Figure 1: Lewis, Mertens, Stock Weekly Economic Index (blue), and Baumeister, Leiva-Leon, Sims Weekly Economic Conditions Index for US plus 2% trend (tan), all y/y growth rate in %. Source: Dallas Fed via FRED, WECI, accessed 6/12/2025.

Off topic – ltr’s return to the comments section here is oddly coincident with fresh reports of slave labor in China:

“Chinese rare earth minerals produced through forced labor: Rights group”

https://thehill.com/policy/international/5344318-china-rare-earth-minerals-uyghur/

Dutch human rights organization Global Rights Compliance finds that forced labor (that’s “slavery” for the less euphemism-prone among us) is used to mine Chinese rare earth metals. Mostly, the slaves in question are – you guessed it – Uyghurs. Some things never change.

Ooh, great opening line! I had missed her return somehow. I guess Xi is planning a new charm offensive aimed at the US.

Israel has attacked Iran. Among the locations hit is Tehran, Iran’s capitol. Tehran may contain nuclear facilities, but it is most certainly a population center. Israel is killing civilians, just as in Gaza and the West Bank.

The timing is no surprise. There has long been speculation that Israel might pre-empt U.S. efforts at a nukes deal with Iran by attacking, should a deal seem near at hand.

Secretary of State Rubio has – thank goodness – said the U.S. had nothing to do with the attack. We were apparently warned of the attack, though.

Off topic: I want to thank our hosts for providing the last intelligent forum for discussing the economic/financial topics of the day. I’m pretty much down to this website and the FT Alphaville for accurate information and thoughtful reflection. Yahoo finance was at onetime a terrific aggregator but that’s over; Bloomberg is just clickbait rubbish; WSJ the same; and Crossing Wall Street, once a go to aggregator is full of clickbait headlines from clickbait “financial” news. CNBC and Marketwatch are pathetic cheerleaders. The SEC website is helpful; but how long will that last?

I’m pretty much out of the market because oversight is nonexistent and dark pools and private trading now do the majority of the trading such that the market functions as a performative front for retail trade; much like the wholesale/retail dichotomy. I guess the good news is a 2008 style crash is less likely because large liquidations (a sign of market stress) are confined to dark pools that eventually report the trades so it is said but verification is a “self-regulated” function with little independent oversight. So much like everything else; what is public is not what is actually happening in real time and that valuable information is known only by the favored few.

Anyway, thank you.